The rosy outlook for the global economy that was held by many at the turn of the year is beginning to darken. The global economy is now confronting a confluence of issues which have the potential to slow global activity and could spur further inflationary pressures.

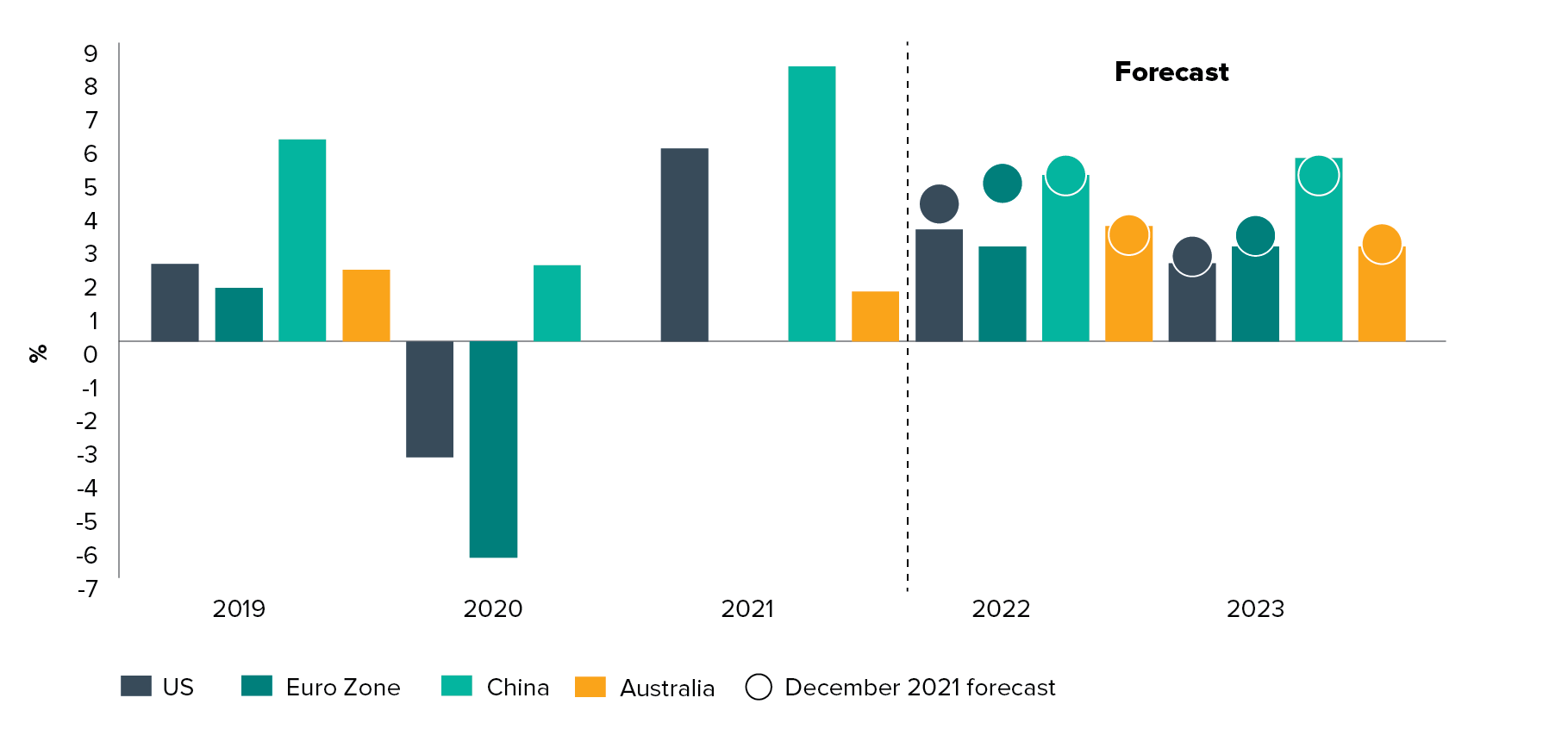

In following on from our note “Russian Invasion Of Ukraine” (8th March 22), the war and its related sanctions and resulting flow on effects is going to lead to a greater dispersion of growth and inflation outcomes among countries and regions going forward. We have already seen consensus 2022 GDP forecasts cut for both the U.S and Eurozone this quarter alone.

