Global Private Credit: A Growing Investment Opportunity

Pitcher Partners Wealth Management (Brisbane) | The information in these articles is current as at 18 July 2024

As global markets continue to evolve, private debt has emerged as a fast-growing asset class despite some recent high-profile challenges. This article delves into the growth of private debt, highlighting both its potential and the risks involved, with a focus on recent market dynamics.

Background on Private Credit

Private debt refers to lending that occurs outside of traditional bank loans and public debt markets. Asset managers typically establish private credit funds and lend directly to private companies, offering an alternative to traditional bank financing.

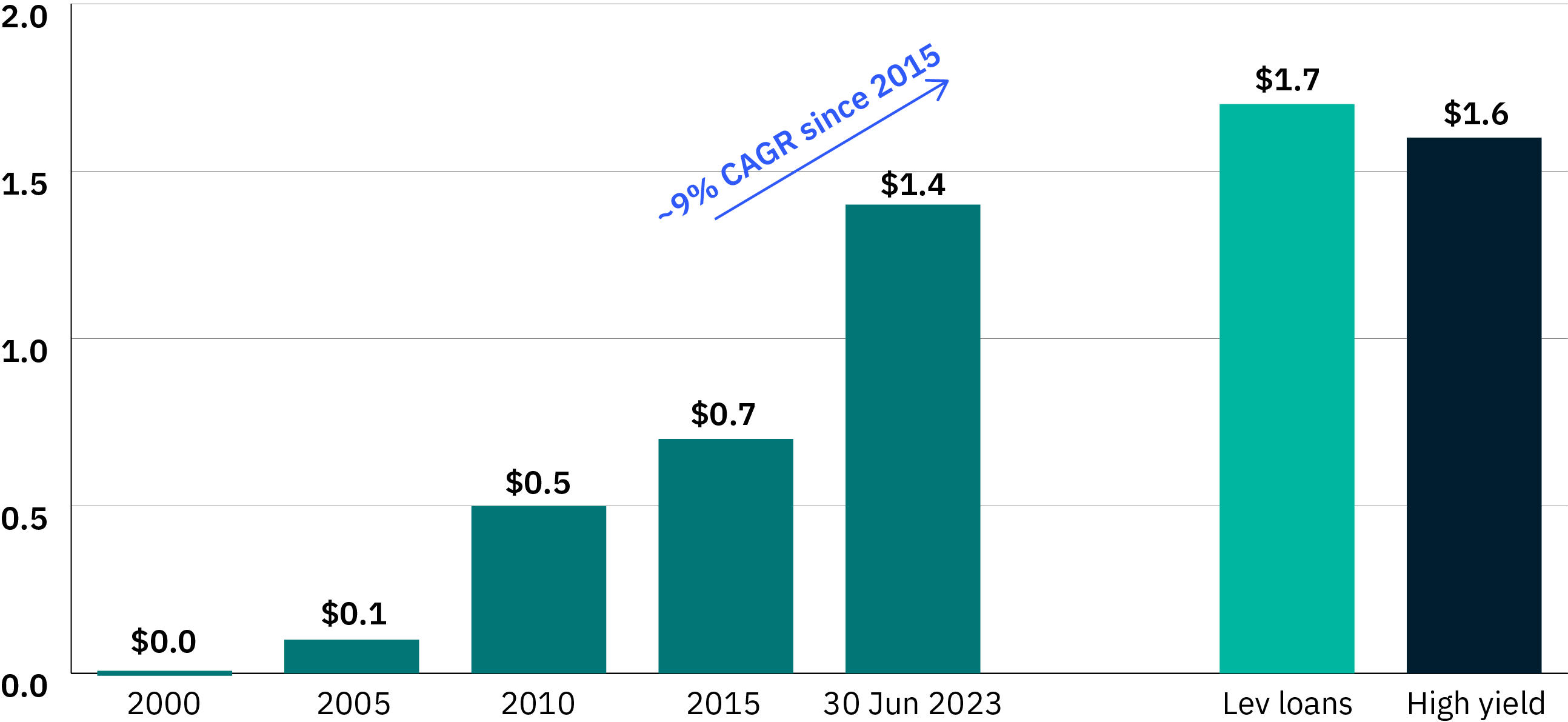

Morgan Stanley estimates that the private debt asset class has surpassed US$1.4tn globally which can be attributed to several factors:

- Banks continue to retreat from lending to specific sectors such as the corporate middle market, due to punitive capital requirements introduced by regulators after the GFC in 2007/08. This is expected to further expand the “addressable market” for private debt borrowers.

