The importance of rebalancing your portfolio

Pitcher Partners Investment Services (Melbourne) | The information in this article is current as at 18 July 2024

Planting and growing a tree is analogous to investing. Rebalancing an investment portfolio is akin to pruning that tree. A vital practice to ensure the tree is healthy, growing appropriately, and trimmed of the dead branches.

Your investment portfolio should be reviewed on a regular basis to ensure it has the targeted allocation to the combination of asset classes most appropriate for your investment strategy.

In this article, we explore how routine portfolio rebalancing can enhance long-term annualised performance and reduce overall volatility. So what is it, and how can it be built into a portfolio management process?

What does it mean to rebalance a portfolio?

Rebalancing is a strategy used for maintaining a desired level of investment in specific asset classes, called a Strategic Asset Allocation (SAA). The SAA outlines how much an investor should be invested in a given asset class over the long-term and it will be different for investors with contrasting risk profiles.

For example, below is a indicative SAA for a 60/40 portfolio – 60% of the portfolio is invested in growth assets (Equities, Alternatives, Property) and 40% in income assets (Fixed Income, Cash).

| Asset Class | Weights |

| Australian Equities | 22.0% |

| Global Equities | 18.0% |

| Alternatives | 5.0% |

| Australian Property | 10.0% |

| Global Property | 5.0% |

| GROWTH TOTAL | 60.0% |

| Australian Fixed Income | 20.0% |

| Global Fixed Income | 10.0% |

| Cash | 10.0% |

| INCOME TOTAL | 40.0% |

| TOTAL | 100% |

Source: PPIS Research

As asset classes generate different returns across market and economic cycles, these percentage weights will drift from their starting values. Rebalancing is the process of resetting the weights back to their target allocations. This may involve selling some assets and/or buying more of others, as well as reinvesting cashflows (like dividends, managed fund distributions and interest payments).

Why is rebalancing important?

Rebalancing adjusts the drift in a portfolio’s position sizes over time. It plays a crucial role in ensuring the risk allocation of a portfolio is maintained and is in-line with the investor’s objectives.

This process can help to optimise longer-term returns. By selling higher performing assets and buying underperforming ones, you can capitalise on market inefficiencies and price corrections – instead of making single judgment calls in potentially stressful or challenging market environments.

Without rebalancing, the portfolio can become concentrated in those high performing asset classes. This may sound appealing but high-performing investments typically don’t last indefinitely. Historically, market cycles do correct and evolve, with examples such as the ‘dot com boom’ in 2000, the GFC in 2007/08 and the COVID pandemic in 2020.

As an example, below is the calculated impact of rebalancing on both the risk and return of a 60/40 SAA (a balanced growth investor) from January 2000 to May 2024, assuming a 0.15% transaction cost on any rebalancing.

We found that over the long term, a yearly rebalancing strategy achieved better outcomes compared to a ‘set and forget’ strategy (often referred to as Buy & Hold):

- Annualised returns over the 20 years improved by 0.44% per annum.

- Annualised volatility of returns decreased by 0.98% per annum.

- The maximum drawdown witnessed over that period decreased by 4.9%

(Maximum drawdown is the biggest loss the sample portfolio experienced over this period).

We also calculated the annualised returns and volatility of the 60/40 portfolio under various rebalancing frequencies and found that rebalancing yearly had the lowest volatility over almost all timeframes.

Whilst yearly rebalancing had the highest returns over the very long-term, quarterly rebalancing provided the most successful outcomes in the medium to long-term.

