Pitcher Partners Investment Services (Melbourne) | The information in this article is current as at 7 July 2022.

The ETF industry has grown rapidly over the past decade. Having initially begun with a series of traditional index tracking products, the sector has evolved which in recent years has resulted in the launch of a number of “thematic” investment strategies. These typically target very specific exposures to niche or structural growth trends such as battery technology, healthcare, carbon credits and many others.

At Pitcher Partners Investment Services we believe some of these ETFs provide an efficient way to gain exposure to these trends via a relatively low-cost passive product vis a vis traditional active managers – however, like every investment, there are pros and cons to assess.

In this report, we examine how the industry has developed and outline some key factors to consider when investing in these products.

ETF Market Overview – Now in the driver’s seat

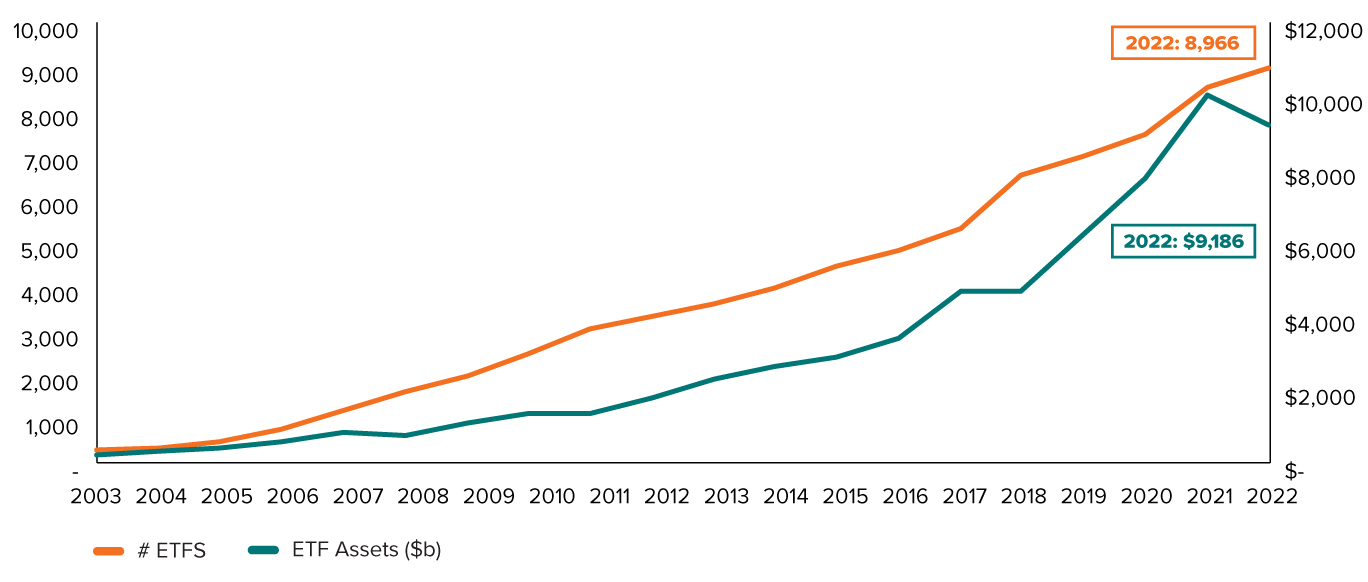

Since the first ever ETF launch in 1993 (SPY – SPDR S&P 500), ETFs have been growing in popularity and it’s not hard to see why; they provide investors with lower barriers to entry and a cost-effective means to invest. Currently there are 8,966 ETFs globally, with a combined total of roughly $9 trillion assets under management (AUM).

Below chart shows the number of ETFs (White) and the AUM (Orange)

Number of ETFs and total ETF assets overtime

Source: Bloomberg

The initial idea was that ETF products would track their benchmarks with very low tracking error. Essentially being the passenger in a car driven by the market.

The EFT market has now grown to such a size and scale that some commentators argue the passive ETF flows are actually market moving (not just along for the ride). There have been instances in the past where ETF products have seen higher trading volumes than the underlying holdings.

According to the CFA Institute, there is evidence to suggest ETFs amplify market movements during periods of stress or uncertainty. Effectively ETFs can exacerbate both the booms and the busts movements. Simply look at what happens when new companies are added to the ASX200 in a rebalance. On certain occasions, we see a dramatic uptick in the share price and volume of these new companies as the passive ETFs invest in them to maintain benchmark weights.

