Business Radar 2023 Understanding the businesses that drive Australia’s economy

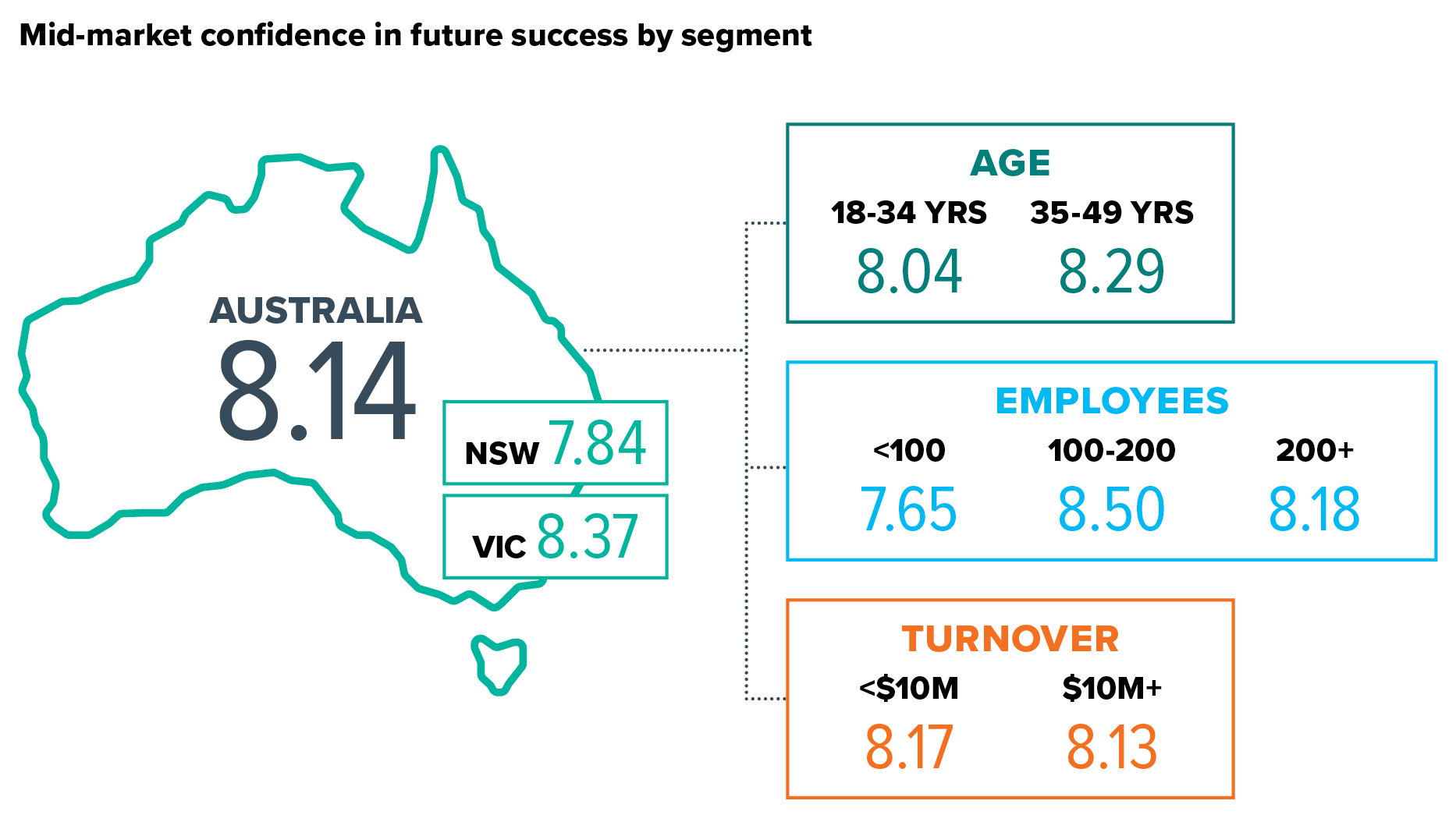

Pitcher Partners Business Radar canvasses the trends, challenges and opportunities experienced by Australia’s mid-market businesses. Independently commissioned, our recent snapshot conducted in September 2023 surveyed over 150 business owners and leaders.

This is the third in this year’s series that deep dives into business leaders’ confidence, considering their organisation, their industry and the economy as a whole. It also delves into their view of the economic outlook and how they may, or may not, be preparing for what’s ahead.

The 2024 report is also now available from here.

KEY FINDINGS

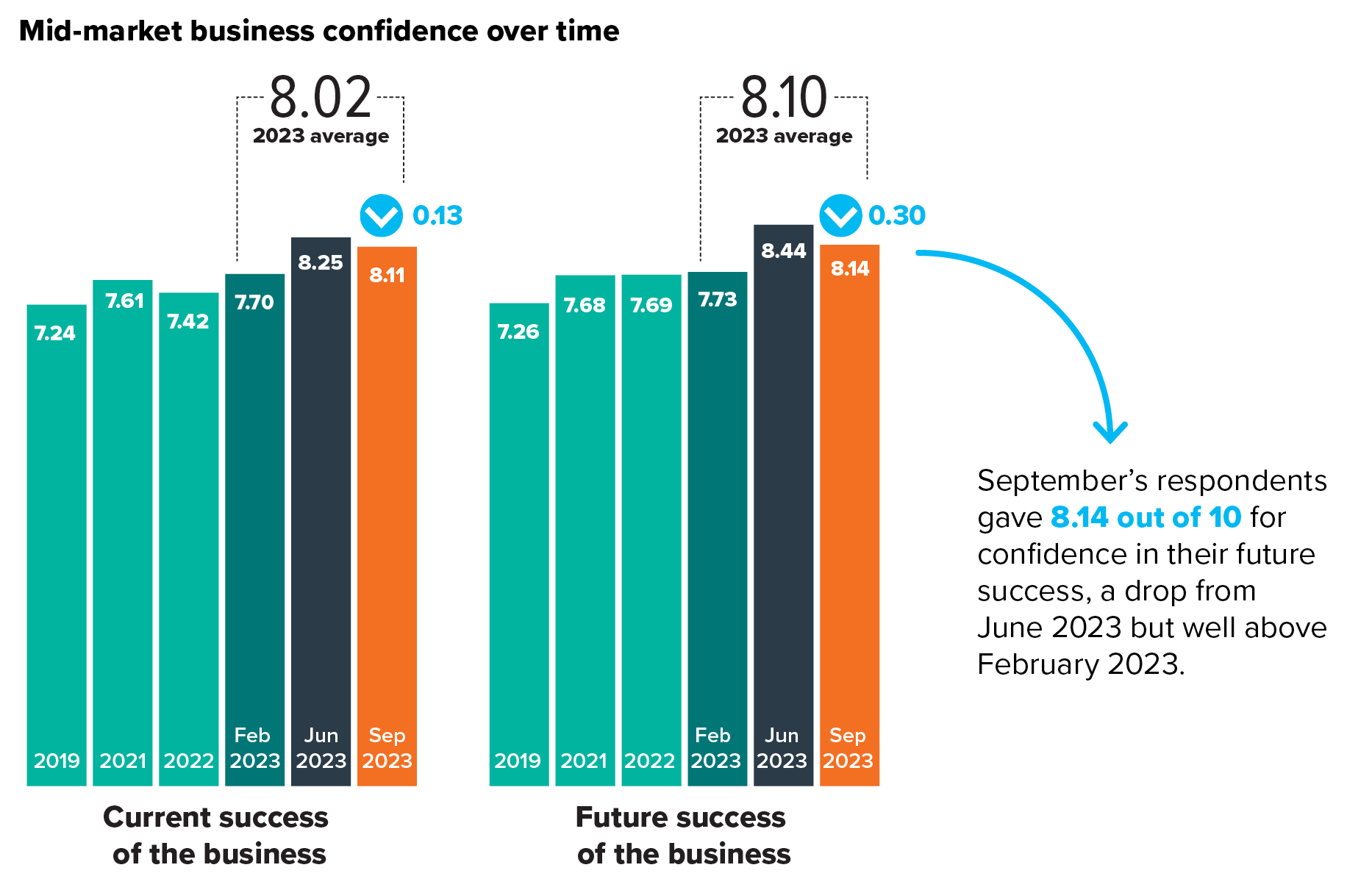

- Mid-market business confidence has softened against peaks seen in June 2023 but still remains high compared to prior years.

