Pitcher Partners Wealth Management (Brisbane) | The information in this article is current as at 7 July 2022.

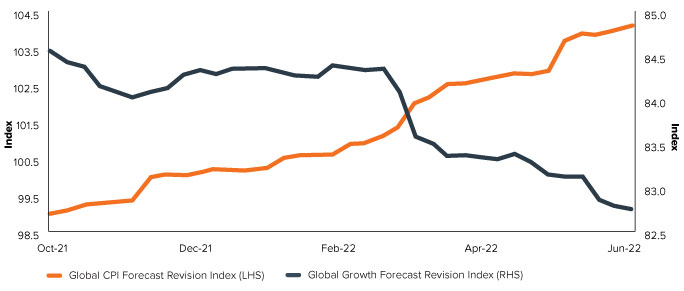

Halfway through 2022, we are seemingly a far cry from the optimistic growth outlook that was shared at the turn of this year. Expectations of growth rates two to three times historical averages have given sway to calls for an impending U.S recession.

Central banks which were focussed on supporting economic recovery have been clearly caught off guard by the surge and persistence of inflation. We are witnessing headline inflation levels at multi-decade highs across many economies and is now a truly global problem. Europe and the U.S are seeing CPI baskets rise somewhere between 8% and 9% at the time of writing. Within Asia Pacific the pressures are slightly less pronounced but in Australia our headline inflation is just over 5%, with the core measure at 3.7%. The RBA expect this to peak at a higher rate (~5%) by the end of this year.

Global CPI and GDP forecast revision indices

Source: Bloomberg, J.P. Morgan and JBWere

To briefly recap, these price pressures have been caused by;

- The pandemic has interrupted supply chains around the world, causing delivery times to be pushed out and increasing firms’ costs of production. This is occurring at a time where many industries are operating at or close to peak capacity.

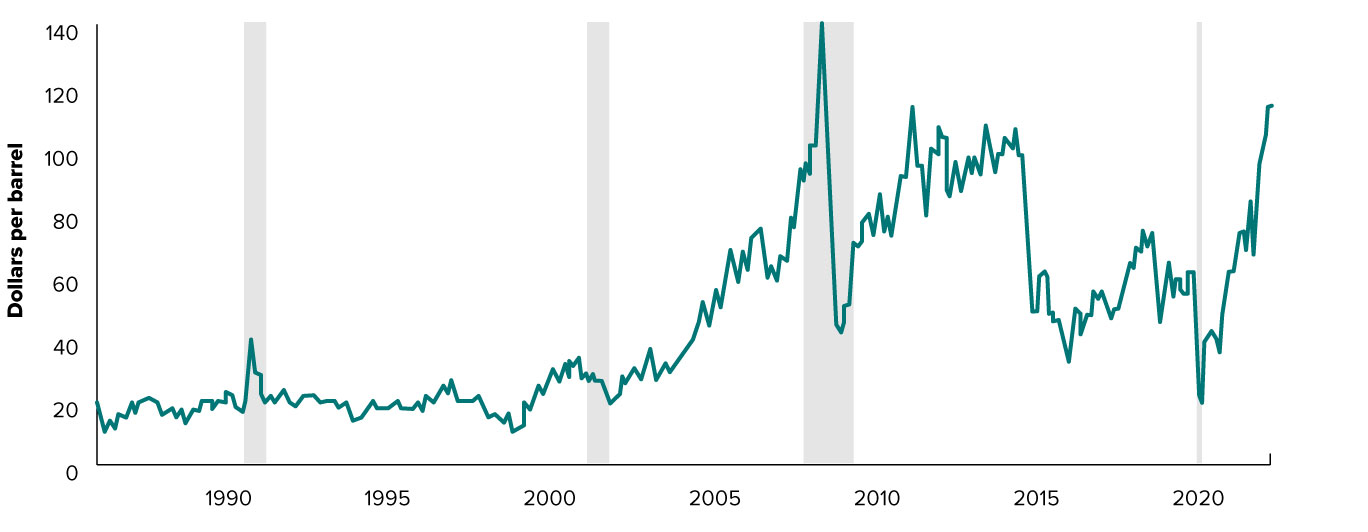

- Russia’s invasion of Ukraine has caused major disruptions to the global markets for energy and food. In addition to a material uplift in natural gas prices, oil prices alone have increased by >25% since February (>30% in Australia, with petrol adding 1% to CPI alone). Global food prices, including the prices of wheat and vegetable oils, have also increased sharply.

