What if I told you that the first 4 cars sold in each month just covers the on costs of property ownership while the next 57 vehicles cover that month’s rent? Scarily, our analysis indicates that this holds true for the average dealer in Brisbane (and this principle would be materially the same for most capital city dealerships). While these 4 units might not sound significant, the important thing to note here is that it’s additional volume required on top of your normal monthly run rate. Furthermore, once annualised, these 4 units basically sum to become a whole month’s trading. Essentially, we are saying that you need to sell 13 months’ worth of vehicles to cover your rent and outgoings from a new and used vehicles perspective.

In our previous article, we launched our gross per customer transaction after rent property best practice KPI thereby creating a link between dealership operations and a dealer’s property. We would now like to turn our attention to analysing what the holding costs of property ownership are and what is the true return on invested capital (ROIC) for the dealership’s land owner. The ROIC in dealer operations is circa 25% whereas for its property the ROIC is between 5.75-7.5%. Whether the investor chooses to invest their capital into dealership operations versus property really comes down to their risk appetite, tax structuring scenarios and propensity to use leverage that property offers. Bottom line, dealers need to weigh up the opportunity costs in owning dealership properties with the conundrum being which is a better investment, owning more dealership operations and less property or less dealership operations and more property. We at Pitcher Partners like to refer to this as the “growth trade off.” If the property makes you 5.75-7.5% ROIC (maybe even up to 9% once you factor in capital gains), but the dealership’s ROIC is 25%, then the “growth” strategy would be to rent and acquire as many dealerships as possible. Though a higher ROIC comes with a higher risk.

The buying and selling of properties are synonymous with being a car dealer. Even the listed automotive entities aren’t immune to this phenomenon; Eagers Automotive currently own just under $727 million worth of property, Peter Warren Automotive Holdings own just under $247 million in property and Autosports Group Limited own $270 million worth of property.

However, from as far back as the sale of Metro Ford’s Fortitude Valley location to Laing O’Rourke in June 2009 for $21.5 million, Eagers Automotive has demonstrated a propensity to offload their CBD dealership properties to developers and replace them with clusters of dealerships further away from the CBD where property prices made more sense. There are numerous examples of this, including Eagers Automotive’s sale of 80 McLachlan Street to Walker Group Holdings (property developers) for $22.2 million in March 2014 or more recently when a large, private Sydney based group sold their CBD site to a property developer for an undisclosed amount in June 2022 after receiving a rumoured multi-million-dollar land tax bill that essentially made the dealerships unviable. The takeaway is dealers have realised that operating dealerships on these prime locations are no longer the highest and best use of that property and are selling them to developers for significant capital gains.

In the Sydney example, land tax became a determining factor in selling the site. We foresee a continuation of this trend as property in prime locations; proximity to the CBD, proximity to public transport hubs etc. continue to be rezoned residential or mixed use thereby changing the value of the property overnight when calculating land tax. The point being hidden costs associated with land ownership will continue and increase. We are focusing on land tax to showcase this point as it’s important for owner operators to keep a watchful eye over their property portfolio and create a property strategy that moves with the market and the times.

Now, let’s take a deeper dive into the hidden costs of land ownership.

We’ve decided to spotlight land tax as it is a significant cost of property ownership. But one which isn’t typically top of mind as it is levied onto the landlord which is then passed onto the dealership and almost unthinkingly hidden in and amongst rates and taxes. Nevertheless, using the following assumptions (we’ve just taken the average across all the data we collected for the property best practice KPIs), let’s see what the land tax would look like by State.