Below are the annualised returns by rebalancing frequency, highlighting the highest in each time period.

| Annualised Returns | Monthly | Quarterly | Semi-Annually | Yearly | Buy & Hold |

| 1Y | 11.14% | 11.18% | 11.11% | 11.14% | 11.74% |

| 2Y | 6.28% | 6.24% | 6.20% | 6.21% | 5.83% |

| 3Y | 3.91% | 3.86% | 3.87% | 3.97% | 3.78% |

| 5Y | 5.32% | 5.35% | 5.20% | 5.18% | 4.76% |

| 7Y | 5.78% | 5.82% | 5.69% | 5.66% | 5.45% |

| 10Y | 6.22% | 6.23% | 6.14% | 6.12% | 5.87% |

| 15Y | 7.70% | 7.74% | 7.68% | 7.68% | 7.41% |

| 20Y | 6.61% | 6.70% | 6.68% | 6.82% | 6.38% |

| 24Y | 6.45% | 6.54% | 6.51% | 6.65% | 6.38% |

Source: PPIS Research – data to 31 May 2024

Below are the annualised volatility of returns (measured by standard deviation) by rebalancing frequency, highlighting the lowest figures in each period.

| Standard Deviation | Monthly | Quarterly | Semi-Annually | Yearly | Buy & Hold |

| 1Y | 9.00% | 9.02% | 9.01% | 9.05% | 10.32% |

| 2Y | 10.62% | 10.66% | 10.65% | 10.47% | 12.16% |

| 3Y | 9.43% | 9.46% | 9.45% | 9.33% | 10.83% |

| 5Y | 10.22% | 10.20% | 10.14% | 10.03% | 11.73% |

| 7Y | 8.97% | 8.96% | 8.91% | 8.82% | 10.25% |

| 10Y | 8.13% | 8.13% | 8.09% | 8.04% | 9.24% |

| 15Y | 7.40% | 7.39% | 7.38% | 7.33% | 8.22% |

| 20Y | 7.63% | 7.61% | 7.56% | 7.44% | 8.42% |

| 24Y | 7.23% | 7.20% | 7.15% | 7.04% | 7.88% |

Source: PPIS Research – data to 31 May 2024

Portfolio drift – What happens if you do not rebalance?

Not rebalancing a portfolio will cause the asset class weights to drift. In our 60/40 SAA, the starting allocation to Australian Equities is 22% of the portfolio. Without rebalancing, over a 24-year investment period, this increases to 33%.

The table below shows how all the asset class weights drift if you did not rebalance. Differences between SAA starting weights and portfolio weights at any time can differ between -11% and +11%

| Asset Class | Starting Weights | Ending Weights | Difference |

| Australian Equities | 22.0% | 33.0% | 11.0% |

| Global Equities | 18.0% | 15.2% | -2.8% |

| Alternatives | 5.0% | 4.1% | -0.9% |

| Australian Property | 10.0% | 12.2% | 2.2% |

| Global Property | 5.0% | 8.0% | 3.0% |

| Australian Fixed Income | 20.0% | 13.8% | -6.2% |

| Global Fixed Income | 10.0% | 8.2% | -1.8% |

| Cash | 10.0% | 5.4% | -4.6% |

| Total | 100% | 100% |

Source: PPIS Research – data to 31 May 2024

These estimates are based on the return of indices in each asset class: the S&P/ASX 200 Accum Index for Australian equities as an example.

Without rebalancing, the potential concentration in high-performing asset classes, can increase a portfolio’s risk. This, in turn, can lead to suboptimal performance through missed opportunities to buy undervalued assets and sell overvalued ones.

As per our analysis above, the Buy & Hold strategy (no rebalancing) generated an annualised standard deviation (our risk measure) of 7.88% compared to 7.04% for the Yearly rebalancing strategy, indicating rebalancing reduced volatility over a 24-year period.

Rebalancing can provide a positive impact in the short term as well as the long term.

The Buy & Hold strategy had a higher return (11.74%) and higher risk (10.32%) in the first year. Investors may be comfortable with this situation as a higher return compensates for the risk taken.

However, over 2-years, the Buy & Hold strategy achieved the lowest annualised return (5.83%) and the highest volatility (12.16%) – due to a higher weight in a falling asset class, causing poorer performance over the period. Buy & Hold had nearly double the allocation to the falling asset class than the Yearly strategy and the SAA.