- Labour markets in some countries are very tight, causing significant wage pressures. In the U.S and Australia, we are seeing record levels of job vacancies in the U.S and Australia, with widespread skills shortages / availability.

- This is all occurring at a time where there has been strong growth in demand globally, supported by stimulatory fiscal and monetary policy around the world.

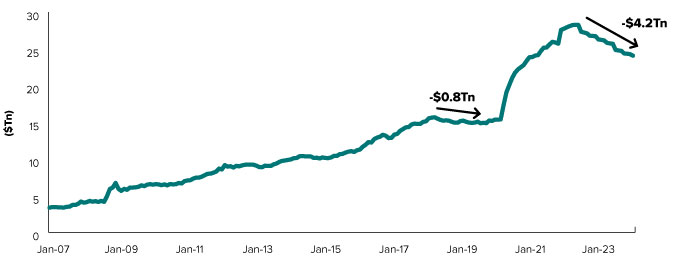

These pressures are now resulting in the sharp unwinding of the extremely accommodative policy settings in force across Europe, the U.S and Australia, with relatively extreme expectations now priced in for cash rates here and in the U.S. Central banks have clearly outlined their focus is on containing inflation rather than supporting growth. It isn’t just rate hikes either. Quantitative easing programs, which have focussed around the purchase of bonds, mortgage backed securities and corporate credit, are also being halted / unwound, with Morgan Stanley estimating ~$US4tn of liquidity being removed from the system by the end of the calendar year.

G4 Central Bank Balance Sheet ($Tn)

Source: FactSet, Morgan Stanley Research forecasts

This has fuelled major fears that the U.S economy is heading for a recession, which depending on which economist or strategist you listen to, could occur as early as the end of this year or into mid-2023. Certainly we have seen the valuation of many financial markets including interest rates and equities start to materially reflect this outcome – the U.S sharemarket is in a technical bear market (-20%), the U.S yield curve has recently inverted again and the USD is at multi-decade highs against many currencies.

The odds are certainly stacked against the Federal Reserve being able to achieve a soft landing (avert a recession). In a recent call, Stanley Druckenmiller, a successful U.S hedge fund manager highlighted the U.S has never been able to avoid a recession when CPI has been in excess of 4.5%. In addition, it has taken the cash rate to be in excess of the CPI growth rate to also bring it under control – if inflation therefore stays at elevated levels… that scenario would be particularly disastrous for economies and financial markets alike if that historical relationship held. Avoiding a recession therefore is possible, but is it probable?

Sometimes the answer can be also be presented in a more straight forward manner. Historically, a sustained surge in the price of oil / energy has precipitated a U.S recession. With pricing remaining elevated due to the Russian of Ukraine, why should this time be any different?

Crude Oil Prices: West Texas Intermediate (WTI) – Cushing, Oklahoma

Source: U.S. Energy Information Administration

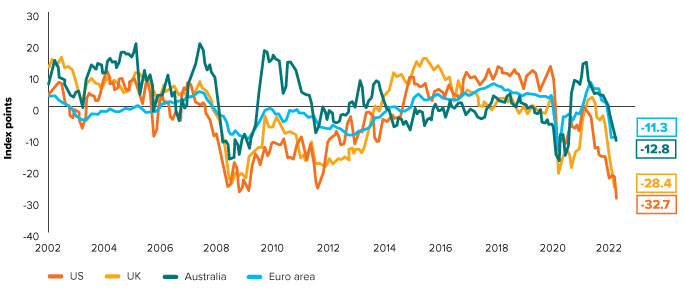

It’s clear that the current and future cost of living pressures have hit home with consumers. Consumer spending was a big driver of the recovery for many economies out of the pandemic, with elevated demand for goods and services (especially the former). The Reserve Bank of Australia estimates that ~$200bn of savings were accumulated over the pandemic period alone. We have seen household savings rates decline but with faltering confidence, declining house prices and declining real incomes, consumption is clearly set to slow. Given consumption typically makes up 60-65% of our GDP, it’s a key issue here at home, as well as other economies offshore. This slowing of aggregate demand is precisely what the central banks are aiming to achieve.

Consumer Confidence Around the World (Deviation from Average*)

* Deviation from long-run average defined as since 1988

Source: National Australia Bank, Macrobond

So as we continue to navigate this period of changing assumptions and economic / markets cycles, this uncertainty is driving quite considerable re-pricing across financial assets over the last few months as investors adjust to this dynamic.

