US Presidential Election – looking beyond the spin

Pitcher Partners Investment Services (Melbourne) | The information in this article is current as at 14 October 2024

The theatrics, spin, wild accusations/statements and dramatic events that have punctuated the lead into the run up to the US Presidential election are now coming to a climax, ahead of the November 5th election date.

Will Donald Trump secure his second term in office? Or will the US get its first female president?

While these events capture people’s attention and dominate headlines, we believe its the real policy changes, not spin, that will ultimately influence financial markets and your investments.

In the hype leading into and post elections, it can be easy to overlook facts such as Trump promised to repeal the Affordable Care Act under his presidency but failed. Biden had been very keen to promote his clean energy agenda but his administration has actually overseen more oil drilling than when Trump was in office.

In this note, we will discuss what the current polls tell us on who will make it into power in November, what their major policy stances are and ultimately, what could be the risks and opportunities that emerge through these events.

Who will make it into power?

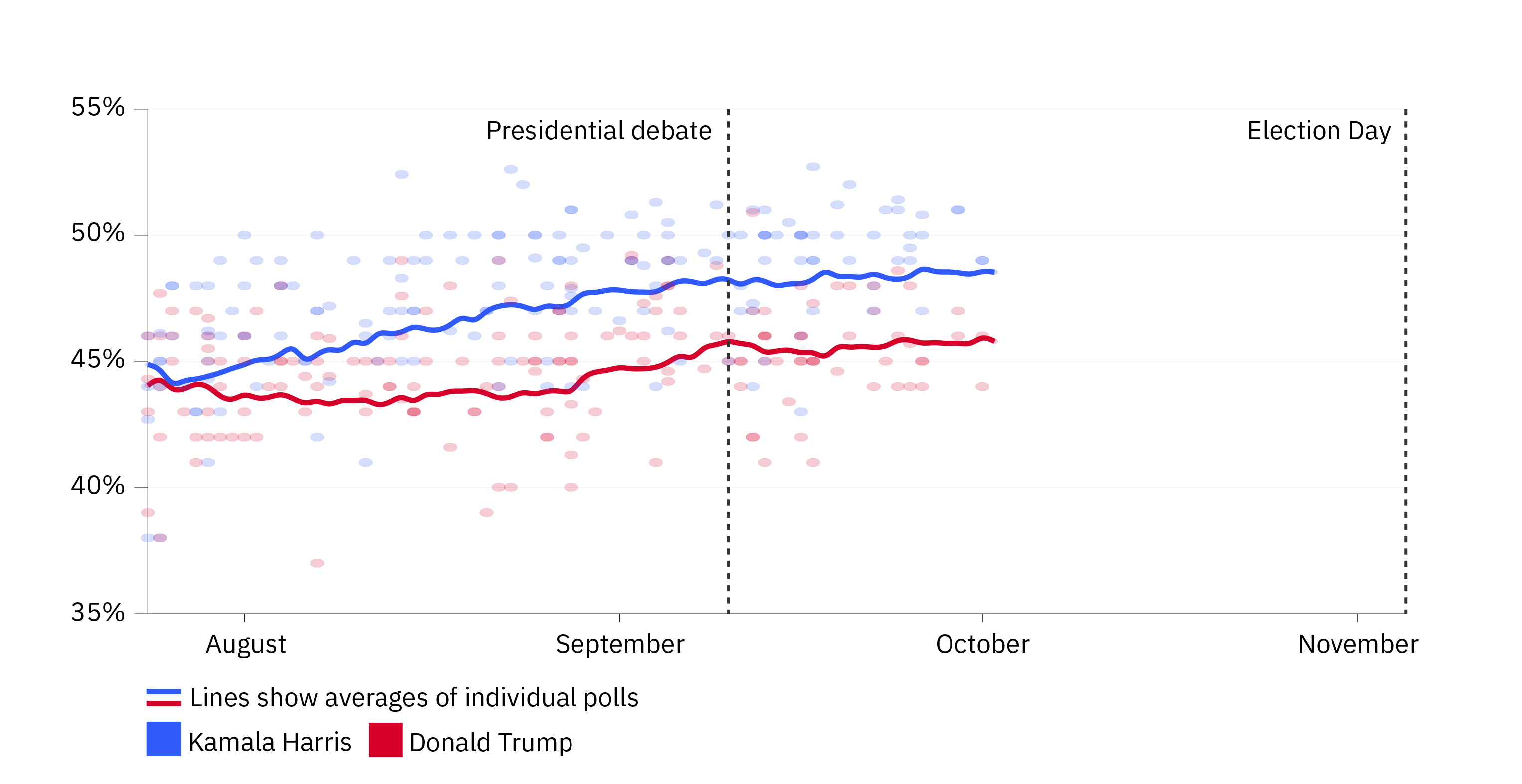

Post the recent and final televised debate, current polling averages data indicates an increased level of support for Kamala Harris, while Donald Trump’s numbers remain relatively unchanged.

