The information in this article is current as at 1 April 2022.

Part 1: Overview

Russia-Ukraine War

On 24 February, Russia invaded Ukraine. This followed weeks of military exercises along their mutual borders and heightened rhetoric from the Putin regime, which is still couching the invasion as a “special military operation” in communications to Russian citizens. The Russian invasion has slowed with Ukraine’s resistance (supported by Western armaments), as well as poor logistical planning that stifled expectations of a swift Russian victory.

The conflict has major geopolitical implications. Unlike the Russian takeover of Crimea, the response from Western powers has been significantly more forceful in isolating Russia from the rest of the world. This prompted a series of Western firms exiting the country with the International Monetary Fund (IMF) now predicting a deep recession in Russia this year1.

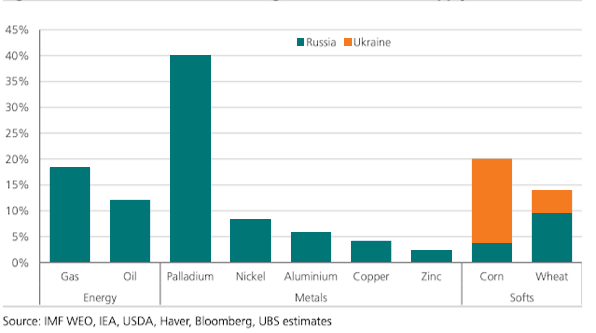

Economically, it has also served to limit Russian and Ukrainian exports. As the graphic below highlights, the two countries account for a major share of global commodities supply2. Russia, in particular, functions as a major energy producer, while Ukraine is a major contributor not only to global wheat and corn production, but also neon. The country reportedly accounts for between 45% and 54% of global neon production3, with this gas being a critical component in making semiconductors. Mariupol is one of the major sites for its production and, given the scale of damage from Russian bombardment, it is unlikely to restore operations for some time.

Russia and Ukraine share of global commodity supply

In terms of how the conflict will play out, there are several potential paths:

Russia-Ukraine war scenarios

| Option | Likelihood | Rationale |

| Russian victory | Unlikely |

|

| Stalemate | Unlikely | We also believe a stalemate, similar to what was seen post-2014 annexation of Crimea, is less likely given the cost of increased sanctions on the Russian economy (more severe than the reaction under the then Obama Administration). |

| Negotiated Peace Deal | Base case | While Russia retains conventional military superiority, an inability to close out the conflict, coupled with the costs of sanctions, suggests that they will be brought to the negotiating table eventually. The exact timing, however, is highly uncertain. |

Implications

Inflationary pressures are likely to persist until our base case scenario of an eventual negotiated resolution occurs. It does not however mean sanctions will be removed straight away. That would need agreement by Western parties, such as the US and EU, which could take some time.

Energy prices are one major area impacting consumers. In Australia, for example, unleaded petrol prices are up over 27% in 2022 alone with the national average unleaded price rising from $1.482/L to $1.888/L as of 28 March4. Other commodities such as food will be significantly affected. Russia is a major producer of global fertilisers (accounting for almost 10% of nitrogen and phosphate fertiliser production5), while Ukraine is a major producer of corn and wheat. Removing this supply will have a negative impact on global food production, which will put upward pressure on inflation. Even if the conflict ends tomorrow and sanctions are lifted, it will take time for production to recover.

In summary, the conflict will support higher inflation in 2022 even if our base case prevails.

Inflation

The concern with inflation now is twofold:

- A growing risk of more central bank hikes to interest rates to tame inflation, leading to reduced economic growth by making borrowing more expensive, and

- Higher inflation reducing overall consumer spending as more spending needs to be put towards essentials such as mortgages (due to higher rates) or petrol (due to higher fuel prices), leaving less capacity to spend on other goods and services.

The scale of the shock raises concerns of stagflation, a period of falling (or negative) economic growth coupled with rising inflation. The last such major episode of this occurred in the 1970s as shown below in the following graph. We can see that the US experience in the 1970s was severe, with the combination of high inflation and high unemployment (a sign of weak growth) at drastic levels compared to today. The major difference lies in both inflation and unemployment. Inflation rates are not as high as the worst of the 70s, but they are rising and unemployment is much lower. A repeat of this decade is not our core assumption, but it is a potential risk we want to highlight in the current outlook. It also gives context on how central banks are thinking. For example, the Federal Reserve Chairman, Jerome Powell, invoked the spirit of Paul Volcker in recent congressional testimony to highlight his conviction in targeting inflation. Volcker was the Federal Reserve Chairman who hiked rates from 11.2% in 1979 to a peak of 21.5% in June 1981 and helped cause the 1980-1982 recession to tame inflation.

Unemployment vs. Inflation in the US (Jan-70 to Feb-22)

Lastly, we should emphasise that the type of inflation matters for what central banks can achieve by hiking rates. When the inflation is driven by a lack of sufficient supply of goods, then hiking rates can only slow this kind of inflation by weakening the overall economy and therefore slowing demand. In the worst-case scenario, this is achieved by helping cause a recession with demand falling as businesses fail and staff are laid off. This is a risk we are watching closely as it represents a case where the cure might be worse than the disease.