Real GDP Growth

Quarter-over-quarter

Source: JP Morgan Asset Management Market Insights March 2022

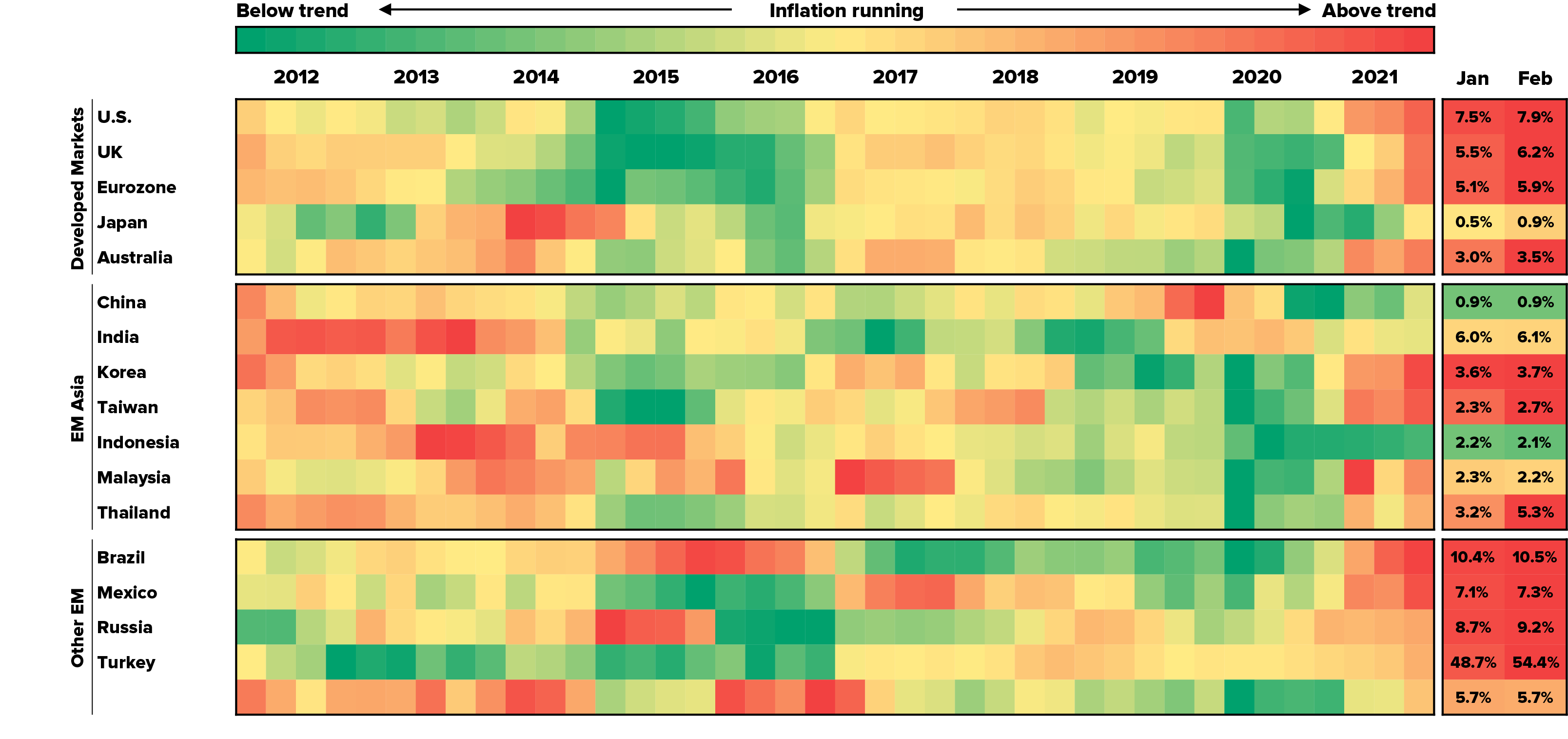

On inflation, surging commodity prices, tight labour markets, pent up consumer & business demand, supply chain disruptions, further exacerbated by China’s COVID zero policy amongst other pressures are resulting in widespread price stresses on a global scale for consumers and businesses alike, as evidenced by the table below:

