India – a long term structural growth story

Pitcher Partners Wealth Management (Brisbane) | The information in these articles is current as at 16 April 2023

India is well positioned to remain an engine for growth for the global economy.

We believe its positive demographics and ongoing structural reforms are likely to underpin growth for many years to come. In this note we unpack this trajectory in more detail and highlight why India could be on track to become the world’s third-largest economy and stock market within the next ten years.

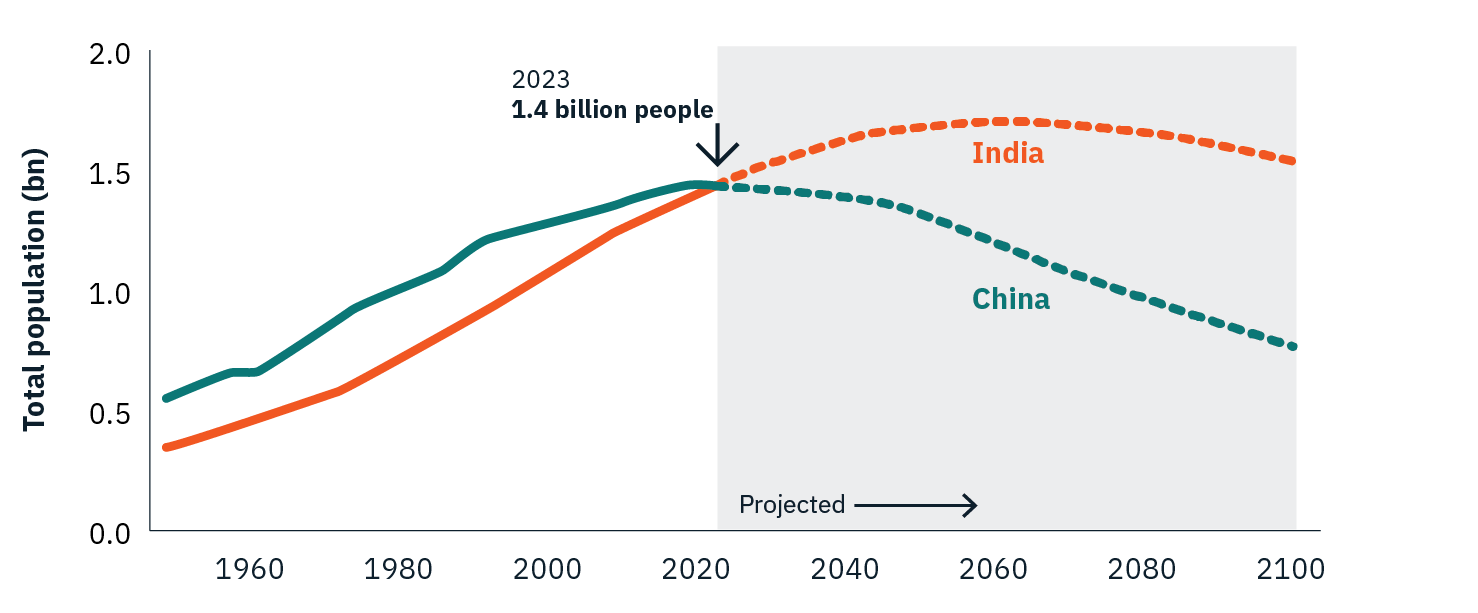

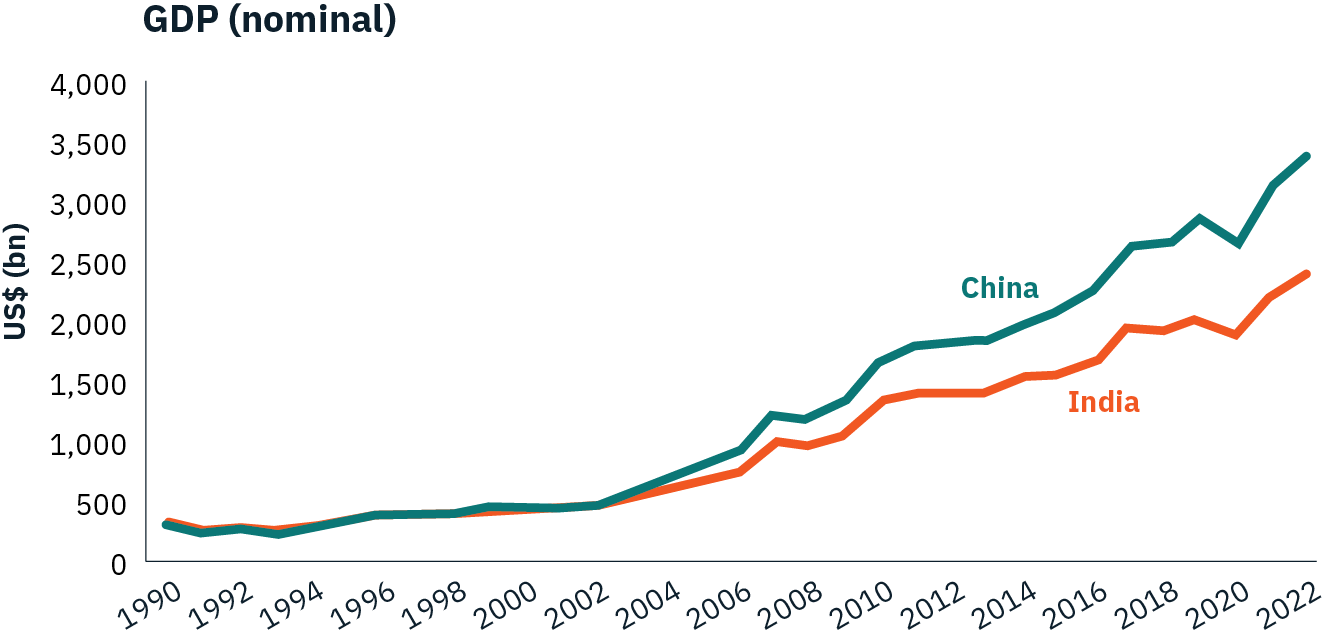

On an economic front, India has long been in the shadow of China’s impressive growth trajectory. However, we believe this dynamic is going to change. China’s population has now likely peaked and is expected to decline from here. This brings several significant growth challenges for China’s economy looking forward.

Figure 1.

Source: New York Times, UN World Population Prospects

India’s demographics, however, remain very conducive to longer-term economic growth. With a median population age of 28 years old, India has one of the youngest, and growing, workforces globally.

