Business Radar 2024 Understanding the businesses that drive Australia's economy

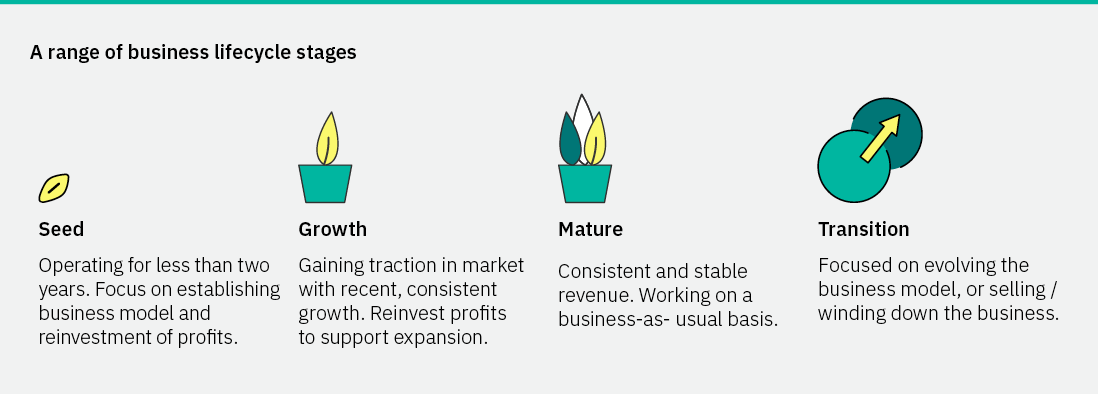

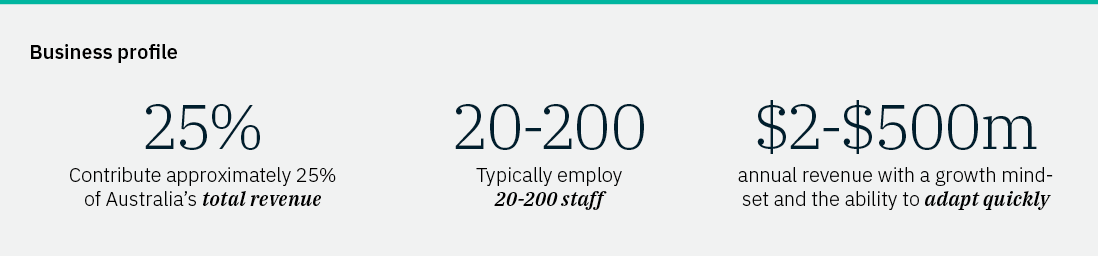

The Business Radar report canvasses the trends, challenges and opportunities experienced by Australia’s middle market businesses. Independently commissioned, our most recent survey captured the sentiment of 142 owners and leaders across a range of growth stages, states and industries.

Here, you’ll read how business leaders feel about the current and future success of their businesses and what that could indicate for Australia’s economy.

