Artificial Intelligence – lessons from past transformations

Pitcher Partners Investment Services (Melbourne) | The information in this article is current as at 07 July 2023

The announcement and launch of ChatGPT in November 2022 was a seminal moment.

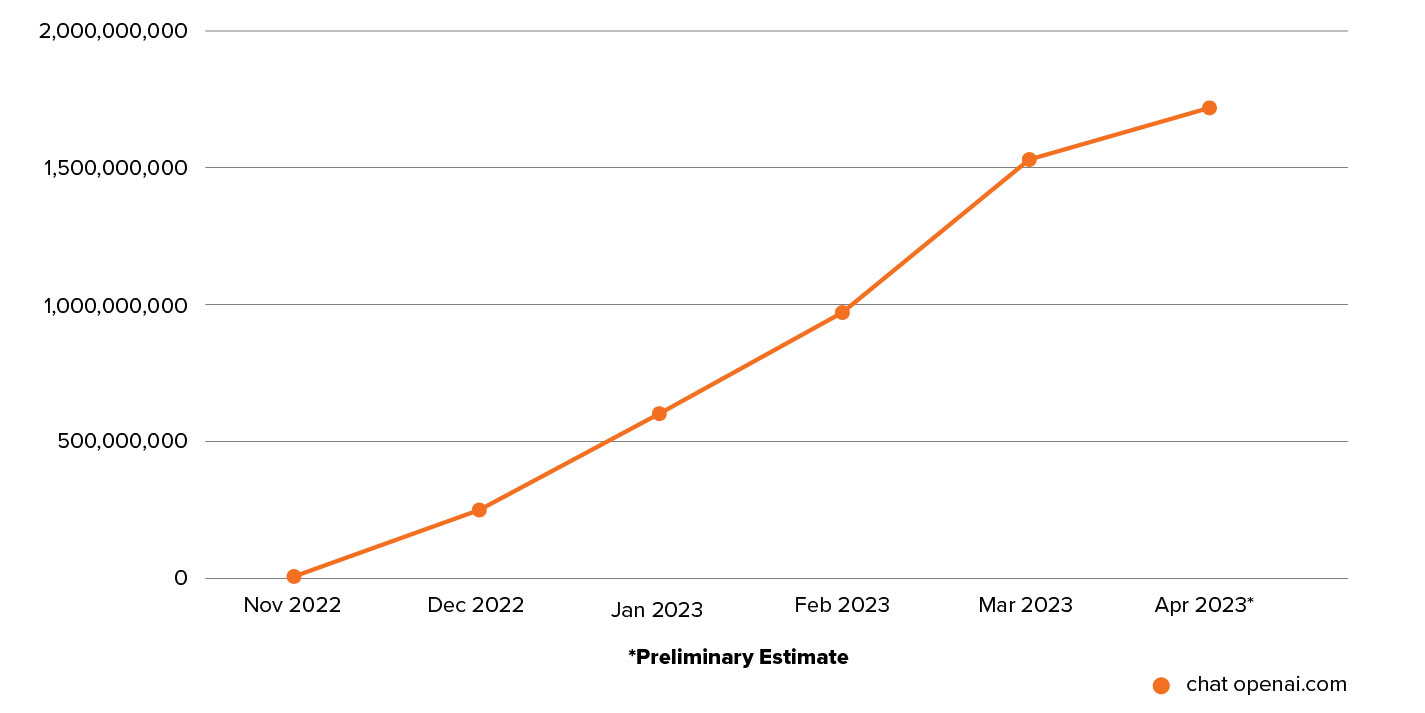

The launch of the Large Language Model (LLM) brought artificial intelligence (AI) into our everyday lives. ChatGPT had a million users within a week of its launch and 100 million within two months, one of the fastest rates of adoption of any new technology/innovation.

ChatGPT – Monthly Visits Desktop & Mobile Web Worldwide

Source: SimilarWeb

While the origins of AI date back to the 1950s, following the development of early computers, it is the development of ultrafast processors and availability of enormous tracts of data, that has enabled LLMs such as ChatGPT to become universally available in the form of a consumer, user-oriented interface.

There has long been interest and excitement around the potential for AI to play a significant role across multiple industries. Healthcare is one such industry, where the potential for AI to play a major role in improving diagnostics and drug development can lead to much improved outcomes for society.