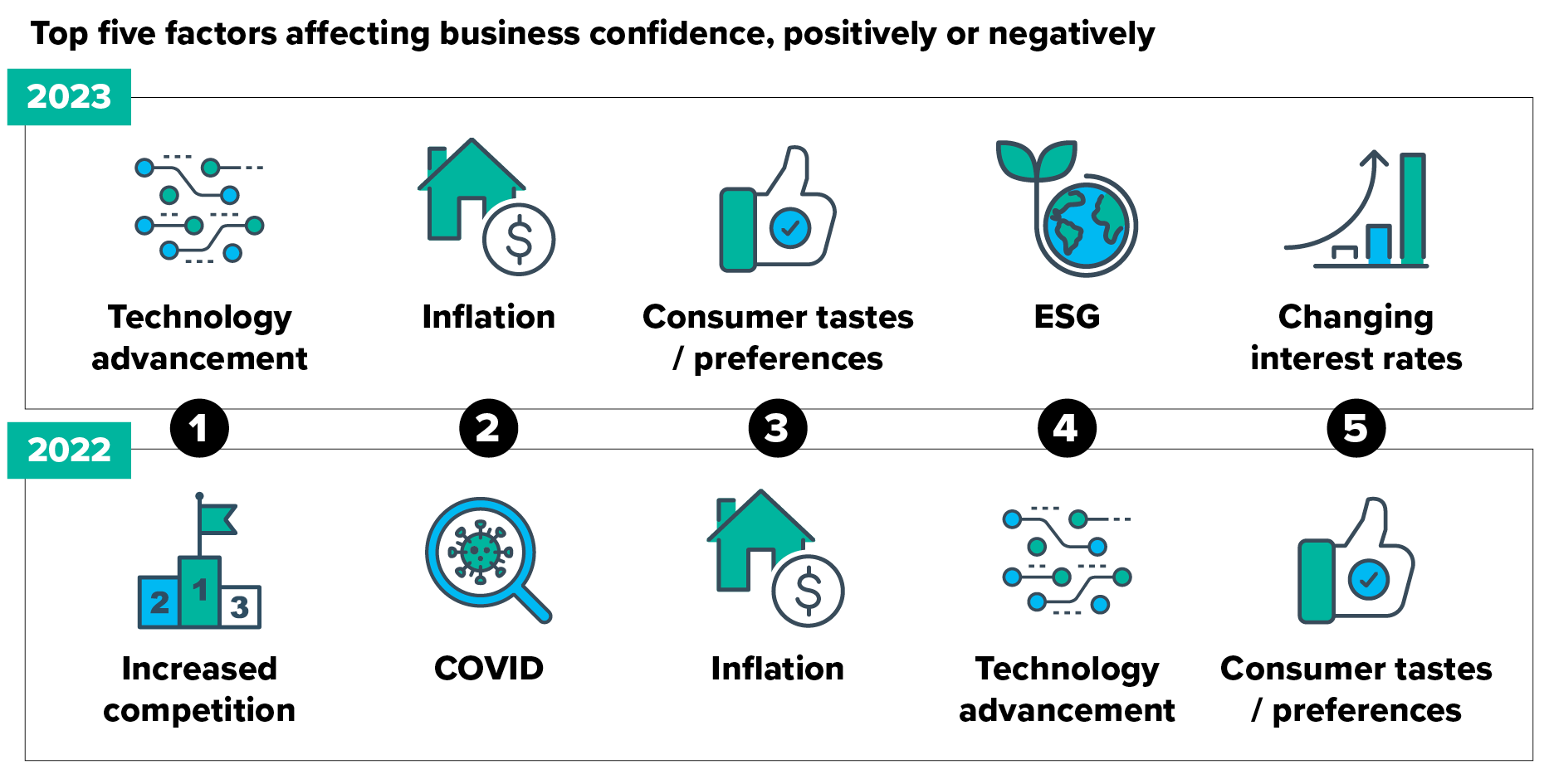

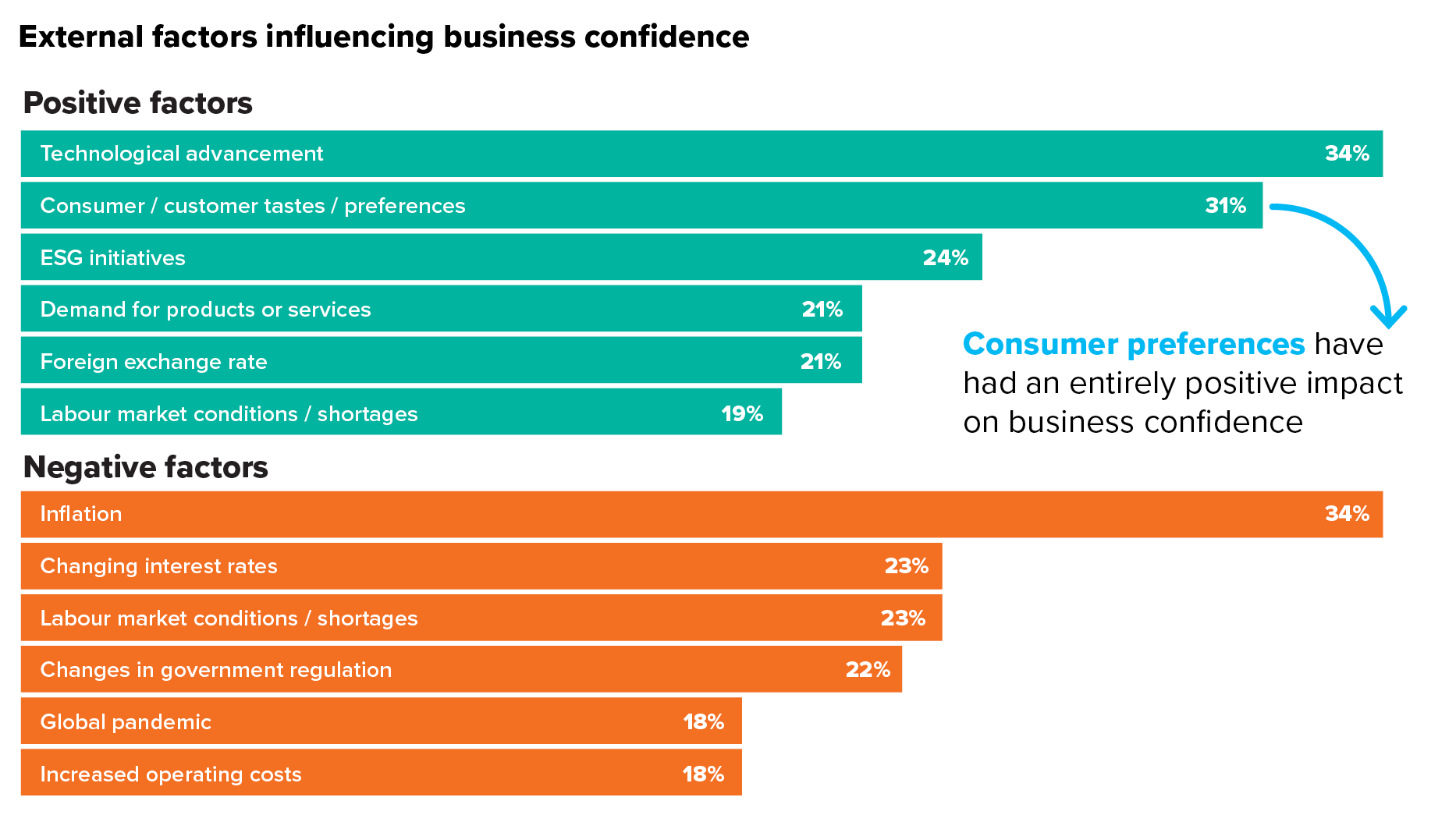

- The mid-market has moved on from COVID-19 – it is no longer in the top five most influential factors, with ESG (seemingly) making a first-time appearance.