Headline consumer prices

Year-over-year, quarterly

Source: Bloomberg

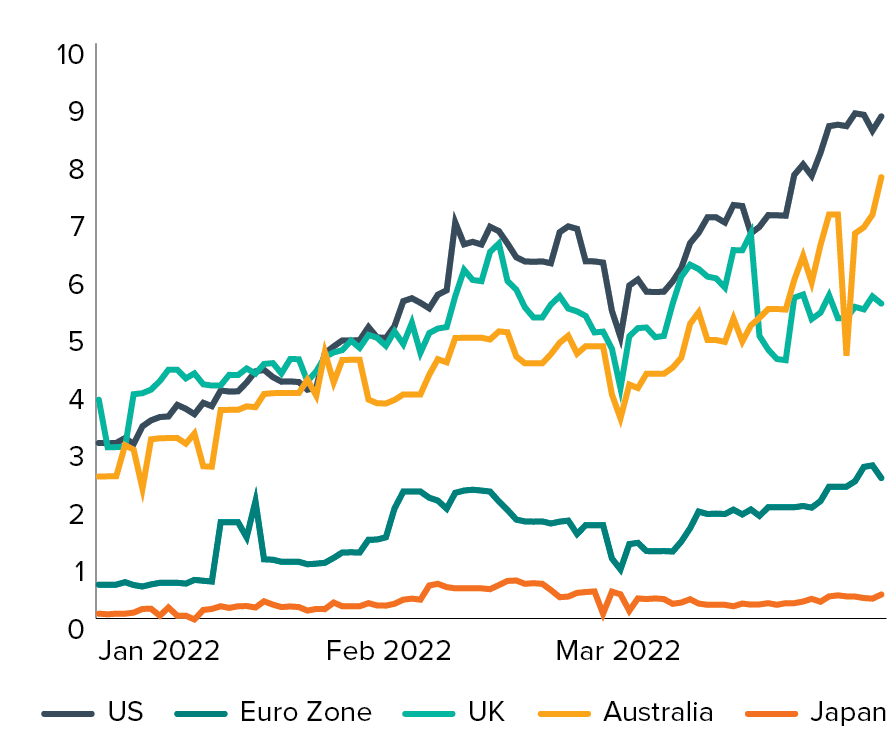

Even as late as Q1 this year, many central banks, led by the Federal Reserve, had been firm of the view that a lot of the inflationary pressures evident in their economies were transitory, however the magnitude of the pressures, in conjunction with the flow on effects from the war in Ukraine, has resulted in a swift policy pivot to try and wrest control of inflation, rather than supporting growth.

As a consequence, we have witnessed considerable volatility with bond markets this quarter. As at the end of March 2022, investors have priced in nearly 9 interest rate hikes in the U.S. Despite pricing pressures being less severe to date in Australia, investors are pricing in a sharp number of hikes between now and the end of the year, including a cash rate of 3.2% by the end of 2023! At the most recent RBA meeting, it provided a few subtle hints it may seek to raise rates in June, no doubt waiting to assess the quarterly data releases on inflation (27th April) and Wages (mid-May) before deciding on appropriate action.

