Pitcher Partners Business Radar 2022 report asked mid-market businesses how they were thinking about, implementing or reporting ESG (environmental, social and governance) initiatives.

The report defined ESG reporting as reporting practices that seek to manage the broader impact of the business on society and the environment as a whole.

ESG initiatives – inevitable business necessities

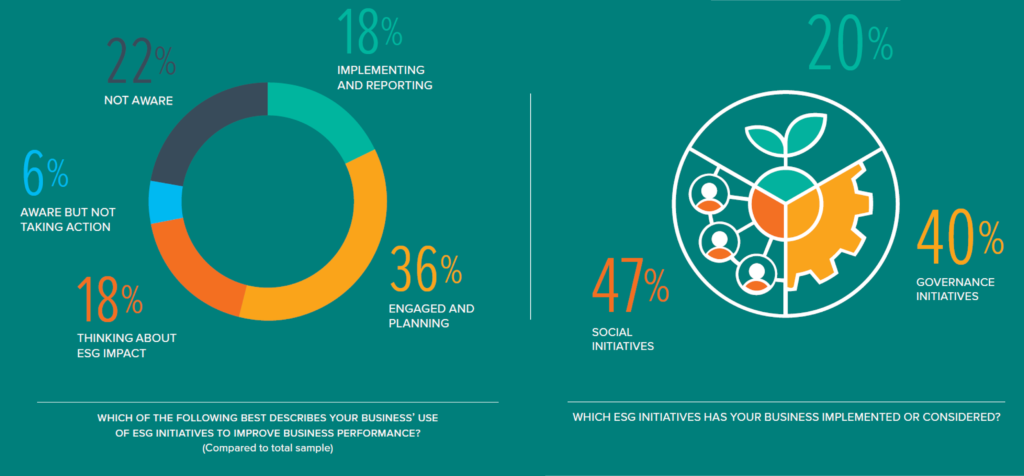

After the rocky few years in business our respondents have had, perhaps it’s to be expected that only 18% have implemented and are reporting on initiatives surrounding ESG (environmental, social and governance) practices, with high confidence businesses more likely to be in this group. Notably, over half of all respondents are planning (36%) or thinking about it (18%).

High confidence businesses tend to be more likely to have implemented ESG initiatives

Personal reasons for adoption, benefits for business

The reasons decision makers consider ESG in the first place are quite personal: community pressure (41%) or alignment with personal values (54%). Once implemented, the reported benefits from ESG initiatives are more business related. 50% said it reduced costs, 47% said it improved revenue and growth and 43% said it increased employee engagement. Environmental issues have the lowest adoption among businesses implementing and reporting ESG initiatives (20%), with much higher numbers for social initiatives (47%) and governance initiatives (40%). This is still a developing space within the mid-market and with a sample size of only n=30, we need to be wary of any conclusions taken from these results

ESG adoption held back by uncertainty

Most businesses already running ESG initiatives experience fewer challenges compared to benefits, businesses who are still considering adopting them are worried about increased cost, tracking the benefits and how they’ll respond to future standards and requirements. Businesses can sometimes fear that starting the ESG process is, ‘writing a blank cheque’ for future regulations or standards..

Insights for business

With fast evolving community sentiment following fires, floods, health concerns with the pandemic, and a likely increase in federal and state regulations relating to ESG (the Modern Slavery Act being an example of this) it appears to be a matter of when, not if, mid-market businesses should step-up their actions. Globally ESG is taking on increased prominence with some estimates suggesting assets invested in ESG strategies may reach $41 trillion by 2022 and $50 trillion by 2025, one third of total assets under management globally according to Bloomberg Intelligence. Currently ESG reporting is not mandatory for ASX listed companies, however, regulation is accelerating globally, trickling down through to mid-market businesses via sourcing and supply chain, access to finance, merger and acquisition and community and customer knowledge and expectations. Promoting corporate responsibility and managing a company’s broader ESG impact are taking on increased importance across both public and private markets. This matters for businesses because:

- It can impair potential sale value in an exit strategy if a business has meaningful ESG risks, conversely it can increase a business value if it has meaningful strategies in place.

- It can spark customer alienation, hitting business sales and profits.

- It can deliver differentiation in brand, products or services creating a competitive advantage.

- It can improve employee engagement and talent attraction.

How businesses approach ESG can be influenced by their personal beliefs (54%) or level of understanding and certainty in ESG factors. Less certain organisations can conduct a risk focused scan of their customer expectations, sourcing, supply chain and operating environment to assess the risk to the business of not adopting ESG factors. Mid-market businesses have typically worked hard over years and decades building trust with their community and stakeholders, and they don’t want to undo that good work by misjudging important shifts in expectations. More mature organisations should be looking to consider how to generate value out of their ESG initiatives, whether that be to reduce costs by reducing their energy or resource costs, more effectively engage their employees through social or environmental initiatives or growing their customer base through promoting their ESG initiatives to become more appealing to consumers that value this. ESG is no different to what Pitcher Partners already sees at the core of most mid-market businesses strategy and practices, underpinning the trust they built.

- Social factors are about the community they serve, their customers, reputation, or their people.

- Environmental factors are about being efficient in the use and costs of resources.

- Governance is about controls and procedures, compliance and effective decision making.

If thinking about implementing ESG initiatives, businesses should consider:

- The risk of not implementing ESG (e.g. sales, contract renewal, access to finance)

- How does ESG align to the business’ purpose and strategy

- Which ESG initiatives will have the most significant impact (e.g. cost savings, risk mitigation, differentiation)

- What is the likely cost and benefit of implementation (financial and non-financial)

- What mechanisms need to be in place to monitor and report (e.g. tracking sentiment)

- What additional capability is required to deliver the ESG approach

What to do now

Explore further insights through the full Business Radar hub on our website today