Pitcher Partners Wealth Management (Brisbane) | The information in this article is current as at 7 July 2022.

The June quarter witnessed a significant re-pricing of financial assets, as persistently high inflation pushed investors to price in further interest rate rises and an increased risk of recession in the U.S.

Investors are currently facing a very sensitive and pretty much unprecedented array of issues at this point in time. Whilst businesses and consumers in aggregate are doing ok this year, the outlook is less certain and confidence is beginning to dip. Inflation is at multi-decade highs which is driving a significant tightening in financial conditions through steep interest rate rises and quantitative tightening. Growth is showing signs of deceleration, there is war, there are issues over global energy and food security amongst other pressures. It is this backdrop which has led to the elevated volatility we have seen over the past few months.

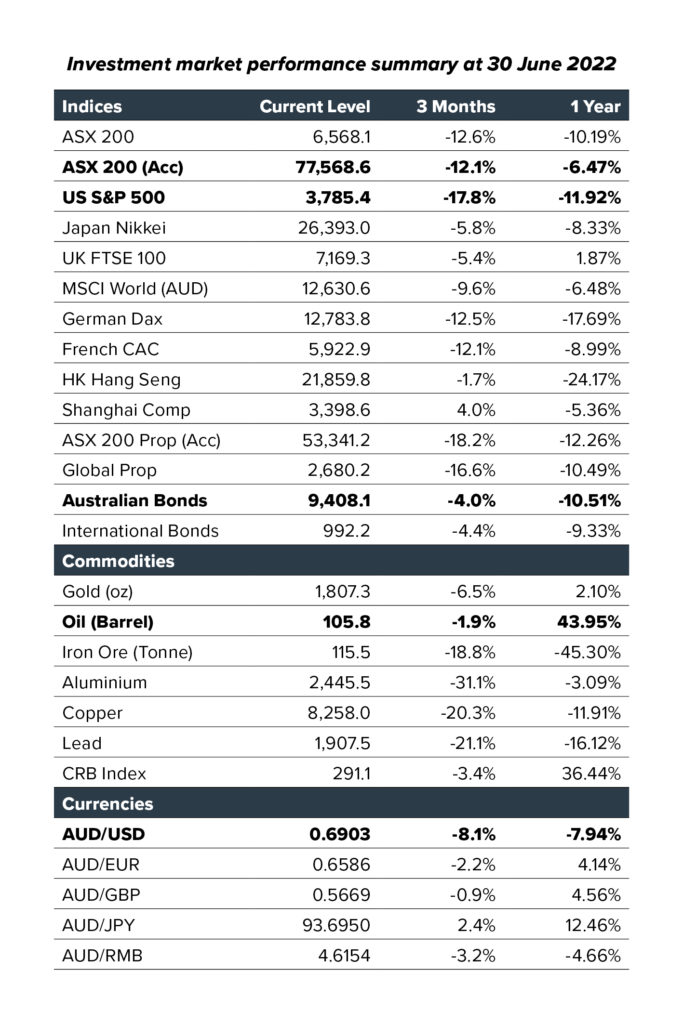

Broad based declines were evident across many equity and bond markets, with the S&P 500 entering official bear market territory (>20% decline) before rallying modestly before quarter end.

Australian equities outperformed the U.S on a relative sense but still posted a 12% decline in absolute terms, as small caps underperformed large caps while the technology, banks and resources sectors all underperformed. Energy and utility stocks provided the only main sources of absolute returns.

At a global level, Chinese equities were the standout performer as the country emerged gradually from its Zero-COVID induced restrictions and modest stimulus measures aimed to kickstart its economy. European equities bore the brunt of rising ‘stagflationary’ concerns across the region. Sector performance trends were similar to that witnessed in Australia, with Value investors outperforming Growth for the period. Unhedged investors were buffered against some of the broader sharemarket declines thanks to the -8% decline in the AUD against the USD, but the MSCI World $A Index still fell close to 10%.

Fixed income markets capped off their worst financial year return for close to 30 years with our local and international bond indices declining 10.5% and 9.3% respectively. Surging inflation forced the hands of both the Federal Reserve and the RBA to commence their rate hiking cycle during the quarter, however markets continue to price in a far more aggressive series of rate hikes than what the central banks are forecasting currently. This caused both our bond benchmarks to decline ~4% over the quarter alone. Floating rate credit investors were far better off for the period, however widening credit spreads made it tough to generate positive returns over the quarter.

Listed property markets underperformed their broader equity markets as fears over the impact of rising interest rates on asset values saw A-REITs decline 18.2% and G-REITs fall 16.6%.

Within commodity markets, the inflation trade fueled rally in Q1, began to reverse somewhat over the June quarter as fears over slowing growth saw price declines across precious and industrial metals. Energy prices remained elevated due to the ongoing Russian invasion of Ukraine.

In our articles for the quarter, we discuss the current growth, rates and inflation outlook in more detail. We also share a transcript of a call we held on the Energy sector with Adrian Prendergast, Head of Energy & Resources at Morgan’s Stockbroking. Lastly, we also discuss the rise in the number of thematic Exchange Traded Funds now available in Australia, highlighting the potential opportunities and pitfalls in using these types of securities.