Number of rate hikes implied by market pricing

Predicted number of rate hikes by 31 December 2022

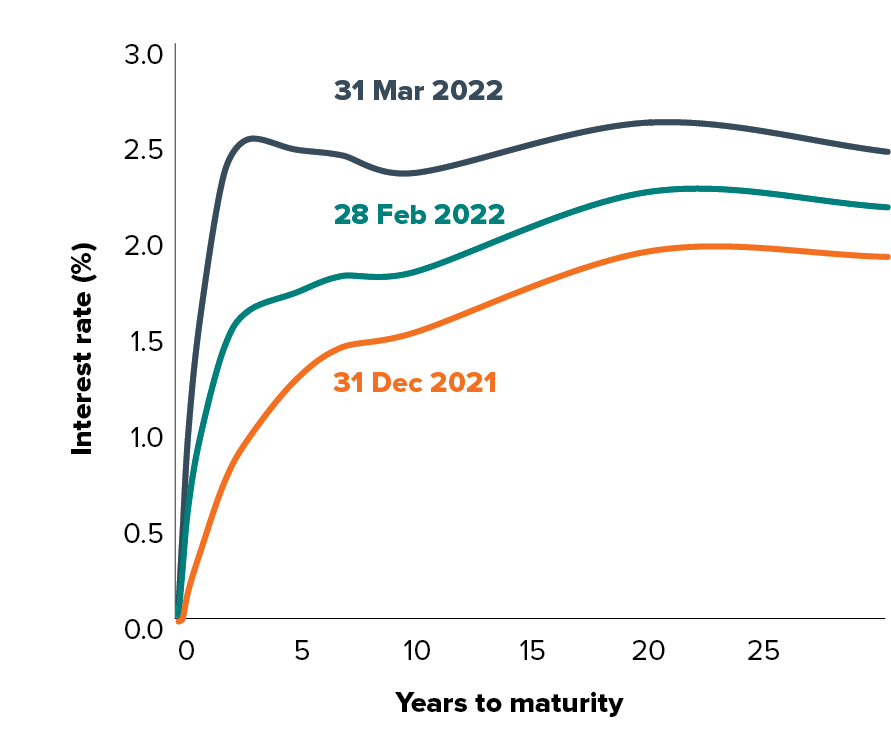

US yield curve over time

Source: JP Morgan Asset Management Market Insights March 2022

When you consider this significant tightening in global financial conditions, the risk of a policy mis-step by central banks has increased substantially – some may argue it has already occurred to date! Certainly Australia is at risk from some form of gravitation pull from the Fed’s policy actions, given implications for currency and funding rates.

