Sydney investment advice | The information in this article is current as at 1 July 2022.

Overview

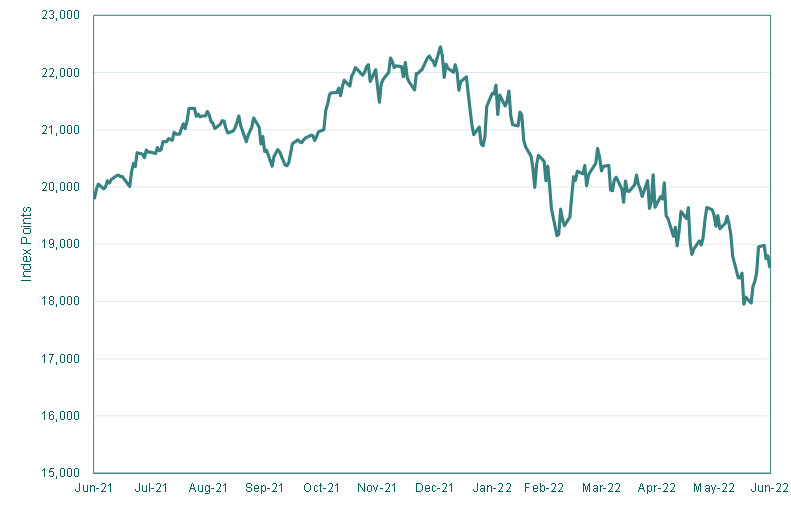

The MSCI World (ex-Australia) Gross Total Return Index (AUD) returned -8.3% over the three months and -6.1% over the year to 30 June 2022.

MSCI World excluding Australia Gross Total Return Index (Jun-21 to Jun-22)

Source: MSCI

Outlook

The earnings outlook has softened further over the past quarter. Key drivers have been:

- Stronger-than-expected rate hiking by central banks led by the Federal Reserve in the US (weakening equity valuations);

- Heightened recession risks; and

- Overestimation of demand leading to an inventory overhang. Companies face the choice of holding back inventory (incurring storage costs) or selling now at a discount (losing margin). Either way profits are likely to fall.

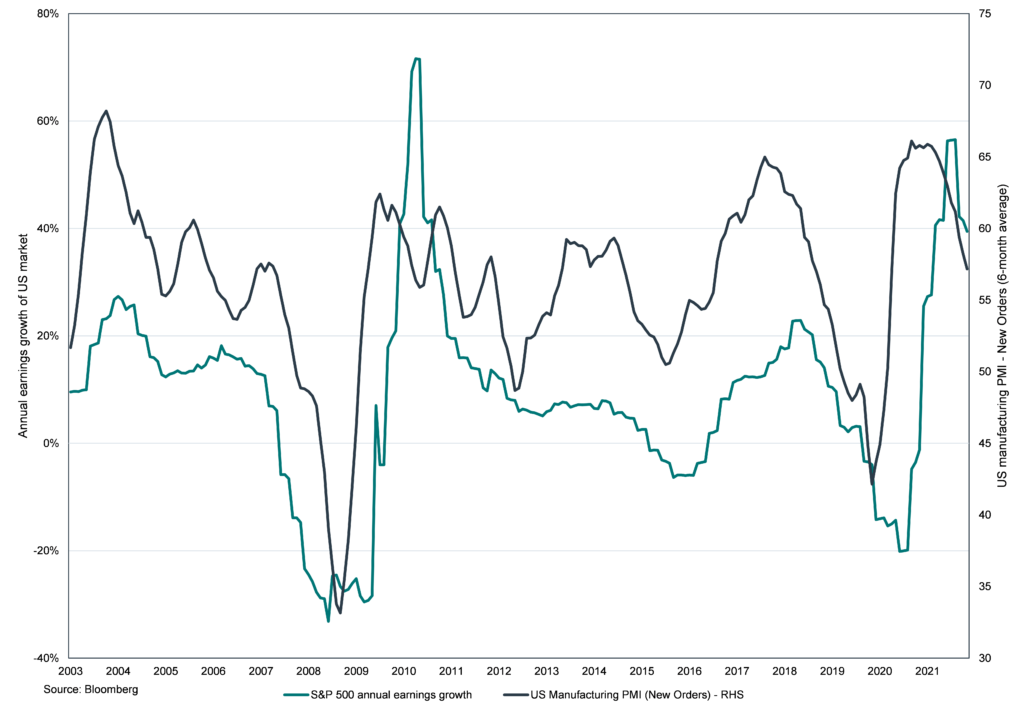

Over the next 12 months we expect corporate earnings growth to moderate. Rising inflation and interest rates will weigh on overall business profits. This can be illustrated in the chart below that compares new orders for the manufacturing sector against US corporate profit growth. The historical trend clearly shows a decline in new orders, as is currently occurring, typically precedes a decline in earnings. This suggests consensus estimates will be revised downwards given this trend.