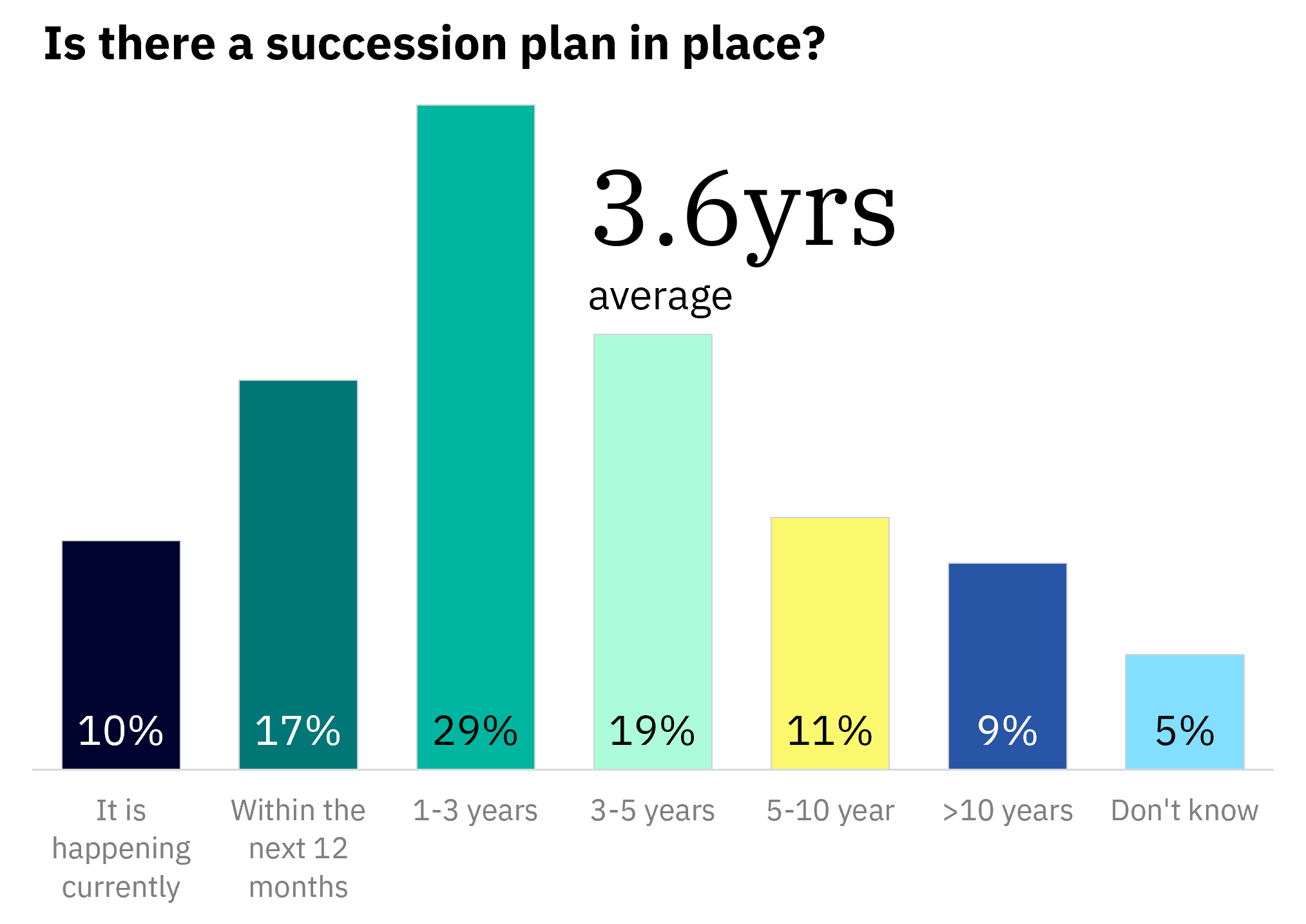

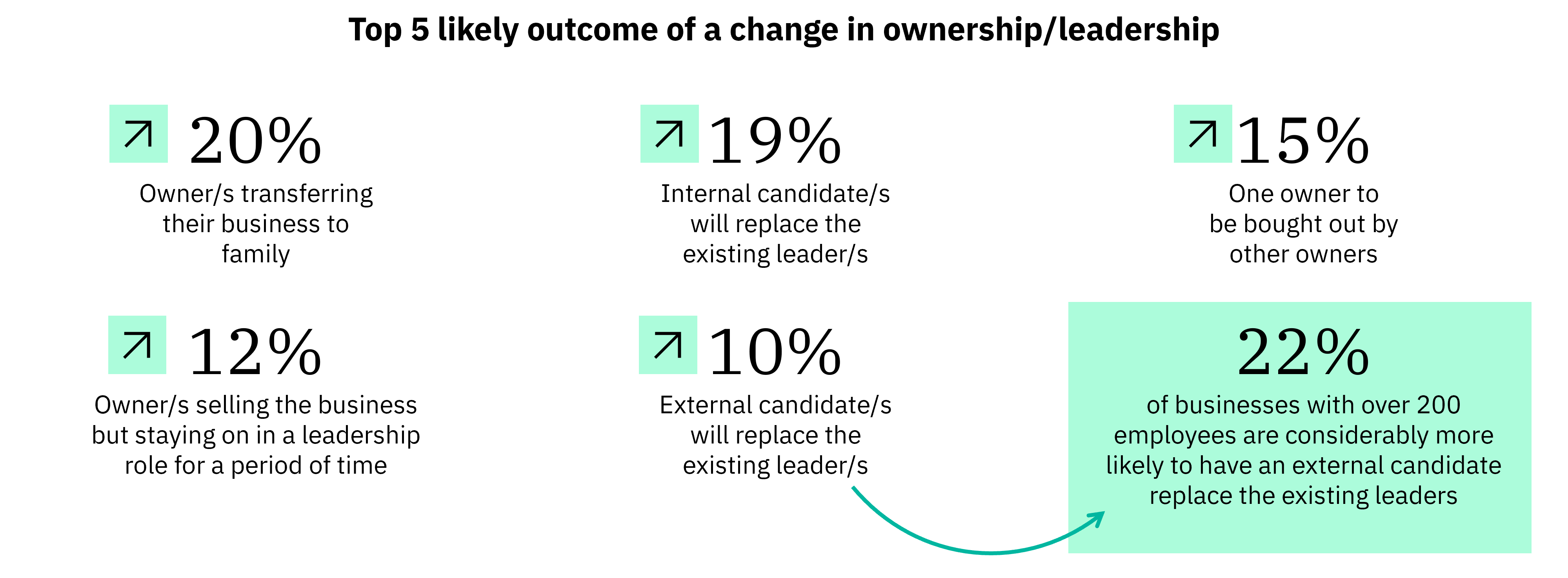