Long-term, the strategy that loses less, should accumulate a higher portfolio value.

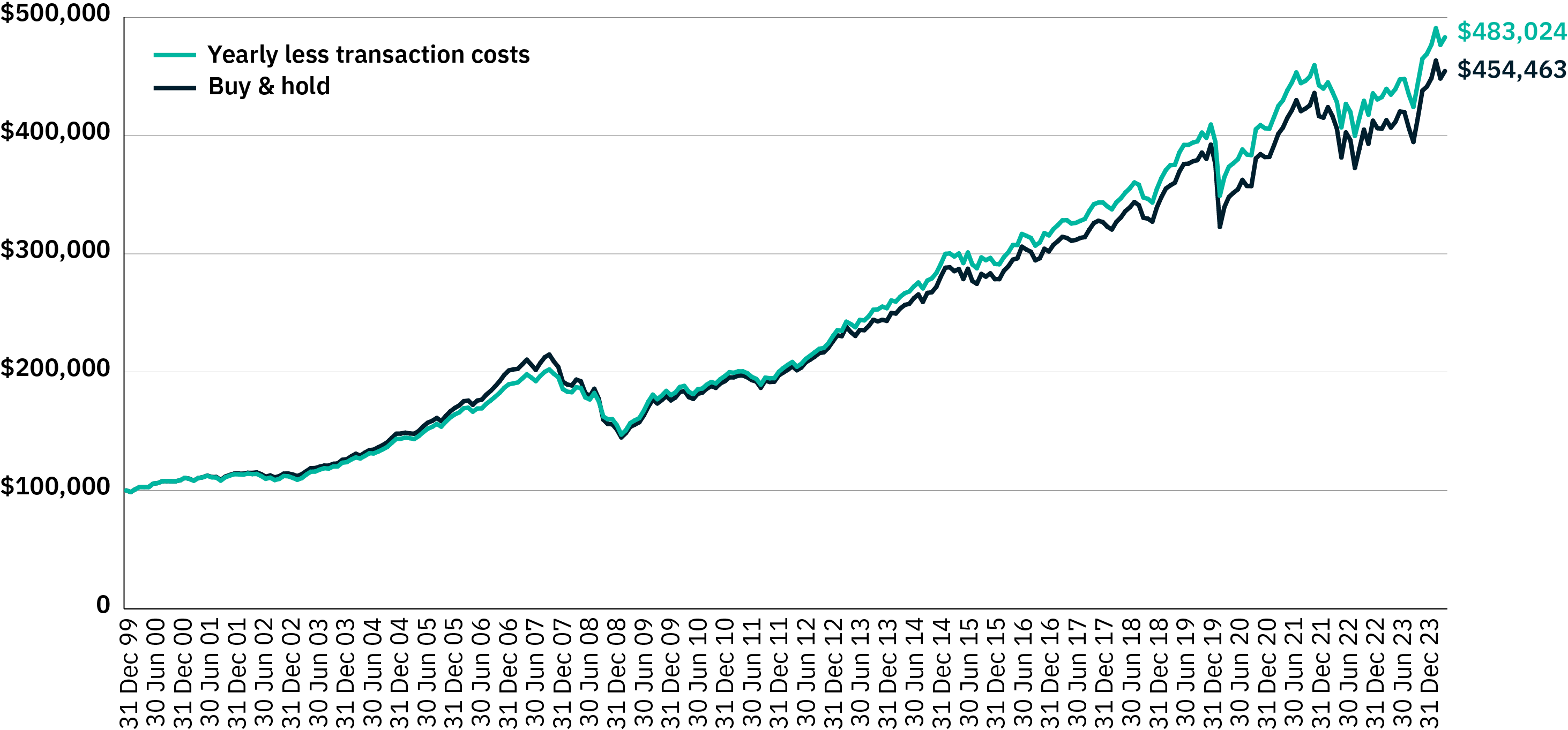

Portfolio value over the long-term

In our analysis, we compared investing $100,000 under various rebalancing frequencies. A Buy & Hold strategy accumulated a portfolio value of $454,000 while the Yearly rebalance strategy accumulated $483,000. Note, we assumed no further cashflows or investment in the analysis. If an investor did make additional investments, the results would be even greater in $ terms.

