This quarter has been defined by macroeconomic factors over and above business fundamentals, which occurs periodically when there is a large shift in the macroeconomic environment.

Two factors have dominated this year:

- Concern over interest rate hikes around the world, particularly the US, which accounts for most of the market value on global share markets; and

- Rising geopolitical risk following the Russian invasion of Ukraine.

Considering this, we wanted to highlight the interest rate sensitivity in different kinds of businesses. We have seen dramatic dispersion in performance where energy stocks are up 21.8% for the year-to-date, while the technology sector has fallen by 12.6%. Energy shares are the only sector with a positive performance for the year-to-date, with financials being the next best performer, which is down only 1.9% in contrast to a broader decline of 7.5% for international shares.

Why is this happening?

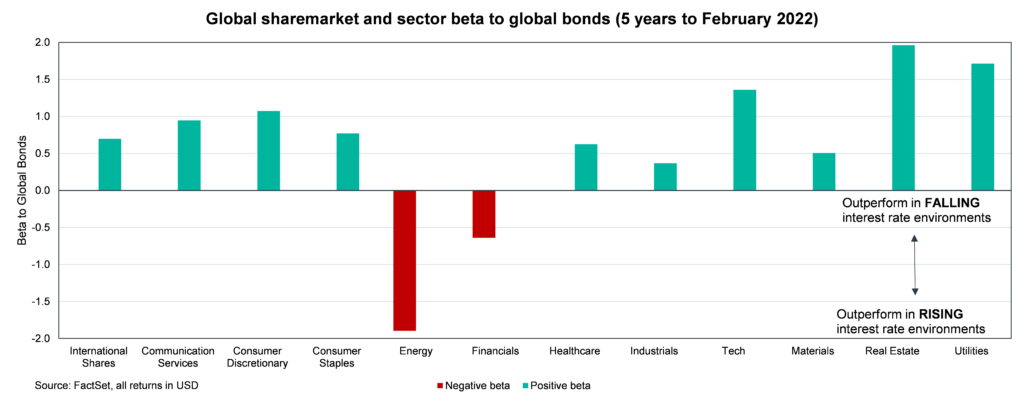

The chart below demonstrates that rising rate environments often correlate the stronger economic growth, which sees higher demand for energy products, boosting sector returns. Higher rates also boost financial sector income, by increasing the yield they earn on their loan book. Columns with numbers above 0 are sectors that perform well in a falling interest rate environment. In contrast the two columns in red, Energy and Financials, perform well in a rising interest rate set up.

The chart above highlights how sensitive different parts of the share market are to shifting interest rate expectations. The start of this year has been marked by a consensus view that rates will be rising higher than initially expected. In that environment it is unsurprising to see the underperformance of sectors, such as technology. Higher-yielding sectors treated as income substitutes, such as real estate, have likewise struggled in this set up. This is because a “risk-free” alternative in government bonds has been offering a more attractive relative yield, seeing investors pivot away from stocks and moving towards bonds or cash.

Our portfolio

We are currently underweight in both energy and financial sector stocks due to concerns over their growth profiles, given their reliance on economic growth to increase earnings and concerns over business sustainability in the energy sector. There also tends to be a lack of competitive advantage outside niche markets, such as Australia, which prevents businesses in these sectors from earning outsized returns on capital. We are concentrated in areas such as technology and health care, where we can find businesses that can grow independent of the external macro environment and have an ability to earn attractive returns without excessive leverage (a key risk for financials notably).