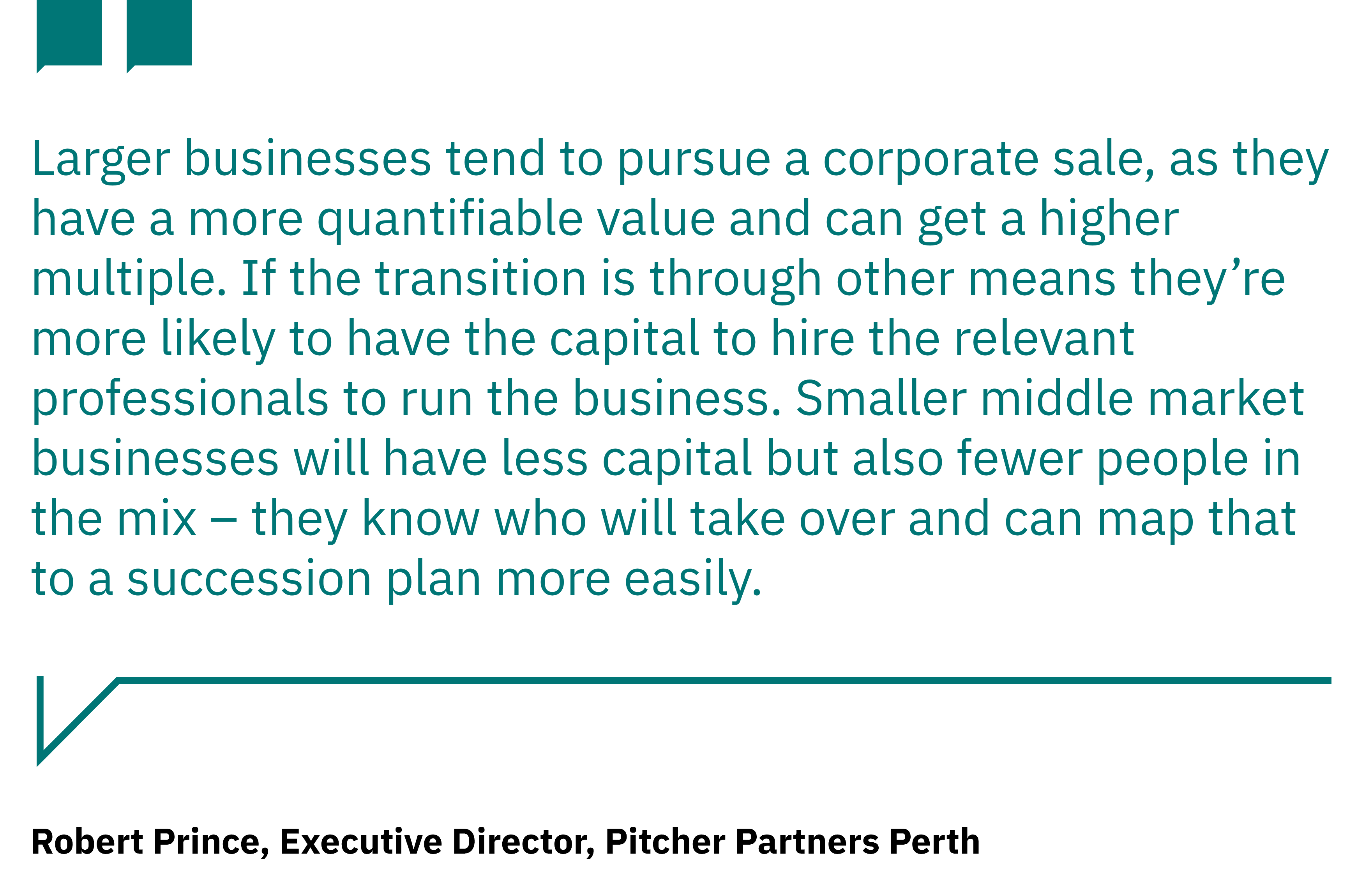

We also deep dive into succession – are Australian middle market leaders planning for it or just seeing how it goes? And are they leaving themselves enough time to plan?