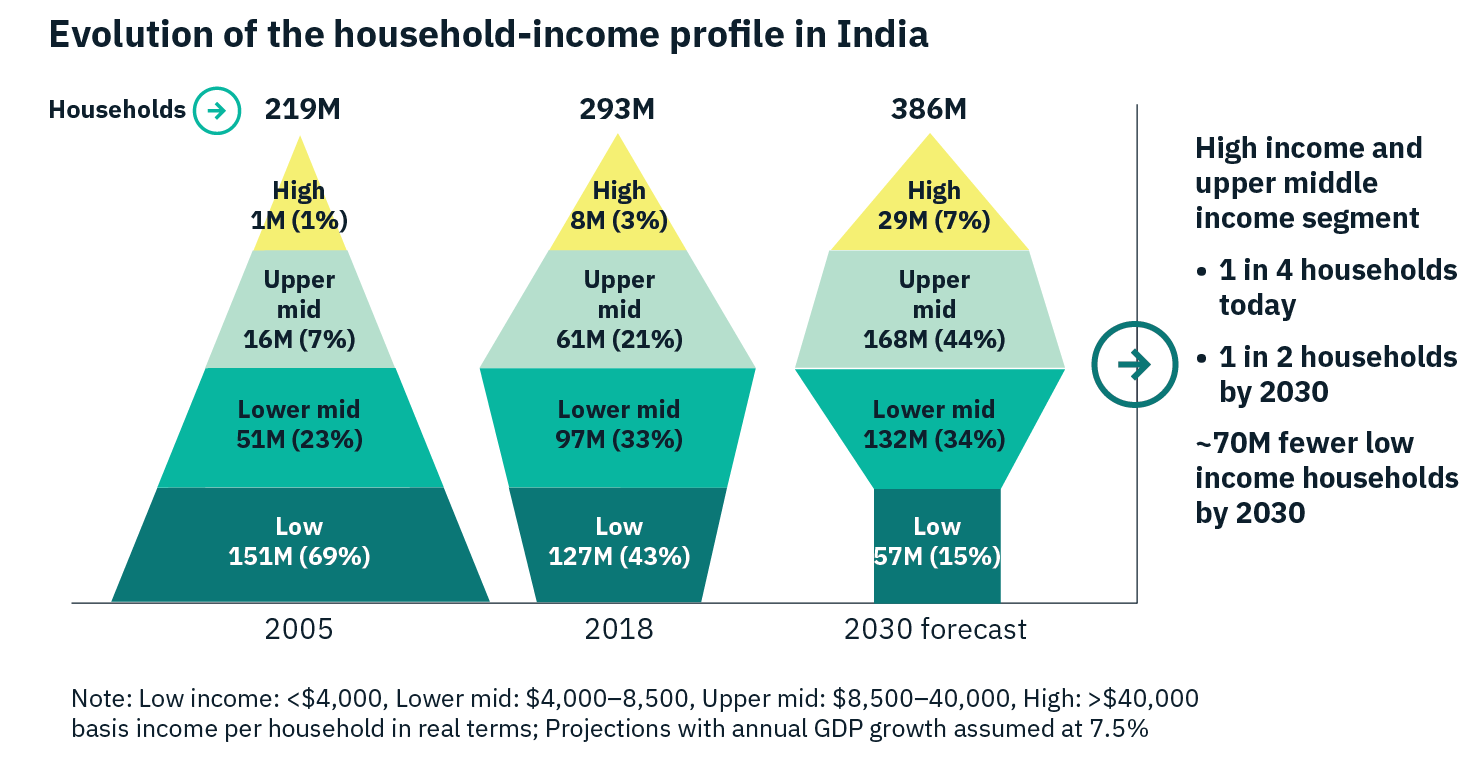

As the middle class grows, India will add 140 million middle income, and 21 million higher income households by 2030 according to a report by the World Economic Forum and Bain. An additional 25 million households will also be lifted out of poverty, with the proportion of households below the poverty line reducing from 15% today to below 5% by 2030.

Figure 2.

Source: World Economic Forum and Bain report, 2024

With 67% of its population at working age, the growing and increasingly better off workforce will be a key driver of economic growth. Indeed, according to UN population estimates, India is likely to account for 21% of the world’s increase in working age population by 2033.

“Growth in income will transform India from a bottom-of-the-pyramid economy to a truly middle-class led one, with consumer spending growing from $1.5 trillion to nearly $6 trillion by 2030”

– World Economic Forum and Bain report, 2024

These trends will all be favourable to consumption spending, and the underlying health of the economy. In our opinion, India presents one of the best structural growth opportunities in emerging markets.

Several drivers will support this structural growth over the coming decades. Urbanisation, long a driver of China’s economic miracle, is set to rise in India as it still remains at 37% compared to China’s urbanisation which is currently at 61%. Rural to urban migration is often associated with rising consumer expenditures.

Figure 3.

Source: Bloomberg

Recent years have seen increasing macroeconomic stability in the economy, with shrinking fiscal deficits. Inflation, long a bugbear, has been tamed and the economy has been on a steady growth path, despite the increased volatility of the global economy.

Behind this sea change has been a number of critical government reforms initiated over the last decade.

Reforms abound

India is in the midst of a number of structural reforms which could see a multi-year benefit to economic and share market performance.

The government has been on a multi-year reform path, which has increased the financial inclusion of a large portion of the population. Starting with the impressive Aadhar program, a large-scale digital ID system, which has helped to reduce fraud, and critically give a large portion of the population access to the formal economy. The Aadhar program, and its extensions into banking and financial services has given this cohort of the population the ability to access modern financial services, previously unavailable, allowing far greater control in shaping their own futures.