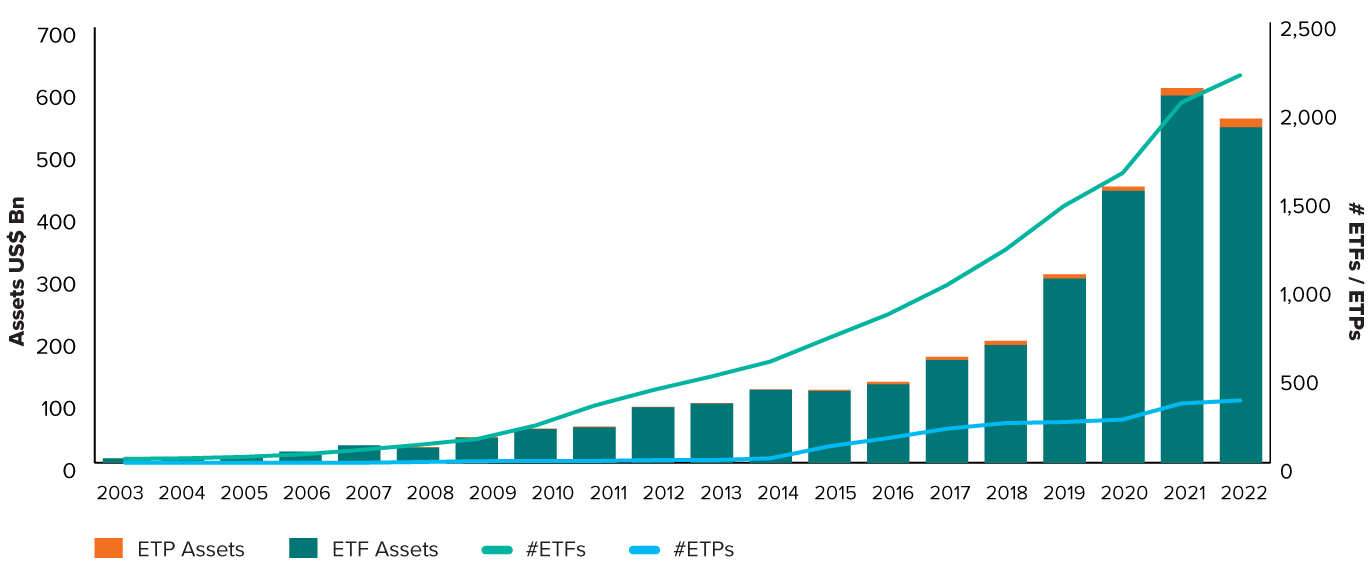

ETFGI ETF/ETP growth charts

Source: ETFGI data sourced from ETF/ETP sponsors, exchanges, regulatory filings, Thomson Reuters/Lipper, Bloomberg, publicly available sources, and data generated in-house.

In recent years, we have also witnessed the rise of active Exchange Traded Managed Funds ‘ETMFs’. Effectively they are listed equivalents of traditional managed funds where investors can buy and sell units at Net Asset Value (less a small fee spread). This structure has helped improve upon the valuation and liquidity inefficiencies that pervade the Listed Investment Company (LIT) sector. This shift is being driven by fund managers seeking to broaden their client mix to a wider audience. As of July 2022, there are over 50 active ETMFs on the ASX with a long pipeline of new products coming.

In Australia alone, there has been a dramatic increase in the number of ETFs over the last 5 years. Not to mention the massive increase in assets under management due to more people investing during COVID-19 lockdowns in 2020/21.

Most broad market index ETF exposures have been covered, so providers have been finding smaller niche products to fill specific portfolio exposures, which has culminated in the rise of ‘Thematic ETFs’.

Thematic ETFs in a Portfolio

Thematic ETFs can provide a useful way to gain exposure to specific trends, themes or industries. They are created selecting a basket of companies which are usually materially exposed (i.e revenue) to a specific theme. The basket of companies are bundled together into a portfolio with generally some rudimentary approach to position sizing / portfolio construction. A rebalance usually occurs on a semi frequent basis i.e quarterly, semi-annually or annually. The portfolios are typically far more concentrated than traditional broad market index tracking strategies.

Thematic ETFs are attractive to many investors given their specific focus, which is usually more difficult to obtain via managed funds which tend to offer far more diluted exposures to individual themes due to their greater diversification.

Role In A Portfolio

Broad market ETFs traditionally have been used as the core exposure in portfolios, which is then complemented by exposures to active managers (or alternatives) seeking alpha above the broad index.