Key findings

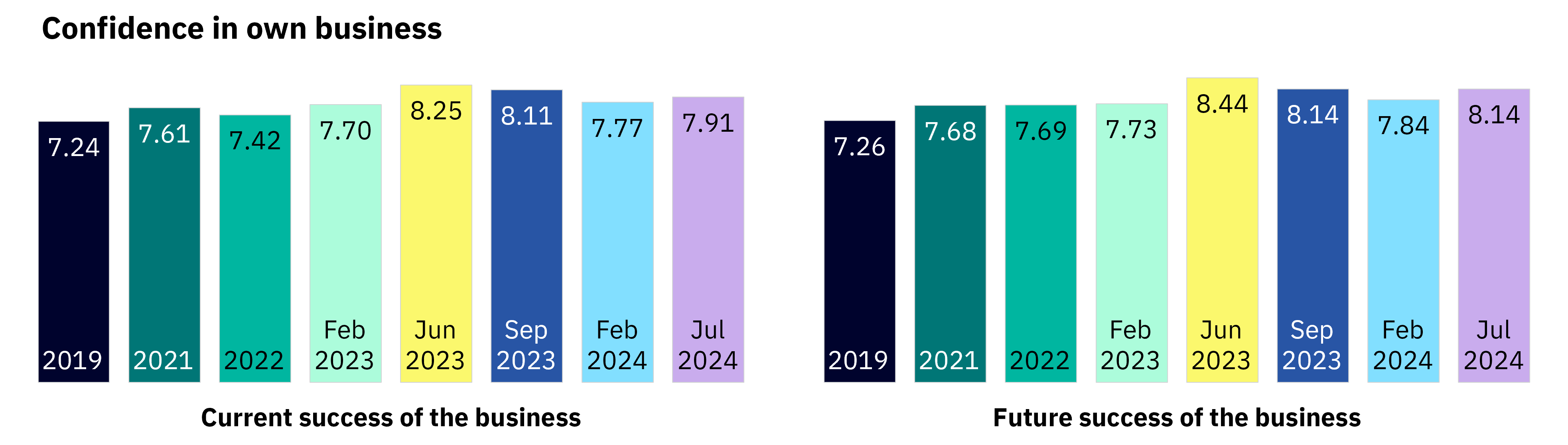

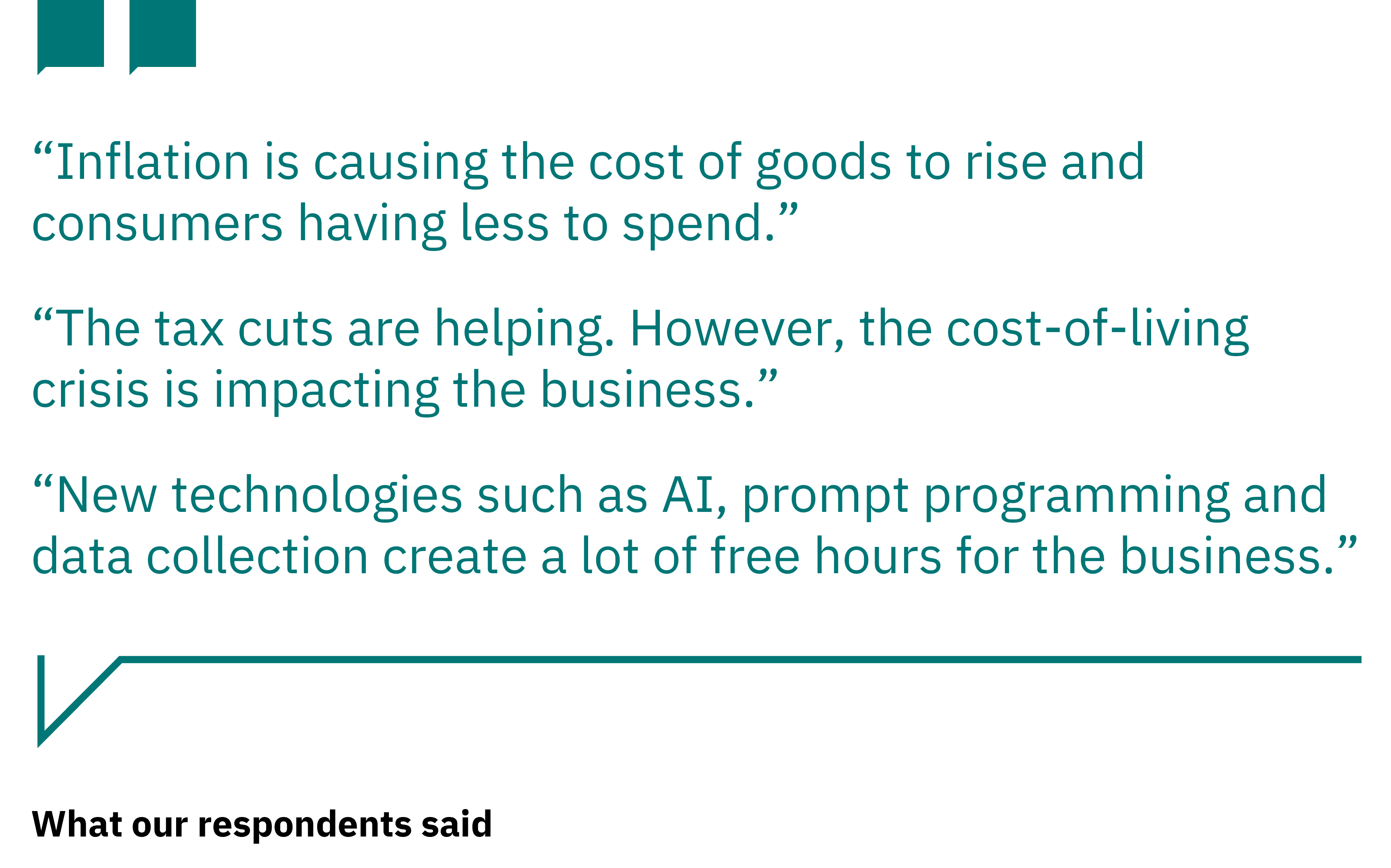

- Confidence is steady and boosted by solid demand, but still being chipped away by increased costs.