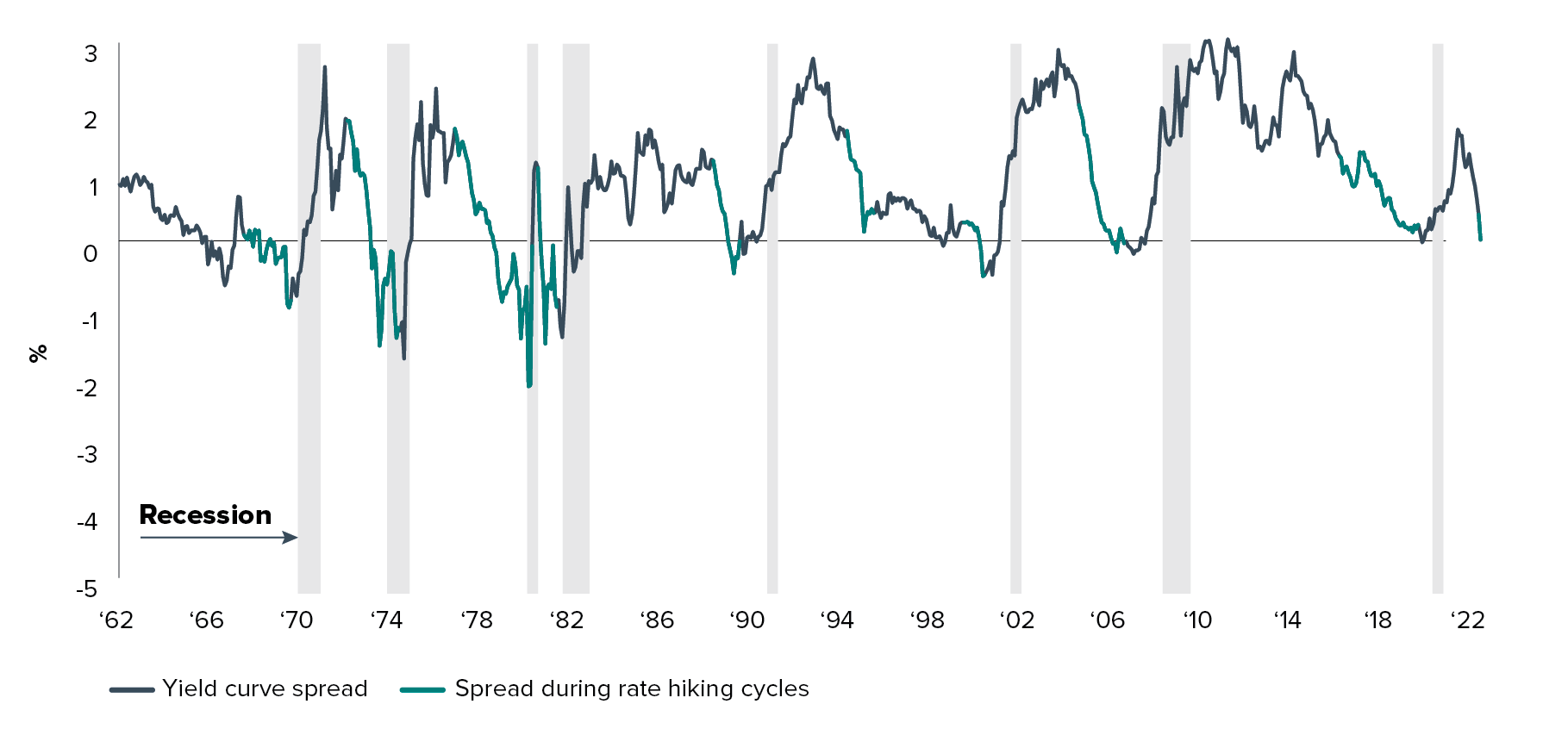

Fears have risen around the risk of ‘stagflation’ in Europe, while in the U.S, the yield curve inverted in early April (10yr bond – 2yr bond yield) , a fairly reliable (but not failproof) indicator of a future recession – although history also indicates time is on your side for now for owners of equities. We note at the time of writing, the yield curve has recently ‘reverted’ to a conventional upward sloping curve given ongoing volatility.

Yield curve spread

10-year less 2-year US Treasury

| Inversion date | Inversion to equity peak | Equity peak to recession | Inversion to recession |

| Jan ’69 | 4 months | 8 months | 12 months |

| Mar ’73 | 0 | 9 | 9 |

| Oct ’78 | 15 | 0 | 15 |

| Oct ’80 | 1 | 8 | 9 |

| Jan ’89 | 19 | 1 | 19 |

| Feb ’00 | 2 | 12 | 14 |

| Jun ’06 | 16 | 3 | 19 |

| Aug ’19 | 6 | 0 | 6 |

| Average | 8 months | 5 months | 13 months |

Source: JP Morgan Asset Management Market Insights March 2022

Whilst risks are building, we don’t believe this is all doom and gloom. Whilst loftier growth expectations may not be fully realised around the world, in many instances we could still see 2022 activity levels above or in-line with trend growth in many economies. Labour markets remain very tight in the U.S and Australia. Indeed Australia’s trade position on a terms of trade basis is close to record highs reflecting the strength of our commodity exports. Consumers are well capitalised in an aggregate sense as well.

With competing forces at bay, we highlight our broader array of views succinctly across different scenarios in the following section.

Market and macro outlook – Scenario analysis

Via this simple scenario table, the central case outlines the core topics / themes which shape our current thinking with respect to the major issues at play for investors. We also outline the downside and upside scenarios around these views.

We have purposefully omitted applying a probability assumption for each scenario in this note, however we assume there is a skew to the downside as things stand today, but there are reasons to still remain optimistic.

| Downside scenario | Central case | Upside scenario | |

| Ukraine | Long lasting war in Ukraine hurts confidence and activity, and pushes commodities and energy price higher for longer, and significantly disrupting supply chains. | The war in Ukraine is hitting confidence and pushes commodities and energy price temporarily higher. | The war in Ukraine ends quickly with limited further disruption of the energy and commodities market. |

| COVID | COVID-19 Omicron resurgence/new strains leads to renewed mobility restrictions and bottlenecks. | COVID-19 becomes an endemic disease, with random contagion waves that gradually become increasing manageable and less disruptive. | Endemic recedes more quickly than anticipated, despite variants/ mutations appearing from time to time. |

| Growth | Clear deceleration of activity while inflation remains elevated and uncontrolled, especially within the U.S and Europe. Recessionary fears build while stagflationary pressures begin to loom large over Europe. China’s zero covid policy results in a big miss on GDP target. | Global activity to remain above trend, but below optimistic forecasts struck at the beginning of the year, with a greater deceleration to be witnessed in 2023. Supply chain and labour bottlenecks will remain in play for much of this year. Consumption to ease as cost of living pressures remain elevated. | 2 x trend growth rates delivered across much of the developed world, buoyed by strong consumer and business confience.

Strong employment markets, extra savings and wage rises fuel consumption with low pressure on corporate margins. Productivity gains thanks to digital and energy transition and structural reforms. |

| Inflation | Surging inflation driven by higher commodity prices, supply chain bottlenecks and rising wages. China’s deflationary pressures reverse as it is forced to import inflation from its trading partners.

A ‘whatever it takes’ attitude to securing access to alternative or new energy sources within Europe spills over to the ROW. Pressures become entrenched and self-fulfilling. |

Persistent inflation pressures throughout 2022 before easing as it rolls off against higher bases in 2023.