U.S National Poll Averages

Source: 538/ABC News. Data as at 3 October 2024.

While the polls are a useful guide, the actual voting system in the US works a little differently. The US’s electoral college system enables each state a number of votes, roughly in line with the size of its population.

A total of 538 electoral college votes are up for grabs, so a candidate needs to hit 270 to win.

There are 50 states in the US but because most of them nearly always vote for the same party, in reality there are just a handful where both candidates stand a chance of winning. These are the places where the election will be won and lost and are known as battleground states or swing states.

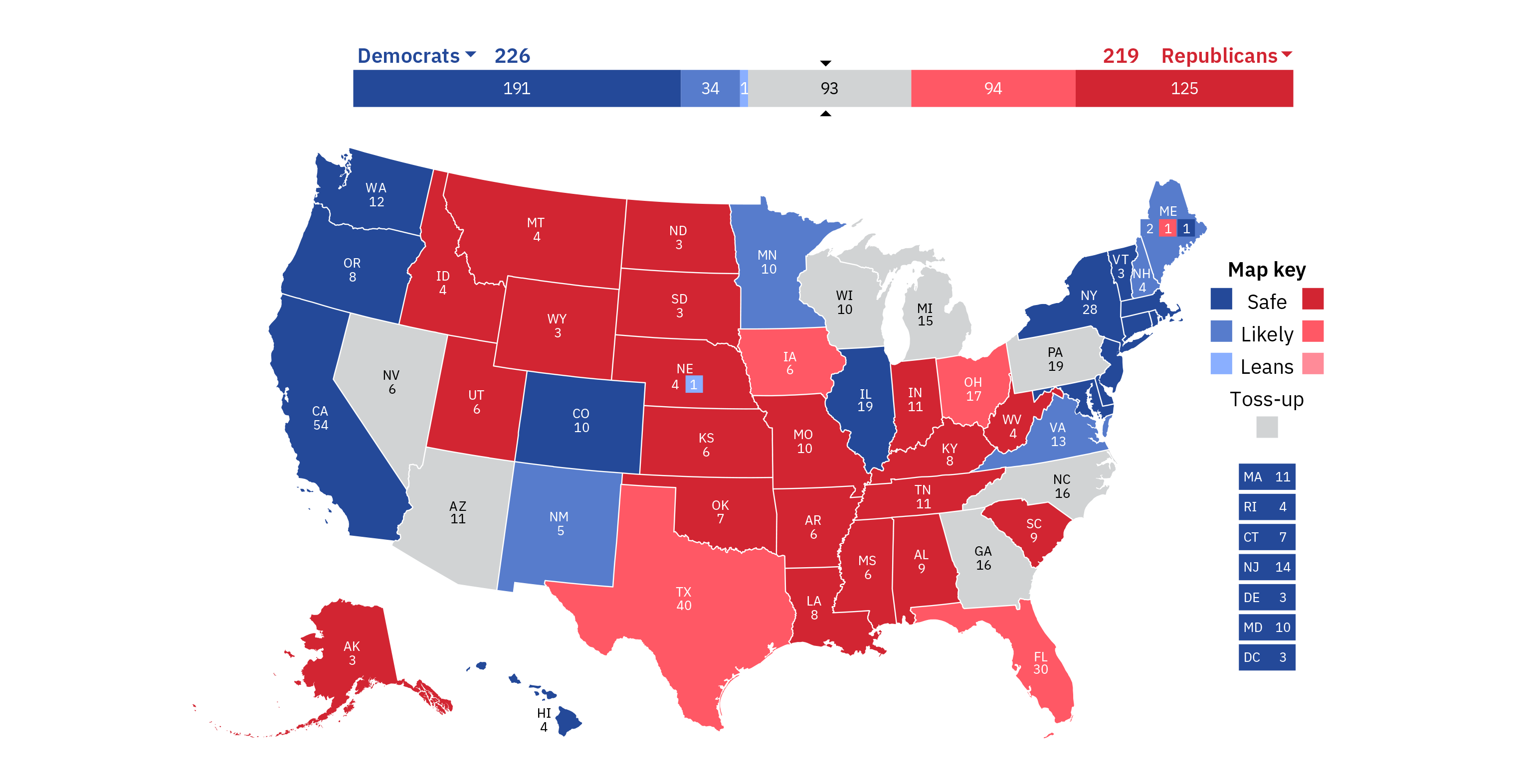

Projected U.S Presidential Election Map

Source: www.270towin.com

As the chart from 270towin.com above highlights, there are seven key swing states, highlighting that Pennsylvania, Michigan and Wisconsin are among the most contested states and have been the recipient of the most extensive lobbying from both Democrats and Republicans.

