OCTOBER 2025

Business Radar 2025 Understanding the businesses that drive Australia's economy

The Business Radar report canvasses the trends, challenges and opportunities experienced by Australia’s middle market businesses.

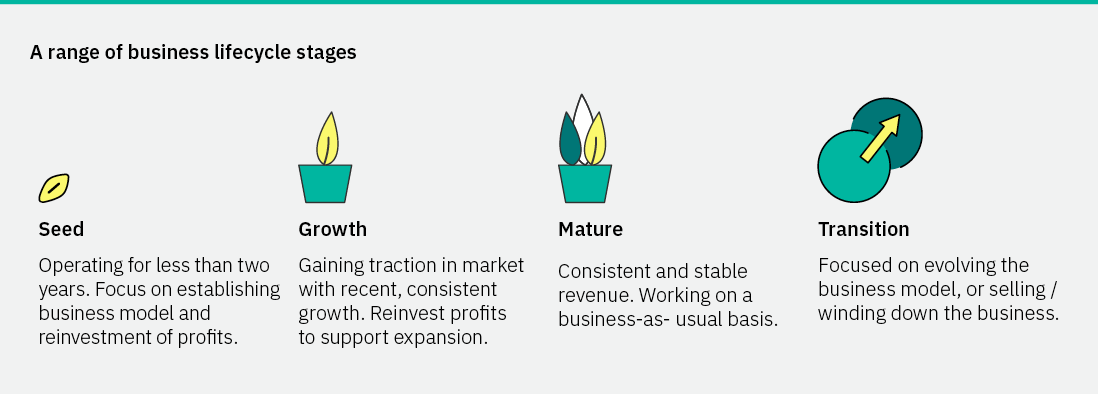

Independently commissioned, our most recent survey captured the sentiment of nearly 150 owners and leaders across a range of growth stages, states and industries.

Here, you’ll read how business leaders feel about the current and future success of their businesses and what that could indicate for Australia’s economy.

Key findings

- AI adoption is widespread but strategic implementation lags: While 93% of leaders are familiar with AI and 72% actively use AI tools, only 13% have made it a true strategic priority with dedicated budgets and scaling plans

- Workforce transformation is underway with mixed impacts: Half of businesses report moderate role changes, with employees spending more time on creative work (42%) and less on administrative tasks (36%), though concerns about job losses have increased from 29% to 37% since 2023

- It’s only just the beginning for AI adoption: Growth-stage businesses (63%) and those with 100-250 employees (61%) show highest readiness for AI-driven industry shifts, and middle market businesses in the growth phase are incorporating operational advantages through bold AI implementation

- Middle market confidence remains stable despite AI disruption concerns: Though mature businesses show declining confidence as they view their size and legacy as potential disadvantages in AI transformation

Read on to learn how middle market leaders are successfully navigating the AI transformation and the strategic actions you can take to position your business for the next generation of growth or download your copy of the latest Business Radar.

October 2025

AI Integration: From novelty to normality

How middle market leaders are strategically navigating widespread AI adoption while balancing efficiency gains with workforce transformation

OCTOBER 2025

Business confidence

Middle market’s resilience underpinning steady confidence

July 2025

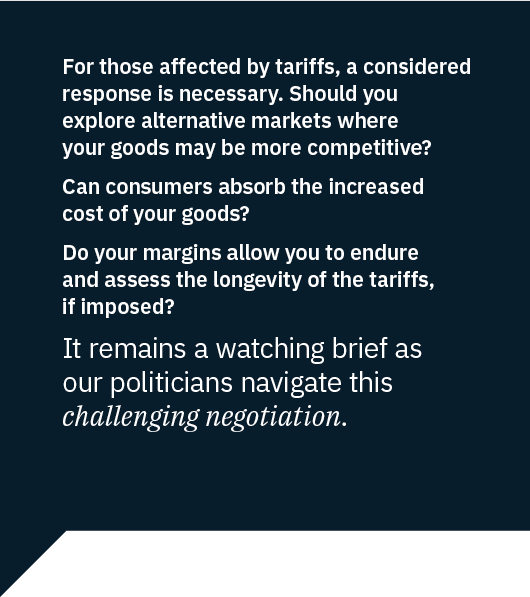

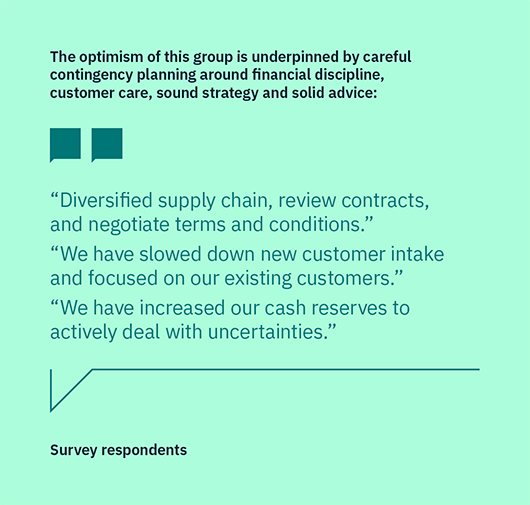

Leadership during uncertain times

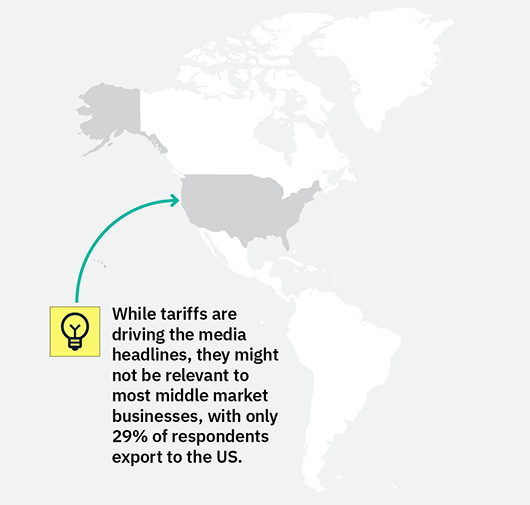

While tariffs are driving the media headlines, they aren’t impacting the middle market so much

April 2025

Mandatory climate reporting and ESG

Ready or not, middle market businesses are navigating a complex landscape

Our experts

asdfafsdfa

asdfafsdfa

asdfafsdfa

asdfafsdfa

asdfafsdfa

asdfafsdfa

asdfafsdfa