Middle market businesses denied much needed tax relief in State Budget

The State Budget handed down on Tuesday was focussed on reigning in spending by delaying some major infrastructure projects and scrapping some existing government programs.

While this was welcomed to address the overspend, there was little relief or support for the businesses doing to heavy lifting in keeping revenue coming into the state coffers.

The Budget papers revealed an increased deficit of $2.2 billion is now projected for the 2023-24 financial year, and the state’s net debt is expected to blow out to almost $188 billion by the middle of 2028.

While changes to some of these infrastructure projects were obvious, other cuts will mean infrastructure that would be supportive for business is now pushed out for several years.

Contrary to the projected decrease in government spending, revenue from state taxes is set to continue its steady upward trajectory.

Total tax revenue is expected to increase by more than $8 billion over the next 5 years, which represents a 22% increase, and payroll tax and taxes on property such as stamp duty and land tax will continue to do the heavy lifting.

Many middle market businesses are doing it tough at present, due to the combined pressure from inflation, higher interest rates and labour shortages.

Some form of tax relief would have been welcomed by those businesses, to incentivise them to continue investing in Victoria and employing more Victorians.

Revenue from those taxes is projected to increase by 21% and 25% respectively over the forward estimates period, and taxation revenue will continue to make up more than 40% of the government’s total revenue base.

With the current focus at both a state and federal level on cost-of-living relief, there is no ‘cost of doing business’ relief in this year’s budget.

Property developers, in particular, are dealing with a very difficult set of economic circumstances at present and the ever-increasing tax burden they have faced over the past 10 years hasn’t helped them or the government’s plan to build more affordable houses for Victorians to live in.

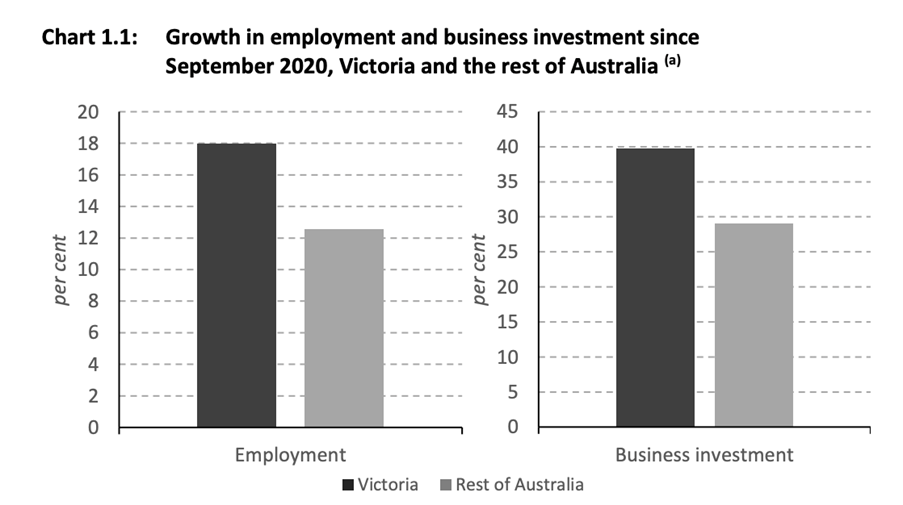

The Government is talking up growth in business investment but the data supporting its position is being taken from the lowest point of the Covid pandemic, which hides that the state is struggling to attract business investment.

Source: Australian Bureau of Statistics Note: (a) Growth in employment is from September 2020 to March 2024; growth in business investment is from the September quarter 2020 to the December quarter 2023 (the latest data).

The Pitcher Partners Business Radar, which tracks the sentiment of business leaders across the country, recently noted that the outlook for growth prospects had faded compared to mid-2023.

In the latest Radar, Government policies were seen as a leading external factor impacting productivity for middle market business, followed by labour market shortages and supply chain dynamics.

Common sentiments among respondents were around the increasing compliance cost and administrative burden associated with red tape and negotiating complex regulations.

There is little in the Budget that recognises these issues and Victoria risks losing even more business investment unless the Government makes Victoria an easier place to do business in.