Copper evolution

Pitcher Partners Investment Services (Melbourne) | The information in this article is current as at 14 October 2024

Despite a recent bounce in iron ore prices after a number of stimulatory initiatives announced out of China, the profits from this key earnings contributor for Australia’s two largest miners are expected to be softer going forward. Fortunately for BHP and Rio Tinto (RIO), they remain well positioned versus a number of smaller peers whose volumes are at risk with current prices trading below their marginal cost of production. However, should the Chinese economy remain sluggish, then new supply into the global iron ore market beyond next year from the low-cost Simandou mine in Guinea creates an additional industry headwind, albeit the pace of production ramp up remains subject to delays.

Whilst BHP and RIO are both low-cost iron ore producers so well insulated from a softening underlying commodity price, its likely to be their copper exposure that will be the strong contributor to their earnings growth in the medium term.

Traditionally, copper’s main uses have been tied to construction, transportation and machinery, making demand historically tightly correlated with the global economic cycle. China and its once dominant property sector in particular, has been a large consumer of copper, being a driver of the ‘super cycle’ witnessed at the start of the century. However, many believe the future demand outlook for copper will be increasingly different to that of the past. The growing momentum of the energy transition, electrification and urbanisation will likely become a larger share of the overall demand picture. Outsized demand growth ex China is also anticipated moving forward, thereby offsetting any further weakness in copper demand from that nation’s property sector. That said, it’s expected that a large percentage of demand will likely remain cyclical, but this structural shift could result in reduced demand volatility, especially during times of slower economic growth.

Even though the copper price rose recently to a new high, there has not been a major greenfield project sanctioned in the industry since well before the onset of COVID. Key reasons often cited for this underinvestment has been technical and geopolitical risks in relation to prospective deposits, regulatory environment (including decarbonisation/broad ESG driven initiatives), capex inflation, water challenges, skilled labour shortages and an increased focus by management on maintaining capital discipline.

More recently, a number of central governments have been pro-actively speeding up the regulatory approvals process for “critical” minerals (which includes copper) along with the offer of large financial incentives to help unlock local supply. Meanwhile in China, environmental production cuts are increasingly being prioritised as the government continues to raise the bar in terms of pollution control technology thereby increasing environmental costs for Chinese miners. With most governments remaining deeply indebted and the threat of trade wars escalates, higher royalties/taxes are seen as an additional source of cost pressure that the industry needs to absorb.

While copper and other critical commodity prices are trading at or above incentive levels, new investment spend has remained surprisingly subdued versus historical spend levels which puts sustainable supply growth further at risk. With long lead times from mine discovery to ultimate production, the more financially disciplined miners are increasingly cautious about ramping up capacity for fear of getting caught out by a cyclical fall in demand. M&A activity has been rising, suggesting companies are looking to buy growth or alternatively, de-risk their investment via strategic partnerships.

Copper has many useful properties that translates into demand from a diverse array of industries. Construction and electronics have long been the main driver for its demand, and with a conductivity rating that’s second only to silver, it’s not surprising that copper is also an ideal metal for use in energy storage, electric appliances including EVs (electric vehicles) and the accompanying charging infrastructure.

As part of the energy transition, increased exposure to intermittent renewable power generation with its highly dispersed network configuration will result in a more materials-intensive outcome than fossil fuel generation (coal and gas) that it’s replacing. With global wealth on the rise, an increased uptake of electric appliances in developing countries will further support an increase in the generation capacity of grids going forward. The build out of energy intensive data centres and AI applications are a small but growing new use for copper consumption.

