DealmakersAustralian mid-market M&A

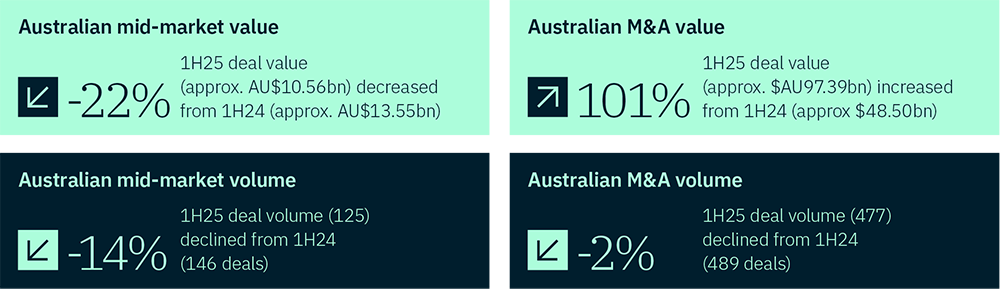

The Australian mid-year M&A landscape reveals a tale of two markets.

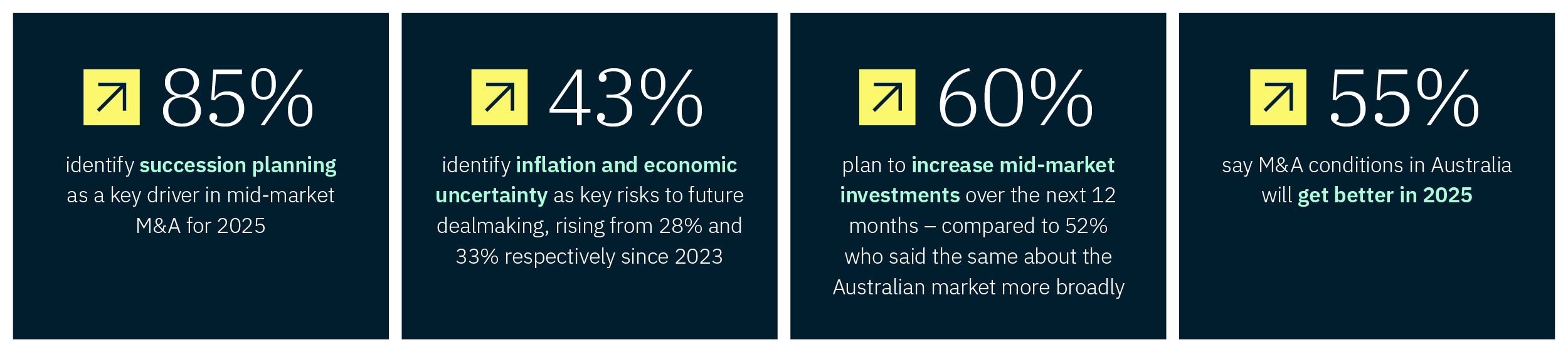

While the broader Australian M&A market surged 101% in deal value, at the halfway point of 2025 the mid-market segment faced headwinds.

This reflects a market where larger transactions are driving growth, while middle market participants navigate increasing complexities and regulatory uncertainty.

The looming ACCC regulatory changes are creating significant market dynamics, particularly for the cautious mid-market navigating the Federal election, global trade tensions and weakened sentiment, which has resulted in volume decline.

Despite persistent global upheaval, the increased IPO activity and cross-border interest from overseas buyers attracted to Australia’s stable market is evidence of underlying confidence. The market appears positioned for potential acceleration in the second half, driven by improved sentiment and reduced trade tensions.

Get the key H1 stats in our PDF version here.

Read on and revisit the full Dealmakers report from earlier in 2025.

Looking to 2025

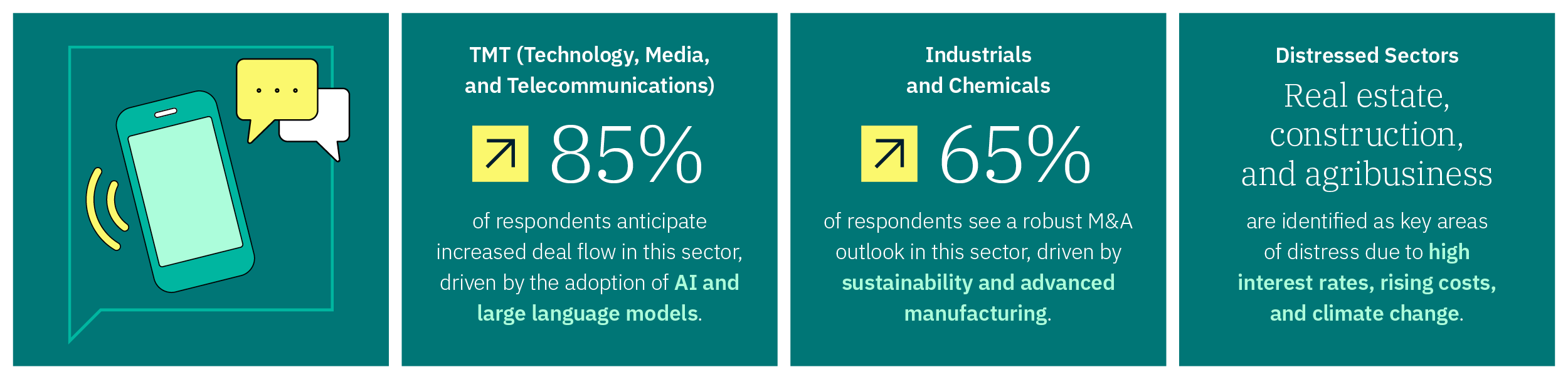

Key sectors and deal drivers

Our experts