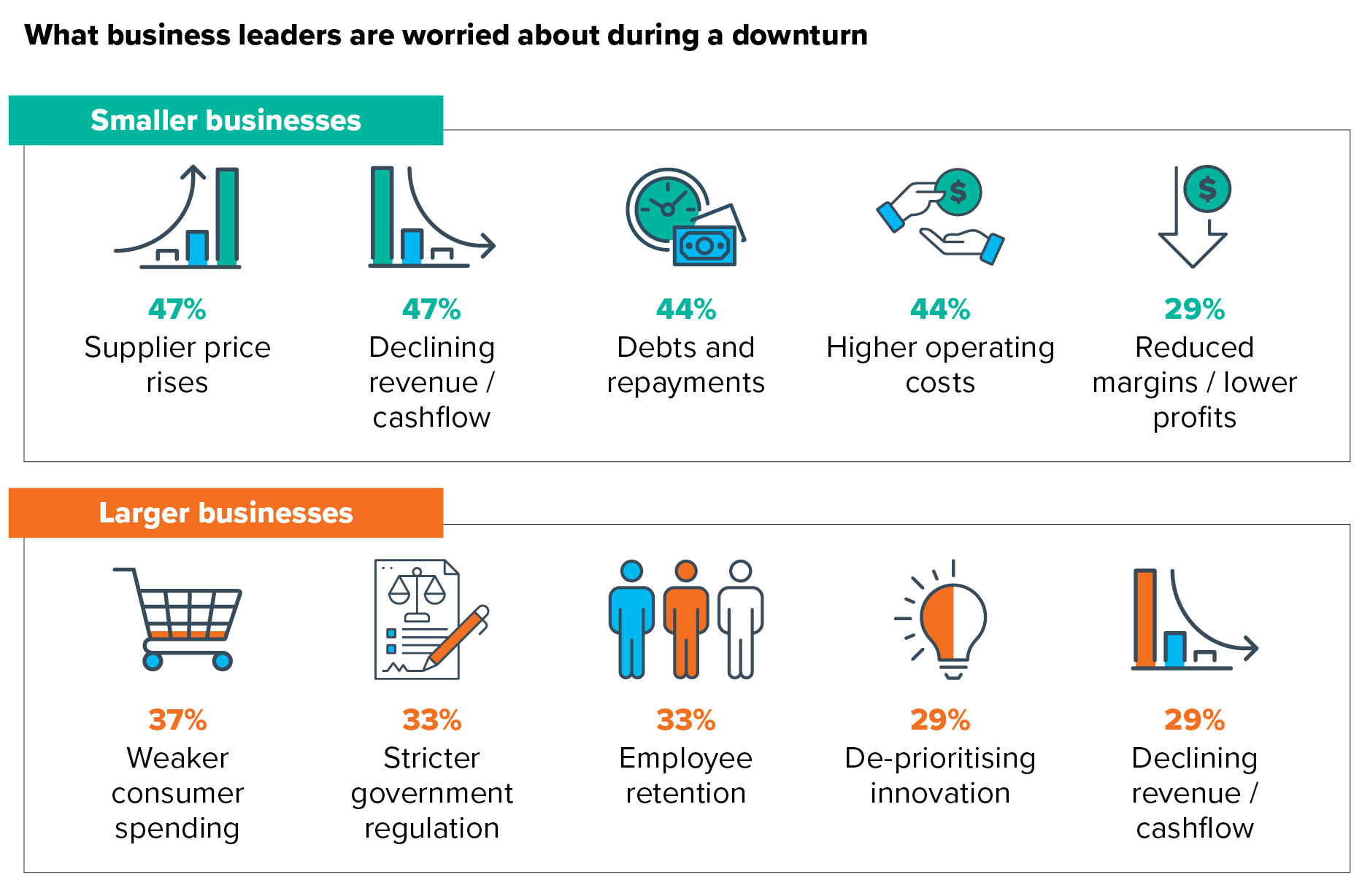

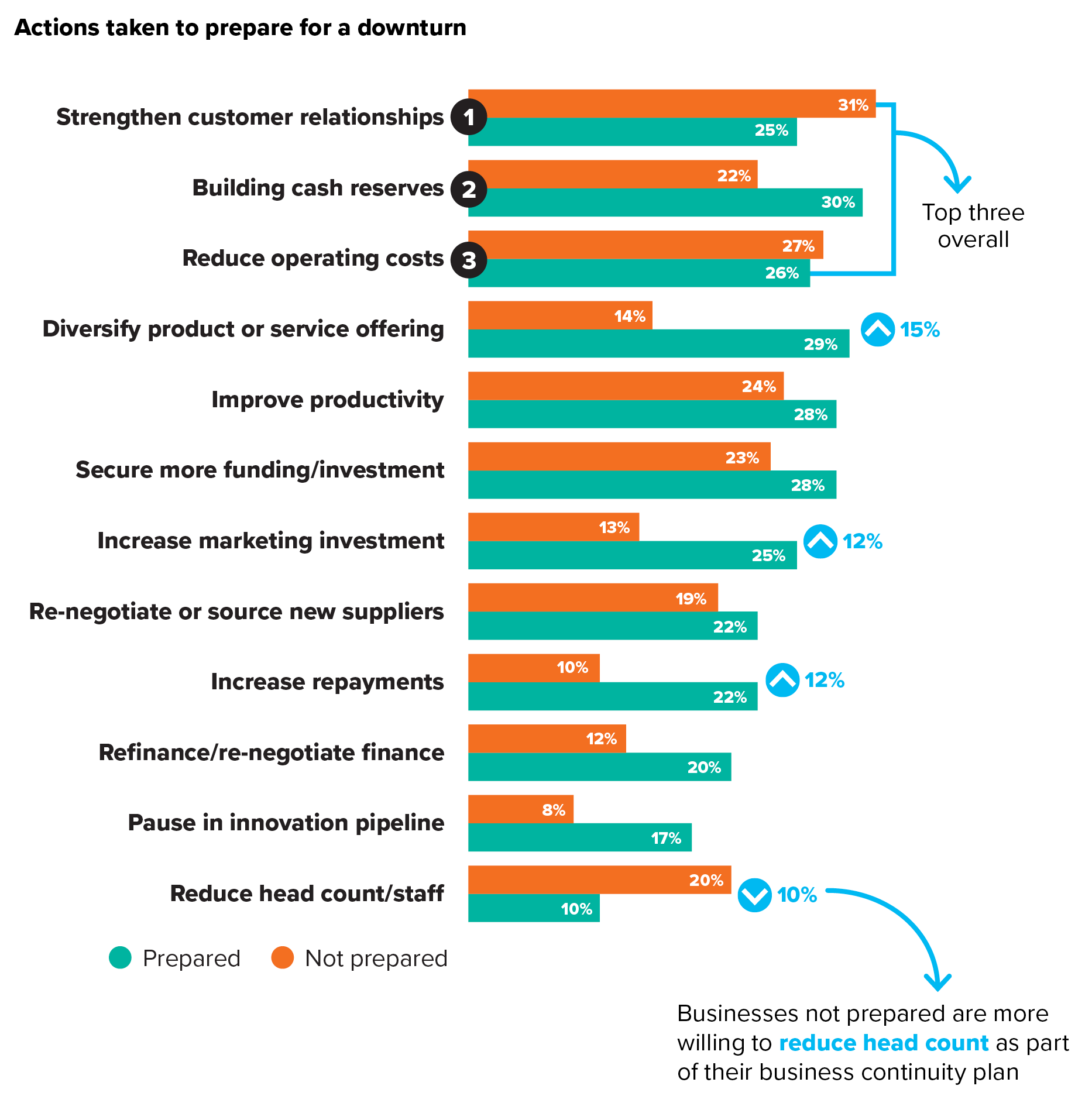

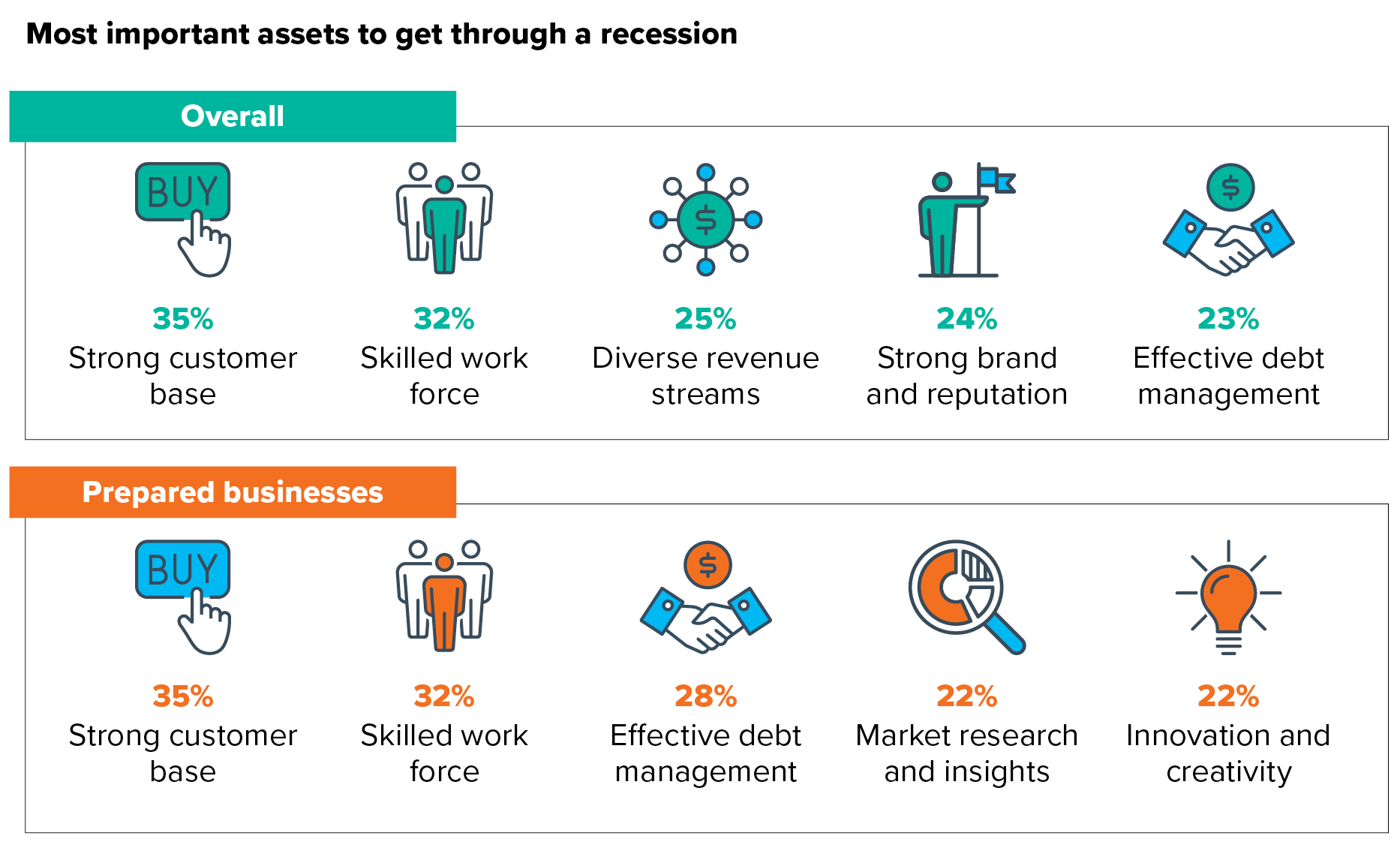

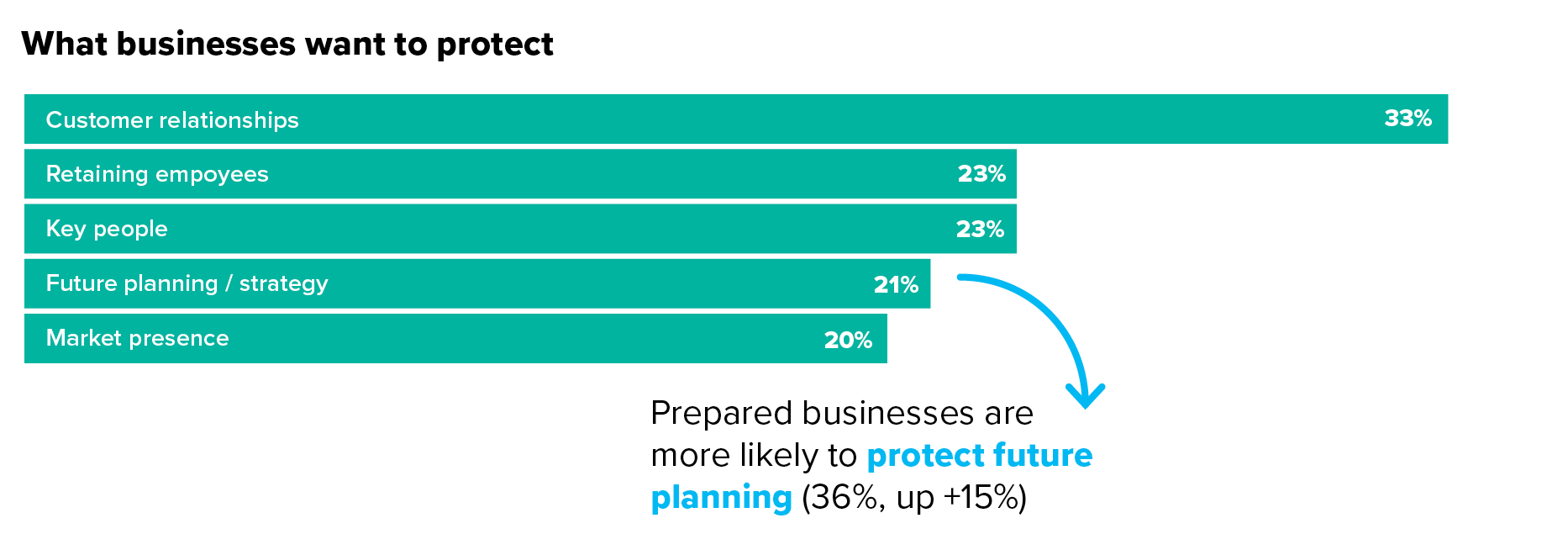

- Many mid-market businesses have turned their focus to building resilience, but how they’re tackling it varies, depending on a range of factors.

You can also catch up on key insights into generative AI and cybersecurity, gathered in our Business Radar surveys in June and February 2023.

Read on to learn how you can proactively address these challenges and ensure your business continues to thrive or access a PDF version here

Business confidence

Business confidence down from June peaks but still above year-on-year average

Is there anything that can knock the confidence of Australia’s mid-market businesses?