US manufacturing New Orders (6M average) vs US earnings growth (Jul-03 to May-22)

Source: Bloomberg

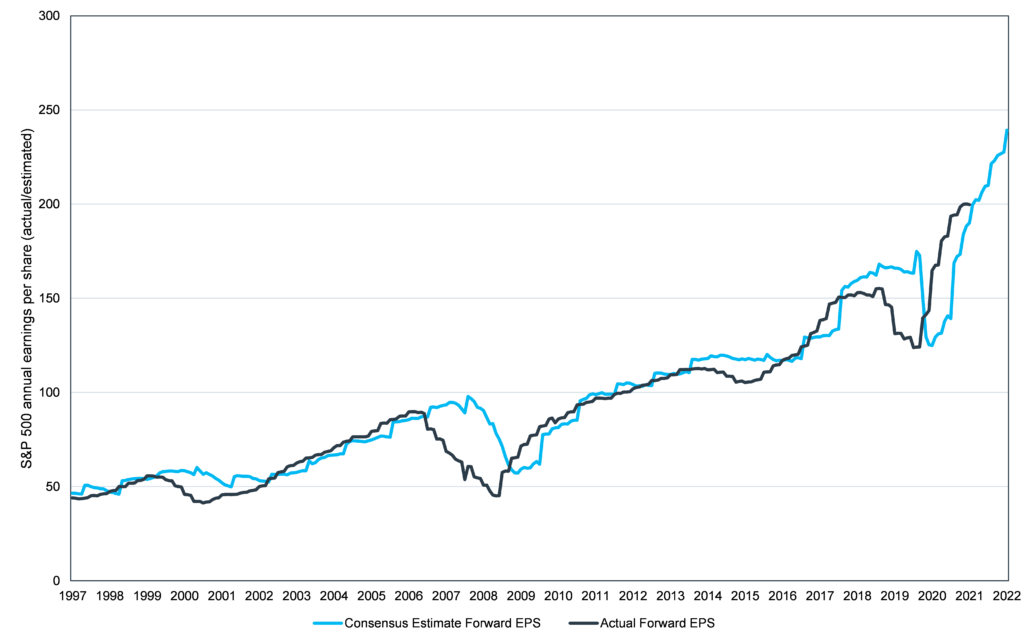

The potential downgrade cycle can be seen in the chart below. This shows that analyst downgrades (blue line falling) tend to occur well after earnings (black line) start to fall.

1-year forward expected vs actual earnings per share (Jun-97 to Jun-22)

