Carbon Capture and Storage – a solution supporting the energy transition

Pitcher Partners Investment Services (Melbourne) | The information in this article is current as at 5 April 2023

For a growing number of investors, understanding how a company proposes to manage its carbon neutral strategy is a very important consideration in identifying an investment opportunity.

One of the key solutions for many of the global heavy carbon emitters in achieving a carbon reduction strategy has been the development of the Carbon Capture and Storage (CCS) technology.

What is Carbon Capture and Storage (CCS) and what are its uses?

Carbon Capture and Storage (CCS) technology refers to a process that captures carbon dioxide (CO2) emissions from industrial processes and stores them in a secure and stable location, typically deep underground.

- Capturing carbon dioxide (CO2) at the emission source. CO2 is separated from the other gases that are produced during the industrial process. These fugitive (quick to disperse) emissions contribute approximately 6% of total greenhouse gas emissions globally.

- Compressing it for transportation. The CO2 is then compressed and transported via pipelines, trucks or ships to the storage site. Potential sites can include depleted oil and gas reservoirs or saline aquifers.

- Injecting the CO2 into a rock formation for long-term storage. The carbon dioxide is stored in permeable rock formations that are typically located at least 1km underground. The CO2 is then sealed within the earth with a cap rock to prevent leakage

Figure 1. CSS Process

Source: Global CSS Institute

This unique technological solution is particularly effective in capturing emissions that are produced from stationary energy sources and ‘hard to abate’ processes including cement, steel, fertiliser, and the operations of oil and gas facilities. Critically, with the rapidly evolving energy transition, CCS can help bridge the gap between current energy production methods (oil, gas, and coal) and a future where renewable energy sources dominate. Today, CCS is backed by authorities such as CSIRO, International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (part of the U.N.) as critical in achieving net zero by 2050.

The world’s first CCS project, ‘Sleipner’, importantly provides a global case study for the reliability of CCS technology. The Sleipner gas field along with the complimentary CCS facilities, were originally built after the introduction of the 1991 Norway carbon tax. For over 25 years, the Sleipner CCS project has successfully stored CO2, 250km offshore, in a 1km-deep saltwater aquifer located in the North Sea. Equinor ASA (formerly Statoil and StatoilHydro), a Norwegian state-owned multinational energy company, has proven that CCS works, and that CO2 can be stored safely over long time periods.

Globally, there are currently around 300 commercial CCS projects in development with 30 being fully operational. As the technology has evolved, analysis has shown the most economical and successful CCS projects:

- have a pure CO2 stream from existing infrastructure

- are situated close to the storage location

- use depleted oil or gas reservoirs for storage

Currently, almost two-thirds of planned investments globally are in the United States, Canada and Europe, where governments have fast-tracked CCS with incentives. A good example of this was in the USA. with the recently legislated Inflation Reduction Act (IRA), which aims to slash greenhouse gas emissions by supercharging clean energy industries. Credit Suisse has estimated the ‘transformative’ tax credits in the IRA make many new CCS and low-emission hydrogen projects suddenly profitable and could spur $US160 billion in spending over the next decade.

In Australia – the ‘lucky country’, our unique geology provides industry with multiple basins which are conducive for the storage of CO2 Fortuitously, many of these basins are located within a proximity to high carbon emitting projects, which significantly reduces transport costs and leakage risks.

In the Australian oil & gas industry, the two leading listed players are well advanced in developing their own CCS solutions.

Santos (STO) is committed to reaching net zero Scope 1 and 2 emissions by 2040. A key element of their strategy is the implementation of CCS technology in two key projects:

- Moomba CCS project

STO has a $220 million CCS project in development at Moomba with operations expected to commence in 2024. Here, they plan to store more than 1 million tonnes (mt) of CO2 each year at a life cycle cost of A$25-30 per tonne.

In addition to storing STO own carbon off-take, the company has spoken to the capability of Moomba acting as a CCS ‘hub’, injecting over 20mt p.a. across the Cooper Basin once they start to receive additional flows of CO2 from third parties. Given its central location with existing pipeline infrastructure, this flexibility will likely enhance the returns of this investment.

- Barossa LNG CCS Project

The new LNG gas field at Barossa (off the coast from Darwin) is expected to be carbon intensive and will likely be the highest emitting CO2 LNG project in Australia. Accordingly, finding solutions to reduce carbon intensity from Barossa LNG will be key for STO to reach their 2040 targets.

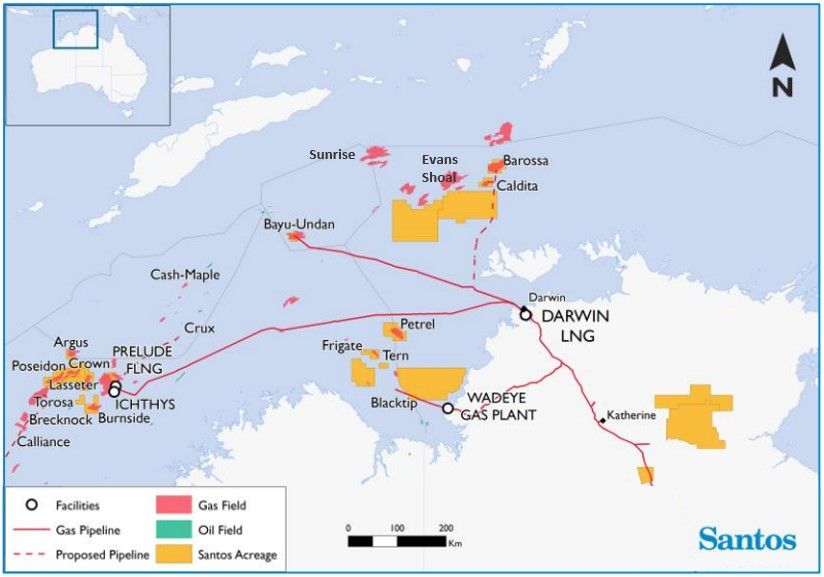

The map below highlights the opportunity for CCS in this gas rich region:

- Barossa gas will be transported to the Darwin LNG plant

- The Darwin LNG plant will strip CO2 out and inject it directly into the soon to be depleted Bayu-Undan gas field.

- Ichthys gas field located west may provide third party tonnes of CO2 to improve the economics of the CCS project and further reduce carbon intensity in the region.

Offshore gas in northern Australia

Source: Santos with annotation by Boiling Cold

For Woodside Energy Group (WDS), their major CCS energy solution based at the Gorgon gas field on Barrow Island off WA is the world’s largest ‘dedicated’ CCS project.

Despite being backed by WDS major partners, namely Chevron, Exxon Mobil, Shell, and the WA Government, Gorgon has consistently missed targets for sequestration and has yet to reach its planned capacity. This disappointing outcome has contributed to the poor reputation of – and lack of confidence in – the CCS technology in Australia.

Investment analysts have identified a number of key issues with the Gorgon project that has undermined its commercial and strategic success:

- A poor choice of reservoir

- Complex design that required large amounts of residual water and sand to be pumped out before CO2 could be injected into the wells

- Excess substances and design complexity resulting in corrosion and clogging of gas pipes

Despite the pitfalls to date, CCS technology currently remains the most realistic solution for those industries that have ‘hard to abate’ carbon emissions. The oil & gas industry continues to be one of the leading players in the evolution of CCS globally that not only contributes to their own net-zero strategies, but importantly provides potential support for the greater energy transition.