In response to the cost-of-living crisis, next financial year (FY2024-25), all 13.6 million Australian individual taxpayers will receive a tax cut under Treasury Laws Amendment (Cost of Living Tax Cuts) Bill 2024.

Workers employed under the pay as you go (PAYG) payroll scheme will see an increase in their take-home pay (after withholding tax) from 1 July 2024 as part of their normal pay cycle. In this article, we outline the changes to the personal income tax rates and a strategy you could utilise to maximise the wealth effect from the tax savings.

Tabled below is a comparison between the current personal income tax brackets and the legislated changes effective from the start of next financial year, 1 July.

| FY2023-24 rate (%) | FY 2023-24 taxable income ($) | FY2024-25 rate (%) | FY 2024-25 taxable income ($) |

| Tax free | 0 – 18,200 | Tax free | 0 – 18,200 |

| 19 | 18,201 – 45,000 | 16 | 18,201 – 45,000 |

| 32.5 | 45,001 – 120,000 | 30 | 45,001 – 135,000 |

| 37 | 120,001 – 180,000 | 37 | 135,001 – 190,000 |

| 45 | Greater than 180,000 | 45 | Greater than 190,000 |

*Please note the above excludes Medicare levy, Medicare levy surcharge and low-income tax offset (LITO).

Source: Treasury Laws Amendment (Cost of Living Tax Cuts) Bill 2024, pages 1-8, Subsection 2, Clause 1. Date: January 2024. https://parlinfo.aph.gov.au/parlInfo/download/legislation/bills/r7140_first-reps/toc_pdf/24010b01.pdf;fileType=application%2Fpdf

The legislated changes are:

- For a taxable income between $18,200 and $45,000, the top marginal tax rate reduces from 19% to 16%

- The top marginal tax rate for the low to middle income tax bracket of $45,001 to $135,000 reduces from 32.5% to 30%

- The threshold for when the 37% top marginal tax rate applies increases from $120,000 to $135,000

- The threshold for the top marginal tax rate of 45% increases to $190,000 from $180,000

Tax saving at various taxable incomes (salary excluding super)

Below is a table of the annual tax savings compared to the current financial year across various Taxable Income levels. Taxable income is gross salary after deductions and excluding employer paid superannuation payments:

| Taxable Income ($) | Tax payable FY24 ($) | Tax payable in FY25 ($) | Tax saving per annum ($) |

| 40,000 | 4,942 | 4,288 | 654 |

| 50,000 | 7,716 | 6,788 | 929 |

| 60,000 | 11,166 | 9,988 | 1,179 |

| 70,000 | 14,616 | 13,188 | 1,429 |

| 80,000 | 18,066 | 16,388 | 1,679 |

| 90,000 | 21,516 | 19,588 | 1,929 |

| 100,000 | 24,966 | 22,788 | 2,179 |

| 110,000 | 28,416 | 25,988 | 2,429 |

| 120,000 | 31,866 | 29,188 | 2,679 |

| 130,000 | 35,766 | 32,388 | 3,379 |

| 140,000 | 39,666 | 35,937 | 3,729 |

| 160,000 | 47,466 | 43,737 | 3,729 |

| 190,000+ | 59,966 | 55,437 | 4,528 |

The above is an estimate only based on publicly available information supplied by the Australian Treasury department; you can source this calculator here: https://treasury.gov.au/tax-cuts/calculator. For the basis of our calculation, we have excluded the impact of the Low-Income Tax Offset as this remains unchanged.

Making additional contributions to super

For many households these tax cuts will curb the impacts of higher mortgage repayments, groceries, energy, and everyday essentials. However, for households with surplus cashflow, directing the additional tax savings into superannuation from 1 July 2024 onwards will have a neutral impact on their cashflow position relative to the previous financial year, while boosting their retirement savings for the future.

For most Australians, superannuation is the preferred tax structure for growing a retirement nest egg. An individual can make a personal deductible contribution into superannuation, claiming a tax deduction against their individual assessable income, while saving for retirement more quickly. Tabled below is an estimate of the amount an individual can contribute into super next financial year before reducing their take-home pay relative to the previous year.

| Taxable Income ($) | Amount to contribute to super without reducing take home pay ($) | ||

| per annum | per month | per week | |

| 40,000 | 800 | 67 | 15 |

| 50,000 | 1,400 | 117 | 27 |

| 60,000 | 1,700 | 142 | 33 |

| 70,000 | 2,100 | 175 | 40 |

| 80,000 | 2,500 | 208 | 48 |

| 90,000 | 2,800 | 233 | 54 |

| 100,000 | 3,200 | 267 | 62 |

| 110,000 | 3,600 | 300 | 69 |

| 120,000 | 3,900 | 325 | 75 |

| 130,000 | 5,000 | 417 | 96 |

| 140,000 | 6,000 | 500 | 115 |

| 160,000 | 6,100 | 508 | 117 |

| 190,000+ | 7,400 | 617 | 142 |

Note, the annual concessional contribution annual limit is currently $27,500, inclusive of employer and personal pre-tax contributions. The above strategy should only be considered from 1 July 2024 onwards. If you are earning $190k or over, as in the current financial year your employer may already be contributing $20,900 or more, limiting further concessional contributions to a maximum of $6,600. The proposed amounts above become relevant from 1 July, as the annual concessional contribution cap is being raised to $30,000.

