The Victorian Government has introduced changes to Land Tax Act 2005 (LTA) in the State Taxation Acts Further Amendment Bill 2019 which amends the primary production land (PPL) exemption in section 67 of the LTA.

The amendment to the PPL exemption means farmers with land in Melbourne’s urban growth areas who have historically received a land tax exemption may no longer be eligible. This will subject farmers to a significant land tax cost. Read on below for a detailed overview of the changes and the farming business ownership structures that will no longer be eligible for the PPL exemption under the proposed amendments.

Changes to the PPL exemption in the LTA

On 16 October 2019, the Victorian Government introduced the State Taxation Acts Further Amendment Bill 2019 into Parliament. The Bill contains some important changes to the PPL exemption contained within section 67 of the LTA. The amendments, if passed, will be effective from the day after royal assent.

Owners of large parcels of land in Melbourne’s urban growth areas where a precinct structure plan (PSP) has been or will be issued (in particular, in the Cardinia, Casey, Hume, Melton, Whittlesea and Wyndham Local Government Areas) may be affected by these changes. Furthermore, developers who do not own the land, but who bear the cost of any land tax as part of their development arrangement with the land owner, may also be impacted.

We recommend our clients consider the impact that the proposed changes could have on their land or development arrangements from a land tax perspective from the 2020 land tax year onwards.

If the proposed amendments are passed, farmers who are undertaking a genuine business of primary production on whole or part of their land will no longer be eligible for the PPL exemption where the entity carrying out the farming activities is not also the owner of the land. Furthermore, if the person engaged in the primary production activities is not engaged in the business of primary production conducted on the subject land, the landowner will no longer be eligible for the exemption.

The current section 67

Section 67 of the LTA sets out the requirements that need to be satisfied to claim a PPL exemption in respect of land located within greater Melbourne and in an urban zone. In summary, the current provisions require that the land is used solely or primarily for the business of primary production. Where the landowner is a natural person(s), that person must be normally engaged in a substantially full-time capacity in the business of primary production of the type carried on on the land. For companies and trustee landowners, there are further ownership requirements which also need to be satisfied. Broadly:

a) all shareholders or beneficiaries must be natural persons;

b) the principal business of the company or trust must be primary production of the type carried on on the land; and

c) the majority shareholder or at least one beneficiary (or a relative) must be normally engaged in a substantially full-time capacity in the business of primary production of that type.

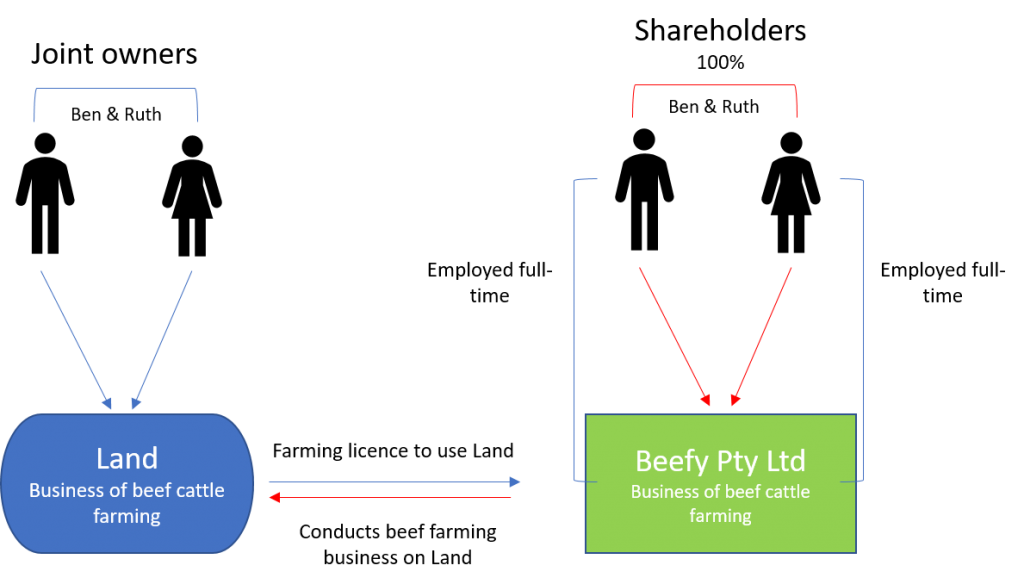

Example A

Under the current provisions, the land in Example A should be exempt from land tax as PPL because:

a) Ben and Ruth are natural person landowners; and

b) Ben and Ruth are both normally engaged in a substantially full-time capacity in the business of primary production of the type carried on on the land, because they are employed in a full-time capacity by Beefy Pty Ltd, which carries on the business of beef cattle farming, which in turn is the type of primary production conducted on the subject land.

The proposed amendments to section 67

The Bill claims the proposed amendments to section 67 aim to ‘reform the primary production land exemption…to require a connection between the landowner and the business of primary production conducted on the land.’ In pursuit of this aim, the Bill proposes to tighten the wording of section 67 to require, broadly, that –

a) the landowner carries on the business of primary production on the subject land;

b) where the landowner is a company or trustee of a trust, the principal business of the company or trust must be the business of primary production carried on by the landowner on the subject land; and

c) the natural person landowner, natural person majority shareholder or at least one natural person beneficiary (or a relative) must be normally engaged in a substantially full-time capacity in the business of primary production carried on by the landowner on the subject land.

If Ben and Ruth from Example A above continue to undertake the same business of primary production that they carried on in prior years, they would no longer be entitled to the primary production exemption from the 2020 land tax year if the proposed amendments are enacted. This is because Ben and Ruth as the landowners must carry on the business of primary production on the Land. In the example, that business is carried on by Beefy Pty Ltd.

Similarly, if the land were owned by the trustee of a discretionary or unit trust, the requirement at (a) above would not be met. That requirement will only be met if Beefy Pty Ltd is also the owner of the land. In other words, the land and the business must be owned by the same person or entity.

If legislated, the proposed changes will mean that many genuine farmers who have historically received a land tax exemption for their land, will no longer have access to the exemption and the land will become subject to what is likely to be a significant land tax charge each year. The business structure in Example A is one of many structures commonly used by Victorian farmers who continue to operate genuine farming businesses.

The consequences of the proposed amendments are contrary to the policy behind why these exemptions were introduced in the first instance, which is to provide land tax relief to farmers supporting Victoria’s agricultural sector. We have put our views forward to Treasury on this issue.

What action should I take?

The proposed amendments are a timely reminder to our clients who undertake a business of primary production to review their farming business structures in order to ensure the strict requirements of the PPL exemption have historically been satisfied and will continue to be satisfied going forward. In particular, if a PSP has recently been issued or will shortly be issued in respect of your land, we can assist you in determining whether you will continue to be eligible for the PPL exemption and potentially what changes could be made to your operating structure in order to satisfy the exemption requirements. This can translate to millions of dollars in land tax savings for large parcels of lands in Melbourne’s growth areas.