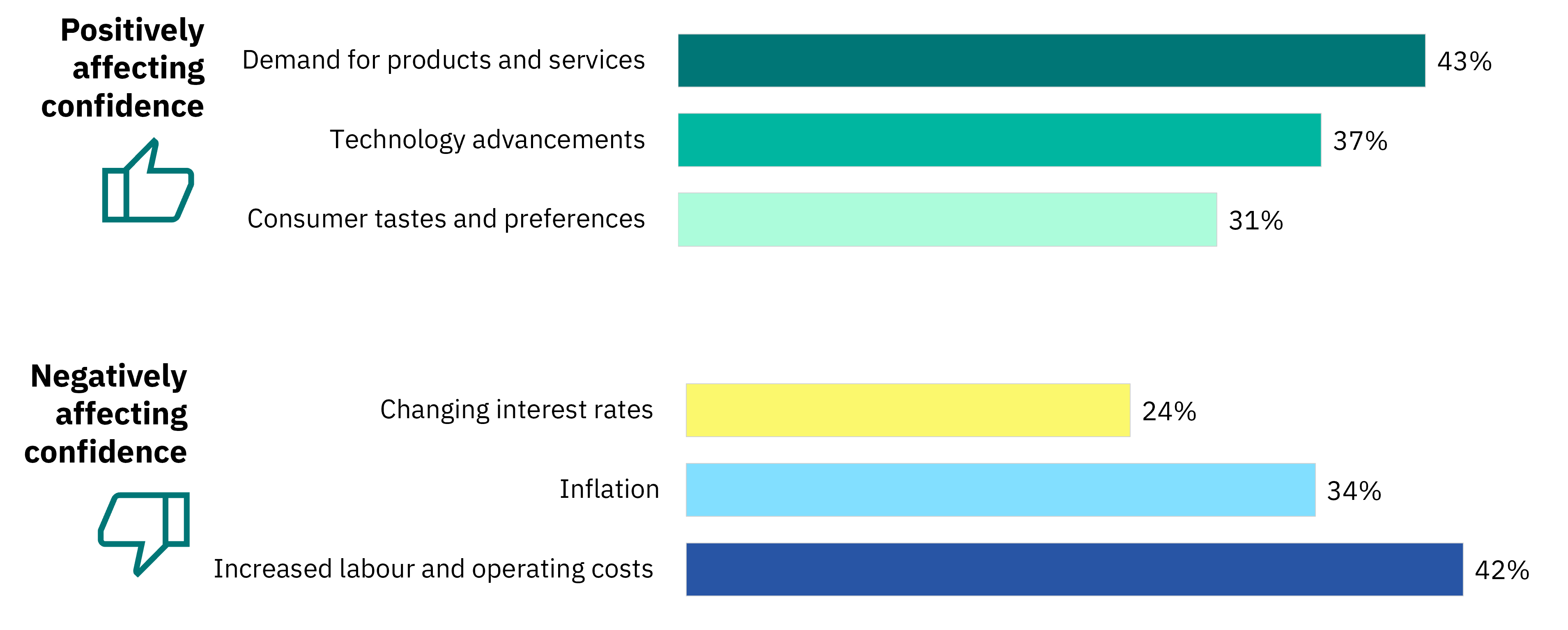

- Australia’s middle market is thinking about succession planning but may not be leaving themselves enough time.

- Succession planning discussions are being put off – how to have the hard conversation.

Read on to learn how you can proactively address these challenges and ensure your business continues to thrive or access a PDF version here.

