The Corporate Collective Investment Vehicle Framework and Other Measures Bill 2021 (“the Bill”) introduces legislation to implement the long-awaited CCIV regime into Australia. Designed to allow managed funds to operate through a legal form corporate entity, but maintain flow-through taxation, it is intended to provide a more familiar vehicle for foreign investors who may not be as comfortable with trusts as Australian investors.

The CCIV regime may provide (in many cases) commercial benefits as compared to running a managed fund as a managed investment trust. However, for trusts that are closely held, the provisions may not work properly and may create taxation risks. Furthermore, as the States have not introduced changes to duty and land tax, there may be additional risks associated with operating a property fund under a CCIV.

What is a CCIV?

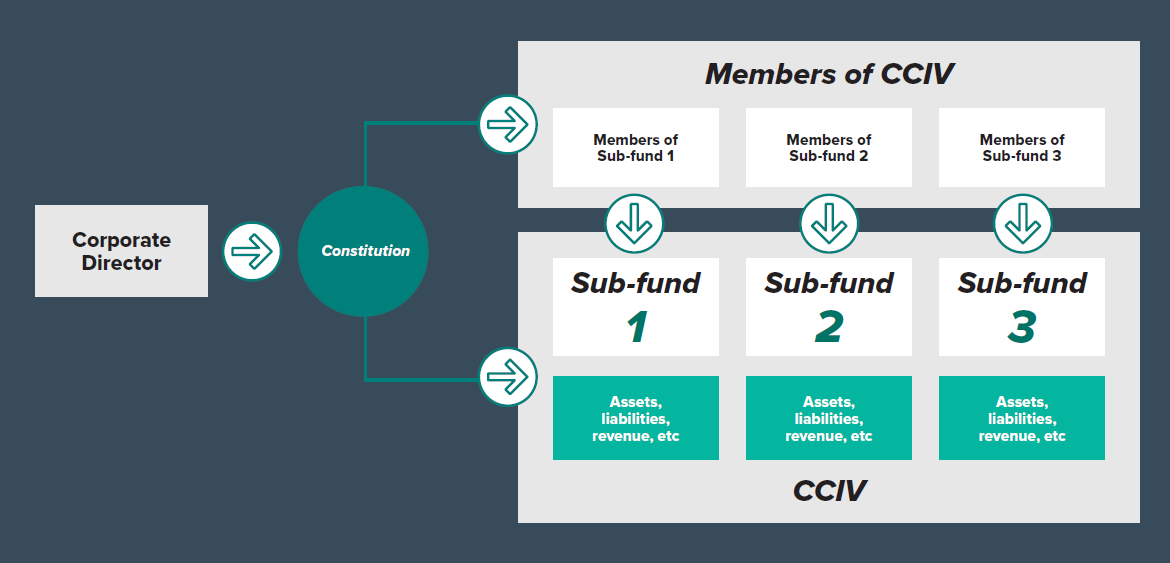

The Bill introduces a new type of company under the Corporations Act (limited by shares), known as a corporate collective investment vehicle (“CCIV”). Similar to a managed investment scheme, a CCIV will have a public company as a director (the corporate director) with an AFSL authorising it to operate the business.

Significantly, a CCIV will be able to conduct its affairs through sub-funds. Each sub-fund will constitute a distinct and protected part of the CCIV’s business, registered independently with ASIC, and segregated from any other sub-fund of the same CCIV. Accordingly, investors will hold an investment in a specific sub-fund of the CCIV and receive returns referable to their share of capital in that sub-fund. The structure of a CCIV is briefly outlined in the diagram below.

What is the benefit of having a CCIV and sub-funds over a trust?

A potentially significant benefit of the CCIV regime is the ability to run multiple sub-funds under the same structure. This may reduce the compliance cost of establishing new trusts for each fund and the ability to offer different products within the same structure (whilst keeping each sub-fund distinct). For example, a Debt CCIV could be created, offering different debt products by issuing different classes of shares (referable to a different sub-fund). Class A shares could be referable to a sub-fund with “secured mortgages” while Class B shares could be referable to a sub-fund with “mezz loans” and so on. From a branding perspective, the CCIV should allow a fund manager the ability to host all of its products within one single vehicle (with multiple and distinct sub-funds).

How is a CCIV and it’s sub-funds taxed?

The Bill introduces new Subdivision 195-C to the Income Tax Assessment Act 1997 which, broadly, contains rules that treat each CCIV sub-fund as a trust for tax purposes (called a CCIV sub fund trust) and the CCIV (the company) as the trustee of each CCIV sub-fund trust.

