Pitcher Partners specialist Pharmacy Division has been helping pharmacists create strategic partnerships for over 35 years. When it comes to pharmacy partnerships, we have seen ‘the good’ where both partners win, ‘the bad’, where only one partner wins, and ‘the ugly’, where neither partner wins.

We understand that often the starting point of a new partnership is for an existing sole proprietor to join with a purchasing partner to commence a long-term succession plan. Usually, the owner wants to maximise their initial sale value while the buyer wants to minimise their initial purchase price. Straight away, the two potential partners have competing motives that without any strategic planning will likely create a winner and a loser. This however need not be the case.

Following are three different scenarios which illustrate how aligning both partners’ interests with the growth in value of the business by strategically planning the sale process should maximise total value for both partners and deliver the prized “win / win” position. While the below scenarios may appear relatively straight-forward, the overlay of personalities and expectations can complicate negotiations. Accordingly, a well-articulated plan that is communicated to both parties and their advisors early in the process is likely to ensure a good opportunity is not lost through loss of focus on the key issues. If so, then a “win / win” position for both parties is likely.

Our scenario comparisons of value realisation are based on the underlying assumptions listed at the end of the article:

Scenario 1 – Owner sells 100% of the pharmacy on the open market and invests proceeds

Assuming the capital gain on sale is reduced to $nil due to the application of the Small Business CGT Concessions, the Selling Partner invests the $3m proceeds into a market portfolio. Annual living costs are deducted from the investment earnings and the balance is reinvested. We have assumed a flat 25% tax rate on all earnings, however, the average tax rate on the investment earnings could be less depending on how much is contributed into superannuation.

The otherwise potential purchasing partner would likely miss the opportunity to purchase the pharmacy as they are assumed unable to obtain at least the 20% deposit ($600k) required to satisfy an 80% loan to business value ratio (LVR) to fund the acquisition.

Scenario 2 – Owner initially sells 30% of the pharmacy to the purchasing partner at a 20% discount to market value and then balance in year 7 at market value

The sale proceeds are invested similar to Scenario 1 and both the investment earnings and pharmacy earnings, net of living costs, are reinvested into the market portfolio. The remaining 70% is sold to the purchasing partner in year 7 and the proceeds invested.