Concessional contributions are subject to a 15% tax on entry into super and there is also an additional tax 15% (Division 293) applied for individuals who earn a gross salary plus employer made super contributions of more $250,000 a year. The Division 293 ruling is determined after the member lodges their individual tax return and can be paid for using cash inside of super or personal cash at bank. Despite these conditions, super remains a tax effective way for Australians to save for retirement, as explained in the scenario below.

Hypothetical scenario

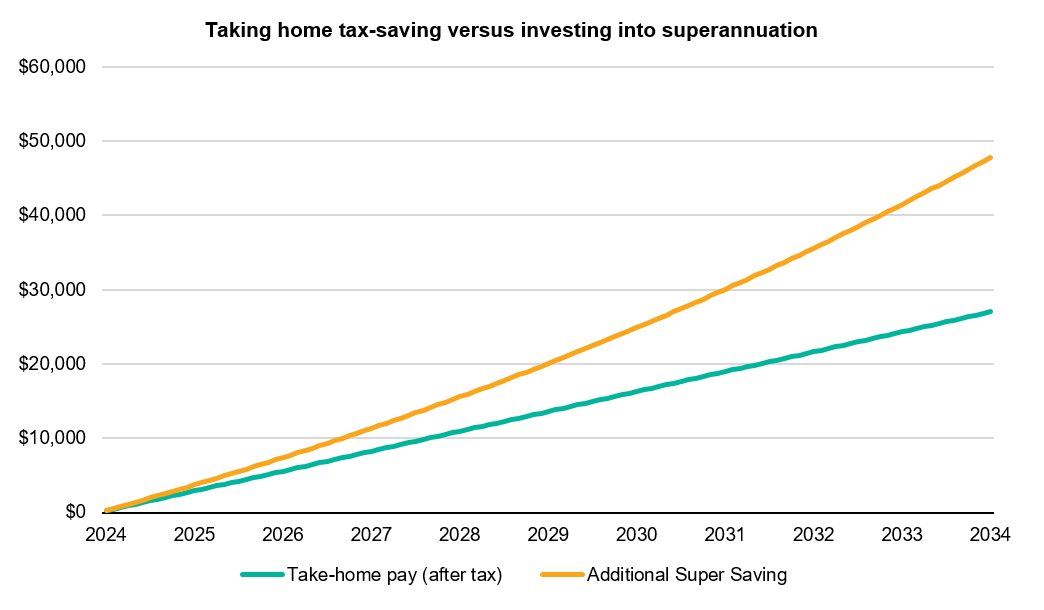

In FY2023-24, Stuart receives an annual salary package of $120,000 plus super and is paid $7,345 per month after PAYG withholding tax. Assuming no change in his circumstances, Stuart’s net pay will increase from 1 July 2024 to $7,568 (an extra $223 each month after tax). Rather than receive the extra amount each month, Stuart establishes a salary sacrifice arrangement with his employer of $325 per month out of his pre-tax pay, subject to his annual concessional contribution cap space. Over the entire year, Stuart will direct an extra $3,900 into his superannuation fund (in addition to the mandatory employer paid contributions of $13,800) but will continue to earn $7,345 per month after-tax (same as the previous financial year). If Stuart maintains this salary sacrifice arrangement for the next 10 years and his super fund averages a 7% net return per annum, he will have an extra $47,815 in his superannuation by the end of the period as illustrated in the chart below. Note, our calculation takes into consideration the 15% contribution tax payable, explained above. Stuart doesn’t incur the additional Division 293 tax as his gross salary inclusive of employer super contributions of $133,800 is less than $250,000.

Source: PPWN modelling

The alternative scenario where Stuart receives the extra $223 per month in his after-tax income would see him earn $26,760 in cumulative personal income over a 10-year period. This difference is widened when you consider the impact over a 20-year period, $143,906 in extra super benefits under the salary sacrificed arrangement vs $53,520 in extra income earned over the entire 20 years. Note, our analysis has taken into consideration the 15% concessional contribution tax payable.

Other changes

Next financial year will also see the employer contributions increase to 11.5% of an individual’s gross salary, up from 11% in the current financial year. Furthermore, the annual concessional contribution limit will increase to $30,000, currently $27,500, all personal and employer concessional contributions are included in the annual cap. These changes mean concessional contributions are more attractive for high income earners as a form of reducing taxable income and improving longer-term superannuation outcomes as more can be directed into super on a regular basis. In the scenario discussed above, Stuart would have likely had an even larger benefit as a result of wage growth over time and the ability to contribute even more into the tax-advantaged vehicle of superannuation thanks to this higher cap.

This article is general in nature only. Before making super contributions you should consider the appropriateness given your personal financial circumstances. Please consult your adviser should you wish to discuss further.