In financial services, a number of benefits to society include the prospect of a more efficient way of identifying and handling of fraud, and improved risk management impacting various forms of insurance premia.

There has even been speculation that AI will be used to release a new Beatles album!!

The arrival of a consumer-oriented AI tool has naturally created a palpable excitement around the potential for AI to become a meaningful catalyst for change and a driver of significant productivity gains. This has caused a flurry of excitement among investors around any potential benefit. Stocks which are seen to be beneficiaries of AI have rallied hard in recent times (such as US listed Nvidia), and the market has begun to negatively view stocks which are seen as longer-term losers from this paradigm.

There are likely to be numerous opportunities for investors as the AI world opens up around us. However, when faced with potentially monumental transformations, it is important to take into consideration how previous large transformations have been implemented and fared.

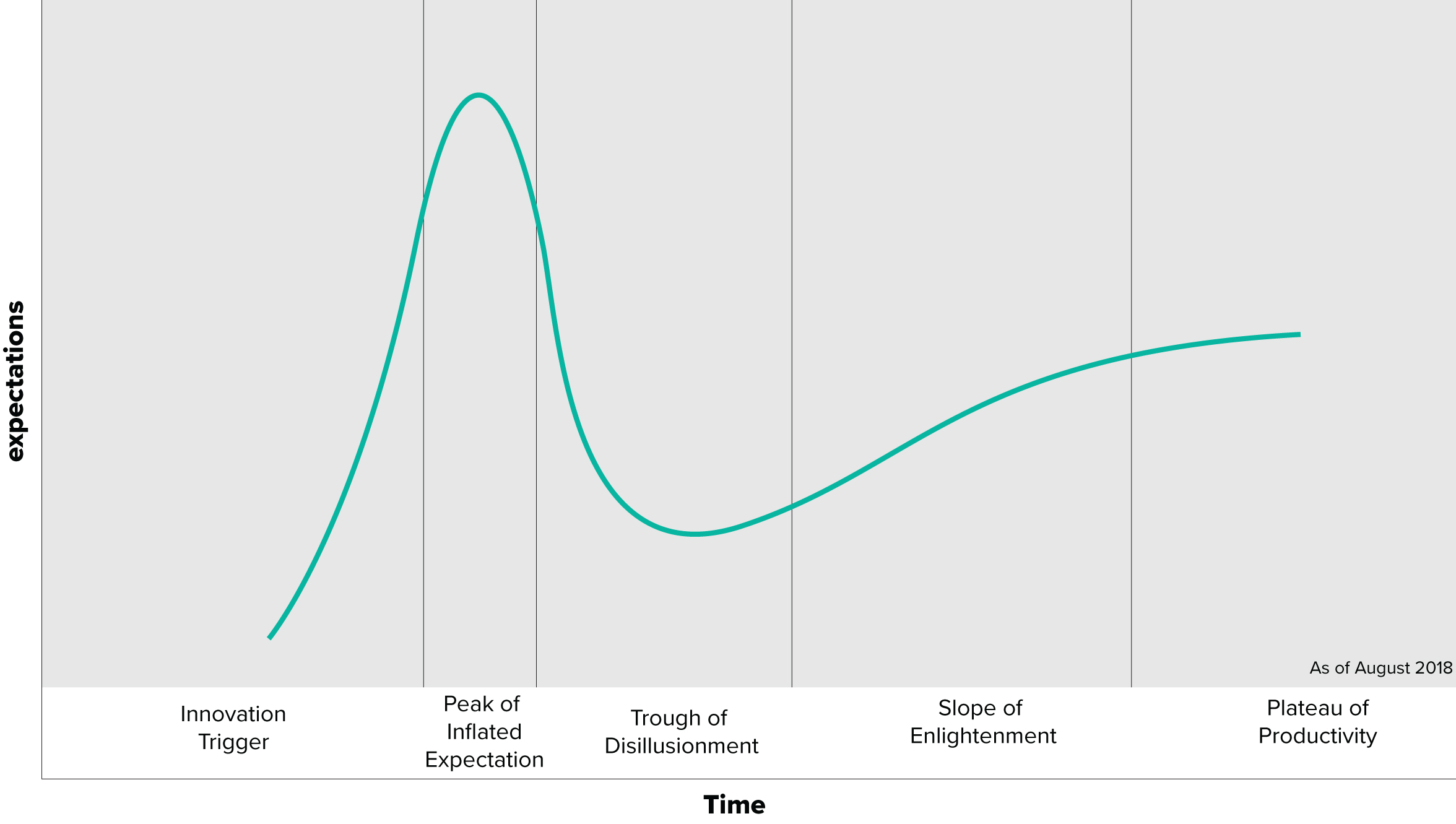

Roy Amara, an American futurist, scientist and researcher developed a poignant adage around forecasting the effects of new technologies. Amaras Law, as it is known, states that “we tend to over-estimate the effect of a technology in the short run and underestimate the effect in the long run.”

Certainly, this law has applied in various ways over several of the last few major technological cycles. The long-term, key applications can take years to develop, and so it remains difficult to know the adoption, growth and pace of growth will look like over the coming years.

The advent of the internet in the 1990s, when it became increasingly available to consumers, also saw a tremendous excitement and fervour over the potential it would have. This led to an almighty bubble in valuations before it deflated when the bubble burst in 2000. However, despite this, the internet has become an integral part of our lives.

The internet saw several impact waves for consumers, the first being the ‘information age’. Also called web 1.0, it was where the internet provided a new and far more efficient access to information and websites provided static content to users, with very limited interactivity.

The second wave, called the ‘platform wave’ or web 2.0, took place after the bursting of the internet bubble in 2000. This saw the rise of social media platforms where interaction and the creation of new content was the primary driver. Consumers were suddenly creators of content, as well as being consumers of content. This second wave also saw a tremendous value creation for the key stocks in this space, far greater than the value created in the first wave.

The typical path to full productivity by a new technology coming about sees it pass through several stages before it reaches its natural glide path. This has been researched at length by the global technology research firm, Gartner, and is called the ‘Hype Cycle’.