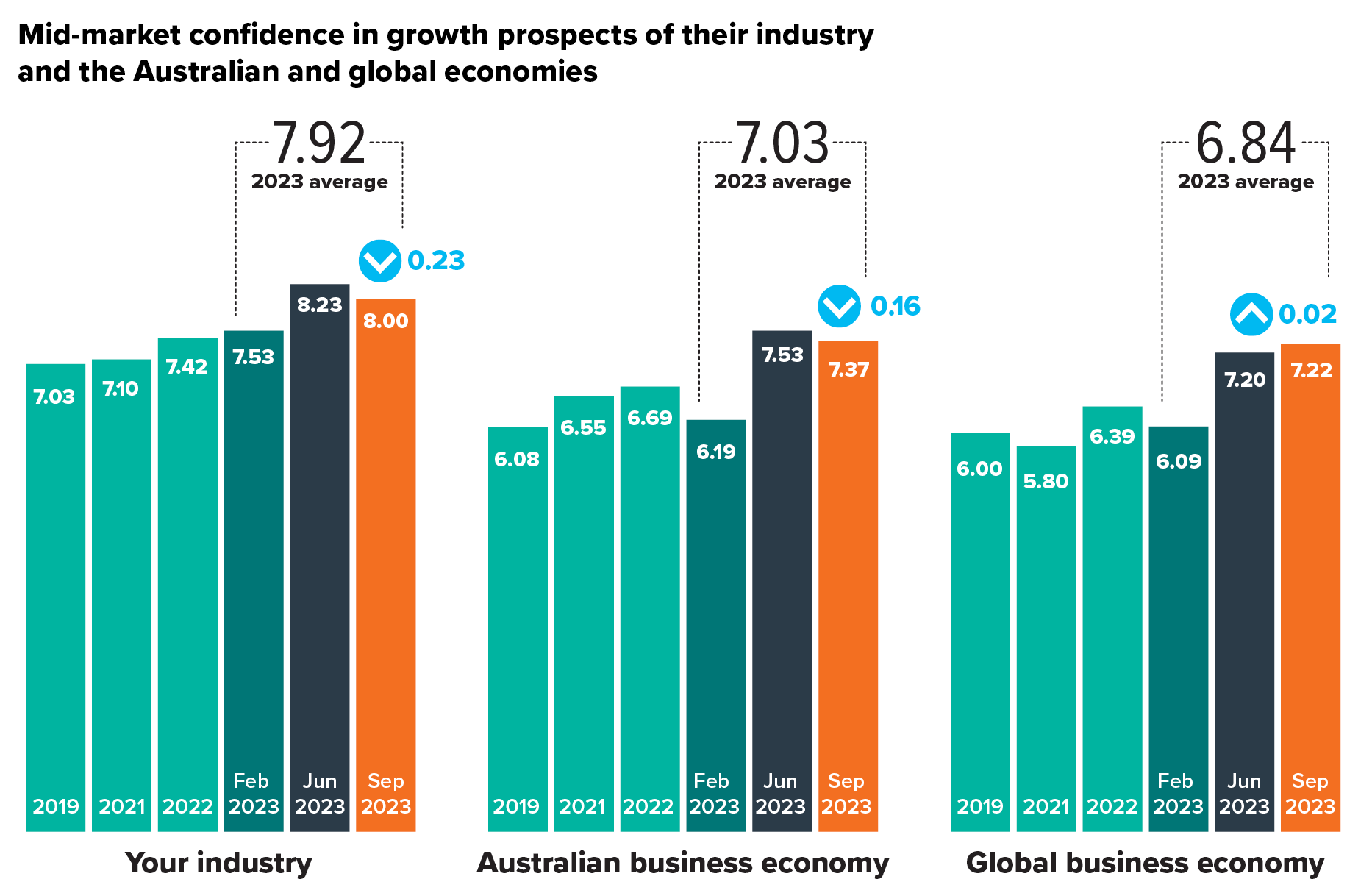

While our September results show confidence has dipped slightly from June’s unexpectedly high figures, they’re still comfortably above yearly averages since 2019.

The June figures were high against a backdrop of economic uncertainty for Australia, but this month’s economic markers align more with the confidence numbers. Recent data from the Australian Bureau of Statistics shows an unexpected boost to the economy since June 2023, driven by an increase in foreign visitors and massive government spend on infrastructure.1

1.https://www.reuters.com/markets/australia-economy-gets-boost-visitors-infrastructure-splurge-2023-09-05/ ,accessed 27 September 2023

Business Resilience

Australia’s mid-market thinks it’ll get through

Reflecting the seemingly unshakable business confidence of the Australian mid-market, many businesses see opportunities ahead.

When asked about the outlook for the Australian economy, many businesses continue to feel optimistic and see prospects for growth, with no drop in the percentage of ‘high-confidence’ businesses.