- Structural changes in public markets which are increasingly catering to larger borrowers, making public debt market deal sizes too large for most middle-market companies.

- Borrowers favour customised funding solutions, for ease of execution, and the flexibility provided by long-term borrower-lender relationships.

- Investors seek diversification in their overall portfolio allocation, with potential for higher yield strategies.

In Australia, it’s worth noting that the private credit market remains relatively small and has largely been concentrated towards commercial real estate. In bigger offshore markets such as the United States and Europe, it has become a common source of financing for the corporate middle market, taking a large market share from the banking sector. Banks have refocused their business toward the residential mortgage markets which has become more profitable for them.

As noted above, structural changes in public markets also favour larger borrowers, making public debt deal sizes too large for most middle-market companies. This shift has been driven by stricter regulations, higher issuance costs, and the pursuit of greater liquidity, effectively barring smaller companies from accessing these markets. Consequently, middle-market companies have sought alternative financing options, often at higher costs and with more restrictive terms. As a result, private credit is increasingly becoming the preferred partner for these companies.

The below chart shows the growing size of the private credit assets compared to the size of the public markets for non-investment grade corporate borrowers – the syndicated loans and high yield markets.

Private Credit Assets vs Leverage Loan and High Yield Markets ($Tr)

Source: Cobalt data as at Jun 30, 2023; Leverage Commentary & Data (LCD) data as of Sept 30,2023. Note: Lev loans captures US and Europe, while HY captures US; Morgan Stanley Research.

The table below compares the key characteristics of each financing option.

- Direct lending, aimed at middle-market companies, offers high flexibility and secured loans, resulting in moderate historical losses.

- Broad syndicated loans cater to large corporations with multiple lenders, offering moderate interest rates and low to moderate losses as they tend to be higher quality, more established businesses.

- High yield bonds, issued by lower credit rating companies, provide the highest returns but also the highest historical losses, reflecting their greater default risk and unsecured nature.

| Characteristic | Direct Lending | Broad Syndicated Loans | High Yields Bonds |

| Borrowers | Middle-market companies | Large corporations | Lower credit rating companies |

| Lenders | Private lenders | Banks, institutional investors | Institutional investors |

| Loan Size | Small to mid-sized | Large | Large |

| Interest Rates | High | Moderate | Highest |

| Security | Often secured | Often secured | Usually unsecured |

| Liquidity | Low | Moderate | High |

| Flexibility | High | Moderate | Low |

| Historical Losses | Moderate | Low to moderate | High |

Global Private Credit – Fund structures and underlying risks

The private credit market has witnessed a surge of different strategies across multiple sectors, tapping an expanding universe of borrowers. This is offering investors an unprecedented range of investment options, attracting them with high yields and potential added alpha, particularly as we emerge from a low-interest-rate environment. However, the landscape is not without its challenges. While the potential for attractive returns is significant, the market’s rapid growth and evolving nature also bring complexities and risks that investors must navigate. This dynamic environment underscores the need for careful strategy selection in the global private credit arena.

When considering private credit funds, investors should be aware that the underlying assets are not traded in public markets, making illiquidity a concern, especially if sentiment for the asset class weakens and the ‘open / semi liquid’ funds experience high redemptions. Some managers may invest a small portion of the portfolio in liquid credit assets (usually syndicated loans or high-yield bonds) to provide limited liquidity in a normal trading environment (however, this typically amounts to 5-10% of the portfolio).

Payment in Kind (PIK) and its considerations

More recently, lenders have been reported offering payment-in-kind (PIK) provisions to some borrower companies. This arrangement is typically used in high-risk situations where the borrower might have cash flow constraints. PIK provisions help borrowers preserve liquidity during challenging periods while still compensating lenders through accrued interest that compounds over time (i.e. delaying cash payments to the lenders). However, because they increase the total debt obligation, PIK provisions can also increase the borrower’s financial risk. This further illustrates the complex risk landscape and it’s therefore worth understanding how managers are handling loans made to companies experiencing stress as well as their expertise in workout scenarios.

Moreover, it’s common for global private credit funds (contrary to domestic funds), to employ a high level of leverage at the fund level. Whilst the senior secured loans within this asset class provide a degree of capital protection due to their collateral backing, high leverage can amplify risks, especially during economic downturns. It’s important to remember that covenants often apply to the debt borrowed by the fund to enhance returns. If the quality of the loans in the portfolio deteriorates rapidly, the fund may face margin calls. This can escalate quickly and jeopardise the fund and its investors. Investors should therefore carefully evaluate the structure and the use of excessive leverage.