Assumptions for the land tax calculations are:

- average general lettable area for each dealership is 1,600m2

- rental yield is 5.75%

- annual rent is $960,000

- market valuation of the property $16,695,652

- zoning of the land assumed to be industrial / commercial applicable for a dealership

Below are examples of what the annual land tax would be based on the above assumptions using the most recent regulations in each state:

| State | Land Tax $ (A+B+C**) | Calculation | State Revenue Office Website |

| QLD | $371,630 | A = $187,500

B = ($16,695,652 – $10,000,000) x 2.75% |

Queensland Revenue Office Land Tax |

| NSW | $290,529 | A = $88,036

B = ($16,695,652 – $6,571,000) x 2% |

Revenue NSW Land Tax |

| ACT | $397,300* | Not applicable, however the Lease Variation Charge which has been in place since 1971 may be applicable | Revenue Act Revenue Office |

| VIC | $394,584** | A = $31,650

B = ($16,695,652 – $3,000,000) x 2.65% |

State Revenue Office Victoria Land Tax

|

| SA | $363,094 | A = $28,110

B = (16,695,652 – $2,738,000) x 2.4% |

Revenue SA Land Tax Rates |

| WA | $361,578*** | A = $186,550

B = ($16,695,652 – $11,000,000) x 2.67% C = ($16,695,652 – $300,000) x 0.14% |

Revenue WA Land Tax |

*Commercial properties in ACT do not incur land tax per se. However, the Lease Variation Charge may apply. This charge has been in place in the ACT since 1971 and is levied on any increase in the market value of land arising from an improvement in development rights contained in a Crown lease purpose clause.

**Property in Victoria may also be liable for the Windfall Gains Tax which was implemented back in 2021. Refer Windfall Gains Tax State Revenue Office Victoria. Please consult a legal or tax advisor for more information.

**This is assuming the land is in the Perth Metro area which is subject to land tax and may also be charged with Metropolitan Region Improvement Tax at a rate of 0.14% of the aggregated taxable value of the land in excess of $300,000.

If you add land tax, council rates and other outgoings to your rent paid, the resultant rent (all-in) as a percentage of gross becomes 22.5% (up from 17% before adding in land tax, council rates and other outgoings) for the average dealer and 14% for the best practice dealer (up from 11%).

| Metro | Rent as a percentage of gross | |||

| City | Average | Average | Average | Average |

| Brisbane | 17.0% | 25.0% | 11.0% | 15.5% |

| Sydney | 17.0% | 21.5% | 11.0% | 13.5% |

| Canberra | 16.0% | 17.0% | 10.0% | 10.5% |

| Melbourne | 17.0% | 24.0% | 11.0% | 15.0% |

| Adelaide | 19.0% | 28.0% | 12.0% | 17.5% |

| Perth | 15.0% | 20.0% | 9.0% | 12.0% |

We introduced the notion of gross per transaction after rent in our previous property article. We chose gross per transaction because gross and volume are key drivers of dealership operations. Incorporating both these elements into the one KPI helps to highlight the difference between the average dealer and best practice dealer which is that the best practice dealer consistently gross better and more often. We simply then subtracted rent to create a link between operations and the land upon which it operates. This also brings property, via rent, to the forefront of a dealer’s mind rather than being buried somewhere in overheads. Unsurprisingly, once we subtract land tax, rates and other outgoings from this gross per transaction after rent KPI it leaves even less on the table from which dealers still need to pay staff wages and commissions, floorplan interest and advertising etc.

| Metro | Gross per transaction after rent vs rent all in |

|||||

| City | Average | Average | Average | Average | Average | Average |

| Brisbane | $430 | $390 | $2,940 | $2,655 | $220 | $200 |

| Sydney | $450 | $425 | $3,230 | $3,080 | $215 | $200 |

| Canberra | $475 | $470 | $3,285 | $3,265 | $240 | $235 |

| Melbourne | $430 | $395 | $2,990 | $2,740 | $215 | $200 |

| Adelaide | $410 | $365 | $2,755 | $2,435 | $210 | $190 |

| Perth | $485 | $455 | $3,390 | $3,190 | $240 | $225 |

| Metro | Gross per transaction after rent vs rent all in |

|||||

| City | Average | Average | Average | Average | Average | Average |

| Brisbane | $585 | $550 | $3,670 | $3,470 | $295 | $280 |

| Sydney | $610 | $590 | $3,955 | $3,850 | $295 | $285 |

| Canberra | $635 | $630 | $4,035 | $4,015 | $320 | $315 |

| Melbourne | $570 | $545 | $3,625 | $3,450 | $285 | $270 |

| Adelaide | $550 | $515 | $3,440 | $3,210 | $280 | $265 |

| Perth | $645 | $625 | $4,135 | $3,995 | $320 | $310 |

Let’s use another example to showcase the importance of doing your due diligence prior to launching into a CI upgrade or taking on a new brand.