In conclusion, we see inflation risks rising and posing a headwind to economic growth. The scale of the rise is highly contingent on the duration of the Russia-Ukraine war and sanctions on Russia. Currently the Organisation for Economic Co-operation and Development (OECD) estimates a 2.5% increase on the global inflation rate for 2022 with the bulk of the pain for European countries (+2%) compared to the US (+1.3%)6.

Growth

Our outlook for global growth has weakened. Stronger inflation and the central bank response of higher interest rates will constrain household spending by pushing the cost of goods higher and making the cost of financing more expensive respectively.

Consumer sentiment has also softened. In the US, the University of Michigan Consumer Sentiment Index is at its lowest point since 2011 as concerns over rising inflation negatively impacts confidence7 and may weigh on consumers’ willingness to spend. The threat of coronavirus waves lingers with the emergence of new coronavirus variants, as many countries have had mixed success in administering booster doses.

Although headwinds are rising, a recession remains unlikely in the near-term. The outlook remains supported by a robust labour market and a broad rebound in services as evidenced by the J.P. Morgan Global Composite PMI (a leading indicator of near-term global growth, which is still in expansionary phase).

The IMF forecast a 4.4% growth for the global economy in 20228 prior to the Russian invasion and ensuing shock to commodity prices. We expect the IMF to revise this to be lower (but still positive) in line with other forecasters. The OECD anticipates a 1% detraction from global growth6 arising from the conflict, but this could be offset by government intervention with fiscal policy support estimated to reduce the slowdown by approximately 0.3%. Some countries have already begun, for example, Italy unveiled an €8bn package in February to combat rising energy prices9.

Interest rates

We expect central banks to continue tightening in the near-term in line with their guidance. The Federal Reserve began this process with an initial 0.25% increase in March. However, doing so is a delicate balancing act. Hiking rates both raises borrowing costs and reduces inflation by slowing economic growth. It can and has been the case where a hiking cycle contributes to causing an actual recession, also known as a “policy mistake”.

In the US, the Federal Reserve (the Fed) is anticipating several hikes this year to a range of 1.75-2%10. This compares against market pricing for an extra hike to end 2022 at 2-2.25%11. Rhetoric is heightened from Federal Reserve officials so there is potential for more aggressive rate increases in the months ahead unless we see a material decline in inflation and/or economic growth. This stance is not a uniform behaviour. The European Central Bank (ECB) is maintaining a conservative stance on rate hikes despite elevated inflation levels. Officials are only, arguably, guiding for one hike in contrast to market expectations of two. The ECB is accelerating the unwind of its bond buying program, a stance similar to the Federal Reserve’s actions. Taken together, policy remains a headwind for this year. Higher rates also pose a challenge to asset prices. Central banks basically transform the attractiveness of cash by offering a higher yield. This makes other asset classes such as stocks and bonds less attractive, driving selling pressure from investors and resulting in weaker, even negative returns as a result.

Conclusion

In summary, we have had a major shock to the global economy with the disruption and withdrawal of a significant percentage of global commodity supply in the wake of the Russia-Ukraine conflict. This has flowed through to a stronger inflation outlook with higher price growth now expected to persist in the near-term with destructive consequences particularly for energy importing countries. This will collectively set back global growth by up to 1% according to OECD estimates. Importantly, for now, growth is expected to be weaker but remain positive, so while recession risk has risen it is not our base case expectation. Finally, higher rates will also drag on economic activity and asset prices as noted in our December update, presenting another headwind to the global economy in the near-term.

To conclude on an optimistic note, leading economic indicators (which give insight into the near-term path of economic activity), such as the Conference Board Leading Economic Index remain in positive territory12, suggesting the risk of recession will be warded off in the near-term despite the headwinds facing the global economy.

Part 2: Key economic indicators

United States

| Economic snapshot | Last reported result | Comments |

| Growth (GDP)13 | 7.0% (annualised) Q4’21 | Economic growth gathered pace in the fourth quarter of 2022, supported by a rise in exports, as well as accelerations in inventory investment and consumer spending. |

| Unemployment14 | 3.8% Feb’22 | The unemployment rate declined by 0.2% in February to 3.8%, with a further 678,000 jobs added over the month. There was significant job growth in professional and business services, health care, construction, and transportation and warehousing. |

| Industrial production15 | 0.5% m/m Feb’22

7.5% y/y Feb’22 |

Industrial production rose in February, supported by higher activity in the manufacturing sector as the impact of the COVID-19 Omicron wave receded. |

| Manufacturing PMI16 | 58.6 Feb’22

61.1 Nov’21 |

November’s manufacturing Purchasing Managers Index (PMI) reading of 58.6 reflected an increase of a single percentage point from January and continues to signal a manufacturing sector in expansion for an eighteenth successive month. |

| Retail sales17 | 0.3% m/m Feb’22

17.6% y/y Feb’22 |

Retail sales remain strong on a yearly view but have recently been impacted by cost inflation. |

| Credit growth3 | 1.9% y/y Jan’22 | Credit increased by 1.9% year-on-year and stands at $4.44 trillion. |

| Outlook | The IMF forecasts that the United States economy will grow at 4.0% in 2022 and 2.6% in 2023. We expect growth to weaken because of inflation remaining stubbornly high and financial conditions being tightened. | |