In contrast, thematic ETFs are best suited to fill gaps in portfolio exposures in an already diversified portfolio. Thematic ETFs have fewer holdings, higher levels of volatility and higher fees than broader index ETFs.

Like any investment product, thematic ETFs have their advantages and disadvantages which investors should consider before committing capital.

Advantages

Simplified Niche Exposure: Thematic ETFs are useful when investors seek exposure to specific niche sectors, such as Battery Technology, Biotech, or Cloud Computing, but do not know which companies are the best. These provide a diversified enough exposure to the niche without needing to conduct in-depth research on every company in the space.

Source of Diversification: Similar to how smaller market-cap companies can tactically add risk and higher return to a portfolio, thematic ETFs can provide a version of this via a small basket of companies rather than a single holding. The additional benefit of diversification removes the single company specific risk.

Variety and Ease of Use: Due to the sheer number of thematic ETFs, investors are spoilt for choice. Even within the same niche (for example sustainability), investors have many options to add exposure as each ETF provider has different criteria when selecting companies to include in their product. Investors can easily jump between ETF products without many barriers to entry or exit as they are all listed on the ASX.

Disadvantages

Concentration: Unlike broader market ETFs, thematic ETFs are usually more concentrated with only a handful of holdings. While a concentrated exposure is not necessarily a bad thing, keep in mind that with concentration comes potentially higher levels of volatility. This is potentially exacerbated further given that many niche ETFs tend to (but not always) hold higher allocations of smaller companies. While Market Makers and Authorised Participants are contractually obliged to provide liquidity in the creation and redemption process for these securities on the ASX, liquidity issues for small companies may amplify price drops during market shocks, which we have observed in the recent market sell off.

Cost: Thematic EFTs charge a higher price than their broader index counterparts, some reaching as high as 0.65% p.a. as well as having higher buy and sell spreads. The cost structure of some of these securities are closer toward those of active fund managers, but do not always provide the same requisite level of ‘active management’ (see point below). The question investors should always ask is: “Will I achieve a return to compensate for the level of risk taken and cost?”.

Active Management: Whilst these securities offer a differentiated and ‘active’ return relative to a broad market index, the level of active management of the underlying investments and portfolio itself is typically inferior to that of an active fund manager. The latter would typically employ analysts to constantly review investments and the portfolio every day, making adjustments where required in anticipation of or when changes in the investment fundamentals of a company occur. In stark contrast, most thematic ETFs would typically be crudely constructed and re-balanced on a pre-determined basis (quarterly, semi-annually, annually), which would not be necessarily timed around any perceived or instant changes in investment quality for a security.

Marketing: ETF providers are savvy and persuasive marketers. They typically launch new products only after the sector / theme has been running ‘hot’ – the recent launch of crypto ETF’s a prime example. Investors should be mindful of the timing of any investment in these types of securities. We discuss this effect below.

The Boom and Bust Effect

As discussed previously, the concentration of these investments and the fact they give exposure to in some cases, more speculative investment themes, gives rise to a bumpy journey at times for investors.