Comparison Yearly Rebalance Frequency with 0.15% Costs

Source: PPIS Research – data to 31 May 2024

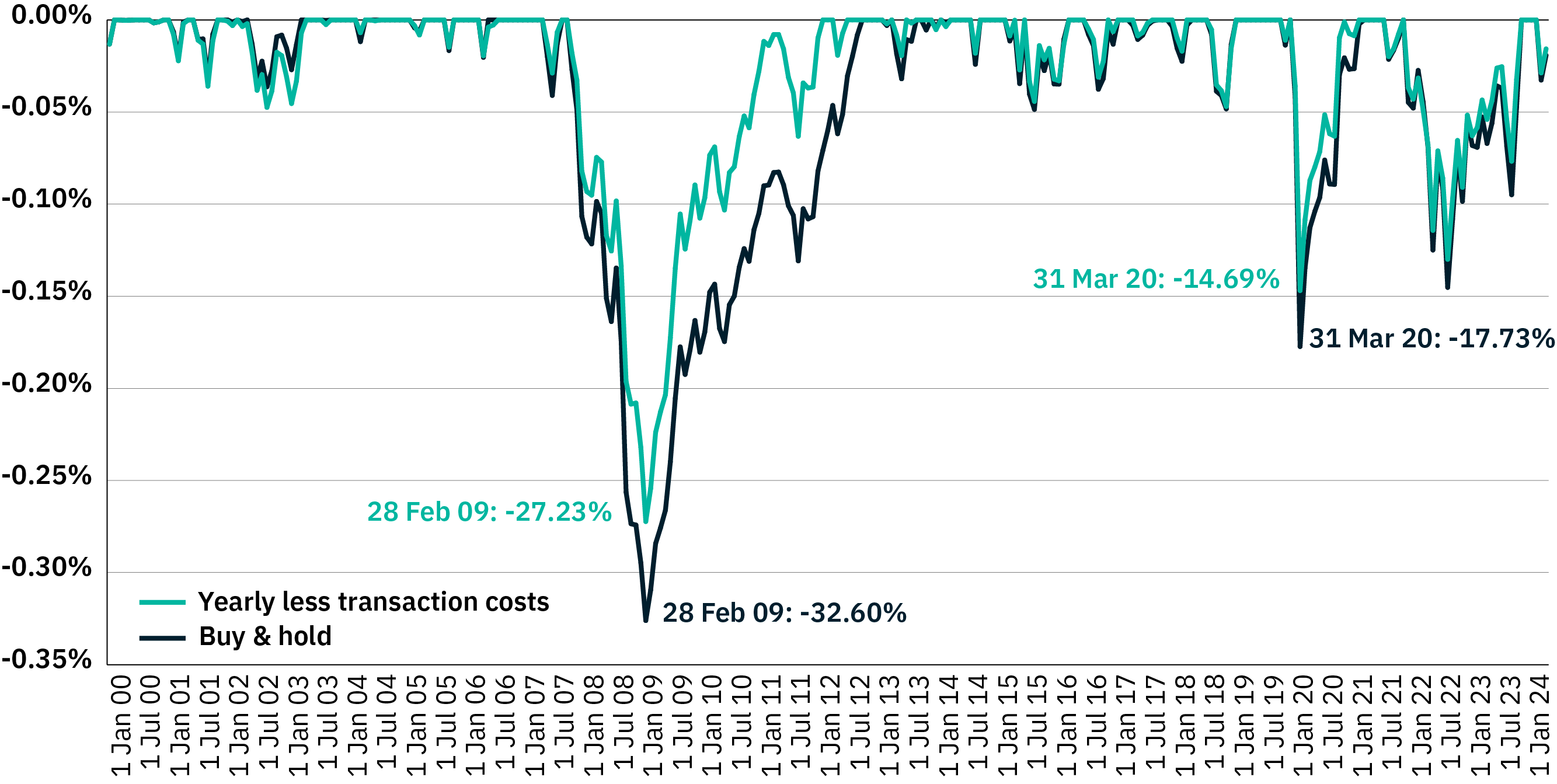

Rebalancing helps reduce the maximum loss in a portfolio, called a drawdown. A drawdown is calculated as the percentage loss from the portfolio’s peak value to its trough value.

In our analysis above, a Buy & Hold strategy experienced a maximum loss (from peak to trough) of -32.6%. While a yearly rebalance reduces the maximum loss to -27.2%. This also allows the Yearly portfolio to recover faster.

Drawdown Profile (incorporating transaction costs)

Source: PPIS Research – data to 31 May 2024

Pros and cons of rebalancing

Regular rebalancing encourages a disciplined approach to investing and reduces the impact from emotional decision making and market timing. Returns are enhanced by lower levels of volatility, a reduction in drawdowns, and appropriate corrective action taken during varying stages of the market cycle.

There are some considerations when assessing the scope and frequency of rebalancing. Frequent rebalancing will incur transaction fees and taxes which can reduce the potential benefits. This highlights the importance of striking a balance between letting your investments compound and adjusting the portfolio when necessary.

Transaction costs can have an impact on the value of a portfolio over time. We assumed a 0.15% (15 basis point) cost in rebalancing and found the yearly rebalancing strategy portfolio value was $29,000 higher than the Buy & Hold. Even with transaction costs, a full monthly rebalance still accumulated a $5,000 higher portfolio value than the Buy & Hold strategy over the long-term.

Selling assets has tax consequences too, depending on if assets are sold at a gain or a loss. Each investor will need to consider their own circumstances when deciding to rebalance.

Lastly, selling high-performing assets and buying underperforming ones can be psychologically challenging due to cognitive biases – it’s mentally hard to let go of something doing well now, for something we ‘hope’ will do better in the future.