Each CCIV sub-fund trust will, in turn, be deemed to be a unit trust with its members deemed to hold fixed entitlements to income and capital of the relevant sub-fund trust based on their entitlements to dividends and capital distributions of that CCIV sub-fund. In this way, subject to relevant modifications, a CCIV sub-fund trust may be taxed in the same way as a MIT and an AMIT (or a public trading trust under Division 6C if the sub-fund trust is a trading entity). The most significant shift from previous exposure draft legislation is that, should the sub-fund trust not meet the relevant criteria (the extent to which it is widely held), it will instead be taxed as a unit trust under Division 6 (i.e. under general trust law principles).

What are the main risks in the taxing regime for CCIVs?

Where a CCIV sub-fund trust does not meet the requirements to be an AMIT, difficulties arise as to how the ordinary rules for taxing trusts and their beneficiaries will interact with the “deemed trust” status of a CCIV sub-fund. The taxation of these trusts is generally based on present entitlements to the trust law income of a trust, which is a concept that is not easily translated to corporate entities.

The Bill attempts to align these principles by deeming the income of the sub-fund trust (for tax purposes) to be equal to the profit determined under accounting standards and by deeming a present entitlement to that income based on the dividends declared payable within three months of year-end (that are referable to that profit). It is not clear how it can be demonstrated that a particular dividend is referable to a profit of a particular period.

Unlike a unit trust which may provide a discretion for the trustee to determine distributable income or otherwise equate distributable income to taxable income, a CCIV sub-trust fund taxed under Division 6 has no such flexibility. This creates a significant risk of taxation at the top marginal rate under section 99A where the CCIV sub-fund trust makes an accounting loss but has taxable income. For example, if the accounting standards require an impairment on an asset to be recorded through profit and loss, this could prevent the taxable income of the CCIV sub-fund trust flowing through to its members.

Further, the need to have that entire profit distributed and paid as dividends (or declared as dividends payable, within three months of year-end) to prevent a lack of present entitlement to some amount of the CCIV sub-fund trust’s income (and consequent section 99A taxation) presents practical challenges that do not otherwise arise for MITs that are taxed under Division 6.

Timely ATO guidance on how they will administer these new rules is essential to provide commercial certainty to fund managers. With so many areas of uncertainty and the potential for taxation under section 99A, fund managers may not be in a rush to utilise the CCIV regime for funds that may not meet the requirements of being an AMIT.

Have there been changes made to the state tax regime?

At this stage, no changes have been made to the various State taxes to accommodate CCIVs. Without modification to the rules, their status as legal form companies could result in favourable or unfavourable treatments, depending on the circumstances. For example, if a CCIV is seen as a company there may be a 50% landholder duty threshold in Victoria for taxable relevant acquisitions (rather than 20% as compared to trusts). However, if sub-funds are not recognised from a State tax perspective, multiple properties held across different sub-funds could be “grouped” from a landholder duty and land tax perspective when the property is legally and beneficially owned by a single CCIV. Pitcher Partners is hopeful that the various States will enact legislation to support the new CCIV regime.

Consultation on earlier drafts

The Bill reflects the third major draft of the CCIV rules since the Federal Government’s announcement in the 2016-17 Federal Budget. Pitcher Partners has been heavily involved in the consultation process on the drafting of these rules, with Treasury adopting many of these recommendations. These have included:

- Removal of a requirement for a CCIV sub-fund trust to meet certain “passive tests” contained in the public trading trust rules or be forever treated as a company for income tax purposes.

- Removal of an earlier rule that would prevent a CCIV sub-fund trust that was a public trading trust from being a franking entity (and hence not being able to allocate franking credits to its distributions). This would have resulted in double taxation when profits were distributed to members.

- Adoption of centralised rules in new Subdivision 195-C that apply broad modifications to the income tax legislation as it applies to CCIV sub-fund trusts (to treat it as a trust for tax purposes). Previous versions of the exposure draft legislation contained lengthy and difficult to navigate provisions that sought to amend each relevant provision separately.

While Treasury have adopted recommendations to provide a clear definition of the “income of the trust estate” for CCIVs that are taxed under Division 6, it is disappointing that Treasury did not adopt recommendations to tax all CCIV sub-funds under an attribution basis and instead maintained general Division 6 treatment for non-AMIT trusts. As outlined above, the lack of certainty around the application of these provisions is likely to dissuade many from using a CCIV as the vehicle for more closely held funds.

What are the next steps?

Alexis Kokkinos, of Pitcher Partners, is a member of the ATO’s CCIV working group and will be assisting the working group in developing guidance on the application of the CCIV regime prior to its application on 1 July 2022. We are interested to hear your views on the CCIV regime and would be happy to talk to you about how the new CCIV regime could be used by you in running your funds management practice.