Using unused concessional contributions to super to build your nest egg.

Many people know they can direct extra payments into their superannuation from their pre-tax income each financial year.

These payments, known as concessional contributions, are capped at $27,500 per year from the 2021-22 financial year – and that includes super paid by an employer.

But what happens if a person comes in under the cap and doesn’t use all their concessional entitlement in one financial year?

Fortunately, it’s not a ‘use-it-or-lose it’ scenario.

Concessional contributions, which are taxed at the lower superannuation tax rate of 15 per cent, can be carried forward for up to five years.

The carry-forward concessional contribution provision allows individuals to take advantage of unused contributions from previous financial years.

These rules provide flexibility around the timing of contributions to match year-to-year changes in cash flow, as well as the ability to manage taxation outcomes each financial year.

Who is eligible to use carry-forward?

Unused concessional cap space can only be from the previous five financial years, starting from 1 July 2018. That means the full five-year carry-forward period will only be available from financial year 2023-24.

Individuals must be eligible to make concessional contributions, including observing the age-based limitations.

The member’s total super balance must be less than $500,000 at the end of 30 June of the previous financial year – and this balance includes all your super interests, such as pension benefits and benefits in multiple funds.

How do these provisions work?

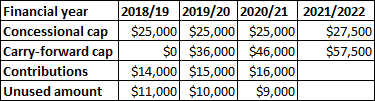

The below example illustrates how carry-forward provisions can accumulate to create a higher contribution ceiling for the following financial year.

In this scenario, the individual had an unused portion of the cap totalling $11,000 in 2018-19, which was rolled over to create a higher cap of $36,000 the following year, and so on.

The outcome in this example is that the individual could make a concessional contribution of up to $57,500 in the 2021-22 financial year.

What are the advantages of carry-forward?

Cash flow: The increased cap of $57,500 in the above example could be beneficial if the individual has excess cash flow in the 2021/22 financial year that they wish to use to boost their superannuation savings.

Proceeds from a bonus, business dividend, sale of an asset or an inheritance are common examples that might lead to higher-than-normal cash flow.

Where the increased cash flow is known in advance, the individual could consider making only compulsory concessional contributions in the financial years leading up to the year where cash flow is expected to increase.

Taxation: Voluntary concessional contributions will typically reduce an individual‘s taxable income during the financial year that the contribution is made. This means it may be advantageous to use the carry-forward concessional contribution cap during years where taxable income is higher.

Higher taxable income might occur when an asset is sold, such as an investment property, managed fund or shares. The capital gain on these assets is added to an individual’s taxable income in the year that the gain was crystallised, increasing total tax payable. The concessional contribution reduces taxable income, providing an offset to the crystallised gain.

Putting it into practice

Returning to the initial example, where the individual made contributions and was left with a carry-forward concessional cap of $57,500, we can take it further to illustrate the effect of a capital gain.

In this case, the individual’s marginal tax rate is 39 per cent, including the Medicare levy, and they receive the superannuation guarantee of $17,000 from their employer during the financial year 2021-22. They also sell an asset that crystallises a capital gain of $100,000.

The individual has the option of using the carry-forward concessional to make a personal deductible contribution of up to $40,500 – that is, the carry-forward of $57,500 less $17,000 of superannuation guarantee.