How should investors think about rebalancing and how often?

Whilst we have showcased the historical analysis for a 60/40 portfolio, each investor should approach rebalancing with their own goals in mind. Some aspects to think about are:

- Defining the desired asset allocation. We used a 60/40 split in our analysis, but each investors portfolio will be different. Investors with higher equity allocations may approach rebalancing very differently to those with a higher allocation to bonds given the differing levels of volatility.

- Deciding whether to rebalance based on allocation thresholds (5% deviation from SAA) or at regular time intervals (annually, semi-annually, quarterly), potentially taking into account future cash flows.

- Reviewing the portfolio for significant deviations from the target allocation.

Other considerations when rebalancing

Tactical Asset Allocation (TAA)

We have focused on the SAA, the long-term allocation of assets. However, investors may consider changing the weight of asset classes in their portfolio for shorter periods of time, in anticipation of specific events or trends. This is known as Tactical Asset Allocation (TAA).

This is an active management strategy, shifting the asset class weights in a portfolio to take advantage of, or protect against anticipated market movements caused by macro or microeconomic events. All to improve the risk-adjusted returns of the portfolio.

TAA changes require more active monitoring than a passive investment strategy and are usually deployed over the short to medium term. Investors who utilise TAA will typically consider any necessary rebalancing as part of its investment process, which will involve buying / selling new or existing investments.

In summary

Rebalancing is an important practice for maintaining desired allocations to risky assets and optimising long-term returns. While it involves costs and requires discipline, the long-term benefits including lower volatility, reduction in portfolio drawdowns and enhanced returns have the potential to make it a worthwhile process.