What do the new US Beneficial Ownership Reporting rules mean for Australian business owners ?

In response to an increased global focus on corporate transparency and exchange of information, effective 1 January of 2024 US businesses are now required to provide beneficial ownership information (BOI) to the US treasury department, via the Financial Crimes Enforcement Network (FinCEN).

What does this mean for Australian businesses operating in the US?

Where an Australian business owns a US corporation, LLC or similar entity, or is otherwise registered to do business in the US, they must file a form with FinCEN via an electronic portal, reporting data about their beneficial owners. Like many other US informational reporting forms, the filing doesn’t impact US tax liability, but failure to file can result in substantial penalties, starting at $500 per day late, and ranging up to a fine of $10,000 and/or 2 years imprisonment in severe cases of non-disclosure.

Why is this happening?

The release of the Panama Papers in 2016 served to highlight the systematic use of opaque and anonymous corporate entities to facilitate illegalities, including corruption, money laundering and tax avoidance. The flow-on impact of this has been a global movement towards increased disclosure of beneficial ownership, maintenance of ownership registers by authorities, and information sharing across jurisdictions. Since 2016 over 80 countries have adopted legislation requiring corporate entities to register their beneficial owners, including the UK, as well as countries in Europe, Africa, South East Asia and Latin America. Despite government consultation in 2022, notably Australia is absent from the list as yet.

While the US implemented the Foreign Account Tax Compliance Act (FATCA) in 2010 requiring financial firms around the world to disclose information held by US citizens to the Internal Revenue Service, it didn’t return the favour and does not share similar information about what happens in the United States with other countries.

The Tax Justice Network ranks the US third in the world in terms of the secrecy and scale of its offshore financial industry behind only Switzerland and Hong Kong and the United States has been described as ‘effectively the biggest tax haven in the world’[1]. As a result of ongoing global pressure, US congress passed the Corporate Transparency Act in 2021, mandating beneficial ownership reporting from 2024.

What steps do US businesses need to take?

From 2024, each entity must report a range of information in an initial filing with FinCEN including:

- Legal name of the entity and any trading names

- Business address

- State of formation

- IRS taxpayer identification number

The entity must also disclose details about the ‘beneficial owners’ of the entity, including:

- Name

- Birthdate

- Address

- Image of an identification document (eg passport)

A ‘beneficial owner’ includes any individual who, directly or indirectly, owns at least 25% of the entity, or exercises substantial control.

Further, any future changes to beneficial ownership, including some corporate re-structures, will trigger the requirement to file an updated form.

When are the deadlines?

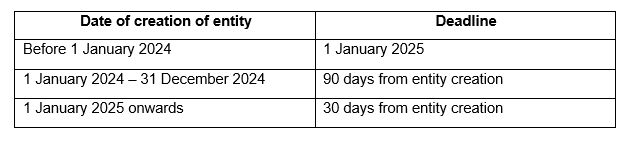

Following a recent extension allowed by the US Securities and Exchange Commission (SEC), the deadlines for filing with FinCEN are as follows:

Key take-aways

- From 1 January 2024 all Australian businesses operating in the US should have an awareness of the rules and take steps to complete initial filings for any existing entities, or entities created during 2024.

- By 1 January 2025 all Australian businesses operating in the US should have adopted a robust process of ensuring filing within 30 days of creation of any new entities or ownership/structural changes, to avoid penalties applying.

This requirement will mean an increased compliance burden for businesses. In particular for owners of US entities who do not currently have to file US tax returns, such as owners of LLCs without US effectively connected income, this will be unexpected. Many will not have ongoing engagement with US advisers and may risk non-compliance due to a lack of awareness of these new rules.

Please get in touch with our Australian-based US tax team at Pitcher Partners for any assistance with compliance with these new obligations.