Semiconductors

Car manufacturers have suffered from a shortage of semiconductors since 2018 due to trade wars and then raw material shortages that were exacerbated by three separate factory fires, the Pandemic and other natural disasters. The auto manufacturers made the situation worse when facing dramatic declines in sales at the onset of the pandemic they slashed their microchip orders. The microchip manufacturers subsequently stopped producing the older less powerful and less profitable chips for the auto industry in favour of those used in technology devices.

Add to this the war in Ukraine, where 45-54% of all semiconductor-grade neon is produced1 and there is not only a shortage of microchips to the auto industry, but in general manufacturing. With demand still significantly higher than supply the ‘Chipdemic’ is by far the biggest cause of the supply problems faced globally and by the Australian automotive industry currently and into the future.

Below is a table of the latest impacts on vehicle production in 2022, totalling 4.3m vehicles.

The breakdown

2022 year to date |

2022 projected |

|

|---|---|---|

North America |

1,267,700 |

1,416,900 |

Europe* |

1,097,000 |

1,450,400 |

Rest of Asia |

702,800 |

907,500 |

South America* |

166,700 |

68,300 |

China* |

167,600 |

272,800 |

Middle East/Africa* |

41,400 |

53,600 |

Total |

3,443,000 |

4,269,600 |

* Unchanged from a week earlier

Source: AutoForecast Solutions Inc. autoforecastsolutions.com.

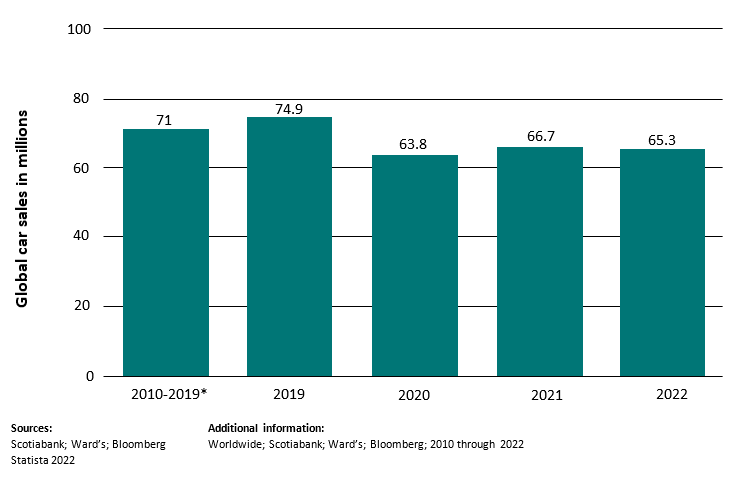

The total impact globally can be seen in new car sales declines of approximately 10-11m units annually since 2019, which is an average of 12.8% when comparing annual volume in 2020-2022 to 2019 (refer chart below). The impact in Australia new car sales volumes has been less severe than the global average. Australia has seen roughly a 5% decline on average when compared with 2019 or ~500,000 cars in total. We cover this in more detail below.

Number of cars sold worldwide from 2010 to 2021, with a 2022 forecast (in million units)

Labour demand lacking (migration)

Australia has a long history of net overseas inbound migration and 2021 was the first year since 1945 that Australia had net loss due to overseas outbound migration2.

This unparalleled run of migration has been contributing to the growth of the population and hence the growth of the economy historically. Governments have used migration to strengthen the labour pool by strategically allowing skilled and unskilled labour in as and when needed.

However, the Motor Trades Association of Australia (MTAA) has been angered by the Federal Government’s omission of any automotive occupation on the latest Priority Migration Skilled Occupations List (PMSOL), as automotive businesses struggle to fill the record number of 31,140 skilled vacancies across the industry3.

According to The Victorian Automotive Chamber of Commerce (VACC), “Automotive businesses are doing everything in their power to address skills shortages. Almost without exception, they are paying well above award wages, they are incentivising remuneration packages and work-life arrangements, seizing every assistance measure and opportunity to hire.” This is a band aid solution in times of increased profits, however if the labour shortage is not addressed this will impact the ability of businesses to continue to service and repair the 20 million vehicles in the national fleet. Recently, the National Skills Commission has listened to the automotive industry and included a variety of mechanic positions to the 2022 Skills Priority List. This is a good start in recognising the shortage of skilled mechanics in Australia, however in order to make any headway into the shortage the Australian Government needs to add the trades to the PMSOL.

Labour and skills shortages will impact on dealer profitability for some time until net inbound migration returns to pre-Covid levels.

1 A. Alper, ‘Exclusive: Russia’s attack on Ukraine halts half of world’s neon output for chips’, Reuters, 2022, https://www.reuters.com/technology/exclusive-ukraine-halts-half-worlds-neon-output-chips-clouding-outlook-2022-03-11/ (accessed 13 October 2022).

2 ‘Overseas Migration’, Australian Bureau of Statistics, 2021, https://www.reuters.com/technology/exclusive-ukraine-halts-half-worlds-neon-output-chips-clouding-outlook-2022-03-11/ (accessed 13 October 2022).

3 L. Grant, ‘Priority skilled migration list is a slap in the face to automotive’, 2GB 873AM, 2021, https://www.2gb.com/podcast/priority-skilled-migration-list-is-a-slap-in-the-face-to-automotive/ (accessed 13 October 2022).

Return to Australian retail automotive industry hub