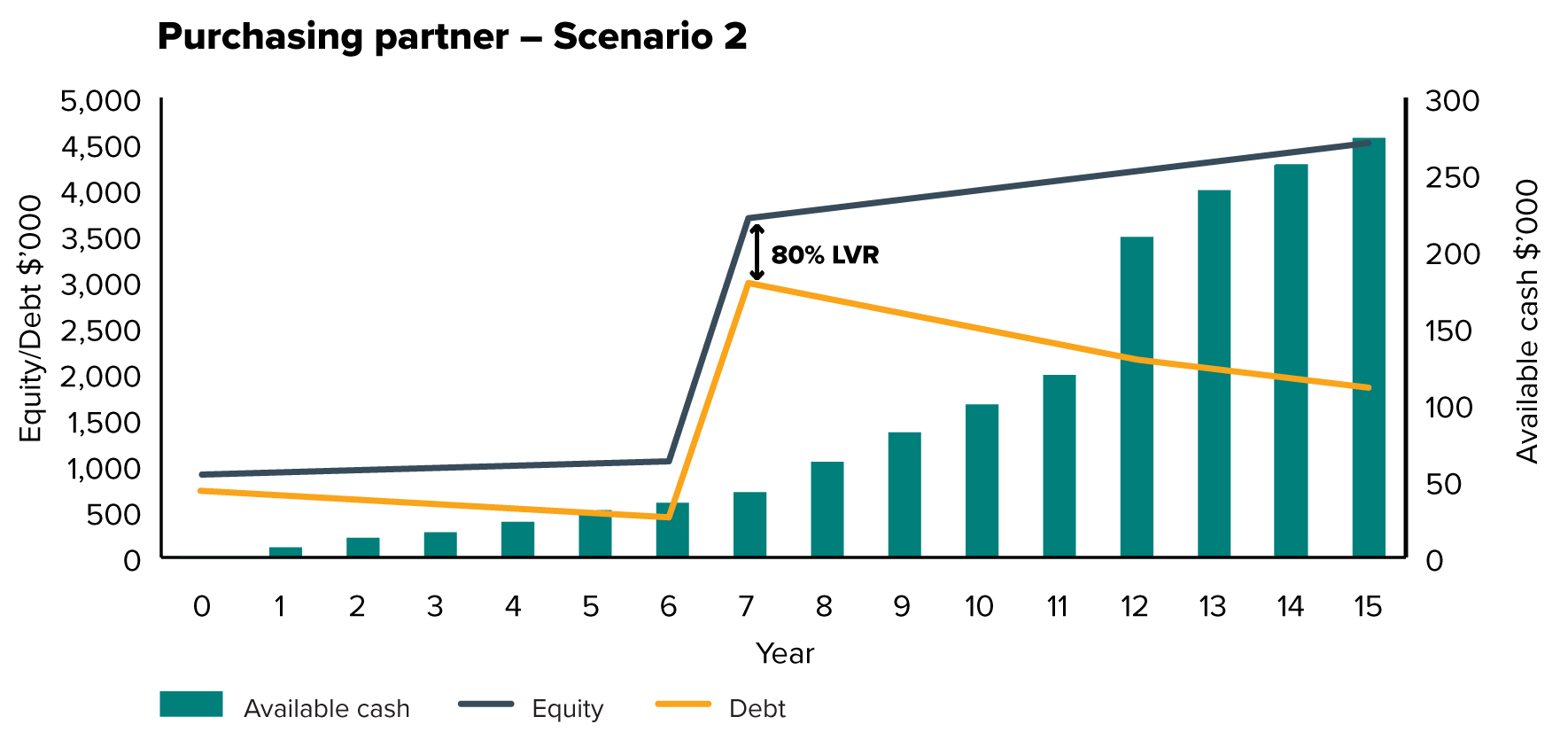

Purchasing Partner – doesn’t require the 20% deposit on the initial purchase due to the pharmacy asset offered securing the purchasing partner’s pharmacy debt (as well as any debt held by the selling partner). The annual debt repayments on the initial borrowings are equal to the share of the pharmacy earnings net of tax in the first year. The annual growth in net earnings above the first year is taken as drawings. By Year 7, the purchasing partner has amassed sufficient equity to purchase the remaining 70% of the pharmacy at an 80% LVR. The annual debt repayments on the second loan are equal to the net earnings generated in the first year of the 70% interest. The annual growth in net earnings from the 70% interest is also taken as available cash.

