Federal Budget 2022-23 | March

Business left to shoulder the burden as government steps back

On 29 March, Treasurer Josh Frydenberg delivered the Federal Budget 2022-23. The Budget details spending in key policy areas along with plans to encourage investment in training and digitisation as businesses weather another period of uncertainty driven by geopolitical developments and the subsequent economic impacts.

The total cost of budget announcements is forecast to be $17.1 billion in 2022-23 which is included in a total forecast cost of $30.4 billion over the next four years. Specific measures designed to encourage targeted business investment and provide cash flow relief include small business training and technology boost incentives, temporary relief measures in the calculation of PAYG and GST instalments, and a temporary reduction of the fuel excise tax.

While some concessions support the middle market, broader measures to encourage innovation and growth across the economy and a vision for long-term structural reform are lacking. Without this vision, the growing deficit will be an ongoing problem for middle market businesses and future generations tasked with paying it down.

Access our analysis below to understand the specific impacts of this year’s Federal Budget on individuals and middle market businesses.

We ran two online events on Thursday 31 March, covering the tax and economic implications of the Federal Budget and what it means for individuals and middle market businesses. The recordings are now available.

At first glance it could be said that this year’s Budget lacks meaningful intentions for greater innovation in the business community. However, on closer inspection, it can be argued that it supports the mantra of not interrupting the current endeavours of business to make their way through challenging headwinds.

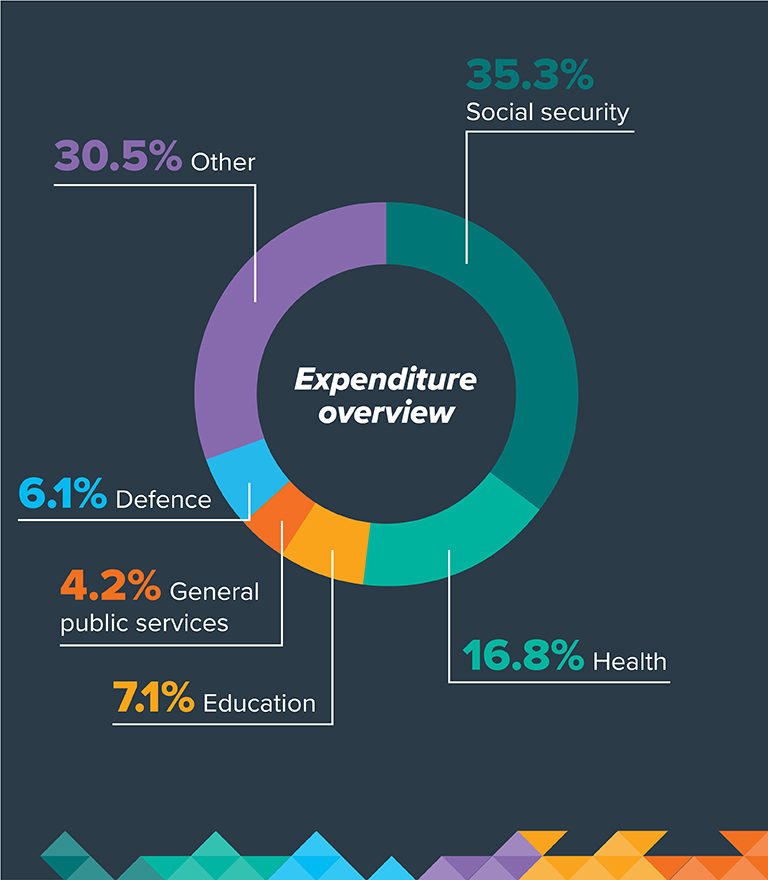

Fast facts

Deficit

The underlying cash deficit is forecast to be $78 billion in 2022-23.Government debt

Gross debt is forecast to be $1.17 trillion by 2025-26, or 44.7% of GDP.Personal tax

An additional $5.6 billion in tax cuts through a one-off $250 cost of living payment to welfare recipients and a new $420 tax offset for low and middle income earners.Attracting talent

Expansion of the Employee Share Scheme rules to encourage talent reward and retention in unlisted companies.

Reducing unemployment

$2.8 billion in payments, over five years from 2021-22, to new apprentices and the businesses who take them on.

Infrastructure

An additional $17.9 billion for priority rail and road projects across Australia.The Government announced it will extend the Tax Avoidance Taskforce for a further two years to 30 June 2025, while expanding their digital data matching capabilities in respect of trust tax returns and payroll data exchanged with states and territories.

Small businesses will benefit from an extra deduction of 20% on expenditures which improve digital capabilities and upskill employees. Further, proposed PAYG instalment changes will assist with cash flow, and proposed changes in relation to carbon tax treatment will assist primary producers in smoothing their income.

In response to the rising cost of living and associated pressures the Government has announced an increase of $420 in the “low and middle income tax offset” for the 2021-22 income year but no changes to the personal income tax rates.

The Government has broadly left the superannuation system unchanged but has extended the minimum drawdown percentage to 30 June 2023 in a bid to minimise the forced sale of investments to pay pensions. Any individual with an account-based pension, allocated pension or market-linked pension is eligible to reduce their minimum pension for the 2023 income year by up to 50%.

In response to growing cost of living pressures, the Government has announced a temporary reduction in fuel excise of 50% equal to 22.1 cents per litre. Providing a saving to both consumers and businesses, this measure will be in place for a period of 6 months commencing on 30 March 2022 and ending on 28 September 2022.

The Government has extended COVID support by treating the cost of rapid antigen tests required for work as tax deductible and exempt from Fringe Benefits Tax (“FBT”). The measure is set to apply retrospectively from 1 July 2021. The Government has also again allowed for various additional State support grants to be exempt from income tax.

The Government has announced that it will be expanding the patent box measures announced in last year’s Budget to additional sectors to drive more investment and encourage Australian companies to commercialise their innovations in Australia. The Government will consult with industry prior to finalising the detailed design of the patent box expansion to the additional sectors.

The Government seeks to expand access to employee share schemes and encourage further employee participation by reducing regulatory requirements for employers that make larger offers in connection with employee share schemes in unlisted companies. Regulatory requirements for offers to independent contractors where they do not have to pay for interests will also be removed. No date of effect is specified in the Budget papers.

The Government will amend Australia’s foreign investment framework to reduce the regulatory burden faced by foreign investors. These amendments apply to unlisted land rich entities and the Acquisition of interests in securities where the proportionate ownership will not increase. The amendments are due to commence for acquisitions made on or after 1 April 2022.

Pitcher Partners insights

Get the latest Pitcher Partners updates direct to your inbox