What we do know is that whenever there is divergence between central bank and markets expectations, you can expect to see elevated volatility. When the May U.S CPI result was published a few weeks ago, it clearly overshot market expectations that inflation was set to peak and we saw immediate and quite swift revisions to inflation and terminal cash rate forecasts across the U.S and Australia, which still remain well above formal central bank guidance.

So what gives? Who is right? Whilst undoubtedly central banks are rushing to get ahead of inflation, we are seeing some signs that perhaps policy settings are beginning to have the desired impact and therefore market expectations of cash rates peaking in the 4% range by the end of the year may prove to be a little farfetched.

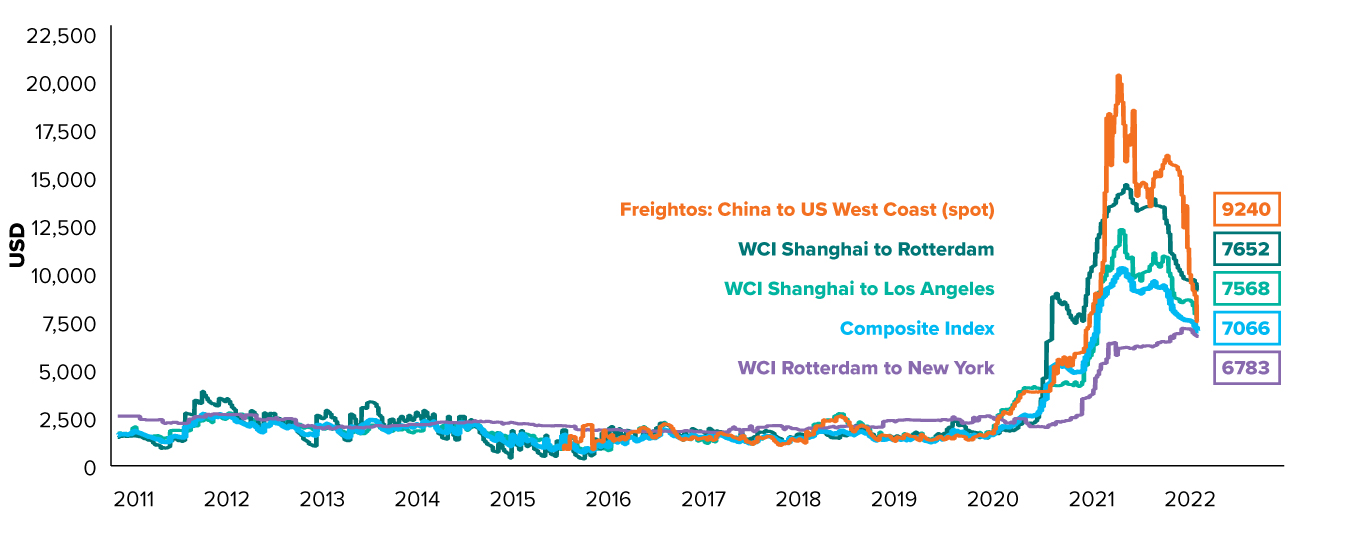

- The first sign is that some global supply-side problems are resolving – whilst this is selective and not indicative of every industry, we are seeing some firms have been adjusting to their new operating environment around production and logistics. Some delivery times have shortened, prices of semiconductors have declined from their recent peak, production of new cars is increasing, shipping container delivery times on the east coast of the U.S have improved. Whilst we will see further setbacks, global production systems are adjusting.

