Real estate has long been a trusted investment but at times when low debt and high liquidity are necessary, such as in retirement, people should be open-minded about other investment classes.

Australians love property and for good reason. National dwelling values have increased by 5.4% p.a. on average across the last three decades, highlighting the value in a tangible investment that has delivered impressive returns over the long run.

As much as 57% of household wealth is held in housing, but as retirement looms it might be time to embrace the advantages of more liquid asset classes, such as shares and bonds.

Liquidity refers to how easily an asset can be converted into cash when needed. Real estate and shares and bonds offer the potential for attractive returns over time, but the difference is how readily we can tap into our investments. Converting real estate into cash can be a time-consuming process but shares and bonds can be quickly accessed.

Portfolio diversity is important to consider but so are individual circumstances. People may need to finance treatment for unexpected health complications, travel or support for their family and a liquid investment can come in handy if something unpredictable arises.

Debt is also a factor. Real estate is often a leveraged asset but in retirement people should be as close to debt free is possible, for two reasons.

Loan repayments are obviously an additional drain on cash flow, and if a retiree’s marginal tax rate is nil, claiming interest costs as a tax deduction may no longer be beneficial.

Case study: Property vs Shares

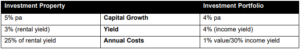

Let’s consider two retiree investment scenarios, each with a value of $1.5 million, and we’ve intentionally made the total return assumptions similar so that we can focus on the impact of liquidity.

The ‘Investment Portfolio’ features liquid assets, with approximately 75% growth assets (shares) and 25% defensive assets (bonds) – similar to what would be offered in most super funds. The returns are not guarantees, or predictions, on what will occur in the future.

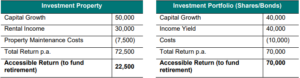

As the below table shows, the total return is similar for both strategies, as expected, but the biggest deviation is with ‘Accessible Return’, which is significantly higher in the Investment Portfolio.

The Accessible Return for the Investment Property is calculated as the rent of $30,000, less costs of $7,500, leaving an after-costs rental amount of $22,500. The Investment Portfolio can fund withdrawals of up to $70,000 p.a. without depleting the capital value. The key difference is the ability to draw-down an amount

equivalent to the capital growth.

The retiree also has easy access to their capital of $1.5m if it is invested in liquid assets, allowing the purchase of, for example, a $100,000 caravan for that long-awaited trip around Australia. Let’s examine the debt angle here as well. Using our example above, any loan repayments on an investment property would be funded from the net rental income of $22,500.

This would further reduce the retiree’s cash flow, which impacts spending on living costs, and potentially leave them exposed to interest rate movements, adding risk to their financial position during an interest rate hiking cycle. Property investors can receive a tax benefit from investment debt, as the interest cost of the loan is tax-deductible. The higher the marginal tax rate, the greater the tax saving. However, a retiree whose taxable income is otherwise zero is unlikely to receive any tax benefit.

While circumstances will differ from one individual to another, retirees should be wary of the risks from holding investment debt.

An investment property may produce strong capital growth, but cash flow is king when planning a comfortable retirement, and liquidity should be one of the top priorities for retirees.

This may mean reviewing your investment strategy, and reallocating funds to more liquid asset classes, as you approach retirement.

A little advance planning can go a long way to ensuring retirees have enough cash flow to fund the retirement lifestyle while remaining agile enough to handle life’s unpredictable moments.