Sydney investment advice | The information in this article is current as at 1 July 2022.

Overview

The S&P/ASX 200 Total Return Index returned -11.9% over the three months and -6.5% over the year to 30 June 2022.

S&P/ASX 200 Accumulation Index (Jun-21 to Jun-22)

Source: S&P/ASX

Outlook

Recommendation: Maintain neutral.

The Australian sharemarket has been volatile and is around 7.5% lower (on a total return basis) this calendar year. The ASX200 index fell 10% in a two-week period in June as a result of high inflation readings and hawkish comments from central banks (notably the Federal Reserve, ECB and RBA) that have raised the possibility of a global recession. The ongoing war in Ukraine and sanctions on Russia, and the associated supply-side constraints are likely to continue to pressure inflation, in the absence of further interest rate rises.

Against this gloomy backdrop it is difficult to form a constructive view on Australian equities but there are several factors that remain supportive. First, the recent correction has served to compress valuations to more attractive levels. Second, the domestic economy remains near full employment. A strong labour market, pent up demand and household savings boosted by stimulus measures should continue to support consumer spending, as long as rates don’t move too high. Third, Australian coal, iron ore and liquified natural gas exporters should continue to benefit from the supply-side constraints caused by the pandemic and the war in Ukraine. Fourth, there is a reasonable probability that inflation could peak over the next six months that could avert more damaging outcomes.

In conclusion, risks have become more evenly balanced. While we expect the economy to slow as rates move higher, valuations have already become more attractive to accommodate this outlook. Accordingly, we maintain our neutral recommendation on the Australian sharemarket.

Sector view

Our outlook for some of the major sectors of the S&P/ASX 200 is as follows:

Banks

Recommendation: Retain neutral.

After a strong start to the year, the banking sector has been sold off aggressively in June on concerns that larger and faster interest rate rises will lead to a sharp increase in defaults and, ultimately, losses. During the first half of the year banks reported solid H1FY22 financial results. Whilst Net Interest Margins (NIM’s) declined over the half (and indeed the year) for all majors, as a result of fierce competition for loans and a continued customer switch into lower margin fixed-rate loans, cash earnings benefited from writebacks of large loan loss provisions recorded in the prior period. Ambitious cost-out programmes that were announced last year were largely abandoned as a result of significant cost headwinds, namely a result of inflation, higher investment spending and increased regulatory costs.

Whilst profitability is likely to remain solid in the short-term, banks remain vulnerable to the excessive debt held in the housing sector, which is at an inflection point. Prices have boomed since the depths of the COVID-19 crisis as a result of interest rates being driven to historic lows, coupled with an aggregate undersupply of residential housing. Developers have taken advantage of these ideal conditions in the past two years, spurring record dwelling construction. Further, investors have also been attracted to the property market, speculating on further asset price gains, aided by the additional benefit of income tax relief through negative gearing and a higher borrowing capacity. Australian Bureau of Statistics (ABS) data for April shows that, while housing loans have moderated over the month, they still comprise three-quarters of new loans written by banks1. Specifically, total investor loans for the month remain some 37% higher than April 2021.

The slowdown in activity in residential property has been more pronounced for apartments, where supply appears to have exceeded available demand. Banks have tightened lending criteria as directed by the Australian Prudential Regulation Authority (APRA), in an effort to reign-in property speculation, displaying the susceptibility of the banks to the effects of rising defaults. In June, banks started to lower the Debt-to-Income (DTI) limit, which effectively reduces the maximum amount applicants can borrow. Furthermore, the 2021 Demographics Housing Affordability Survey reported that the median multiple of house prices to household income was 8.0 times in Australia (inflated by multiples of 15.3 times in Sydney and 12.1 times in Melbourne). These figures compare to multiples of 5.0 times and 5.1 times for the US and UK respectively2. These statistics give credence to critics who claim that the housing boom is a debt-fuelled bubble.

At this stage, we do not expect any sharp increase in bad debts from housing loan defaults unless interest rates or unemployment levels both rise sharply, as borrowers have accumulated large cash buffers. Whilst the risk of the latter appears low in the short term (assuming no significant deterioration in domestic economic conditions), significant interest rate rises heighten the risk of significant impairments. On the flip side, the majority of current loans are fixed, with many of these not maturing until 2024. Dividends are attractive and sustainable, albeit with little earnings growth. On balance, valuations in the sector remain reasonable, notwithstanding the challenges. We maintain our neutral recommendation, noting the rising risks within the sector are offset by attractive fully franked dividends which appear sustainable (in the absence of a significant uptick in bad loans).

Resources

Recommendation: Maintain neutral.

Commodity prices have shown strength over the past year with supply being impacted by COVID-19 related disruptions and exacerbated by the war in Ukraine. The outlook, however, has deteriorated as the global economy starts to slow.

The World Bank in January forecasted global growth to fall from 5.7% in 2021 to 4.1% in 2022. The forecast in the World Bank’s latest Global Economic Prospects has now been further downgraded to 2.9%3. China accounts for approximately half of global commodity consumption, so a further weakening in demand from the Asian behemoth would be a harbinger to lower commodity prices. Whilst Chinese demand remains solid, much of this demand is due to rebuilding depleted stockpiles, where inventories are at historically low levels across most commodities. China’s and indeed global growth rates are expected to further be challenged should COVID-19 disruptions continue to impact production and disrupt supply chains, and tighter monetary policy to curb high inflation levels. A more pronounced slowdown in China will inevitably flow through to a reduction in demand for Australian resources, which is likely to lead to lower domestic production and investment intentions. In an effort to minimise the fallout from such a slowdown, the Chinese Authorities have recently flagged their willingness to stabilise financial markets and manage property risks, should the need arise. Over the longer term, however, demand for steel and copper as a result of rising urbanisation rates across the world is expected to remain solid.

