ATO releases long awaited new guidelines for professional firms but uncertainty remains for many

Four years after suspending their guidelines relating to the allocation of profits of professional firms, the Australian Taxation Office (“ATO”) released PCG 2021/4 (“Guidelines”) setting out its revised compliance approach.

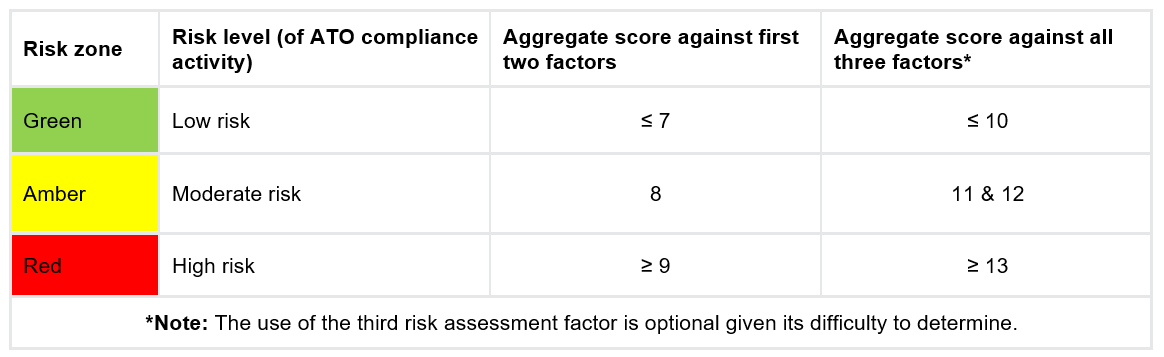

The Guidelines provide for a “traffic light style” risk assessment framework containing three risk factors that allow certain professionals to self-assess their risk of ATO compliance activity but does not otherwise provide a safe harbour from the ATO applying Part IVA to such arrangements. While the Guidelines take effect from 1 July 2022, the PCG provides for a two-year transitional period for those with pre-existing arrangements that were considered to be low risk under the suspended guidelines.

What are the guidelines about?

The Guidelines (click here) set out the risk of ATO audit or review activity in relation to the allocation of professional firm profits. The Guidelines target arrangements that are perceived to be a form of income splitting by Individual Professional Practitioners (“IPP”) whose entitlement to a share of the profits of their firm is seen as comprising both income from personal exertion as well as income generated from a business structure and its assets.

The Guidelines do not provide a legal basis upon which such arrangements are not permitted under the tax law. Indeed, no specific provisions are directed at such arrangements. However, the ATO maintains that the general anti-avoidance rule in Part IVA of the Income Tax Assessment Act 1936 may apply to cancel any tax benefit obtained under these arrangements and notes that it is seeking to run a suitable test case to obtain further judicial guidance.

Whether Part IVA applies will ultimately depend on the particular facts and circumstances of any arrangement. As such, the Guidelines merely outline how the ATO will allocate their compliance resources in considering arrangements relating to professional firms. The more income returned in the hands of the IPP and the more tax paid on that income the less likely the IPP is to come under ATO scrutiny. However, the Guidelines do not provide a safe harbour and ultimately cannot bind the ATO even where an arrangement is considered low risk.

Who do the guidelines apply to?

The Guidelines apply to the owners (i.e., the IPPs) of certain professional firms that provide services in recognised professions such as accounting, architecture, engineering, financial services, medicine and management consulting. Despite its application at the level of the IPP, firms themselves need to consider how their structure may affect their owners’ risk ratings. Some firms may adopt a policy requiring all of their owners or equity holders to obtain a low-risk rating so as to reduce the risk of ATO compliance activity for all.

The Guidelines do not operate where the firm generates personal services income (PSI).

The above list of professions is not exhaustive, and the Guidelines are stated to have application to other vocations considered to be “professions” based on a set of indicators. This may leave certain taxpayers unsure whether they are even covered by the Guidelines.

Importantly, while the Guidelines are ostensibly about “professional firms”, they apply at the level of the business owner or IPP rather than at the level of the firm and can apply to those that provide services to the firm only (rather than to clients of the firm). For example, this may mean that a managing partner who effectively acts as a CEO of a professional firm will be subject to the Guidelines even if they are not personally a member of a recognised profession.

When do the guidelines apply from?

The Guidelines are stated to apply from 1 July 2022. This represents a 12-month deferral from the original 1 July 2021 start date envisaged in the Draft Guidelines. Effectively, IPPs may need to consider the Guidelines in respect of their profit allocation for the year ended 30 June 2023, subject to the transitional arrangements (discussed below).

What are the transitional arrangements?

The transitional arrangements allow certain IPPs to continue to rely on the “Suspended Guidelines”, being the previous iteration of the Guidelines that were withdrawn in December 2017.

Where certain pre-conditions were satisfied, the Suspended Guidelines provided for three alternative benchmarks under which IPPs could be considered as low risk, with only one needing to be satisfied:

Benchmark 1: Appropriate remuneration – Assessable income personally returned by the IPP represented an appropriate return for the services provided to the firm.

Benchmark 2: 50% entitlement – Assessable income personally returned by the IPP was at least 50% of the total that the IPP and their associate entitles were entitled to for the year.

Benchmark 3: 30% effective tax rate – Both the IPP (as a standalone entity) and the IPP and its associated entities (collectively) paid tax of at least 30% in respect of the share of income from the firm to which they were entitled for the year.

The Guidelines confirm that IPPs with pre-existing arrangements may continue to rely on the Suspended Guidelines for the year ending 30 June 2022 provided the arrangements comply with the two “Gateways” introduced by the new Guidelines (discussed below).

Further a two-year transition period applies to those with pre-existing arrangements allowing for the Suspended Guidelines to be relied upon until 30 June 2024.