Source: S&P

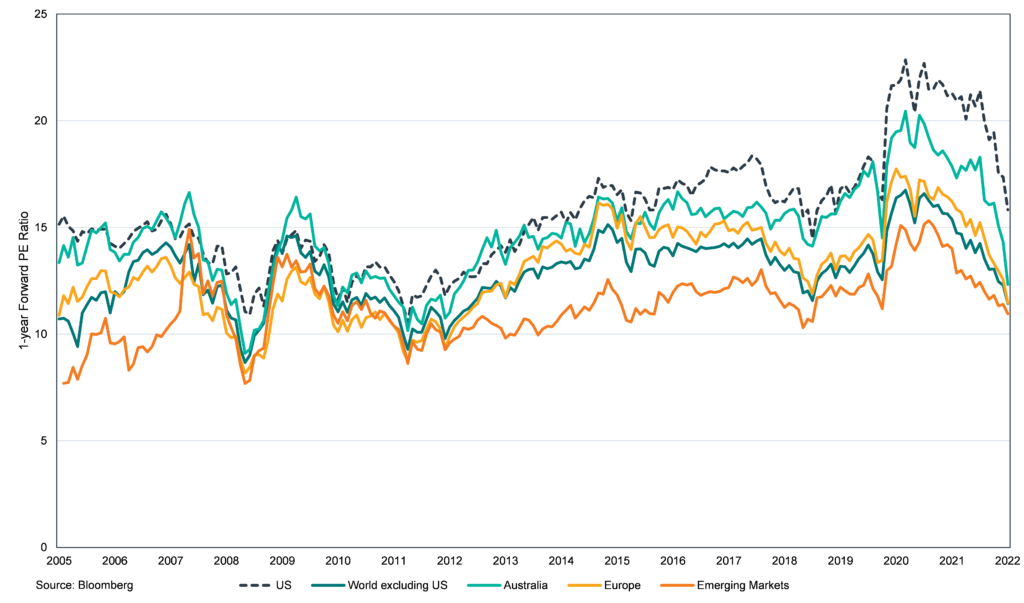

One material factor offering relief to investors is that the continued correction in global equities now sees valuations trade at more reasonable levels. While we are cautious on the near-term earnings outlook from a longer-term perspective, these are now presenting attractive entry-points to build market exposure. This is the case across global equity markets given the breadth of the selloff.

1-year Forward Price: Earnings (PE) ratios for major equity markets (Jun-05 to Jun-22)

Source: Bloomberg

Following recent weakness, the US is looking increasingly undervalued with potential upside ranging from 4% to 13%. The US accounts for the vast majority of total market value in global equities (68.3% as of 31 May), so this upside scenario suggests now is the time to begin building additional international equity exposure.

Accordingly, while we remain cautious on earnings growth, the shift in valuations sees us move from underweight to neutral for international equities.

Valuations

In the United States, operating earnings for S&P 500 companies are currently expected to rise by 10.5% in 2022 and 9% in 2023. Assuming an 8% growth rate in 2024 and conventional long-term multiples, we estimate that the United States sharemarket (as measured by the S&P500) is overvalued by 4% in the near-term and undervalued by 13% over the medium-term.

| 2021 calendar year forecast | EPS earnings estimates (US$) | S&P 500 fair value estimate | Upside/(downside) S&P 500 = X |

| Consensus | 227.9 | 3646 | -4% |

| If 10% below | 209.6 | 3354 | -11% |

| If 10% above | 226.4 | 3622 | -4% |

| 2022 calendar year forecast | EPS earnings estimates (US$) | S&P 500 fair value estimate | Upside/(downside) S&P 500 = X |

| Consensus | 248.4 | 3975 | +5% |

| If 10% below | 228.5 | 3657 | -3% |

| If 10% above | 246.8 | 3949 | +4% |

| 2023 calendar year forecast | EPS earnings estimates (US$) | S&P 500 fair value estimate | Upside/(downside) S&P 500 = X |

| Consensus | 268.3 | 4293 | +13% |

| If 10% below | 246.8 | 3949 | +4% |

| If 10% above | 266.6 | 4265 | +13% |

Source: Bloomberg consensus estimates for 2022 and 2023 as of 29 June 2022. 2024 assumes a growth rate of 8%1.

In contrast, forward Price-to-Earnings (P/E) multiples broadly remain either below or in-line with longer-term averages in most other major markets, as follows:

| Region | Forward PE | 15-year Average Forward PE | Potential upside/downside |

| All Country World (ex-US) | 11.7x | 13.0x | +11.3% |

| Australia | 12.8x | 14.8x | +15.3% |

| Europe | 11.7x | 13.1x | +11.8% |

| Emerging markets | 11.2x | 11.6x | +3.6% |

| Japan | 12.3x | 14.2x | +15.5% |

| UK | 10.3x | 12.4x | +20.4% |

| China | 12.3x | 11.6x | -5.1% |

Source: Bloomberg

Conclusion

Recommendation: Move from underweight to neutral.

Although the global economic outlook remains challenging with growth slowing in the wake of elevated global inflation, valuation multiples (including price to earnings and price to book) have compressed over recent months and most major share markets are now trading below their long-term averages. Historically, when markets are cheaper than average on a valuation basis this has typically proven to be a good time to increase exposure to equities. We acknowledge however that corporate profits are likely to slow and so the probability of earnings downgrades in coming months is high. With this in mind, we expect market sentiment to remain subdued and trading conditions to be choppy over the near-term. Nevertheless, we would argue that value has emerged considering valuations on a through-the-cycle basis and accordingly upgrade our recommendation from underweight to neutral.