Inflation to become an increasingly psychological and political issue for consumers and business. |

Central banks policy settings kick in and see inflation return to being in control, driving a sustained uplift in consumer and business confiddence leading to broad based earnings revisions. |

| Policy impulse | Renewed monetary and fiscal accommodation to arrest slide in growth, flaming further inflationary pressures down the track.

Markets lose confidence in central bank policy pivots/actions, tug of war between fiscal and monetary policy makers. |

Multi-paced but positively correlated monetary policy action from global Central Banks. Fed to move the swiftest and hardest, with a relatively lighter form of QT until the quantum of tightening financial conditions can be calibrated. PBoC on an easing bias but unlikely to push hard unless its 5.5% GDP target is under threat. RBA to begin a more gradual hiking process post confirmation of inflationary pressures at hand – mostly likely late Q2/Q3. Rates to move higher but not at peak levels priced in by markets currently.

Fiscal policy support is slowly withdrawn (outside of Europe) and/or focussed on addressing cost of living pressures. |

Debt burdens are sustainable thanks to strong growth and a gradual shift towards fiscal discipline.

Central banks’ policy normalisation is well received by financial markets, with minimal impact from a gradual tighenting in financial conditions. Higher but stable and manageable interest rates, due to stronger investment and depletion of excess savings. |

Key risks

We also share a breakdown of the various risks that help shape our thinking above. The aim is not to be alarmist here – there are always an array of risks or challenges facing investors at any point in an economic or market cycle.

However reflecting the broad range of challenges at this point in time, we simply wish to keep you informed as to the range of our thoughts and views. In addition, we note that the risks are clustered in different groups, however there are clear linkages between the different sections. COVID-19 risks have been listed in the economic section, however in reality we acknowledge the impacts are comprehensive.

| Geo-political | Economic | Financial |

War in Ukraine:

|

Global recession driven by an oil and gas shock and a deteriorating sentiment as the war in Ukraine stalls, or worse escalates via the threat or actual usage of tactical nuclear weapons. | Sovereign debt crisis:

|

| EU political fragmentation and populist vote bring a disagreement on how to manage the relationship with Russia. | Economic crisis in Eastern Europe following a collapse of the Russian economy, elevated energy prices, uncontrolled inflation and a migrant crisis. | Corporate solvency risk increases, despite strong fundamentals as uncertainty rises and corporate margins are under pressure (high input cost, double orders lead to profit warnings). |

| The US takes a hard line with China in order to block any tentative to invade Taiwan. Risk of accidental confrontations in the South China Sea or the Taiwan Strait. | Pandemic 3.0:

|

USD instability and gradual loss of its reserve currency status lead to unstable currency markets. |

EM political instability driven by:

|

Supply chain disruptions carry on (China new lockdowns), and input cost pressures lead to corporate earnings recession. | A surge in the rise of commodity and shipping costs causes pressure in short term funding markets. |

| Cyber-attack or data compromise, disrupting IT systems in security, energy and health services. | China property market collapses, leading to lower growth prospects and flow on effects to Australia and ROW. | |

| China retaliates to Australian Government criticism of its position surrounding Russia’s invasion of Ukraine, blocking or restricting a number of our key exports to the country. | Monetary policy mistake:

|

|

| Minority Government formed at the upcoming Federal election, hindering an ability to implement meaningful policy initiatives. |

Positioning

We continue to reinforce the message of balanced yet active portfolio construction against this medley of competing factors in markets.

There are still a variety of ways to help insulate your portfolio against inflation – commodities or commodity linked equities, infrastructure & direct property with CPI linked cashflows, quality equities with high free cash flow yields.

We are getting closer to the point where we may consider adding duration back into portfolios, but we are not there quite yet given the velocity of inflation is not fully known yet. For credit investors, we are conscious that tighter financial conditions may prompt some further spread widening in any higher beta / lower quality sectors later in the year, however any senior floating rate date that is providing adequate carry either in public or private markets is the place to be for the near term.

We would also caution against over concentration into specific themes / investments given the probability that macro uncertainty will drive episodic bouts of volatility over the year ahead, likely rotating from one theme and back to another, until a clear form of market leadership is established again. Excess cash balances will provide opportunities for nimble investors to take advantage of any price dislocations, however fleeting they may appear at the time. We expect further uncomfortable periods of performance ahead, interspersed with rallies / recoveries in particular markets.