This may assist those IPPs who entered into arrangements (e.g., became a partner) after the Suspended Guidelines were withdrawn. However, it is not clear whether a “pre-existing” arrangement is tested at the 16 December 2021 date of publication of the Guidelines or the 1 July 2022 date of effect.

What are the gateways?

The “traffic light style” risk assessment framework is available where the IPP’s arrangement passes Gateways 1 and 2. If they do not pass the Gateways (or there is some uncertainty), the IPP is encouraged to contact the ATO’s Professional Firms team directly to discuss their circumstances.

Gateway 1 – commercial rationale

This Gateway requires the arrangement to be “commercially driven”. That is, there must be a genuine commercial basis for the arrangement and resulting distribution of profits that reflects the needs of the business and its profitability. The Guidelines recommend, as best practice, that the IPP evidence this by recording the commercial rationale for arrangements and distribution of profits.

The Guidelines provide a list of indicators that suggest when a sound commercial rationale might not exist that relate to both the structure of the professional firm as well as the distribution of the IPPs share of the firm’s profits between the IPP and their related entities.

Gateway 2 – high-risk features

This Gateway requires that the IPP’s arrangements not contain any high-risk features such as those covered by Taxpayer Alerts or any of the following (non-exhaustive) examples:

- Entities related to the IPP financing their acquisition of a portion of the IPP’s equity interest

- Deliberate creation of differences between taxable income and accounting profit to create a tax advantage

- Everett assignments being entered into by those that are not true equity holders (i.e., salaried or fixed draw partners)

- Firms operating through a company or unit trust providing special classes of shares or units to those that are not true equity holders or their associated entities

These Gateways may leave many IPPs in a position of uncertainty given Gateway 1 is somewhat subjective, and Gateway 2 does not specify all features that would be considered high-risk.

What is the risk assessment framework?

Satisfying both Gateways means the IPP is then eligible to self-assess their risk rating against three risk assessment factors. Performance against each factor is assigned a score according to the following table:

| Risk assessment factor: | Score | |||||

| 1 | 2 | 3 | 4 | 5 | 6 | |

| (1) Proportion of profit entitlement from the whole of firm group returned in the hands of the IPP | >90% | >75% to ≤90% | >60% to ≤75% | ≥50% to ≤60% | >25% to <50% | ≤25% |

| (2) Total effective tax rate for income received from the firm by the IPP and associated entities | >40% | >35% to ≤40% | ≥30% to ≤35% | >25% to <30% | >20% to ≤25% | ≤20% |

| (3) Remuneration returned in the hands of the IPP as a percentage of the commercial benchmark for the services provided to the firm | >200% | >150% to ≤200% | >100% to ≤150% | >90% to ≤100% | >70% to ≤90% | ≤70% |

The overall score will determine which risk zone – Green (low risk), Amber (moderate risk) or Red (high risk) – the IPP’s arrangement falls into as follows:

How are the risk assessment factors measured?

The first risk assessment factor – amount assessed to the IPP personally – is perhaps the most basic as it merely considers the percentage of the profit allocated to the IPP and its related entities that is assessed in the IPP’s hands.

The second factor – the average tax rate on firm related income less associated deductions – is somewhat more complex as it provides for two alternative calculation methods. The total tax paid may be calculated on the basis that either the firm-related income of the IPP and its associated entities were their only amounts of taxable income or alternatively the firm-related net income was the top slice of taxable income of those entities (in which case, if a taxpayer is already on a 45% marginal tax rate, the share of firm profits is taken to be taxed at 45%). The Guidelines explain that the effective tax rate does not factor in levies and tax offsets.

The third factor – appropriate remuneration for the IPP personally – requires a benchmark to be established based on comparable employees in the firm who perform commensurate duties as the IPP. In practice, this may be difficult to establish as the IPP will generally have duties and responsibilities (inherent with being a business owner) that are not otherwise performed by employees of the firm.

The Guidelines explain that firm-related income (relevant to all three factors) includes profit distributions, salaries, superannuation and fringe benefits and also factors in other taxes paid such as superannuation contributions tax and fringe benefits tax.

The Guidelines also explain that firm-related income includes distributions from service entities and any other businesses that make up the overall professional firm.

What issues may arise in applying the risk assessment framework?

The Guidelines contain 12 case studies demonstrating how the risk assessment framework applies. These include examples involving firms operating through partnerships, companies and unit trusts. However, these examples are often overly simplistic and leave doubt as to how to apply the risk assessment framework to many common arrangements.

Various complicating factors involving incorporated practices, use of corporate beneficiaries, tax-to-book differences and the effect of trust losses being applied against firm-related income are not adequately addressed in the Guidelines and case studies therein.

The Guidelines note, at paragraph 74, that there may be a number of “extraordinary factors”, such as access to accelerated tax depreciation and other tax concessions, timing differences and retention of income at the firm level, which will affect the risk rating that is achieved. Where such factors exist, IPPs are encouraged to engage with the ATO. This is yet another example of the Guidelines not providing clear and practical guidance to enable IPPs to self-assess their arrangement with certainty as such factors are not necessarily rare or extraordinary.

What are the next steps?

Clients, both individual professionals and professional firms, should contact their Pitcher Partners representative to consider their arrangements and how the Guidelines affect them. With a 1 July 2022 start date and availability of a two-year transitional arrangement to some, clients should start reviewing their structures and considering if any changes are required including whether engagement with the ATO is necessary.

Risk assessment toolkit

Following the publication of the ATO’s Practical Compliance Guidelines PCG 2021/4, Pitcher Partners professional firms risk assessment toolkit is now available. Explore the toolkit here, and if you have any questions please reach out to your Pitcher Partners tax expert.