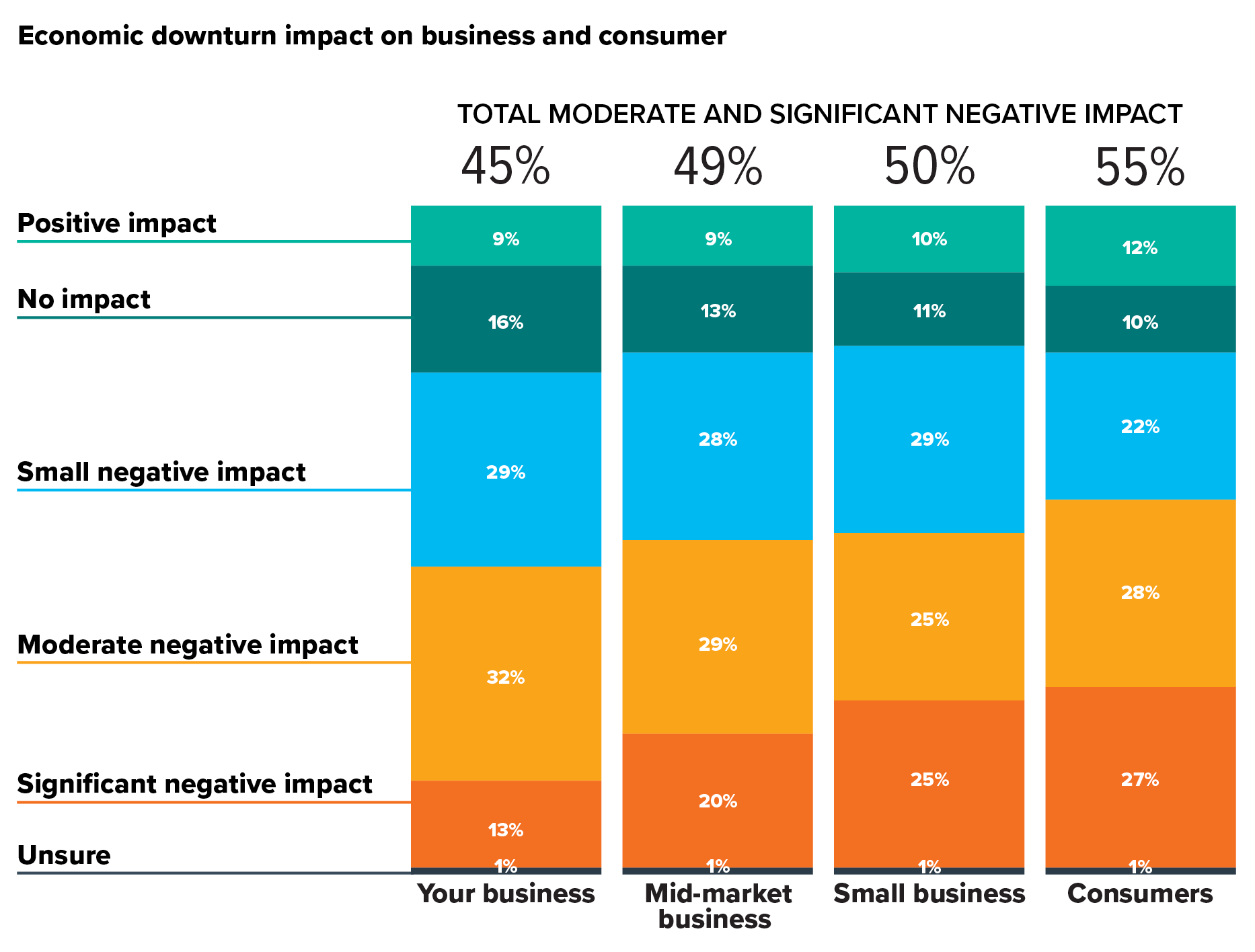

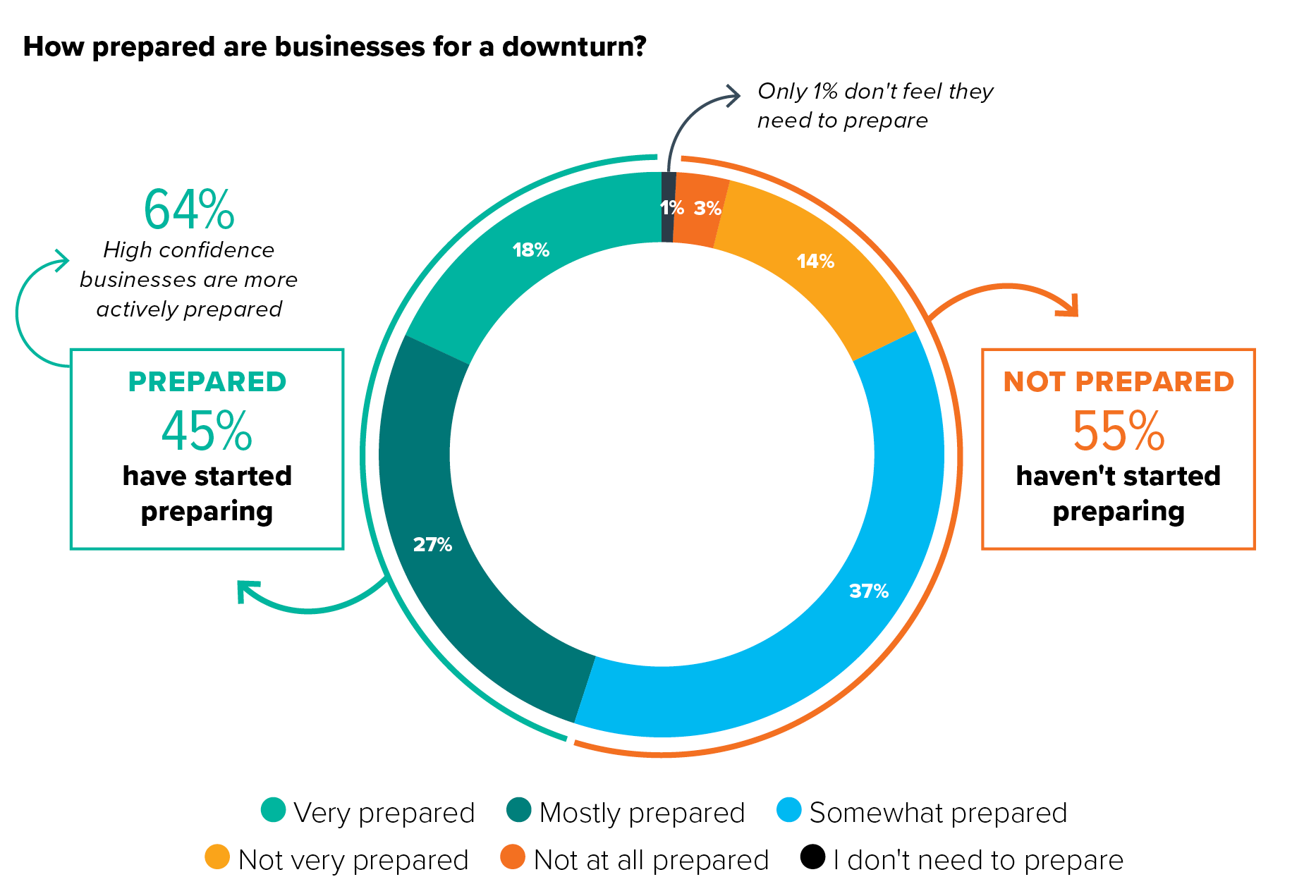

This is tempered, to a degree, by concerns about the increasing cost of living and high interest rates, with some respondents still foreseeing a potential downturn. While predictions are mixed, many businesses are preparing to build resilience in case turbulence and uncertainty continue for a sustained period.