Furthermore, the global products often come with a combination of management fees and incentive fees, which can significantly impact overall returns. This high fee structure can erode the benefits of the high yields and requires careful consideration when evaluating private credit investment opportunities.

Consider the scenario below to understand the impact on fees and investor returns when comparing leveraged and unleveraged direct lending strategies. The key point to note is that if 100% leverage is deployed at the fund level, net profit for investors increases by 29%, while fees paid to the fund manager increase by an astonishing 92.8% due to high performance fees.

| Scenario | Total Fees Collected | Net Profits for Investors |

| With leverage | $3.3 million | $10.7 million |

| Without leverage | $1.7 million | $8.3 million |

| % Increase | 92.8% | 29.0% |

| Key Assumptions | Values |

| Fund Capital | $100 million |

| Leverage Ratio | 1:1 (borrowing an additional $100 million) |

| Total Capital Available | $200 million |

| Investment Returns | 10% annually |

| Interest Rate on Borrowed Funds | 6% annually |

| Management Fee | 1.25% of total capital |

| Performance Fee | 12.5% of profits above a hurdle rate of 5% |

Global Private Credit – Performance over time

Investors in direct lending have been attracted by the perceived stable and attractive returns in recent times, as well as the potential diversification benefits for their investment portfolios. Valuation in direct lending can be less transparent compared to broad syndicated loans and high yield bonds. Direct loans are not marked-to-market daily, potentially delaying recognition of credit deterioration or market changes that could impact valuations. In contrast, syndicated loans benefit from regular review and adjustment processes by multiple lenders, enhancing transparency. High yield bonds, traded publicly, provide immediate market signals reflecting credit risk and potential impairments.

The frequency and method of valuing assets in private credit funds can potentially mask their true value, leading to unexpected impairments that negatively impact investors’ returns. Therefore, it is crucial to conduct thorough analysis of fund managers, understand their valuation processes, and assess their capabilities in handling workout scenarios.

