The third edition of Pitcher Partners Business Radar gathered critical insights that highlight the key challenges, opportunities and trends facing Australia’s mid-market businesses and what they’re doing to grow and thrive.

Interestingly, despite general operational upheaval, many businesses are feeling optimistic as we move forward from the COVID fog.

It’s an understatement to say the last few years have come with upheaval, challenge and opportunity for Australia’s mid-market businesses. COVID-19 slowed or halted in-person business dealings, closed borders to travellers and squeezed staff availability.

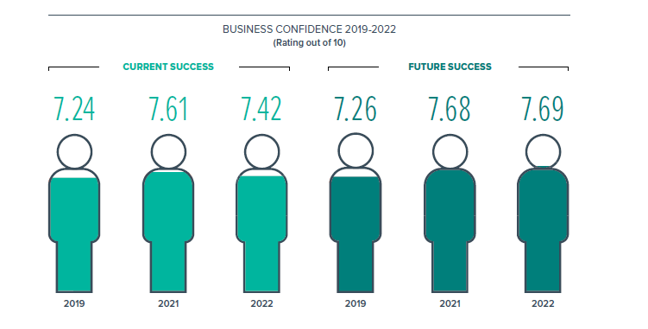

More recently, inflation, rising interest rates and global events have compounded these issues contributing further to the volatility being experienced by the mid-market. And the pace of technological advancement has added both opportunity and uncertainty for business. Despite that, business confidence remains up compared to pre-pandemic 2019, but perhaps the question is how long will this optimism last?

Business confidence: cash flow, leadership and a bit of luck

It’s perhaps surprising that businesses overall were more optimistic about future growth prospects for their industries and the wider economy than they were over two years ago, but dissecting the numbers shows a more nuanced story.

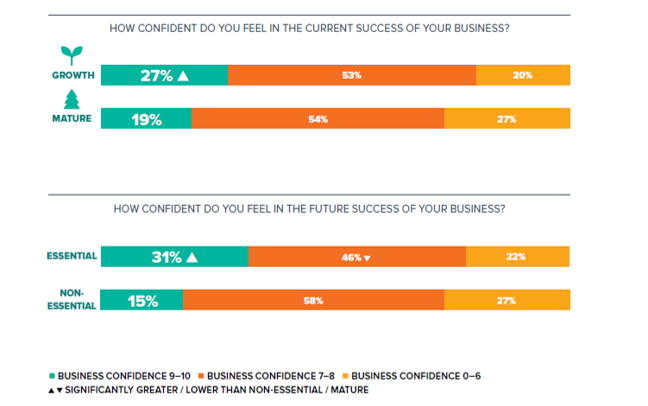

The pandemic has benefited some businesses much more than others. 27% of growth businesses rated their confidence in the highest bracket, 9–10/10. This is significantly more than mature businesses with only 19% rating themselves as in this bracket. Comparing what was deemed to be an essential business to non-essential businesses during our recent COVID lockdown experience, there is an even greater difference: 31% and 15% respectively rate business confidence as 9–10/10. If you were lucky enough to be an essential business, or one whose market experienced an increase in demand due to COVID, the outlook has been very positive.

Strong drivers of business confidence are perennial business basics

Across all mid-market businesses, the top three drivers of business confidence are:

- Strong customer relationships (31%)

- High quality talent (20%)

- Operational efficiency (20%)

Looking at high-confidence businesses, the second and third most important drivers are different to the overall mid-market, being:

- Strong cashflow management (27%)

- High functioning management team and structure (25%)

In a world that is experiencing speed of change greater than any time before, it is heartening to know that the fundamentals of great, successful businesses continue to hold true.

The global pandemic

Our findings reveal that the global pandemic continues to have the most negative impact on business confidence. The second and third most impactful are labour shortages and inflation, both of which can be partly tied to the effects of the pandemic. More recently, the response to inflation, rising interest rates, is starting to bite. All the more reason to focus on cashflow management and capital structures. Respondents also identified the global pandemic as the third most positive impact on their business confidence. In fact, the impact of COVID has been so pervasive, a third of mid-market businesses who identified COVID as a positive also saw it as having some negative impact on their business (31%). The common themes of these positive impacts of COVID for mid-market businesses were that it increased or opened new market demand and accelerated innovation and change. The COVID linked tech advancements and a shift in consumer preferences were also ranked as the two most positive effects on business confidence.

Grappling with uncertainty

29% of our mid-market businesses named unforeseeable events as their main barrier to success – and only 15% say they’re happy to plan further out than five years. Respondents suggest this is likely from the experiences of disruption during the height of the pandemic, leading to a feeling that longer-term planning is less valuable.

It could also reflect an increasing unease with the volatility of the business environment, with supply-chain difficulties and increasing operating costs identified as top barriers to success.

The worrying talent gap

Perhaps most worrying to businesses is the difficulty of retaining and attracting talent, two sides of the same issue and named as both the second and fifth-biggest barriers to success respectively. 31% of respondents also identified labour and staff shortages as negatively impacting their business confidence, second only to the global pandemic (37%). Businesses know this is an issue, ranking high-quality talent as the second most important driver of success.

Insights for business

There’s a degree of luck involved in whether businesses saw the global pandemic and all its spin-off impacts as positive or negative. There is also an attitudinal element. Businesses that were able to identify and respond to market forces and demand, and adopt new technologies or ways of working likely found more opportunities than challenges through the pandemic. Estimating both supply of, and demand for, goods and services takes on increased importance in this disruptive environment. The disruption to manufacturing and logistics caused by COVID has led to supply shortages and left many businesses short of materials to meet the demand of customers. On the flip side, globally some businesses have overestimated demand, or overordered to address the supply shortage, and consequently have needed to write down or store excess inventory. That has meaningful negative implications for business profitability particularly in sectors where gross margins tend to be low e.g. consumer discretionary. Given the uncertainty still lingering over mid-market businesses, supply chain management, retaining or nurturing flexibility, adaptability and nimbleness will be key. However, businesses shouldn’t overlook the critical importance of getting the basics right – great staff retention, excellent leadership and tight control over cash flow.

What to do now

Explore further insights through the full Business Radar hub on our website today.