Generative AI

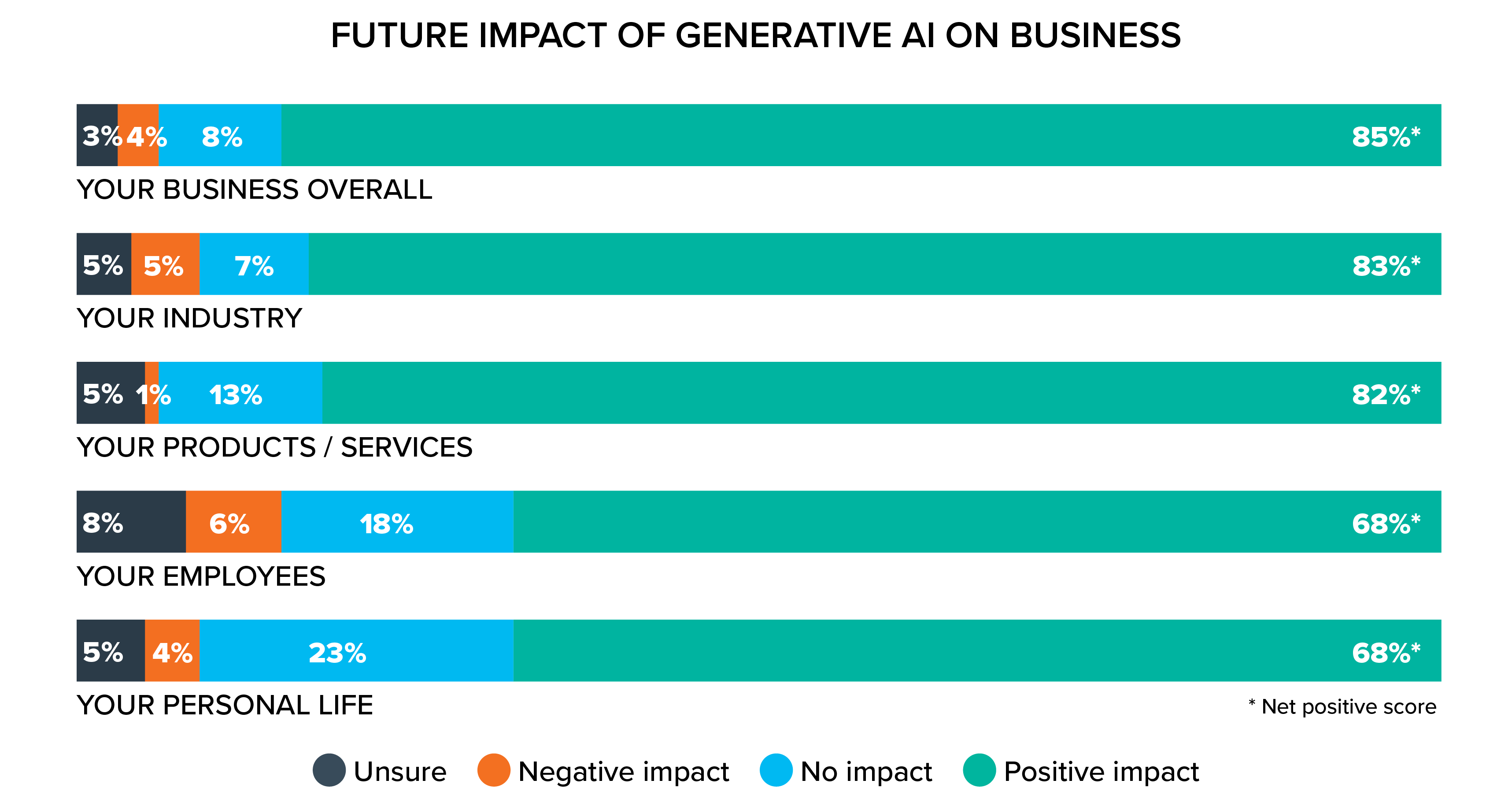

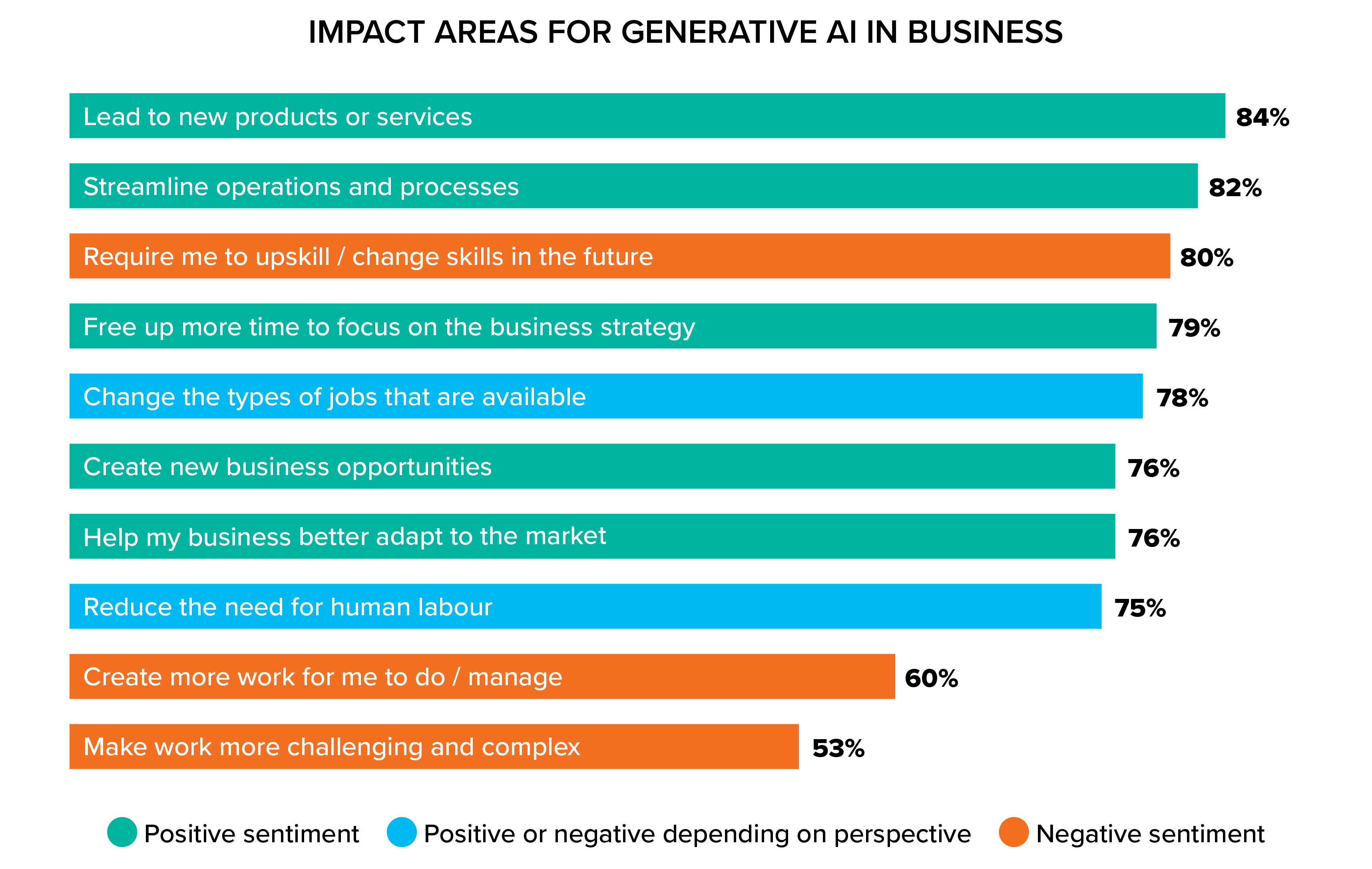

GenAI is here – are business leaders ready?