The Hype Cycle

Source: Gartner

Given the typical cycle for new technologies being adopted and becoming mainstream, the path from here will likely see several stages yet to be experienced.

Previous technologies which have generated considerable hype have ended up fizzling out (personal 3D printing, anyone?), whereas others have taken considerable time to become fully effective. For example, 3G mobile took 5-8 years to come to fruition.

Amid the excitement, there are some fears being raised – most radical being the spectre of Skynet, the takeover of the world by robots, as depicted in the Terminator movies.

But perhaps more relevant are the ones AI-pioneer Geoffrey Hinton and a host of other AI experts recently warned about – the potential for ‘bad actors’ to misuse AI. A recent letter from prominent scientists and computer experts has raised the concern of the need for a balanced, regulated and measured roll-out of AI.

A lot of uncertainties are still to be determined regarding the consumer use of AI, namely copyright to information and data, data protections, spread of misinformation, etc.

Data governance is a key issue – being able to trust the data and know it is not being misused or violating privacy will be a key concern for many and will play a role in determining the development and adoption of AI more broadly. Fraud and crime are also a potential issue where AI can be misused.

A key aspect of the success of AI will be trust, safety and integrity. Regulation will likely come in, and the time that is needed to fully develop the ‘killer’ applications that will truly benefit from the advances in AI will not be instantaneous. The path for regulation will be uncertain and evolve over the coming years.

AI has all the hallmarks of becoming a likely force for positive change, and numerous productivity benefits are likely. However, the technology is at the early stages of what could likely be a long-term inflection. The peak of AI usefulness is likely many years, if not decades, off.

While it is fair to believe AI is for real and will likely lead to some great efficiencies, it is likely early in predicting the extent to which it will change the ways we do business and deliver meaningful gains for investors.

The hype and excitement around AI raises the spectre of valuations in certain stocks directly seen as AI-plays becoming frothy. The prospects of a larger market bubble arising out of the AI frenzy should also not be discounted. However, there is still ample opportunity for investors to profit from the underlying tools and services that will support this paradigm over a longer term basis. Sometimes, adopting a selective approach to investments is likely to be the best course of action, and the biggest beneficiaries may not have emerged yet. While AI will undoubtedly result in meaningful outcomes for investors, there will potentially be some significant ups and downs along the way.