As highlighted, polling indicates a mild swing toward Harris but this may be a very closely contested race with only 1-2 percentage points separating the candidates. It could well take days or weeks beyond November 5th to declare a winner, with the Republicans likely to challenge any relatively close results that don’t go their way.

Another curveball remains the array of very serious litigation facing Trump. These cases will continue to proceed beyond November 5th, however if Trump becomes President he may be able to pardon himself from some of the charges or appoint favourable judges for certain federal cases at least. Earlier this year a Supreme Court ruled that Trump couldn’t be prosecuted for actions that were within his constitutional powers as President. There is a lot of unchartered territory here and we expect this to remain a live issue for quite some time.

Whilst all the focus is on who wins the presidency, voters will also be choosing new members of Congress, which is where laws are passed.

Congress consists of the House of Representatives, where all 435 seats are up for election, and the Senate, where 34 seats are being contested.

Republicans currently control the House, which initiates spending plans. Democrats are in charge of the Senate, which votes on key appointments in government.

Currently, the Democrats hold a slim majority (51-49), including a few seats where Republicans have previously won elections. Winning both the House and the Senate would enable Trump to far more easily pass through his policy agenda, whereas all Harris can aim to do is to maintain the status quo.

What are the key policy differences?

There are a number of very important social and other policies which are being hotly debated, but in narrowing our gaze toward the main policy areas which are most likely to impact financial markets in the near term, it’s all about taxes, trade, immigration and industrial (including climate) policy.

Taxes

Taxes are heavily connected to the US burgeoning fiscal deficit. Despite the looming expiration of Trump’s tax cut packages in 2017, various economists point to the policies of both parties increasing the fiscal deficit, although Trump’s is by a much greater margin.

- Harris wants to increase the tax rate on corporations and the highest income earners, while decreasing the burden on families and extending child tax credits.

- Trump wants to extended his 2017 tax package and assume that his tariffs package and assumption of higher growth from ‘unhindered’ corporations will pay for this.

Trade

We expect the US to continue to navigate further away from its free trade policy agenda of the past, favouring US industry. While there is clear bipartisan support for tariffs and other protectionism measures on China, the lines become blurrier when it comes to the quantum of tariffs, which trading partners and industries they are enacted on. Party lines are split when it comes to the potential impact on consumers and their spending.

- Trump is opting to aggressively lift tariffs and this forms a central pledge within his campaign. A universal 10% is being proposed on all imports with a ~60% tariff is being pledged for Chinese goods. It may be a ruse to get China to the negotiating table to force trade negotiations and discuss intellectual property rights.

- Harris is likely to walk a softer line, with the Democrats continuing to limit US market access to foreign countries if it can protect US industry. Favoured industries remain pharmaceuticals, semiconductors, batteries and critical minerals.

Immigration

Immigration has surged in the last couple of years due to a post-COVID backlog, relaxed restrictions on pent-up demand and global economic and social instability. It’s become a contentious topic. Any attempt to address or reform this will lead to greater expenditure:

- Harris will be looking at revisiting legislative reform to try and bolster border security that had failed previously. It would seek to increase security personnel and streamline the asylum process.

- Trump would be adopting a very hardline, restrictive immigration policy, promising to complete the border wall construction and engage in mass deportation of illegal immigrants – this would require a huge increase in spending relative to Harris’s policy.

Industrial policy

A combination of factors – different visions for US industry, different plans for spending or incentivising investment, different perspectives on regulation, and the role of government – contribute to meaningful potential impacts of new industrial policy on economic sectors:

- It appears to be very much the same agenda for Harris as it was under the Biden Administration. Supporting manufacturing, strengthening key supply chains around semiconductors, batteries, critical minerals and pharmaceuticals. Biden did the heavy lifting in recent years with the passing into law of key policies around the Inflation Reduction Act, Chips & Sciences Act and the Infrastructure & Jobs Act.

- Trumps mandate in 2017 was about removing red tape. His proposals this time centre around supporting fossil fuel producers including raising the number of drilling permits, providing tax breaks for energy producers, faster approval of pipelines and lifting the ban on natural gas exports. The likely repealing of subsidies to the electrical vehicle industry will create uncertainties for the battery and car manufacturers.

