Victorian State Budget 2023-24: Stamp duty to be abolished on commercial and industrial properties

Stamp duty on commercial and industrial properties to be abolished and replaced with annual property tax.

The new regime and how it will apply

The 2023-24 State Budget saw the Treasurer announce a significant reform to Victoria’s duty regime, with duty on commercial and industrial properties to be replaced over time with an annual property tax.

The finer details of the new regime are unlikely to be known for some months as we understand the Government intends to consult with industry before introducing the relevant legislation into Parliament. However, based on the Government’s media release we understand the change will involve:

- From 1 July 2024, commercial and industrial properties will transition to the new system as they are sold, with annual property tax equal to 1% of the land’s unimproved value to be payable from 10 years after the sale transaction;

- The first purchaser of eligible property after 1 July 2024 will be able to choose whether to pay the final duty liability as an upfront lump sum, or as fixed instalments over 10 years together with an interest charge; and

- Once the property enters the new system after 10 years, no further duty will be payable when the property is sold and the annual property tax will then apply moving forward

The new regime will not apply to the current owner of any commercial or industrial property purchased before 1 July 2024.

What the new regime aims to achieve

The change is being promoted by the Government as a concessional measure which will help business growth in Victoria and boost the state’s economic activities and employment. It is intended to free up much needed capital for businesses and allow them to redirect this capital to expand operations and employ more staff.

We welcome the Government’s encouragement of commercial activities to grow the state’s economy. We believe abolishing stamp duty on commercial and industrial property purchases will boost mobility and help businesses’ cashflow position. However, the new regime also could result in significant holding costs for owners of these properties. For investors who are looking to hold properties long term, these added holding costs over an extended period could offset the benefit of the upfront duty saving.

Below is an example to illustrate the cost and benefit of the proposed new regime, in the context of a longer-term investment.

Example

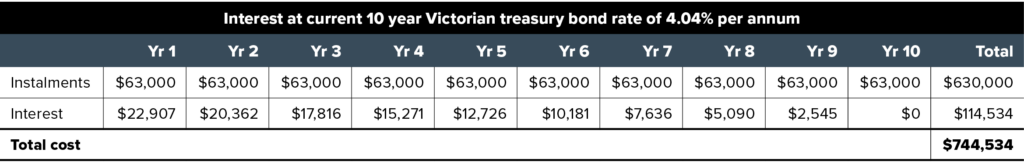

On 1 July 2024 Jim acquires a commercial property for $10m. The duty payable on $10m based on the current rates is $630,000. He elects to pay the duty in instalments over 10 years rather than paying all of it upfront. Over the 10 years, the total duty and interest charges are as follows:

If Jim holds the property for 15 years, under the new regime he will be liable for the additional 1% annual property tax on the property’s unimproved land value in the last five years of his ownership. Assuming the property’s unimproved value (for land tax purposes) is $6m, the additional property tax payable over the five years will be $300,000.

In the above example, under the new regime, the duty (plus accrued interest) and the additional annual property tax will be $1,044,534 in total. Whereas under the current system, only $630,000 of upfront duty is payable.

Accordingly, whilst on the face of it this reform looks promising, it would be prudent to examine the full impact of the new measure taking into account all relevant circumstances, including the intended length of ownership of the property, the amount of duty payable, the amount of annual property tax payable over the relevant length of ownership of the property, the risk of the annual property tax being increased over time (in addition to the risk of the land value increasing each year) and the breakeven point (compared to a scenario where a property acquired prior to 1 July 2024 is only subject to transfer duty).

What does this mean for clients?

Clients who are looking to purchase commercial and industrial properties in the next 12 months should pay close attention to the cost and benefit that the new regime could bring. As the above example illustrates, the new regime may not necessarily be beneficial for certain types of investors or businesses. For clients who are looking to invest in commercial or industrial properties long term, they should consider making that purchase prior to 1 July 2024 to avoid the potential for the additional 1% annual property tax to apply should they hold the property longer than 10 years. For clients who are looking to invest for a shorter term (less than 10 years), the opportunity to defer payment of upfront duty could provide much needed cashflow and capital benefits.

Further issues for consideration

Once the relevant legislation has been introduced into Parliament we should have further clarity on the new regime and how it may impact our clients. However, we have already identified a number of issues for further consideration.

1. The definition of commercial and industrial property

Currently the Duties Act 2000 provides a duty concession for purchases of certain regional commercial and industrial land. Under this concession, only properties that fall within certain code ranges of the Australian Valuation Property Classification Code qualify for the concession. The new regime could adopt a similar approach. However, it will be interesting to see if the government will look at the intention of the purchaser following the purchase of a property as a factor in determining whether the property should be treated as a commercial or industrial property. For example, in relation to a person who acquires commercial property with the intention to rebuild or convert it into residential property, for foreign purchaser additional duty purposes the legislation would treat the property as residential, rather than commercial. Therefore, we query what the position will be with respect to the proposed annual property tax for properties that are currently commercial in nature, but which are intended to be developed as residential property.

Further, we query what the position will be with respect to commercial or industrial property that is brought within the new system and subsequently converts to non-commercial and non-industrial property (for example if it gets converted to residential property) and sold. We presume that the current duty rules will apply and the property will remain outside the new system, but it remains to be seen whether and how the new rules will cater to that situation.

2. Sale of property during the 10 year period following the initial acquisition of property that brings it within the new regime

What happens if a person after making the choice to pay duty in instalments, disposes of that property prior to making all their instalment payment obligations? Do they have to pay all the remaining instalments at the time of disposal of the property? Will there be cessation events that will trigger the remaining instalment payments to be payable all at once, similar to the deferral regime applicable to the new Windfall Gains Tax?

In the above scenario, when will the subsequent purchaser be liable for the 1% annual property tax? Will they be entitled to the remainder of the initial 10-year period from the initial purchaser’s acquisition of the property? Or would the subsequent purchaser be immediately liable for the new tax following the change in ownership?

3. Landholder acquisitions

In circumstances where, rather than making a direct purchase of property, a person instead acquires shares or units in the entity that holds the property that results in a landholder acquisition, it is uncertain whether the new regime will apply at all. Should the new regime be limited to direct acquisitions of commercial or industrial property only, there appears to be an option to stay out of the ambit of the new regime by indirectly acquiring commercial or industrial properties through the acquisition of companies or unit trusts that own such properties.

4. Design and administration features

It is unclear whether the annual property tax will follow the general land tax cycle (with a taxing date of 31 December), or an assessment cycle that is in line with the transaction/acquisition date of the property.

It is also unclear whether the annual property tax will be subject to the tax administration regime under the Taxation Administration Act 1997, including whether an annual property tax assessment is subject to the 60-day statutory deadline, and the imposition of penalty tax and interest on any tax/notification default.

5. Recovery from commercial and industrial property tenants

Whilst the measure aims to provide some cash flow relief to purchasers of/and investors of commercial and industrial properties, the annual property tax liabilities may ultimately find their way to the bottom line of small and medium business owners.

Business insurance duty to be abolished

The Treasurer has also announced in the Budget that business insurance duty will be progressively abolished. Specifically, insurance duty on public and product liability, professional indemnity, employers’ liability, fire and industrial special risks, and marine and aviation insurance will be reduced by 1% per year until it is completely abolished by 2033.

The Government states that this measure is to support the growth of the Victorian economy. While we welcome this announcement and believe that it is long overdue, if the currently proposed timeframe of gradual abolition could be halved to a five year period it would further accelerate the economic benefits that the measure brings.

What are the next steps?

If you believe this will affect you and/or your business reach out to your Pitcher Partners expert to discuss the impact today.