Australian economic update

Conventional economics would portend that the blunt instrument of 13[1] interest rate rises since May 2022 would be more than enough to squeeze the life out of the consumer and send the economy into a tailspin.

Yet, this would be an oversimplification that fails to account for the complexities and nuances of an economy that supports the aspirations and dreams of over 27[2] million people.

Despite the headwinds of high interest rates and inflationary pressures, the domestic economy continues to hold up better than expected, recording GDP growth of 1.5%[3] over the year to December. Timelier datapoints, including the latest unemployment figures for February (which fell from 4.1% to 3.7%[4]), suggests that this modest growth trend has continued over the first few months of 2024.

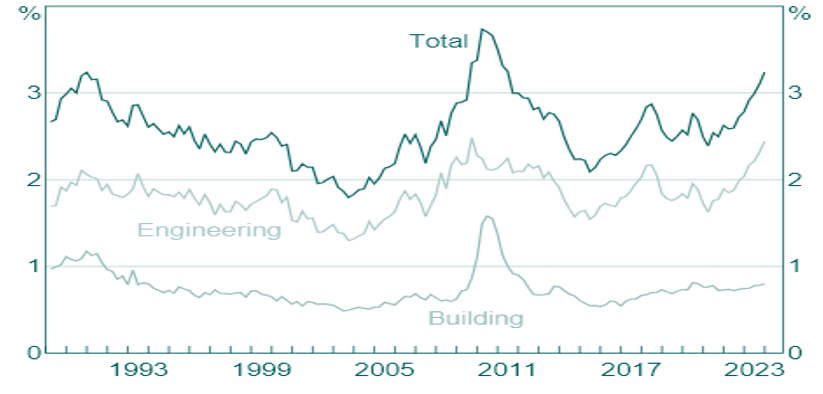

Clues as to why the economy is not yet contracting are littered across the landscape. Traversing across the city and sprawling suburbs of Sydney reveals a series of complex road and rail infrastructure projects that are a testament to the marvel of engineering and human endeavour. Similarly, other large scale construction projects across the country continue at pace. In Western Australia, the green energy transition supports a swathe of mining construction projects in addition to the more traditional Liquified natural gas (LNG) projects.

Public Construction Work (Percentage of Nominal GDP)

Source: ABS, RBA Chart Pack[5].

With less fanfare, but no less importance, has been the evolution of the NDIS industry which now helps improve the lives of thousands of Australians and supports over 320,000 workers[6] as well as the businesses that are interlinked. Further, in response to the closed borders and labour shortages experienced during the pandemic, the government allowed an influx of new migrants, which has also been supportive of growth, albeit with unintended consequences (worsening the housing crisis).

Against this backdrop, it is impossible to ignore the looming headwinds that continue to threaten the outlook.

Some economists continue to believe that inflation remains a key risk, but we do not subscribe to this view. While it is true that services inflation remains elevated as insurance premiums soar and the limited supply of housing continues to put upward pressure on rents. We have however seen a moderation outside these areas as household incomes continue to be eroded. We would argue a material reason that services inflation is elevated is because landlords have been passing on rent increases to cover their higher mortgage costs and this pressure should abate once the RBA starts to cut. In our view, monthly employment datapoints can be unreliable and so to suggest that there could be any reignition of wages inflation due to a tight labour market is highly unlikely given that both job vacancies and hours worked are still both decreasing.

We have also seen a significant deceleration in goods inflation courtesy of China’s extraordinary overinvestment in many manufactured goods (EV’s, steel, semi-conductors, solar panels, etc) that has helped export disinflation across the world. It has been estimated that by the end of next year, China will have built enough solar and battery capacity to quadruple the entire global supply of these products[7]. It already has enough capacity to meet global EV demand three times over.

The real risk then remains the evolution of China’s economy. Not only have China’s authorities made significant policy errors in recent years by curbing private sector investment and innovation, but this has been compounded by the implosion in China’s property sector. This sector remains in turmoil following the collapse of Evergrande and other large developers. With property prices falling in China[8] after years of massive over-investment, it is difficult to see this sector improving anytime soon.

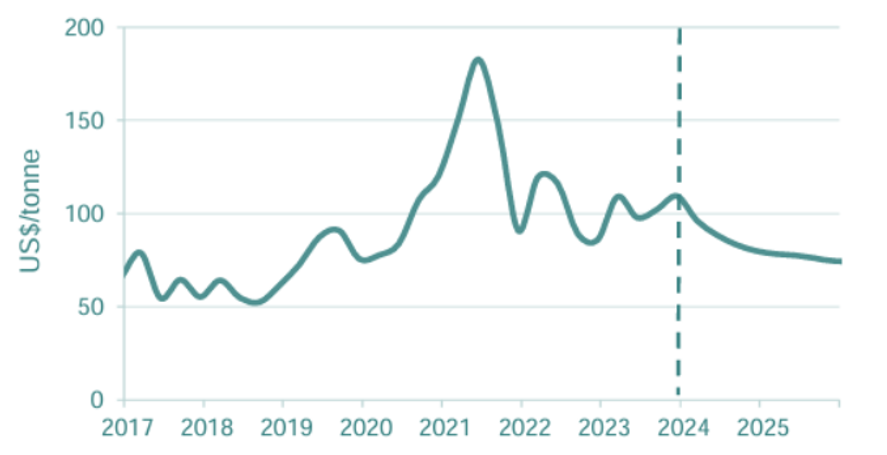

The significance of this cannot be understated. Failing large scale government stimulus, which will only exacerbate its structural debt problems, China’s economy is likely to continue to slow. These structural problems are a by-product of heavily indebted local government authorities and state-owned enterprises that overinvested in unproductive property and infrastructure assets to keep GDP growth on target. A decline in dwelling construction is now inevitable, which will reduce demand for steel and in turn, iron ore, Australia’s biggest export commodity. Moreover, iron ore supply is set to surge[9] in 2025 as new mines in the African region of Simandou become operational.

With export revenues set to fall, mining profits and mining services profits are also likely to decelerate, reducing government revenues. This comes at a time when heavily indebted households have experienced a sharp decline in disposable income and have near exhausted their savings buffers.

Iron Ore Outlook

Source: Office of the Chief Economist, Resources and energy quarterly[10]

It follows then that the sizeable headwinds facing the Australian economy should drag on growth unless we see the RBA reverse course and begin cutting rates.

Conclusion

The Australian economy is likely to continue softening for the rest of the year as disposable incomes remain challenged by high interest rates and cost of living pressures. These impacts will be compounded by a likely decline in the price of Australia’s largest export commodity, iron ore, as China continues to come to terms with the implosion in its property sector. This fall could reduce exports, decease profits from the mining sector and reduce government tax revenues, all of which are likely to exacerbate the downturn unless the RBA starts to cut interest rates soon.

Part 2: Key economic indicators

| Economic snapshot | Last reported result | Date |

| Growth (GDP) | 1.50% | Dec-23 |

| Inflation | 4.10% | Dec-23 |

| Interest rates | 4.35% | Feb-24 |

| Unemployment rate | 4.10% | Jan-24 |

| Composite PMI | 52.1 | Feb-24 |

| Economic snapshot | 2024e | 2025e |

| Growth (GDP) | 1.4% | 2.2% |

| Inflation | 3.3% | 2.8% |

| Interest rates | 4.0% | 3.3% |

| Unemployment rate | 4.3% | 4.6% |

| US Dollars per 1 Australian Dollar ($) | 0.69 | 0.70 |