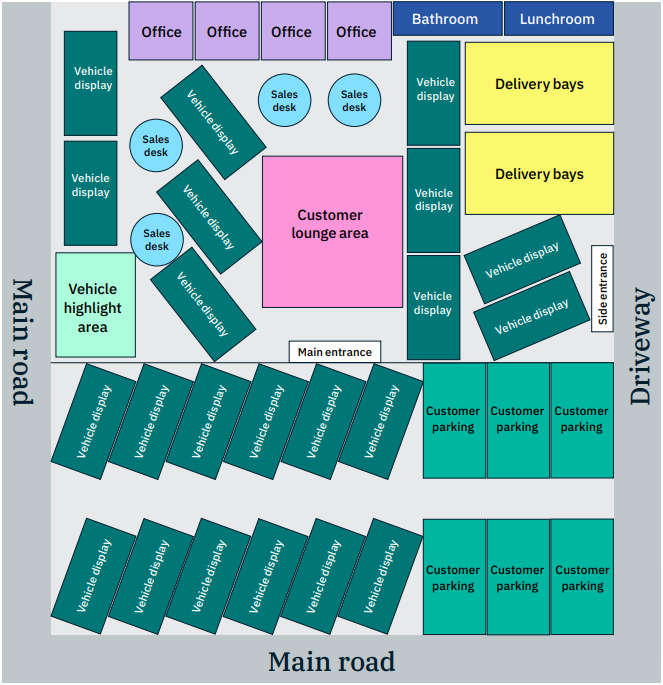

Below is a diagram of a Brisbane metro dealership where there are 23 vehicles on display (11 inside the showroom and 12 on the forecourt)

| Rent only | Rent all in |

|||

| Total number of vehicle displays | 23 | 23 | ||

| Monthly rent per vehicle display | $1,925 | Typical OEM requirement of 5m x 7m per vehicle display x $55/m2 rent only per month | $2,800 | 5m x 7m x $80/m2 rent all in per month |

| Gross per transaction after rent | $2,940 | Per table above | $2,655 | Per table above |

| Rent as percentage of gross for showroom | 21% | Per Property Best Practice KPIs | 28.5% | 21% per previous article + 7.5% increase due to land tax, rates and other outgoings |

| Gross per transaction before rent | $3,720 | $3,720 | ||

| Rent per transaction | $780 | $3,720 – $2,940 | $1,065 | $3,720 – $2,800 |

| Stock turns / vehicle display to cover rent | 2.47 | 2.63 | ||

| Total number of vehicle sales to cover rent | 57 | 61 | ||

| Total gross pool (excl. F&I per month) | $167,580 | $161,955 | ||

The example above shows that the average dealer needs to sell an additional four vehicles per month to pay for land tax, rates and other property outgoings. While an additional four units per month doesn’t seem like a lot, when you multiply it out for the year, it’s close to a whole month’s worth of volume. The outcome is that you need to sell 13 months’ worth of vehicles to cover your rent and outgoings from a new and used vehicles perspective. This further highlights the importance of completing your due diligence prior to agreeing to any CI upgrades (with the rising costs of construction) or taking on a new brand. Assuming that the rent factor used in the above example relates to adding a new brand to your portfolio where you built them a new dealership, you would only take on this brand if:

- you could reasonably expect to sell at least 61 new and used units per month from this brand new dealership and

- the total gross pool of $161,955 per month was sufficient to pay the remaining front end expenses and still

- generate you a profit.

Fundamentally, we want to emphasise that if it doesn’t work on paper, chances are it won’t in practice and you need to go back to the drawing table and ask yourself, is this ultimately the best and highest use for this property. If investing more capital into your dealership operations doesn’t make sense, you may then want to ask yourself is now the right time to sell given that valuations will likely include at least one year of higher COVID profits or do you risk waiting another 3 years before the current lull in the market dissipates and we are once again at the top of the cycle. The question to ask yourself – are property acquisitions and holding costs eating into your profitability.