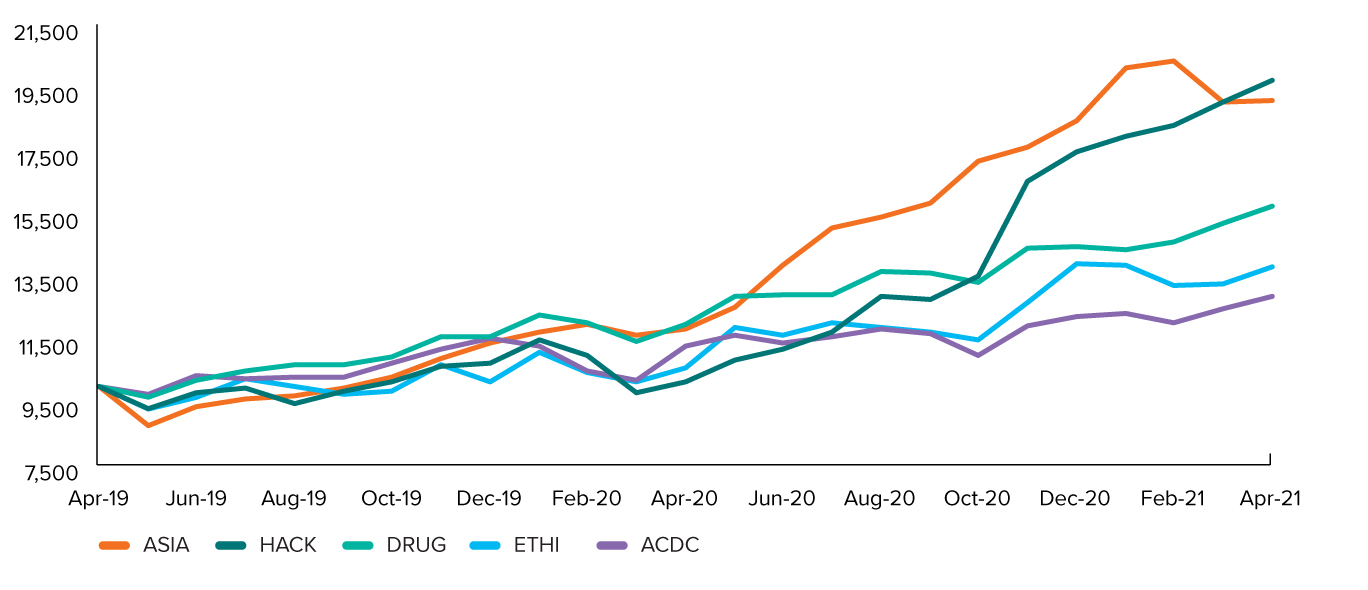

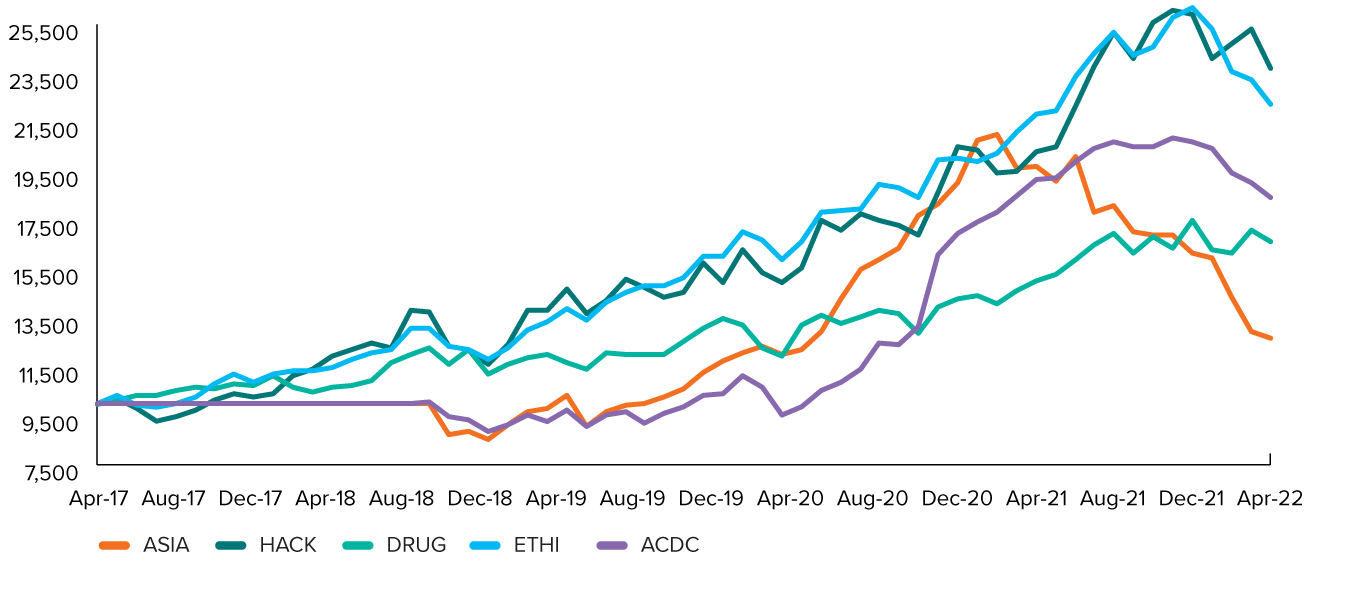

To illustrate, let’s examine some thematic ETFs over different investment periods and each from a different theme (battery technology, healthcare, cybersecurity, Asian equities, climate change). These ETFs are relatively concentrated (compared to broad market products) and thus price movements will have different driving forces due to the different companies within each ETF.

Ticker |

Investment Theme |

|---|---|

ASIA |

Technology companies that generate a majority of revenue in Asia |

HACK |

Companies involved in cybersecurity. |

DRUG |

Global healthcare companies on the NASDAQ |

ETHI |

Global companies that are deemed “Climate Leaders” |

ACDC |

Energy storage and battery production trends |

In all of the below examples we are assuming an investor purchases the ETFs at the beginning of the investment period.