Financialisation of the economy, giving all citizens access to the banking system, and enabling access to financial products, has spurred growth and brought not just economic implications, but huge social benefits.

Social infrastructure is improving, with female to male participation in education moving from 77% in 2011 to over 96% in 2020. Between 2011 and 2021, the number of students enrolled in higher education (graduate level and above) courses increased by 50%. According to Morgan Stanley, India’s tertiary-educated workforce is set to rise from 98.6 million in 2011 to over 260 million by 2030. As workforce education levels increase, productivity also tends to rise accordingly.

The formalisation of the economy has brought further benefits, including improved tax receipts and more efficient distribution of government transfers to those most in need. Subsidies in the economy can thus be more efficiently distributed, and the benefits have been significant.

With over three quarters of household spend currently being spent on essentials (food, rent etc), improving economic performance will likely result in a large increase in discretionary spend over coming years and decades.

Domestic savings are ~30% of GDP, and around 60% of India’s GDP is driven by domestic private consumption. As access to goods and services improves and as consumers wealth improves, consumption should increase, as savings continue to provide a buffer.

As consumers are increasingly wealthier and better connected, they tend to become more discerning of how and what they spend their money on, and this will likely drive new consumer behaviours versus the traditional spending in the economy.

Other reforms that have been initiated include:

- ‘Make in India’ initiative to encourage manufacturing and broadening of the skills base of the workforce.

- Foreign Direct Investing rules easing, allowing increased foreign investment into sectors previously restricted.

- Encourage innovative start-ups and creating an ecosystem for entrepreneurship, removing red tape to encourage setting up and running start-up firms.

- Investment into digital services, providing internet connectivity to 250,000 villages, as well as providing increased mobile connectivity. India will see over 1.1 billion of its population with access to the internet by 2030, bringing a significant portion of the population into the digital age.