What does this actually mean for investors?

Firstly, for investors it means that the key policy differentials outlined today are not set in stone. Typically into the run up of any election, each parties proclamations and statements can get bolder, recency bias kicks in and expectations/sentiment can get out of hand. There may well be unforeseen future events which will ultimately influence future policy.

But if we focus on what we can assess to date, firstly the shape of Congress will be a key determining feature. We don’t know how the balance of power will rest across both the House and Senate. If we have a split (i.e. one party controlling the House, the other controlling the Senate), then many policies will likely be rehashed, sanitised or compromised on.

If we get a clean sweep in either direction, this will likely lead to greater spending as either party will be able to enact their policies far more easily. While many political parties are great at articulating the spending policies, the details often missed or loosely articulated are about how they can fund them – either through generating income (taxes) or how they will cut costs to be able to afford those plans.

A clean sweep will allow either party the ability to more easily appoint key officials in various executive branches, typically those persons whose views are aligned with that of the President. This will impact federal policy, the judiciary and regulation.

Higher spending will equate to a higher fiscal deficit, which already is at extreme levels of the US. Higher spending will require the issuance of more Government bonds and raises the risk of higher inflation and potentially higher interest rates. Whilst interest rates are set to decline in coming years, the burden on the US economy to service its outstanding debt is thus potentially requiring higher interest rates.

The Congressional Budget Office estimates that the US Government will spend ~US$1tn in the next 12 months, or ~3% of GDP, just to simply service its interest payments alone. This liability also keeps growing year on year.

One of the most polarising issues for the economy is tariffs, especially with respect to the aggressive Republican stance on this issue. These higher prices are paid by US consumers, with the tax revenue flowing directly to the US Government. Trump believes the revenue from tariffs will go to reducing the Federal deficit, however history tells us there isn’t a very strong relationship here, especially under Trump’s reign where spending escalated at a greater rate relative to the additional revenues generated.

Tariff revenues don’t make much of a dent in the deficit

Source: New York Life Investments Global Market Strategy, U.S Department of Treasury, Macroband, August 2024.

A case can be easily made that tariffs may be hurtful for the economy. Tariffs are paid by end consumers. The Peterson Institute for International Economics has predicted that Trump’s tariff policies could cost middle income US households US $1,700 – $2,600 per annum. Lower income households tend to have the most sensitivity to changing prices, given they have the greatest propensity to spend. BCA Research estimate that even after the tax cuts, lowest quintile income households will see a close to 4% fall in after-tax income – this at a time where considerable cost of living pressures exist. The benefits clearly accrue to the top 1% income earners, a segment where Democrats are seeking to increase taxation.

Higher tariff revenues, despite tax cuts, will hurt lower income households the most

Source: Tax Policy Center (2022), Bureau of Labor Statistics (BLS), and Department of Treasury. * Tax Cuts and Jobs Act

We believe elevated tariffs will likely lead to a fall in spending. Lower consumption will be negative for economic growth. On the flip side, these policies may lead to the creation of new jobs and therefore wealth creation in the US but higher cost bases, higher goods prices – all lead to the risk of higher inflation.

