Active Management – Cutting Through the Noise

Pitcher Partners Investment Services (Melbourne) | The information in this article is current as at 01 October 2023

At Pitcher Partners Investment Services, we continue to be a long-term believer in the merits of active management. However, when it comes to selecting active fund managers, the process is not straight forward.

When you analyse the historical data across the industry, you may be surprised to see that the odds of picking a successful manager are not in your favour, despite the tenacious marketing activity from some of the big active management houses.

We take a deep look at what the actual performance data tells us about how active managed funds have performed in Australia and discuss what approaches or considerations can help to improve your chances of generating long term outperformance through actively managed products.

One of the age-old debates in investment circles is the role of passive vs active management in a portfolio.

Either approach at certain times may be better suited to certain investors, however not many people can deny the lure of chasing and achieving big investment gains or beating the ‘market’.

Later, we will discuss why the generation and retention of outperformance (otherwise referred to as ‘alpha’) through fund manager selection is challenging to achieve, but not impossible across the different asset classes.

As a result of comprehensive sales or distribution efforts, ‘placed’ media, selective interpretation and glossy marketing from active fund managers, the industry hasn’t done a great job over the years setting more realistic expectations about ‘alpha’ for investors. Equally, supporters of passive investing can apply subjective judgement and data to support their own beliefs and/or commercial interests.

Driving this marketing machine are the billions and billions of fees that are extracted by the global funds management industry every year from the trillions of dollars in funds under management deployed around the world.

Despite a lot of the exuberance that surrounds this industry, there is no one set formula or process or approach that guarantees outperformance on a consistent basis. Indeed, despite major advancements in computing power, education and academic research (despite what many professional investors will tell you), there is also no way to consistently measure what contributes most to outperformance – is it skill or luck? Or both?

Perhaps consistency is the most reliable indicator of fund manager skill? Do we focus solely on that when reviewing fund managers to invest with? Being lucky though can prove to be extremely profitable and valuable to investors as well. Is it just the outcome that counts? I’ve analysed fund managers for the better part of 16 years, and it can still be very difficult at times to independently ascertain between which of these two factors drove performance outcomes for fund managers at certain times.

From an academic perspective, proponents of the Efficient Market Hypothesis will contend that the price of investment securities react immediately in an unbiased way to the receipt of new information. While this does not mean that securities can become mis-priced, it does imply that there is no way to consistently use available information to identify these mis-pricings. This implies that any outperformance generated by a fund manager is either short-lived or randomly generated.

However, theory and reality can often clash, especially with respect to finance. There are certain practical realities and financial market anomalies, including behaviourial biases, market restrictions and information asymmetries that challenge the key assumptions of the EMH – but it does go a long way to explain why it is so hard for so many fund managers to consistently deliver outperformance over time. We will save further debate and critique around the EMH for another article!

Let’s break this discussion into two key components – what the data tells us and secondly, what can we do about it?

Historical data

Spoiler alert – believers of both active and passive investing have something to support their philosophy.

Passive management fans will say:

“The average fund manager underperforms an index.”

Correct! (see Table 1 below). However, who wants to invest in an average manager? Average also implies there is a distribution of returns, with some managers performing above the average and some below. The job is to identify more of the products sitting above the mean and minimising exposure to those below. More on that later in this article.

Active investors will retort:

“Passive funds always underperform because they track an index before the deduction of fees.”

Also correct! However, their average underperformance is generally less than the average active manager, thereby potentially providing more of a predictable journey over time. Investment is not without risk though – this is true in both an absolute return and relative return perspective. Some investors may only wish to tolerate one of these two aspects over time, especially in the absence of greater information and expert opinion / advice.

Now we have got this main perpetual squabble dealt with, let’s take a more meaningful look at the actual data.

Investors experience in the Australian funds management history – 1990 to present

We have undertaken a very detailed analysis of the monthly and annual performance of active fund managers available to Australian investors since 1990, covering thousands of products, categorised across 11 different asset classes and sub-sectors. Alternatives have been excluded given the lack of a relevant benchmark.