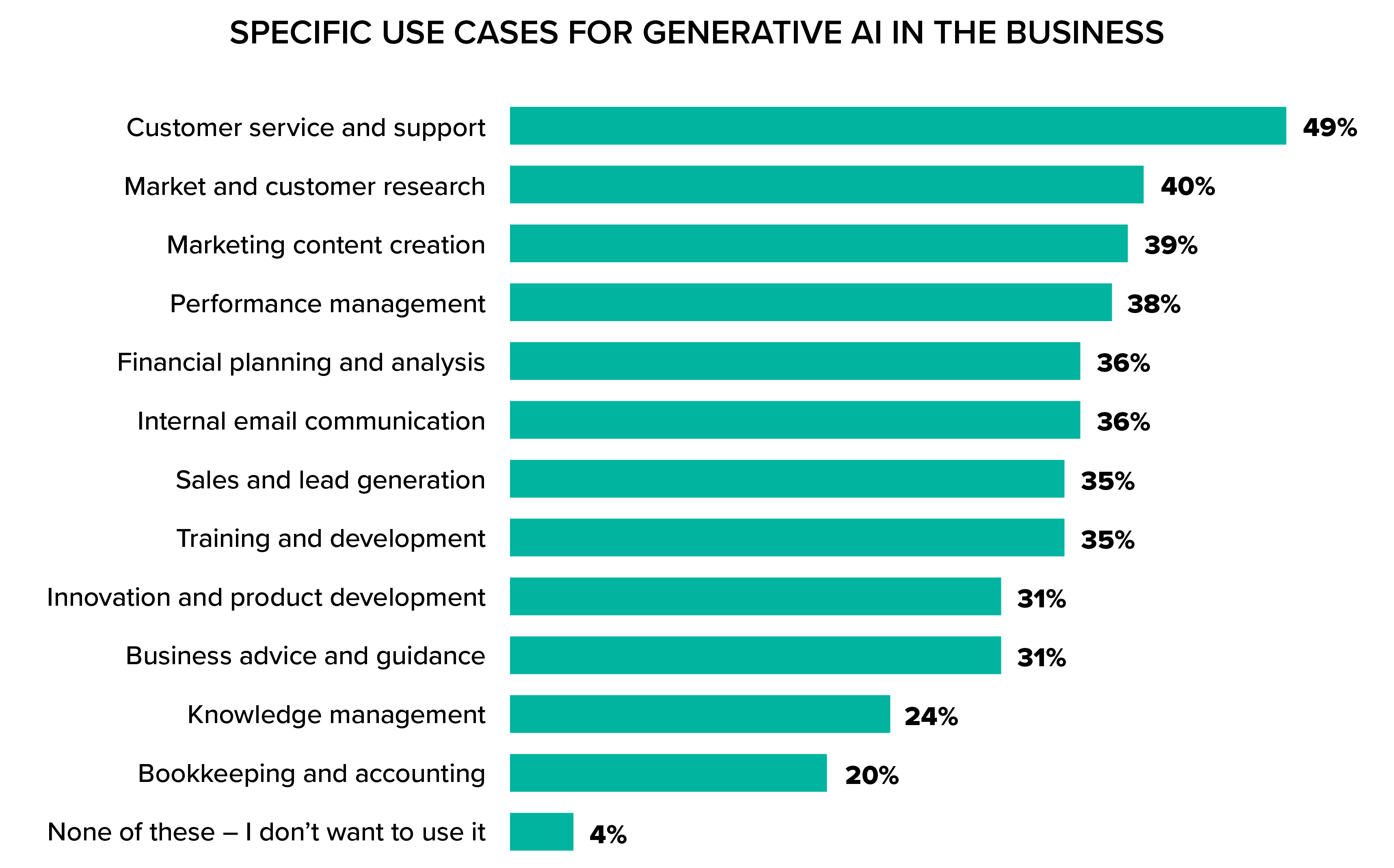

Risk, rewards and challenges of building GenAI into business-as-usual

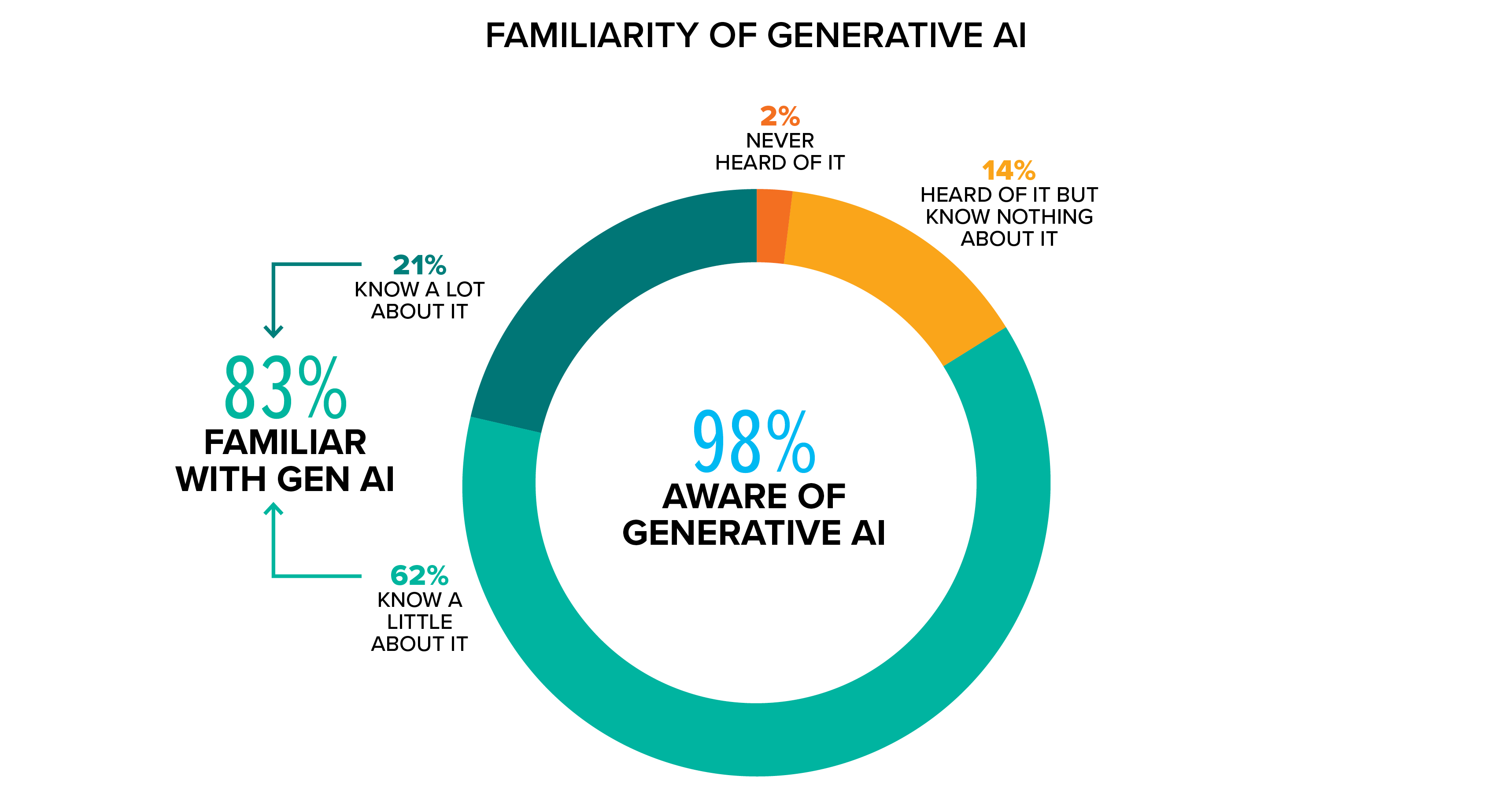

The arrival of ChatGPT and its trailing competitors in late 2022 pushed generative AI (GenAI) into mainstream consciousness, democratising AI tools in unprecedented ways.

For the first time, GenAI is accessible to anyone with an internet connection. ChatGPT’s 3.5 model is currently free and intuitively usable to even the least technical people. As with any new and potentially disruptive technology, business leaders are still trying to navigate the possible applications, benefits and risks of building it into business-as-usual operations. However, its users and the world are moving at pace – ChatGPT reached 100 million users in just two months – an extraordinary uptake speed.

One thing’s for certain: GenAI is here. Is Australia’s mid-market ready for it?

Cybersecurity

Cyber INsecurity in mid-market businesses

Study shows businesses could be more at risk than they think

Cyberattacks are low-risk, high reward crimes requiring nothing but basic tech skills and a lot of persistence. As more major attacks hit the news and Australian regulators hold C-Suite executives responsible for data security, cyber security has become a more urgent topic for discussion.

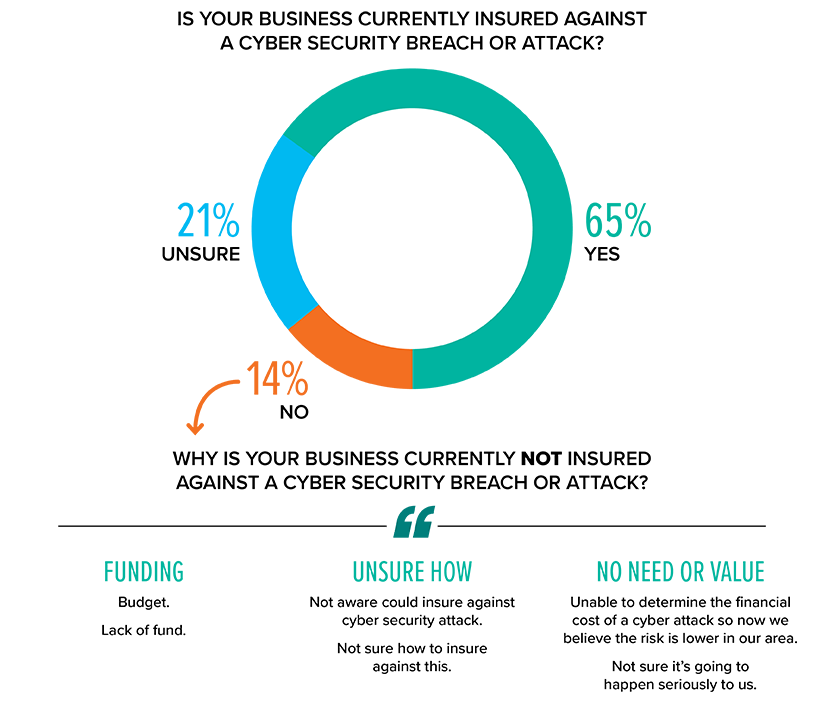

It’s more likely a question of when an attack will happen, rather than if, but has this translated to action among Australia’s mid-market business owners and leaders?

Data – worrying but still worth it

A whopping 84% of our respondents are concerned about the chance of their business experiencing a cyberattack, with 48% saying they’re very or extremely concerned.

And they’re right to be concerned. Last year the Australian Cyber Security Centre reported a 13% increase in cyber incidents on the previous financial year, with mid-market businesses suffering the highest loss per attack at $88,407.

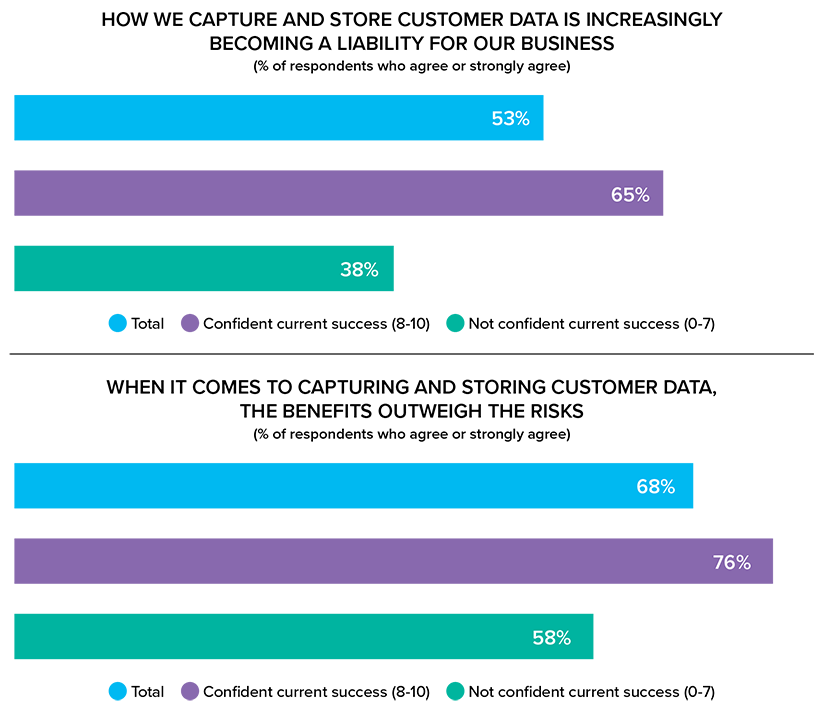

Understandably, just over half (53%) of surveyed business leaders agree or strongly agree that how they capture and store data is increasingly becoming a liability.

Split these results between those businesses who feel confident in their current success and those who don’t, and an interesting picture emerges. Higher confidence businesses are much more likely to see data storage as a liability (65%) than lower confidence ones (38%), potentially highlighting a greater awareness of the risks of storing endless amounts of data, much of which may not be required for day-to-day operations.

Nevertheless, 76% of high-confidence businesses still agree or strongly agree that the benefits of capturing and storing customer data outweigh the risks. That’s compared to the 68% of all respondents who agree or strongly agree and the 58% of lower confidence businesses.

Our experts