Figure 1: $10,000 Investment April 2019 to April 2021

Source: Times Series data from ETF providers – Calculations made by PPIS Research

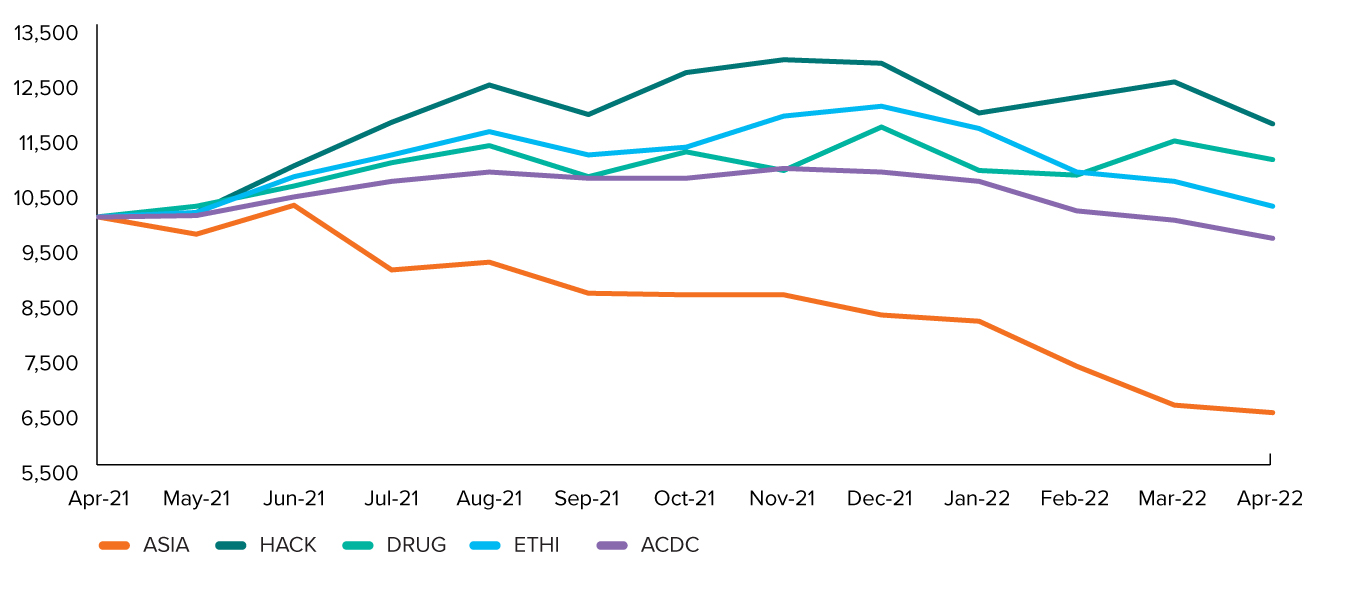

From April 2019 to April 2021 (Figure 1), the ASIA and ACDC ETF both performed remarkably well. However, over the next year (Figure 2), both ASIA and ACDC make losses.

Figure 2: $10,000 Investment April 2021 to April 2022

Source: Times Series data from ETF providers – Calculations made by PPIS Research

As another example, HACK and ETHI did not perform as well as ASIA and ACDC in Figure 1. But over a 5-year time period (in Figure 3) they performed better than both. The ETFs in the above examples are targeting different themes, it would be easy for investors overlook any one particular ETF especially as tastes and preferences change.

Figure 3: $10,000 Investment April 2017 to April 2022

Source: Times Series data from ETF providers – Calculations made by PPIS Research

While timing the market is not something any investor should attempt, examining different investment periods demonstrates that thematic ETFs can be fickle, from one period to the next, as themes move in and out of favour. Product manufacturers have been known to close new products quickly if ongoing support is withdrawn indefinitely.

Conclusion

Thematic ETFs are arrows to add to your quiver of potential investments. They could hit their target if fired correctly, otherwise they will miss the mark. Thematic ETFs could add benefit to investors seeking concentrated exposures in specific areas without taking single company risk, but investors should expect higher levels of volatility and be aware of each product’s potential risks.

We have approved a wide range of approved thematic ETFs covering areas such as climate change, technology and healthcare amongst others.

Please reach out to your adviser should you wish to discuss these or any other thematic opportunities in more detail.