Whilst several sectors were in their infancy in the early 1990s, the number of investable products has grown considerably over the last 30 years and, despite a little sample bias in the early years, we wanted to provide a complete picture as to the reality of the product choice facing Australian investors over this time frame.

Table 1

Source: PPIS Research, Morningstar

There is a lot to unpack here, and we would encourage you to discuss the messages here further with your Pitcher Partners adviser. We also remind you these are the average fund manager outcomes only – individual fund outcomes can differ greatly depending on the underlying investment strategy – both positively and negatively!

Here are some of the key observations the data tells us:

- The average fund manager does indeed generally underperform the index, which is caused predominantly by not outperforming its benchmark when the market rises; however, when markets are falling, they are generally a lot more resilient.

- The data shown above are on an-after basis. If we compared these on a pre-fee basis using each category average fee load, all the equity categories (except for listed property and global SMID caps) would be demonstrating a positive alpha contribution across all markets. This messaging around fees is consistent with several academic studies undertaken in the US.

- The ‘up and down month’ average returns for each category indicate that there is a wide dispersion of returns around the average monthly index return. This implies there is genuine scope in picking outperforming managers, however the skew between the up and down month average returns, highlight that the losers ‘lose’ more than the winners ‘win’, therefore it’s all about careful manager selection.

- The old adage of picking active managers in inefficient markets plays out – to a point. Australian small cap managers provide the greatest opportunity set, while the average emerging market and Asian equities and Global Small Mid cap managers are perhaps not as effective as more efficient markets or asset classes, which challenges a lot of the assumptions these managers promote to investors.

- The fixed income asset classes surprised us the most in this table. Products in these categories are index aware and therefore highlight the importance of incorporating additional specialist credit products (not covered in this analysis) and unconstrained managers as part of a diversified portfolio over time. Given the low interest rate setting in prior years and subsequent inflation driven sell off, very few new products have been added to this segment, perhaps exacerbating this relative performance drag.

- With the average active manager generally struggling to outperform in rising market conditions, it’s no surprise to see a greater interest in the role of specific index tracking strategies when undertaking shorter term Tactical Asset Allocation (TAA) decisions.

- We also note that these averages do gloss over smaller time periods where we can see 70-80%+ of managers outperforming (see charts below). But we also see some months where only a very low proportion outperform (if at all).

Source: Morningstar, PPIS Research

Given financial markets’ inherent unpredictability, it’s clear that there is a challenge around not just generating alpha, but consistently doing so (and protecting what you have already made), as we discussed earlier around the assumptions of the EMH.

Too often people simply rely on investing in a managed fund that performed well in a previous year. This type of decision making is unfortunately exacerbated by the issues also discussed earlier around selective or perhaps lazy marketing, selective data representation etc – it also preys upon common investor behavioural traits such as recency bias.

But what does the data tell us? To keep the chart below less ‘busy’, we have looked at the four main asset classes – local bonds and equities, as well as global equities and global bonds. We selected each fund that outperformed in a given calendar year (since 1990) and then calculated what was the following 3yr average excess returns for all those managers – the answer is pretty clear, outside of fleeting outperformance from Australian bond managers, this is not a sustainable way to pick winning fund managers!

Source: Morningstar, PPIS Research

But what if we homed in on the very best 3 performing Funds in each asset class? Would the outcome be different?

Source: Morningstar, PPIS Research

While it’s still messy, this chart showcases the following 3yr excess returns of the top three performing funds in a peer group in a given calendar year. There is a little more success here but it’s still elusive. Equities provide some of the better opportunities and perhaps points to the duration of particular cycles or themes occurring in markets at those times.

This perhaps gives us a little more to work on, but what can we do to improve our chances of consistency than trying to follow what has simply just done well in the past, given the evidence generally points to a mixed outcome at best.

We believe you can significantly improve your prospects of picking the long-term winners by considering the following points.