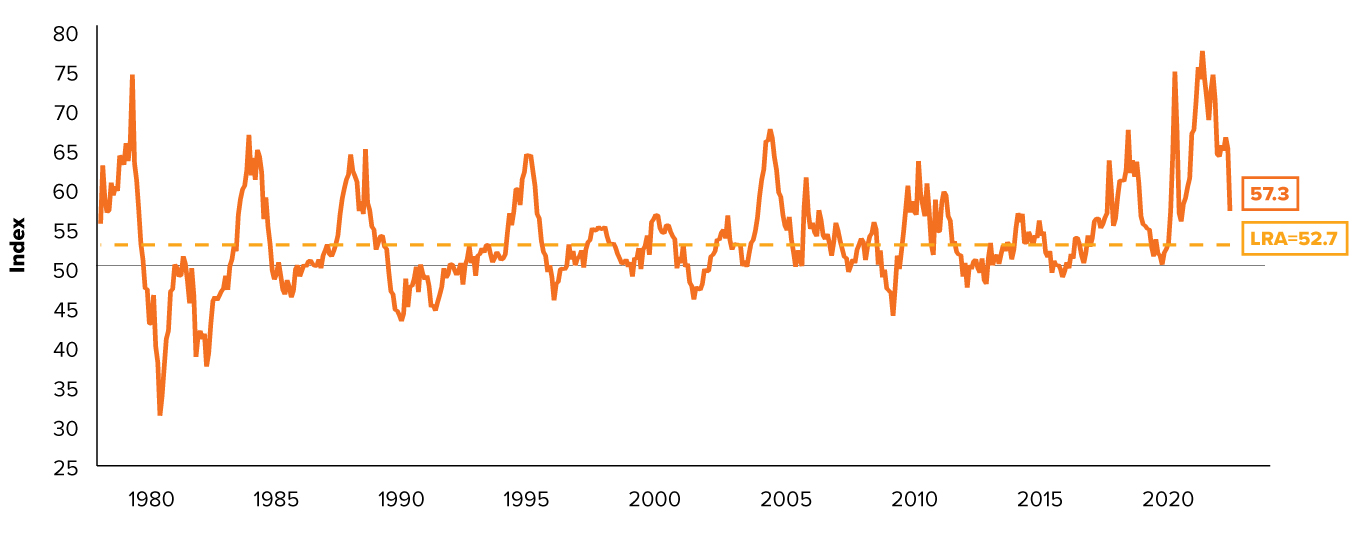

Supplier Deliveries Indexes*

* A reading above 50 indicated slower deliveries

Source: National Australia Bank, ISM

Container Freight Cost per 40 foot container (USD)

Source: National Australia Bank, Macrobond

- Secondly, it’s important to note that inflation is a measure of the rate of change. Whilst cost of living pressures are likely to stay elevated in the near term, we will need to see higher prices off already high levels to get higher inflation. Therefore, we are likely to see some base effects roll out of the calculation period and likely reduce headline reported inflation numbers – whether it happens in Q3 or Q4, mathematically this will happen. It still doesn’t assist consumers and businesses which are facing stickier cost pressures, but the rate of price growth is set to moderate at least.

- Lastly, we are seeing tighter monetary policy globally and this is coming through in measures such as consumer confidence and other economic releases which are missing consensus expectations on the downside. This lower activity may be starting to reflect the desired response that central banks are seeking and therefore whilst rate hikes in the magnitude of 75bps in the U.S and 50bps in Australia have been required with perhaps a little more to come, central banks may not need to get to the levels currently priced into the market to achieve this slowdown. Achieving that balance is not straightforward and there are risks involved, but higher interest rates will lessen the current inflationary pressures.

As things stand today, it seems unlikely that the U.S will be able to escape this extreme period of financial tightening and inflation without slipping into a recession – but whether it takes 6, 12 or 24 months – it’s still not clear. Australia will not be immune but our positive trade position continues to position us well comparatively. Europe remains in a very delicate situation and the ongoing invasion of Ukraine by Russia and the resulting ‘stagflationary like’ flow on effects will likely be felt for quite some time to come. China is attempting to stimulate its economy albeit in modest terms and it continues to grapple with challenges around its COVID-Zero approach. The outlook for many Emerging Market economies may well be bifurcated between the commodity importers vs exporters, particularly if the US dollar and energy prices remain elevated.

Currently, activity levels still remain positive and are not reflective of a full blown global recession, but if we look at more real time measures of activity such as PMI data across both services and manufacturing it’s clear that we are slowing. Whilst equity valuations have repriced materially, we are yet to see company earnings and profit margins be downgraded to fully reflect the lower growth and higher cost environment – indeed this maybe one of the final pieces of the puzzle to fall into place before equity markets begin to start looking beyond the looming recession risk.

However as discussed previously, with central banks still focussed around fighting inflation, we may see a more reserved response from them relative to prior recessions where inflation was lower and Government debt levels weren’t so high. Any sluggish response has the risk of prolonging any recession or dulling the speed of the recovery.

We certainly face tougher economic times ahead, but we continue to be reminded that financial markets will evolve and price in anticipation of these events, with periods of under and overshooting likely to occur. Against this backdrop, flexibility and resiliency within investment portfolios will be critical to achieving your investment goals.