Investment into physical infrastructure, including smart cities, industrial corridors, road, rail and shipping hubs, and power projects have all been undertaken. A series of pro-growth budgets in recent years, with a sizeable emphasis on public infrastructure spending has contributed greatly to the longer-term growth trajectory.

The implications to the economy have been widespread. The banking sector’s non-performing loans, long a hindrance to stability, have declined from a peak of 11% in 2018 to 4% in 2023. This has driven a more stable economic backdrop and spurred a more stable growth environment.

Stock market reflects growth

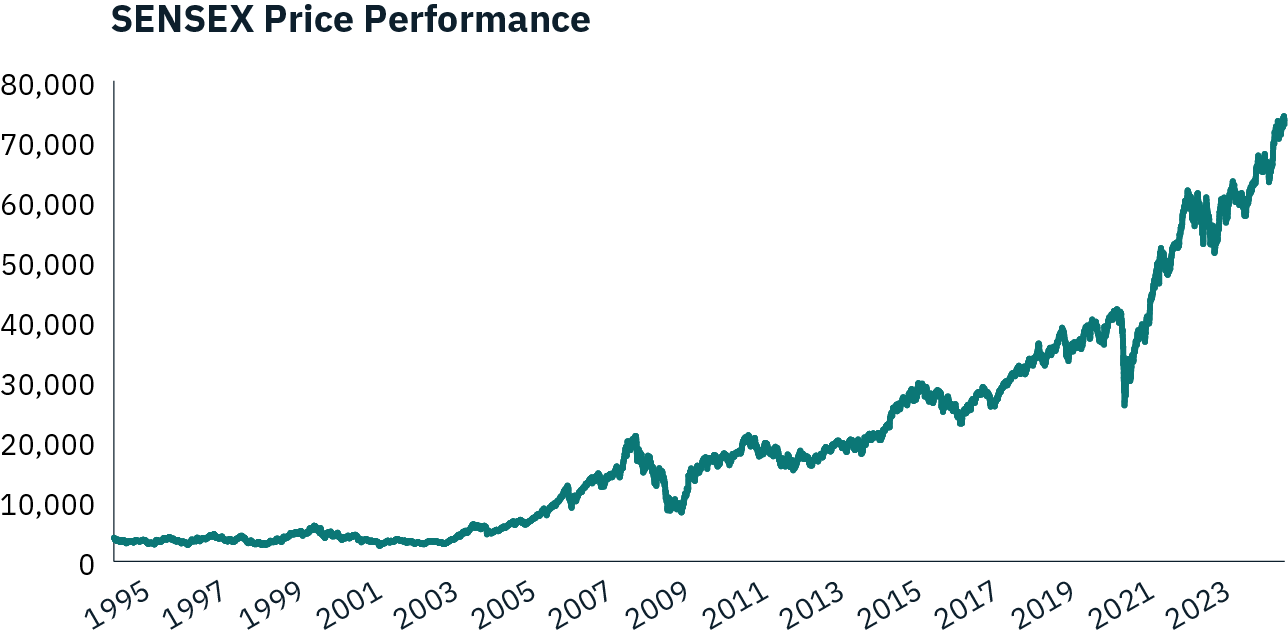

India’s stock market has reflected a number of these initiatives and reforms, rising steadily over the recent years. Indeed, it has been one of the best performing stock markets over the last decade, and one of a very few to post a positive return each year in that decade.

Figure 4.

Source: Bloomberg

India’s market is home to a wide variety of companies, from leading banks and consumer companies to globally competitive software companies. Indian companies generally have a very entrepreneurial culture, and many companies generate strong returns, in a tough market to operate in.

Even on the world stage, India is making its mark. Indian-born CEO’s dominate the world scene, with Microsoft, Alphabet, Starbucks, IBM and Swiss drug giant Novartis, among the major global companies featuring Indian-born CEOs.

Additionally, the Indian market benefits from a number of strong protections. It has a strong, independent market regulator, and protection of minority shareholder rights.

In recent years, as the reforms have taken shape, the market has also seen a decreasing reliance on foreign shareholders, with domestic appetite for equities rising. This has given rise to a growing and well managed mutual fund industry, which has seen the number of accounts rise from 40 million in 2015 to over 140 million today. Equally, life insurance assets have risen more than five-fold since 2010. As increased savings are deployed into domestic mutual funds, we expect it should continue to broaden the market further.

India is set to remain a large engine of growth for the global economy, contributing up to 20% of global GDP growth for the next many years. As China’s economy faces demographic challenges and the need to boost consumption and economic growth, India looks poised to continue its growth path and play catch up. It is on track to become the world’s third-largest economy and stock market within ten years.