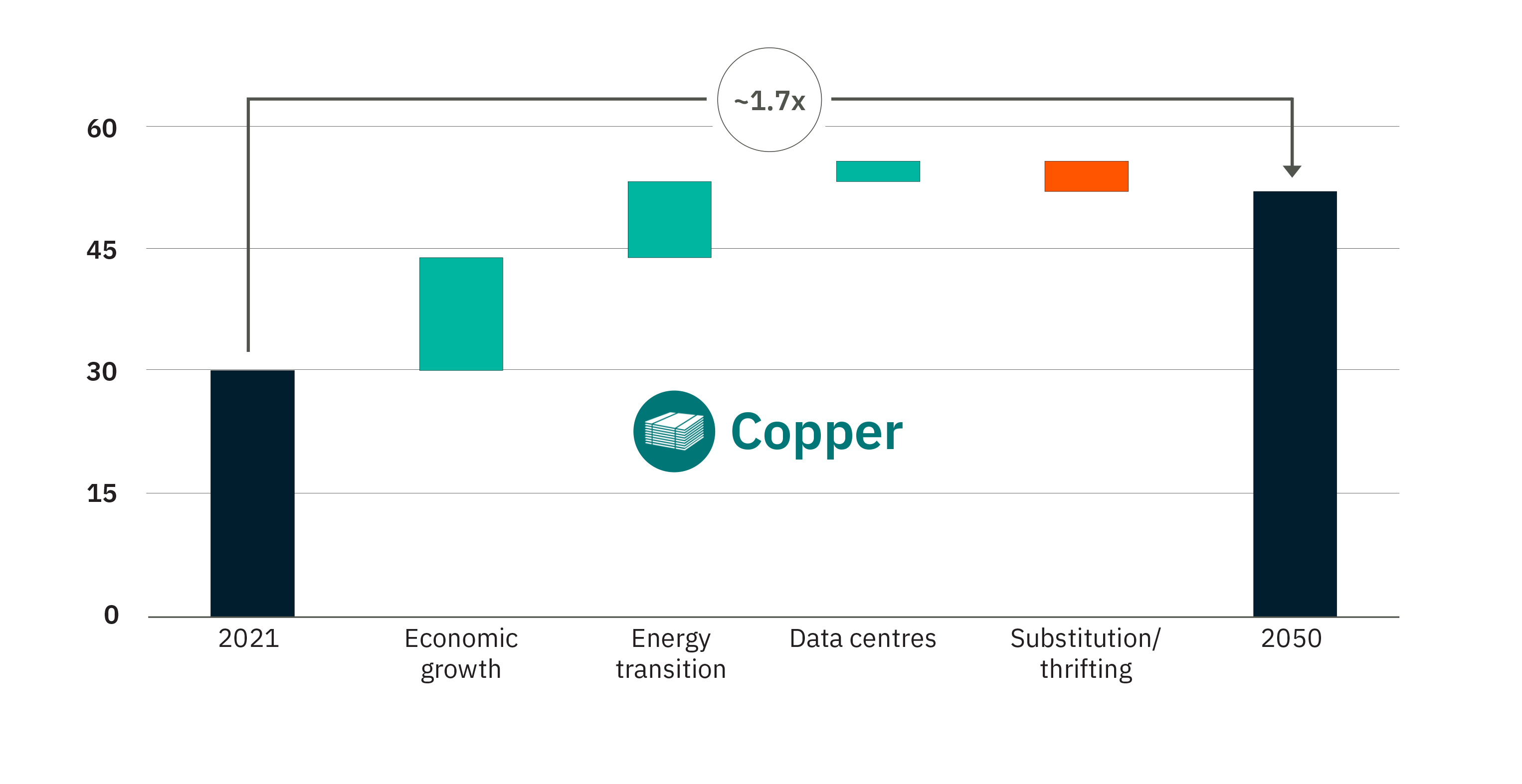

Energy transition is expected to continue to add to traditional demand.

(Copper demand, Mt)

Source: BHP FY24 results presentation, August 2024

Given the above BHP analysis is a long-term forecast, it’s far from certain that this much copper will become available. Not surprisingly, a number of commodity forecasters have been recently raising their long-term copper prices given the challenges outlined above. However, as the BHP chart above indicates, some level of demand will be mitigated through substitution whereby the more expensive material is replaced with cheaper or more accessible materials, often described as ‘demand destruction’. Aluminium has already been used to replace copper in several traditional electrical conductor markets, including electric transmission, distribution, building wire, magnet wire and transformers,

BHP’s recent copper strategy updates

BHP has positioned itself strongly in the copper market with several recently announced expansion plans:

- BHP aims to double its copper production in Australia, particularly focusing on the Olympic Dam, Prominent Hill and Carrapateena mines in South Australia.

Recent takeovers:

- In April 2023, BHP finalised its $9.6bn acquisition of Australian copper-gold producer OZ Minerals.

- BHP and Canadian listed company, Lundin Mining are acquiring Canadian-listed company Filo mining for $4.5bn via a 50/50 joint venture to progress two Argentinian copper projects.

- Highlighting a preference of buying versus building copper production, BHP recently attempted a $75bn takeover of Anglo American in a deal that was structured to gain exposure to its prized copper assets in Latin America.

Rio Tinto recent copper strategy updates

Rio Tinto is also making significant moves to bolster its copper portfolio:

- Expansion of both the open-pit and underground operation of the Kennecott mine in Utah, US resulting in increased copper output.

- Recent takeovers: In December 2022, Rio Tinto completed a US$3.1bn deal to acquire the remaining interest in the listed Turquoise Hill Resources, securing a direct 66% ownership of the Oyu Tolgoi copper mine in Mongolia. Oyu Tolgoi is set to become the world’s fourth-largest copper mine by 2030.

Conclusion

While commodity market volatility will continue given the uncertain global outlook, the underlying drivers of the copper market appears more assured given the structural support of rising urbanisation in developing economies, the energy transition and electrification of our economies. For BHP and RIO in particular, iron ore will continue to be a strong earnings contributor, but it is likely that their more recent strategic moves in boosting their copper production that will be the key contributor to their growth in the future.