1. Adopt a total portfolio mindset

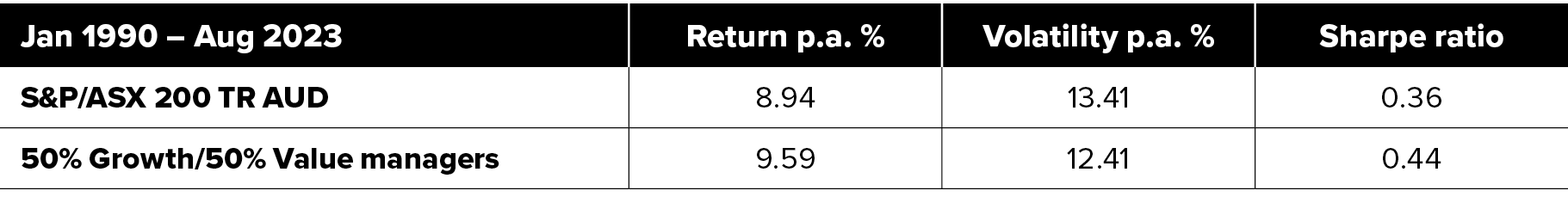

Not all managers can perform well all the time – for example, growth and value equity managers will perform well at different points in the market and economic cycle. Allocating to both has the potential to improve the consistency of investment outcomes and probability of outperformance over the long term.

The table below provides a simple illustration of this approach. A combination of both growth and value managers investing in Australian equities, held at a constant 50/50% allocation, has not just outperformed the S&P/ASX 200 Accumulation Index, it has generated less volatility as well, delivering superior risk-adjusted returns.

Source: Morningstar, using the Morningstar Aus Large Growth & Aus Large Value sub-categories.

2. Accept that underperformance at certain times is part and parcel of investing

Active and passive funds both underperform, it’s not a novel or unique experience. Even the greatest stock pickers and hedge funds in the world have had their tough or negative periods.

The Medallion Fund, run by Renaissance Technologies, is widely regarded as just about the most successful hedge fund of all time, generating 66% pre fees p.a from 1988 to 2018 (it has since been managed privately for its employees, according to Bloomberg). Despite its incredible consistency, the Fund has generated several 20%+ drawdowns over its history.

Human and systematic errors and traits are commonplace and, given the dynamic nature of financial markets and economies, particular themes or factors reward certain strategies or specific positioning more than others at different times. Building a portfolio that is exposed to a number of these themes and events, can help, but the real secret to success in my opinion is to identify some of the key unique elements specific to each fund manager that can lead to more sustainable and superior performance.

3. Identify a fund manager’s true edge

This is not easily done. Analysing historical performance and positioning data is helpful to build a picture of how a fund manager acts, performs and its risk levels over time. But to stand out from the hundreds or thousands of competing products consistently, there must be a definitive edge to some aspect of the strategy and approach that leads to this performance.

Most robust managed fund research processes should do all the right things – aside from quantitative analysis they should look at the quality, depth, culture and experience of the teams, review the investment philosophy and strategy, assess its risk management framework, its product structure, leadership, financial stability, operational framework, responsible investment credentials and so on. While this helps narrow the investable field to avoid the potential product ‘blow ups’ or frauds, what really places a strategy consistently ahead of its peers is via an identifiable ‘edge’.

In my experience there is no set formula that identifies this, yet ‘independence of thought or process’ is a more common thread. Talent or unique characteristics are finite in any field or endeavour. Sometimes quantifying or identifying this can be more art than function. It can manifest itself in different ways, such as a deep industry specialisation, a very narrow yet durable investment approach, a pragmatic and objective assessment of quality and price, a simple decision-making framework, deep experience, discipline around sell and position sizing, effective capacity management or culture. It can also manifest itself very differently across many investment teams. Perhaps also some people can just be persistently luckier than others.

Summary

So many firms are very well briefed and professionally marketed nowadays, providing greater challenges for independent managed fund research. We believe having deep managed fund research experience and perspective on your side is critical to far more easily sort the wheat from the chaff – but true and definable edges are rare. Critically, some of these edges can persist for the long term, and some can dissolve fairly quickly for a variety of reasons.

The data tells us that while successful active management exists, picking these winning strategies, especially consistent ones, can be elusive. At Pitcher Partners, we believe there are techniques and approaches to help improve your chances. It’s not easy, but we believe persistence and thorough due diligence provides the greatest opportunity to uncover these strategies and we remain committed to do so. We encourage you to discuss this topic further with your Pitcher Partners adviser.