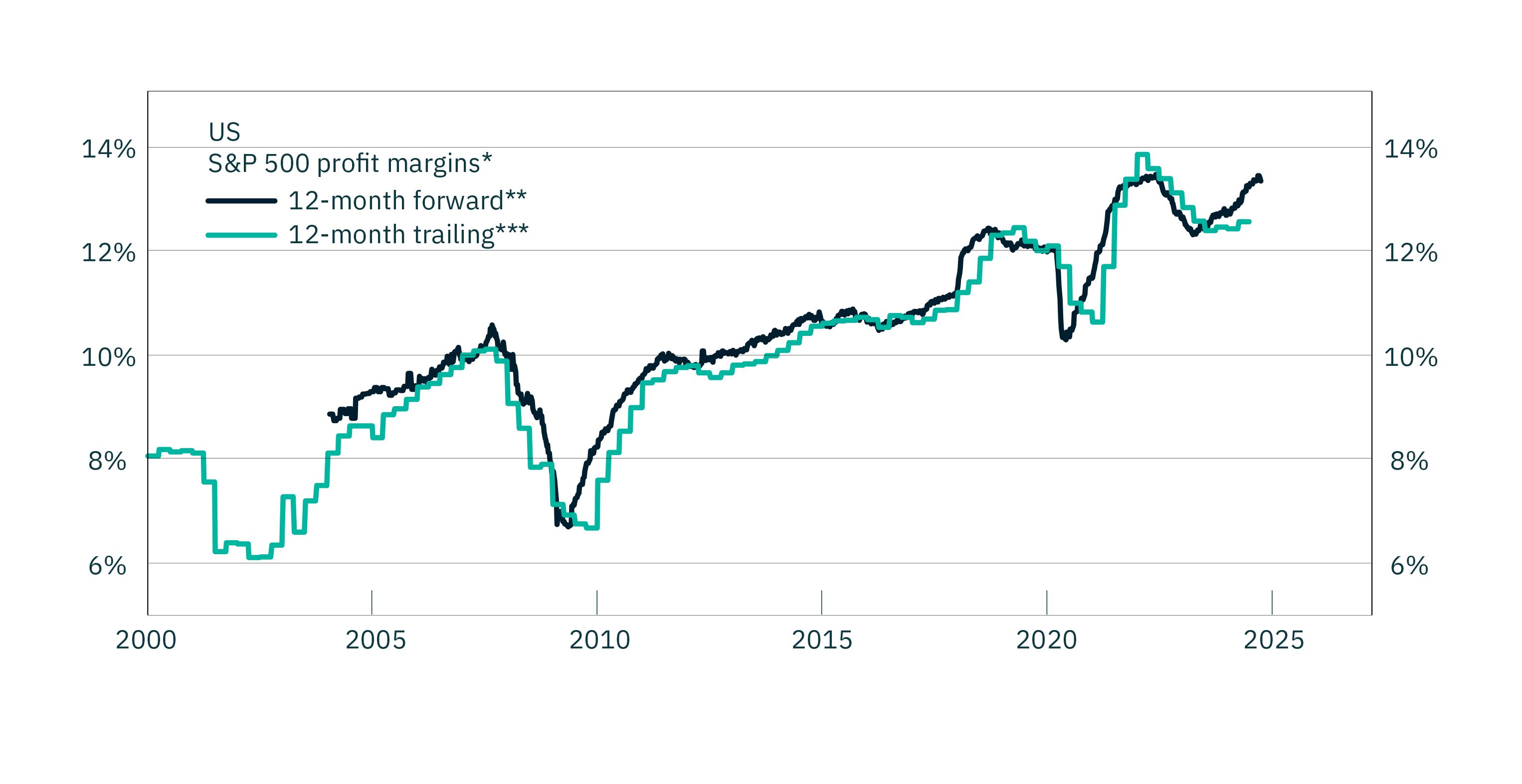

Higher tariffs will likely be negative for US equities. When we consider potentially lower spending, falling demand and higher costs, this does not bode well for many US equities. Future profit margin expectations are already at extreme levels and, when reflecting the premium valuations among many US-listed business, there is clear downside risk. There is also the very real possibility of retaliatory tariffs from other trading partners, hurting US exporters as well.

Expectations for future profit margins in the U.S are at extremes

Source: BCA Research * Calculated as EPS / SPS. **Source: Refinitiv/IBES. ***Source: Bloomberg Finance L.P

Note: Shaded areas denote NBER-designated recessions.

S&P500 P/E Multiple approaching peak levels again

Source: Refinitiv/IBES and BCA Research

Note: Shaded areas denote NBER-designated recessions.

The EU, Japan, Mexico and China carry the greatest goods trade surplus with the US. Mexico, who actually became the largest source of US imports last year, may well continue to benefit the most from the ‘onshoring’ thematic at China’s expense.

Conclusion

It’s likely to be a very close election race. Harris remains marginally in front, however the polls don’t always get it right. The combative nature of the Republicans will likely see any unfavourable result challenged aggressively through various courts.

From a policy perspective, any initial sugar rush from various spending programs will likely give way to inflationary pressures and further debt. Consumers in aggregate will likely be worse off under any increasingly punitive tariff regime, with these imbalances exacerbated through the aggressive stance by Trump.

All credible economic analysis we have reviewed to date points to the risk of lower growth and potentially higher inflation. We see downside risks to equities through higher costs and lower demand – an environment which is not reflected in current pricing expectations.

Longer term, the US will ultimately need to find a more sustainable way to address its ballooning debt problem and lower its fiscal deficit – if not, its status as the reserve currency of the world may well be challenged.

A Republican victory could well generate greater market volatility going forward due to the more combative nature of Trump, although financial markets may well be better adjusted to his modus operandi this time around.

While we continue to remain focussed on the more tangible aspects of this event, we expect to see full media saturation, plenty of spin and theatrics over the next month or two.