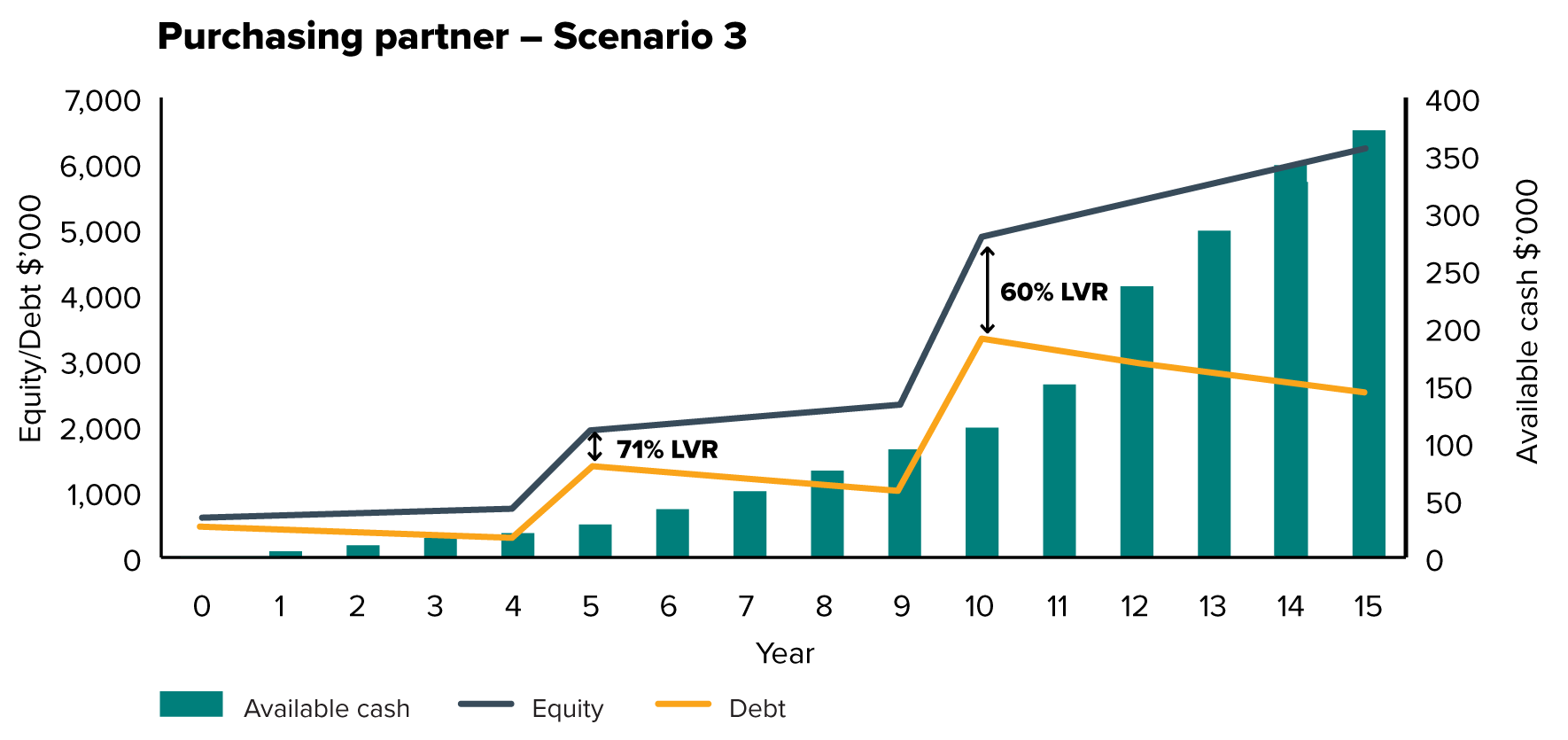

Scenario 3 – Owner initially sells 20% of the pharmacy to the purchasing partner at a 20% discount to the market value then 30% in year 5 and balance in year 10

Selling Partner – same other assumptions as Scenario 2 except:

- sale price in year 5 is capped at a 15% uplift from the initial value

- remaining 50% is sold at market value in year 10

- pharmacy earnings will rise at 5% p.a.

Purchasing Partner – same methodology as Scenario 2 in terms of borrowings, debt repayment and available cash. The main difference in this scenario is that capping the second purchase price at a 15% uplift incentivises the purchasing partner to increase the market value as much as possible and hence the assumption that pharmacy earnings will rise at 5% p.a.

The Outcomes:

Selling partner

The graph below illustrates the estimated investment portfolio value of each scenario over the 15-year period from the initial sale.

The benefits and trade-offs to the Selling Partner under each scenario are as follows:

|

Selling Partner |

||

|---|---|---|

|

Scenario |

Benefits |

Trade-offs |

|

Scenario 1 |

|

|

|

Scenario 2 |

|

|

|

Scenario 3 |

|

|

Purchasing Partner

The graphs below illustrate the Purchasing Partner’s debt, net equity and available cash position over the same 15-year period under Scenarios 2 & 3. Note that Scenario 1 has not been considered from the Purchasing Partner as the straight 100% purchase is unaffordable without significant capital support to commence.

The benefits and trade-offs to the Purchasing Partner under scenarios 2 & 3 are as follows:

|

Purchasing Partner |

||

|---|---|---|

|

Scenario |

Benefits |

Trade-offs |

|

Scenario 2 |

|

|

|

Scenario 3 |

|

|

All three scenarios have their benefits and trade-offs, and they are different for both partners. Scenario 3 produces the best financial outcome for both partners over the succession term of the pharmacy ownership. The implied growth in pharmacy earnings means the business value increases from $3m in year 1 to circa $5m in year 10.The main drivers to the outcome produced under Scenario 3 are the discounts and incentives offered by the Selling Partner, especially the 15% uplift cap in value for the 30% equity purchase in year 5.The Purchasing Partner knows from the outset that they’ll be rewarded for their extra efforts in growing the business rather than the growth merely resulting in a relative increase in the future purchase prices. The other benefit of Scenario 3 is the 10-year succession period which is important when the pharmacy is entrenched in the community, especially when in a regional location. It’s a good outcome for the Selling Partner, the Purchasing Partner and the community. A win / win / win!

As always, please contact your Pitcher Partners advisor should you wish to discuss any of the above or how a Win / Win Strategic Plan can be structured for your business.

Assumptions

- Pharmacy initially has EBITDA of $500k, an enterprise value of $3m (being 6 x EBITDA) and no debt

- The Selling Partner invests his sale proceeds into an investment portfolio which delivers 7% gross earnings and grows at 2.5% p.a.

- Selling Partner’s living costs of $100k p.a. and indexed 2% annually

- Pharmacy EBITDA increases 3% p.a. under Scenario 2 and 5% p.a. under Scenario 3 due to a different incentive arrangement for the Purchasing Partner

- 25% tax rate on all earnings (pharmacy and investment)

- Purchasing Partner’s interest rate on borrowings is 5.5%

- Purchasing Partner works full-time in the pharmacy and draws a market salary