Thanks to current high and estimated future profits, there are many dealer groups and investors looking to acquire dealerships.

Automotive dealerships have proven to be excellent investments in both good and bad economic times. While there are plenty of buyers in the market, there is little consensus on how to value dealerships. The only thing that can be agreed on is that dealerships are worth more today than they were before the pandemic.

Therefore, one of the biggest questions on every dealer’s mind is “what is my dealership worth today?”

The answer is complicated.

First things first, we need to determine the dealership’s future maintainable earnings (FME). This is covered in detail below. Calculating FME is a mix of art and science that could be aided using a crystal ball, in particular, to determine when supply will return to pre-pandemic levels and when margins will normalise. The second part of the goodwill equation is the multiple of earnings (NPBT) that the buyer is willing to pay of the dealership. We cover the valuation and consolidation trends in the market below.

Current Australian market trends

The current market is ‘hot’ when looking at the present M&A activity. The overarching theme of consolidation continues to drive the activity in the Australian market. The listed and large family dealership groups continue to invest heavily into expanding their footprint to new markets, as well as consolidate their position in their existing prime market areas (PMA). The market has had to shift its approach from traditional dealership valuation techniques in response to what is widely believed to be temporary and abnormal profits.

Public company spending spree

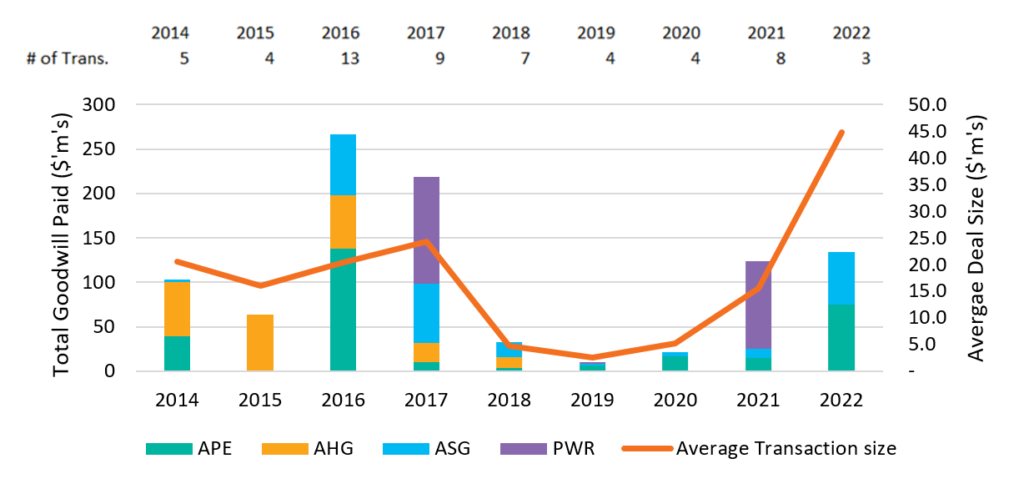

Local M&A has accelerated during the pandemic as dealerships post record profits despite experiencing a reduction in units sold. In recent years, the Australian listed companies have shown their willingness to purchase strategic assets utilising significant amounts of capital, evidenced by the nearly $1bn of goodwill paid in acquisitions since 2014.

Goodwill spent by Australian Listed Companies

Source: Pitcher Partners Analysis – compiled from publicly available information

Notes:

Automotive Holdings Group (AHG) ceased trading on the ASX 27 September 2019 after an on-market take-over by Eagers Automotive

Autosports Group (ASG) IPO 16 November 2016

Peter Warren Automotive Holdings (PWR) IPO 26 April 2021

The industry has been through a period of high gross margins and low interest rates resulting in bloated earnings1. This is evident from reviewing the publicly listed company’s financial statements with significant cash reserves and decreasing debt to equity ratios. Eagers Automotive (Eagers) have announced an on-market buy back of 10% of their outstanding share capital, based on 15 September 2022 market capitalisation, a $325m investment. This will keep Eagers in good stead if the market were to turn, as it is prudent to allocate more cash to share repurchases rather than dividends during a broader economic downturn. The large, listed groups also are not shy when it comes to market consolidation and deploying capital. Sydney based Suttons Group has recently purchased the 9.1% stake in Peter Warren Automotive Holdings from Quadrant Private Equity for $50m.

These transactions reflect the wider consolidation in the retail automotive industry. Australia’s new car market revenues are estimated to be approximately $63.6bn annually2. It’s Pitcher Partners Motor Industry Services (MIS) view that the large dealership groups need to grow turnover to at least $3.0bn annually in the medium term. At this size, the once in a century change occurring in the industry (Electric Vehicles and Agency) will be able to be navigated, assuming there is efficient operating expense management and optimal capital structures in place.

1 S. Bragg, ‘Australian Listed Dealer Comparison 2022’, Pitcher Partners, 2022, https://www.pitcher.com.au/insights/australian-listed-dealer-comparison-2022/ (accessed 23 September 2022).

2 ‘Motor Vehicle Dealers in Australia’, IBIS World Report, 2022, https://www.ibisworld.com/au/market-size/motor-vehicle-dealers/#:~:text=The%20market%20size%2C%20measured%20by,to%20increase%203.5%25%20in%202022. (accessed 23 September 2022).

Return to Australian retail automotive industry hub