Business confidence

Succession planning

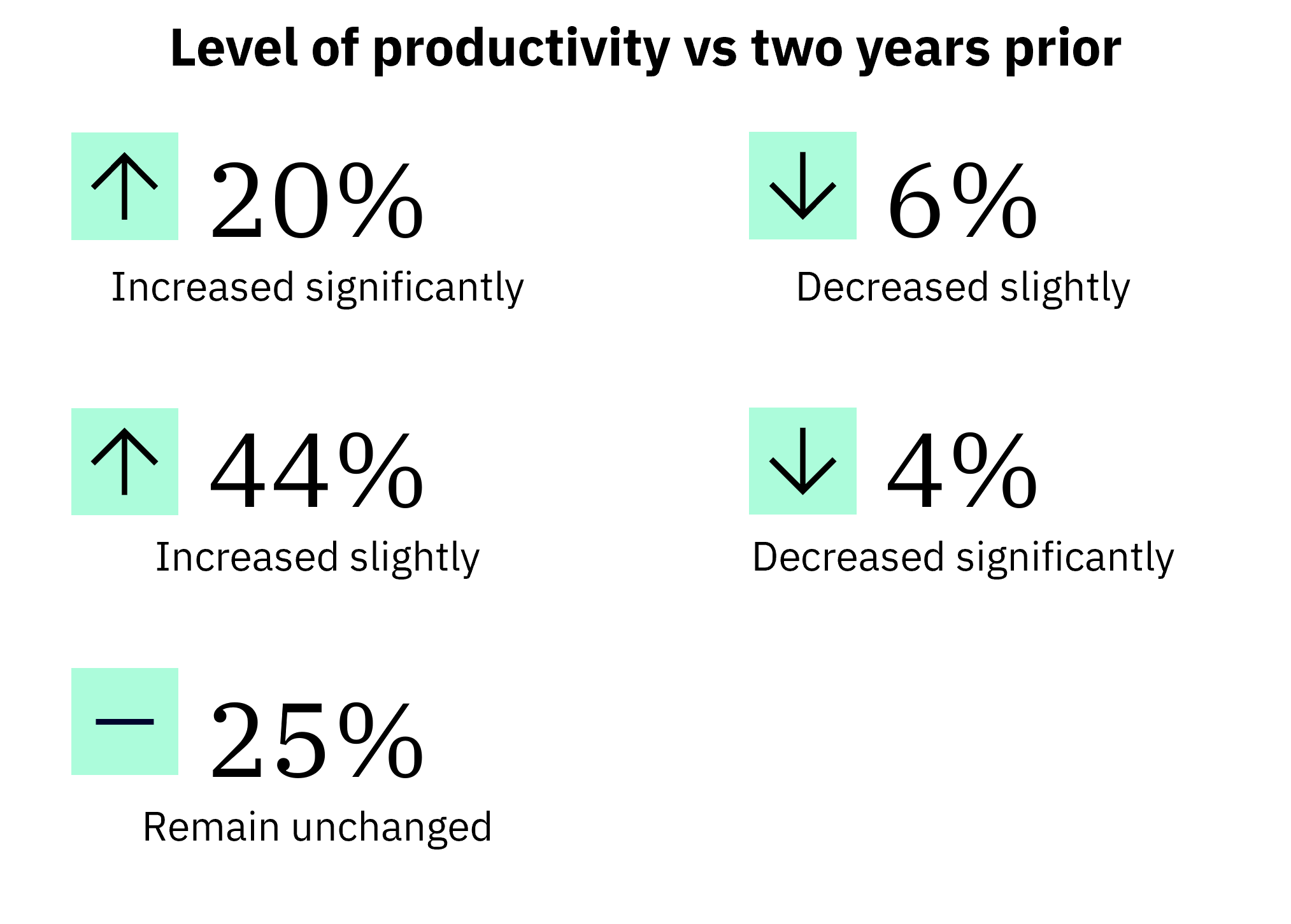

The pressures of productivity

Our experts