Dealmakers 2022

The Dealmakers 2023 report has now been released. You can find it here.

Mid-market M&A in Australia

Welcome to our Dealmakers hub, where you’ll find key highlights from our mid-year Dealmakers report released in August 2022.

While the start of the year was not a record-breaker, our findings show that M&A in Australia is bound to remain robust. Australia’s strong fundamentals – economic growth, political stability and a mature dealmaking industry – remain unshaken and will allow dealmakers to weather the seas of uncertainty through the rest of 2022 and into the year after.

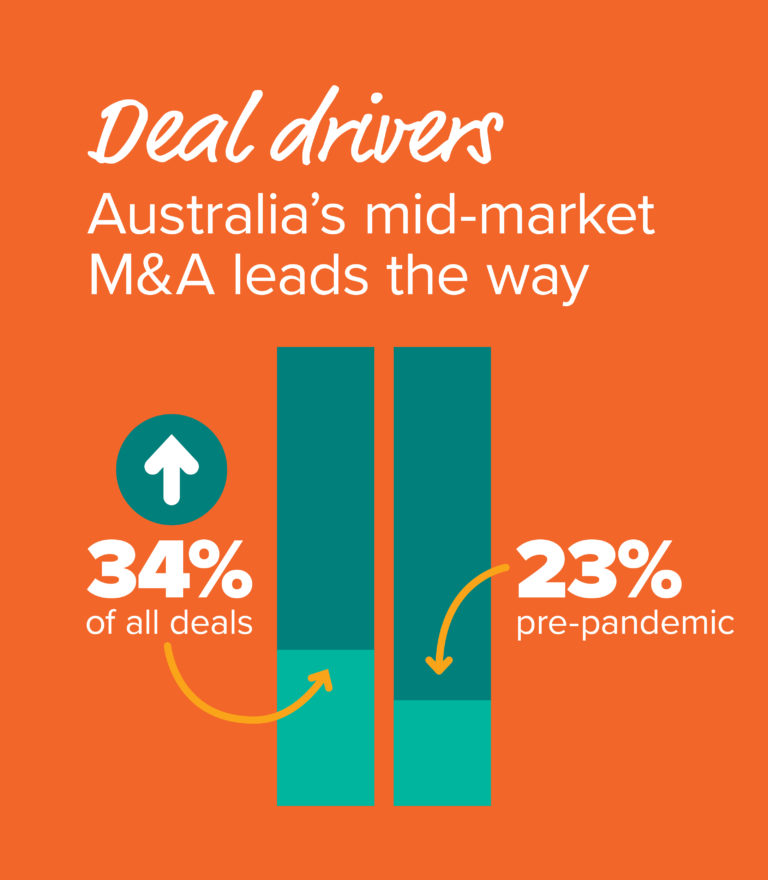

Australia’s mid-market (deals valued between AU$10m and AU$250m) remains a mainstay of dealmaking, where growing appetite for deals among domestic and international buyers will continue to drive M&A forward.

To make sure you’re across the latest trends and predictions for M&A this year, you can browse the key findings below or enter your details into the form to access the full report.

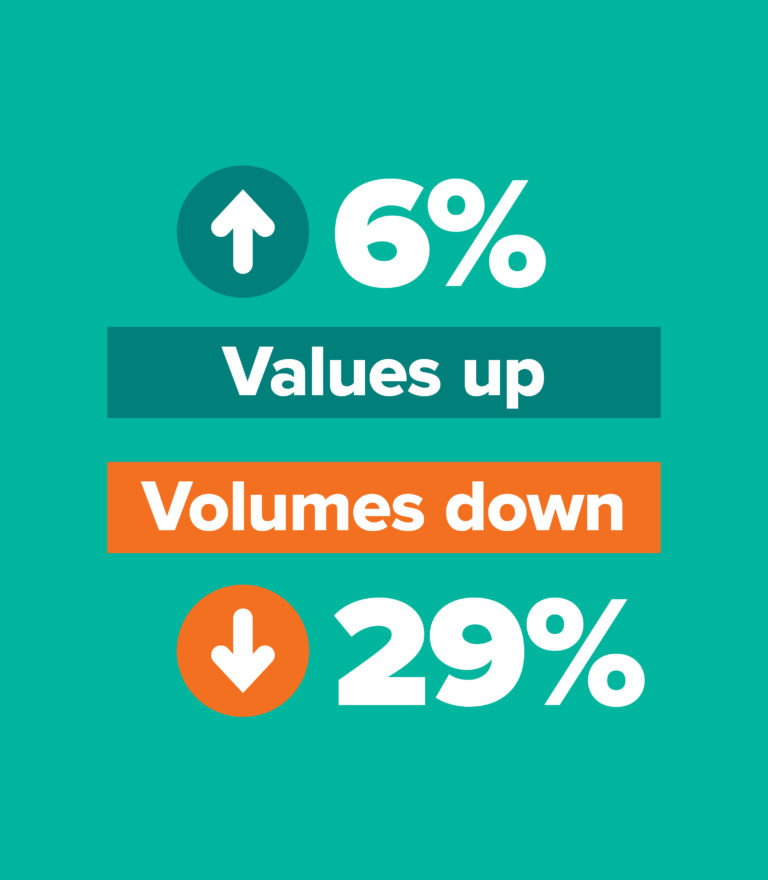

Following 18 months of relentless dealmaking, investor euphoria appears to be tapering off in a noticeable drop in volumes, although values remain buoyant. But dealmakers aren’t throwing on the brakes full stop – many may just be taking more time to do deals and engage in M&A that more closely aligns with strategic objectives.

Despite recent elections, there is little to no political uncertainty as the new government seems content with maintaining the status quo. And when it comes to the numbers, median deals show a historical trend toward small-cap and lower mid-market deals, compared to the past year.

Australia’s mid-market continues to be in the spotlight. While the mid-market experienced similar declines to the broader M&A market in 1H22 – values down 42% and volume down 28% from 2H21 – this segment remains a mainstay of dealmaking in Australia, accounting for 34% of all deals.

Mid-market deals remain a target segment for foreign investors looking to expand their presence or gain a foothold in Australia. Further M&A could unfold as larger corporations and multinationals reassess their business strategies.

Overall inbound M&A accounted for almost 40% of total deals in Australia, and one of the highest valued first halves in the past five years (AU$19bn) although one of the lowest in deal volumes.

Mid-market inbound M&A values rose 1% from 1H21 to hit AU$2.7bn, although volume declined 23% (31 deals). The mid-market remains a value center possibly as foreign buyers recognise Australia’s strong fundamentals. Private equity mid-market activity dropped from record highs in 2H21, now settling into familiar territory seen both before and slightly after the pandemic.

Digital transformation and decarbonisation are key trends driving M&A, although leisure and healthcare see significant deal values. The AU$28bn Ramsay deal puts pharmaceuticals and healthcare far and away first in value terms, with leisure also seeing greater deal values compared to traditional sector leaders like tech and energy.

Decarbonisation and the energy transition drive strong interest in Australia’s renewables sector, and Environmental, Social and Governance (ESG) has risen as a major consideration when doing deals.

Our Dealmakers mid-year update was produced in collaboration with Mergermarket, an Acuris company. The data in this report comes from Dealogic and was compiled on 4 July 2022.

Some of the findings are compared with our Dealmakers report which was released in February 2022 and shows the opinions of 60 M&A dealmakers in Australia regarding their expectations for dealmaking in 2022. You can access the February Dealmakers report here.

Our experts

Pitcher Partners insights

Get the latest Pitcher Partners updates direct to your inbox