Recent statistics and discourse demonstrate there is growing appetite for dealmaking across acquisitions, sales and mergers to better position organisations for the future.

While at the start of the COVID-19 pandemic businesses were focused on ‘survival’ tactics, today they are turning their minds to how they can best position themselves for the future through strategic growth and acquisitions.

Funding is expected to come from private equity, corporate cash, capital raisings or other forms of borrowing. The question many are asking is “how can I better position myself and my business for the future, so that when the market opens up again I can be opportunity ready?”

There is no straightforward answer here. Every industry, and every business, will have been impacted differently, and presented with different opportunities. For some, now might be a good time to sell, because there are still plenty of buyers prepared to pay a good price. Whereas, for others, they may be better off waiting until market conditions are more favourable, or they take this time to shore up their businesses so they can better capitalise on dealmaking strategies – whether through a sale, acquisition or merger.

Pitcher Partners has received an increased amount of client enquiries lately to discuss search mandates. These clients have put aside capital at the beginning of the pandemic, which they have weathered better than expected, and are now looking at how they can put that additional capital to good use through acquisitions and mergers.

But it’s not just corporate cash that is being looked at to fund dealmaking activity. Whether Australia is set for a U, V or W-shaped economic recovery from COVID-19, a great deal of capital has been invested in publicly listed companies through capital raisings since February. In fact, according to S&P Capital IQ, the figure stands at $24.3bn between February and May, with a total of 200 ASX listed companies tapping the markets for additional liquidity.

The most prevalent sectors by volume of capital raises throughout the period have been Resources (82), Healthcare (28) and I.T (23), as companies have persuaded investors to part with their cash for a variety of reasons, ranging from emergency cash to continue operating, through to capitalising on a favourable environment for pursuing strategic initiatives such as M&A or entering new markets.

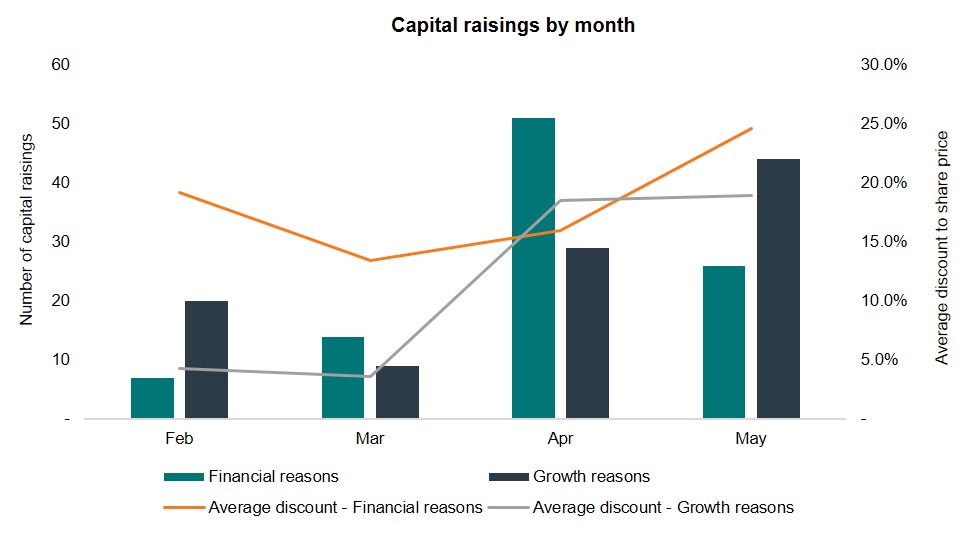

Broadly categorising the capital raises based on the primary objectives communicated to the market, of the 200 capital raisings completed, 98 were for financial strengthening purposes, while surprisingly, 102 were for pursuing initiatives linked to a growth agenda. Yet below these high-level statistics there is an interesting narrative, one that speaks to the optimism returning in the corporate world.

As the chart above shows, when a nationwide lockdown was implemented and companies were scrambling for survival in April, a total of 80 capital raisings were completed, with 64% of those being for financial reasons. However, just a month later, a sharp reversal of reasoning took place, with 63% of capital raisings being completed by companies wanting to capitalise on favourable conditions and pursue growth initiatives.

This trend is also evident when analysing the average share price discount companies have raised capital at over the past four months. Investors were initially more susceptible to part with their cash at lower discounts for financial strengthening purposes through March and April, with discounts averaging 14% and 16% respectively. In May, there was a marked turnaround, where average discounts for financial reasons jumped to 25%, showing a clear negative shift in investor sentiment towards this rationale for raising capital.

Given the recent over-estimation of support required for the economy by the Australian Government, and a quicker than expected transition out of hibernation for some industries, a number of companies may find themselves asking if the amount of capital they’ve raised is truly necessary.

The future of M&A in Australia

As we transition from the pandemic world (or appear to for now) what does this mean for the M&A environment in Australia?

While Australia appears to be making progress in its economic recovery, volatility in both international and domestic markets is unlikely to abate any time soon. Corporates that have raised funds on the back of strategic initiatives need to deploy their capital to realise the returns shareholders expect.

Corporates that have raised funds on the back of shoring up their balance sheets (in industries that are making a quicker-than-expected recovery), may now find they have surplus funds, which they can deploy to generate higher profits.

While there may have been a few spot fires in portfolio companies, there is still plenty of dry powder to deploy in the world of private equity.

What does this mean for business owners?

With large sums of capital in the system looking for a return, strong demand for high quality assets means businesses that outperform the market will continue to attract a premium.

However, if there are elements of risk, be that in financial performance, capability, supply chain or growth prospects, pricing that was commonplace in 2019 is unlikely to be achieved in the near future.

Business owners that find themselves questioning if there is an element to their operation that they would like to improve can look to buy-side M&A or merge to create value and push themselves into the premium pricing bracket.

For more information or to discuss opportunities, contact a Pitcher Partners representative.