Eurozone

| Economic snapshot | Last reported result | Comments |

| Growth (GDP)18 | 0.3% q/q Q4’21

5.2% y/y Q4’21 |

Growth moderated in the fourth quarter but rose strongly over 2021, erasing the contraction the Eurozone economy suffered as a result of COVID-19. |

| Unemployment6 | 6.8% Jan’22 | The unemployment rate declined in January and is the lowest jobless rate on record. |

| Industrial production6 | 0.0% m/m Jan’22

-1.3% y/y Jan’22 |

Industrial production was unchanged in January as a strong lift in the production of non-durable consumer goods (3.1%) was offset by a sharp fall in the production of capital goods (-2.4%). |

| Manufacturing PMI19 | 58.2 Feb’22 | The Manufacturing PMI confirmed the manufacturing sector expanded for a twentieth successive month. |

| Retail sales6 | 0.2% m/m Jan’22

7.8% y/y Jan’22 |

Retail sales increased in January, though the increase was negatively impacted from lower sales of automotive fuel. |

| Credit growth6 | 6.2% y/y Jan’22 | The annual growth rate of total credit to euro area residents stood at 6.2% in January 2022, compared with 6.1% the previous month. The annual growth rate of credit to general government decreased to 10.8% in January from 11.3% in December, while the annual growth rate of credit to the private sector increased to 4.3% in January from 4.0% in December. |

| Outlook | According to the IMF, growth in the Eurozone is forecast to be 3.9% in 2022 and 2.5% in 2023. However, the overall outlook remains particularly challenging as the impacts of the war are felt more profoundly in the region. | |

China

| Economic snapshot | Last reported result | Comments |

| Growth (GDP)20 | 1.6% q/q Q4’21

8.1% y/y Q4’21 |

China’s economy expanded strongly in 2021 but growth slowed during the fourth quarter after a spate of COVID-19 outbreaks forced the closure of some factories, ports and airports. |

| Unemployment8 | 5.5% Feb’22 | The unemployment rate of 5.5% continues to mask the extremely high youth unemployment rate of around 15%. |

| Industrial production8 | 7.5% y/y Jan-Feb’22 | Industrial production was strong in the first two months of 2022 as the high-tech manufacturing sector expanded sharply, aided by a marked increase in the output of new energy vehicles. |

| Manufacturing PMI21 | 50.2 Feb’22

49.9 Nov’21 |

China’s manufacturing PMI was relatively unchanged in February, as manufacturing activities slowed down due to the Lunar New Year holiday. |

| Retail sales8 | 6.7% y/y Jan-Feb’22 | The solid rise in retail sales was underpinned by an 8.9% uplift in services revenue. |

| Fixed asset (urban) investment8 | 12.2% y/y Jan-Feb’22 | Fixed Asset Investment (FAI) rose strongly in the first two months of 2022, supported by sharp rises in high-tech manufacturing and infrastructure investment. |

| Outlook | The IMF forecasts that the Chinese economy will grow at 4.8% in 2022 and 5.2% in 2023. Overall, we expect growth in China to slow as it remains challenged by over-investment in the property sector, which Authorities are trying to manage via other stimulus measures. | |

Japan

| Economic snapshot | Last reported result | Comments |

| Growth (GDP)22 | 5.4% (annualised) Q4’21 | The Japanese economy rebounded in the fourth quarter as a COVID-19 state of emergency was lifted at the end of September, underpinned by a boost in private consumption. |

| Unemployment23 | 2.8% Jan’22 | The unemployment rate inched higher in January due to a surge in COVID-19 cases. |

| Industrial production24 | -1.3% m/m Jan’22

-0.9% y/y Jan’22 |

Japan’s industrial output fell 1.3% in January from the previous month, as both shipments and inventories declined. |

| Manufacturing PMI25 | 52.7 Feb’22

54.5 Nov’21 |

The latest reading of 52.7 continues to signify an expanding manufacturing sector, albeit the rate of expansion has declined significantly as a result of geopolitical tensions that have led to war in Ukraine. |

| Retail sales12 | -1.9% m/m Jan’22

1.6% y/y Jan’22 |

Japan’s retail sales declined for the second successive month as a surge in coronavirus infections hit consumer sentiment. |

| Outlook | According to the IMF, growth in Japan is forecast to be 3.3% in 2022 and 1.8% in 2023. The Japanese economy should benefit from the eventual reopening of international travel but this is likely to fade in 2023 as global growth moderates. | |