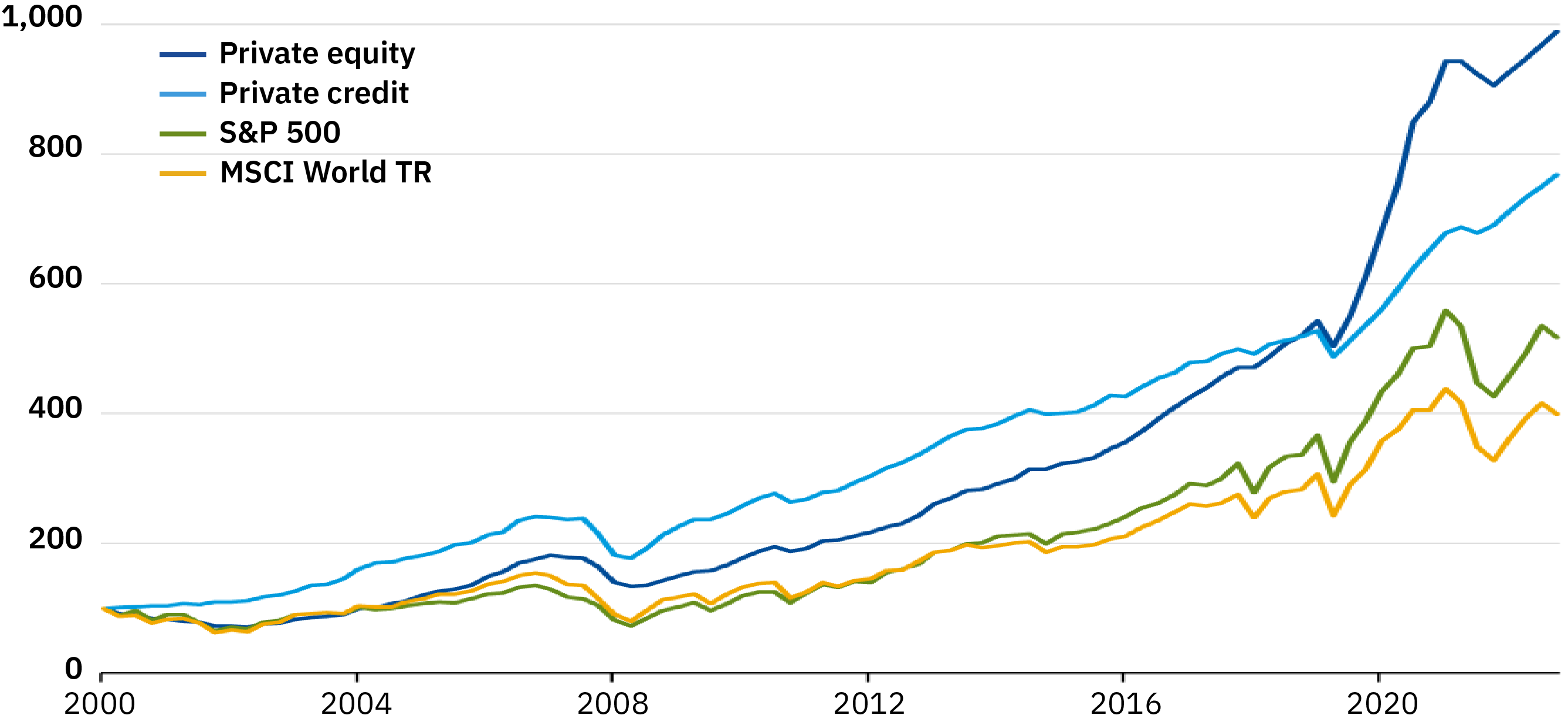

Below you can better understand the performance of private credit compared to private equity and major equity benchmarks over time.

Returns of private equity, private credit, and equity benchmarks (indices, December 2000-100)

Source: Prequin and IMF staff calculations

Note: Private capital indices are rebased to 100 as of Dec 31,2000 and are available until June 2023.

Historical credit losses have varied across private and public markets:

- Direct Lending: Loans to middle-market firms typically experience moderate losses. These loans are generally secured, giving lenders recourse to the companies’ collateral.

- Broad Syndicated Loans: These loans usually have lower to moderate losses. They are also secured and involve larger, more established companies.

- High Yield Bonds: Issued by lower credit quality companies and usually unsecured, high yield bonds historically incur the highest losses due to the higher risk of default.

These differences highlight the trade-offs between risk and return associated with each financing option. While credit losses have historically been relatively mild in private credit, the market landscape has evolved, and investors should anticipate some level of credit losses when investing in this asset class.

Average annual credit losses between 2013 and 2022 (in%)

Source: Cliffwater, Federal Reserve, Fitch Ratings, Prequin and IMF staff calculations. Note: In panel 1, “bank loans” refers to US banks’ commercial and industrial business loans. Average annual credit losses are computed for a 10-year window between 2013 and 2012.

Market news and dynamics

Recent market news has highlighted the complexities and risks inherent in the private debt market. For instance, Vista Equity, a large private equity group, completely wrote-off $3.5 billion in value for a company it owned, Pluralsight. This is despite the company’s 26% revenue growth in 2023. Pluralsight’s inability to service nearly $1.3 billion of debt that was issued when interest rates were lower, led to severe financial distress. This left lenders, including major players like Blue Owl Capital Inc., Ares Management Corp., and Goldman Sachs Asset Management, in a challenging position.

Worryingly, Pluralsight has moved critical intellectual property into a new subsidiary to raise new capital, sidelining the original direct lenders. It’s just one example of how excessive leverage and inadequate protections can undermine investor interests, particularly in large deals involving numerous lenders. It also illustrates the limitations of investor influence over Private Equity sponsor behaviour, where benign economic cycles can mask underlying vulnerabilities until market conditions deteriorate.

The strong growth of the asset class is also influencing the competitive landscape which has shifted economic terms in favour of borrowers. Many large private credit managers aggressively raised capital from investors in 2023, but muted M&A activity has delayed deployments which left many funds behind schedule and creates fierce competition among lenders. These managers are also amending and extending loans aggressively to avoid addressing issues in underlying credits. These trends reflect the adaptive strategies employed by both borrowers and lenders to navigate the current market conditions.

Conclusion

Global private debt presents a promising investment opportunity, characterised by high potential returns and diversification benefits. However, investors must remain vigilant about the associated risks, including illiquidity, credit risk, high fee load, and excessive leverage. Understanding market dynamics and engaging with experienced fund managers can help mitigate these risks. As the private debt market continues to grow and evolve, it offers significant opportunities for informed and strategic investors.