Cost pressures within the resources sector are continuing to persist as labour, freight and other input costs have risen. Our preferences within this sector remain the larger, well-diversified miners. Due to their healthy balance sheets and strong cashflows (notwithstanding volatile commodity prices), some of these companies have the ability to declare buybacks should the weakening of share prices persist through the second half of 2022.

Retail

Recommendation: Retain neutral.

Share prices across the retail sector have fallen by 14.3% over the quarter, buffeted by cost pressures, including increased raw material, commodity, shipping and labour costs and falling consumer confidence. The Westpac-Melbourne Institute Index of Consumer Sentiment4 fell 4.5% in June to 86.4 as concerns around inflation and interest rates begin to affect spending patterns. The Index is now at levels only seen during the Global Financial Crisis and at the height of the COVID-19 pandemic.

Despite the sharp fall in consumer confidence, retail sales have risen 9.6% over the past year, underpinned by stronger food sales, with turnover at cafes, restaurants and takeaway food outlets now 19% higher than pre-pandemic levels. Markets, however, are forward-looking and we would expect retailers to face headwinds as interest rate rises impact discretionary spending, with more disposable income being diverted into servicing housing debt and essential items like petrol, electricity, gas and food. Nevertheless, in our view valuations have become attractive after the recent sell-off and we therefore maintain a neutral recommendation for this sector.

Australian Real Estate Investment Trusts (AREITs)

Recommendation: Upgrade to overweight.

The AREIT universe has seen a substantial selloff in 2022, underperforming the broader market index. Part of this is driven by the rise in interest rates and bond yields following the RBA rate hikes. AREITs are often treated as bond substitutes due to their high distribution yields. As such, when bond yields rise, we typically see weakness in AREIT prices as they are now a less attractive alternative and see investors retreat from them.

On balance, the selloff has made AREIT valuations substantially more attractive. Most AREITs are trading at a discount to net tangible assets (NTA). NTAs may fall due to a drop in property valuations from the higher interest rate regime we are now in. However, prices more than reflect a substantial decline in property values. In addition, most AREITs offer a measure of inflation protection not easily found elsewhere via the value of the properties themselves, because in a higher inflation environment it costs more to replace these assets, supporting the value of existing properties. Most AREITs also have a measure of inflation protection due to rents automatically increasing with inflation as part of lease agreements. Lastly, unlike the global financial crisis experience, the sector carries substantially lower leverage, so there should be less need for the emergency capital raisings of that period that damaged investor returns by diluting their positions.

Accordingly, due to attractive valuations and the potential for inflation protection, we are moving our view on AREITs from neutral to overweight.

AREIT sub-sector outlook

The retail sector has been underpinned by strong food sales but there are continued signs that discretionary spending is beginning to wane. Consumer confidence is weaker on expectations of house price declines and sharp increases in interest rates. This is likely to translate to weaker retail sales over the next year that will limit earnings growth for landlords.

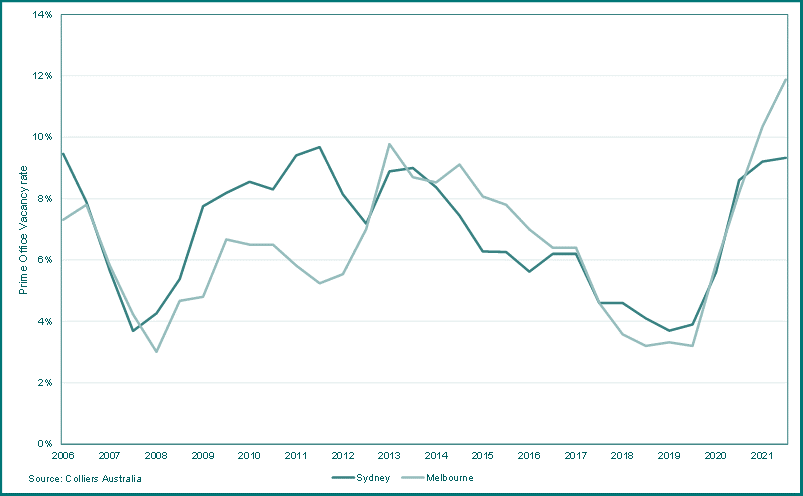

The office sub-sector has only partially recovered from the carnage inflicted on it at the start of the pandemic. Persistent lockdowns have seen many workers adopt a more flexible workplace arrangement on a more permanent basis. This has resulted in many businesses desiring a smaller footprint, either by renegotiating their lease on more favourable terms on expiry, or sub-leasing part of the premises to third parties. Vacancy rates are also high with limited signs of relief in prime office sites across both Sydney and Melbourne.

Prime Office Vacancy Rates by city (Sep-06 to Mar-22)

Source: Colliers Australia

The residential sub-sector is likely to see a further unwinding of tailwinds that supported it during the recovery from the pandemic. Interest rates have begun to normalise, and lenders have tightened borrowing criteria, which is likely to lead to fewer new loans and a lower capacity to borrow. Potential house price falls should be partially mitigated by the resumption of immigration, which would see a new cohort of buyers re-enter the market.

The industrial sub-sector continues to benefit from solid investor demand, notwithstanding increased construction costs and maintenance expenses. Whilst capitalisation rates and vacancy rates are likely to rise from current historical lows, expected increases in e-commerce penetration are likely to sustain demand for warehouse and logistics space over the medium term.